Brett_Hondow/iStock Editorial via Getty Images

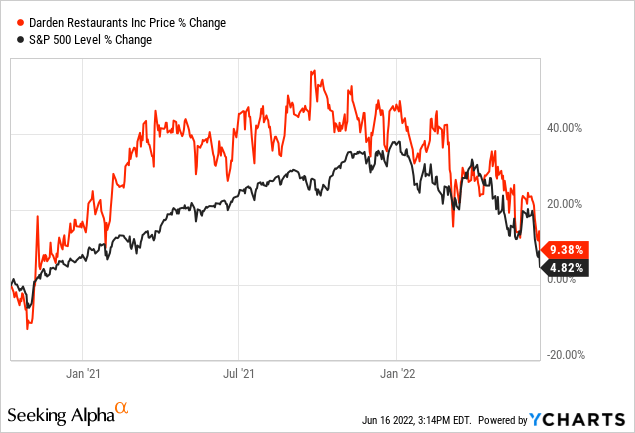

It has been about 20 months since my last article about Darden Restaurants (NYSE:DRI) was published. Back then, I rated the stock as a “Hold” when it was trading slightly above $100. In the meantime, the stock returned about 10% (without dividends) and actually outperformed the S&P 500 (SPY).

Back then, I was rather cautious (or slightly bearish) as the COVID-19 pandemic was still ongoing and it was extremely difficult to estimate what lockdowns to expect and what effect these lockdowns would have on the business. But now, the pandemic hopefully won’t have such a huge impact on the business anymore. Instead, we must expect a recession and talk about its effect on the business.

Results

When looking at the results of the first nine months, we can see revenue increasing from $4,917 million in the first nine months of 2021 to $7,027 million in first nine months of 2022. This is resulting in 42.9% year-over-year growth, which is extremely impressive. Operating income increased from $325 million in the first nine months of 2021 to $825 million in the first nine months of 2022, which is resulting in 154% year-over-year growth. And diluted earnings per share increased from $1.98 last year to $5.16 in this year (once again 9 months numbers) – this is resulting in 161% YoY growth.

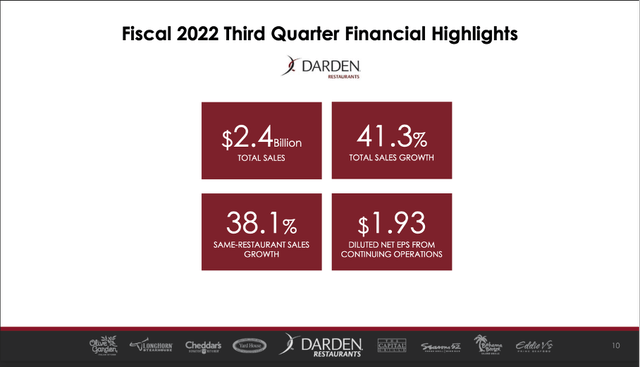

Darden Q3/22 Investor Presentation

And when looking at third quarter results, growth rates are similar impressive. Sales increased 41.3% year-over-year from $1,733 million in Q3/21 to $2,449 million in Q3/22. Operating income increased from $148 million in the same quarter last year to $301 million this quarter resulting in 103% YoY growth and diluted earnings per share increased 97% from $0.98 to $1.93.

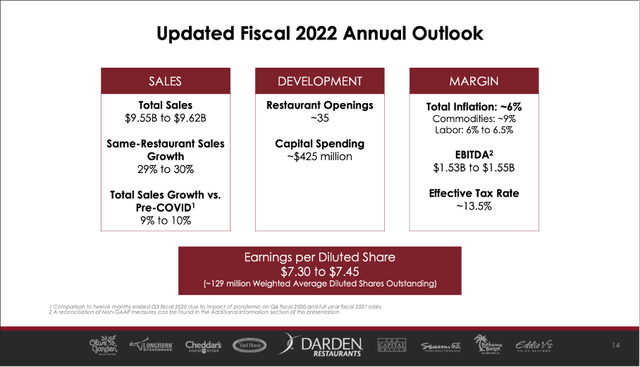

Darden Q3/22 Investor Presentation

When looking at the guidance for fiscal 2022, Darden Restaurants is expecting total sales to be between $9.55 billion and $9.62 billion. And while Darden Restaurants will clearly exceed results from fiscal 2021 ($7,196 million in sales), the company will also exceed pre-COVID-19 results. The same will be true for diluted earnings per share, which are expected to be between $7.30 and $7.45 for fiscal 2022 and therefore clearly above pre-pandemic levels.

Risks: Staffing and Recession

Among the issues Darden Restaurants is facing right now, the staffing issues might especially be worth mentioning. During the last earnings call, management commented on the current situation:

Our biggest staffing challenge during the quarter was managing the impacts of team member and manager exclusions due to Omicron. To provide some context, at the peak, team member exclusions in January were three times higher than the monthly peak we experienced with Delta.

However, the COVID-19 pandemic is only part of the reason why restaurants like Darden Restaurants are facing staffing issues. A second reason is the labor shortage as a lot of people obviously don’t want to do certain (rather low-paid) jobs anymore. But management is seeing improvements:

From a people perspective, we are seeing positive momentum in applicant numbers, and we feel much better about where we are now in terms of overall staffing. Our focus will continue to be on hiring and more importantly, training our new team members to reach the productivity level required to enable us to operate at optimum staffing levels.

And I don’t want to sound snooty, but the bear market – especially in crypto – will lead to several people being happy if they can find a job again and the stuffing issues for many different companies might get resolved rather quickly in the next few months and quarters.

A second major risk could be the recession, which seems to be upon us. It will not be surprising to hear that many businesses will suffer hard in case of a recession. And “consumer cyclicals” are one of the sectors that are not really considered to be recession-proof – hence the word “cyclical”. In a recession and bear market, people must cut spending and will start cutting on non-essential products and services. And Darden Restaurants seems to belong in that category.

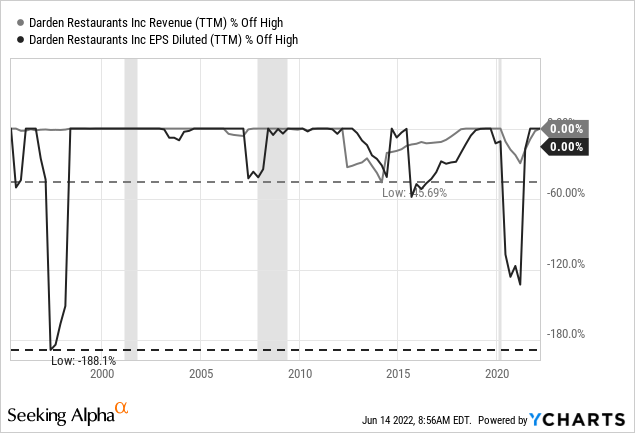

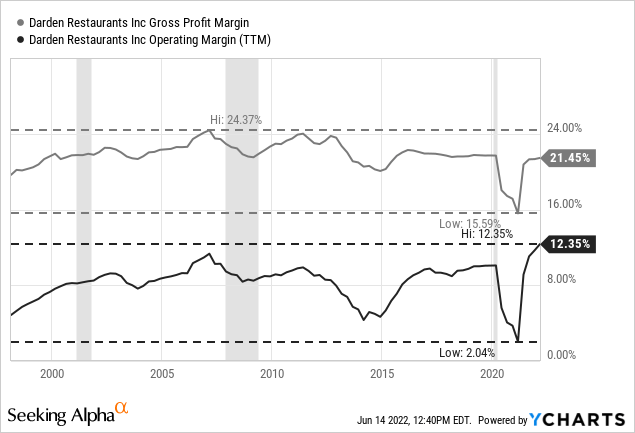

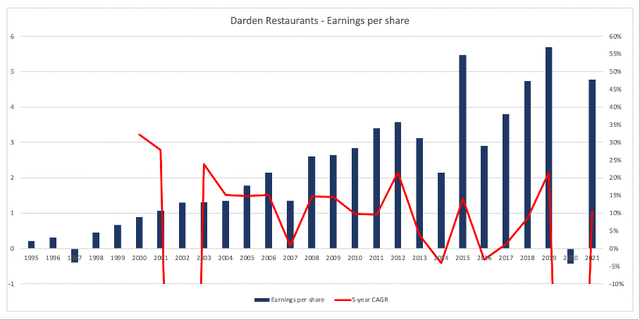

However, when looking at Darden Restaurants’ performance during the last few recessions, we can make a different argument. When excluding the last recession (and we must exclude that one as Darden Restaurants performed horribly due to the pandemic and lockdowns and not so much due to the recession), Darden Restaurants is performing quite well during recessions. The recession in the early 2000s is not visible in the charts at all and while earnings per share declined a bit before the Great Financial Crisis, the business recovered rather quickly (and revenue was hardly affected).

The different restaurants of the company can be seen as rather affordable restaurants and it seems likely that people might actually stop going to more expensive restaurants and choose the different brands of Darden Restaurants instead (like Olive Garden). And so far, Darden Restaurants is planning to open about 60 new restaurants in the next fiscal year (and will spend about $300 to $325 million on new restaurants).

Growth

Over the last ten years, Darden Restaurants could grow earnings per share only with a CAGR of 3.47%. However, we should be cautious about these numbers as the pandemic affected Darden Restaurants quite heavily. And when looking at longer timeframes, Darden Restaurants could report much higher growth rates. For example, since 1995, Darden Restaurants could grow earnings per share with a CAGR of 12.57%.

And while I don’t expect similar high growth rates for the years to come, we can certainly expect solid growth rates as Darden Restaurants will be able to grow in many different ways. First, Darden Restaurants can grow by opening new restaurants, which should add about 2% growth annually (new restaurants might in some cases cannibalize the revenue of the older restaurants a bit). Second, Darden Restaurants can improve sales in its existing restaurants (for example by raising prices a bit or trying to get customers to buy more or more expensive menus).

The company can also try to improve margins and over the last two decades, I see a slight upward trend for the company’s operating margin. And Darden Restaurants might be able to increase the margin further, but we should not expect a huge impact from this on the bottom line.

And finally, Darden Restaurants could also use share buybacks. In the last few years, share repurchases slowed down a bit (and during the COVID-19 crisis, the company actually increased the number of outstanding shares). However, share repurchasing programs have been an important tool since the 1990s and the company constantly decreased the number of outstanding shares over time. And especially in the last quarter, the number of outstanding shares was reduced by 2.7 million (about 2% of the total outstanding shares).

Overall, I would assume Darden Restaurants can grow earnings per share at least 5% with the potential for higher growth.

Dividend

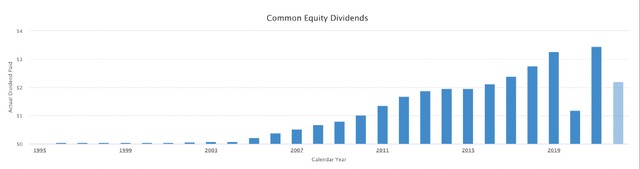

Darden Restaurants is also interesting for its dividend. The company had to cut its dividend to zero during the COVID-19 recession. However, the company was rather quickly at previous levels again. After two quarters without a dividend, the company increased the dividend again and after only five quarters, the dividend was higher than before. Right before the COVID-19 crash, the dividend was $0.88 and now Darden Restaurants is paying a quarterly dividend of $1.10. This is resulting in an annual dividend of $4.40 and a dividend yield of 3.85%.

On June 23rd, Darden Restaurants will report quarterly results and we can assume that the company will increase the dividend again. And despite the dividend cut in 2020, Darden Restaurants increased the dividend with a CAGR of 14.46% in the last five years.

Intrinsic Value Calculation

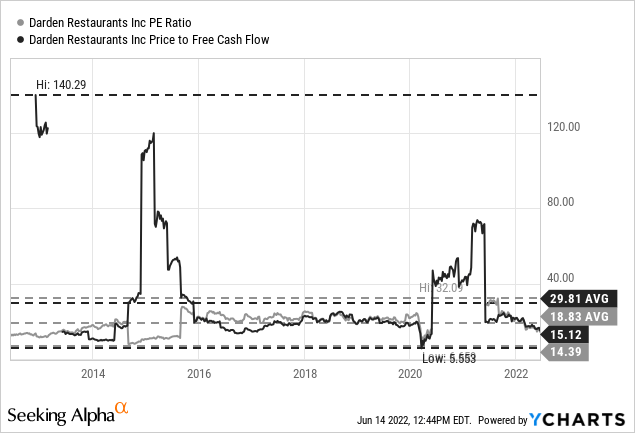

When looking at the two major simple valuation metrics – the price-earnings ratio as well as the price-free-cash-flow ratio – Darden Restaurants seems to be fairly valued right now. The stock is trading for about 14 times earnings, which is below the average of the last ten years (18.83). And Darden Restaurants is also trading for 15 times free cash flow, which is clearly below the 10-year average of 29.81. However, that number might be a little distorted by the extremely high P/FCF ratios in the years 2013 till 2015.

Aside from looking at simple valuation metrics, we can also use a discount cash flow calculation to determine an intrinsic value for Darden Restaurants. As basis for our calculation, we can take the free cash flow of the last four quarters (which was $988 million). And we can be rather optimistic that Darden Restaurants won’t be hit so hard by a recession. Nevertheless, we will assume stagnating free cash flow in fiscal 2023 and fiscal 2024. For the following years, we assume 5% growth till perpetuity, which leads to an intrinsic value of $140.76 (assuming 128.2 million outstanding shares as well as 10% discount rate).

And as I am writing this the S&P 500 clearly entered a bear market (the index already declined 23%). Keeping that in mind, we should definitely calculate a bear case scenario as well. And we assume that Darden Restaurants will be affected by the recession and free cash flow will decline 50% in fiscal 2023 (as I can also imagine the recession to be extremely steep). For fiscal 2024, we assume 20% growth and 10% growth for fiscal 2025, followed by 5% growth till perpetuity again. This would lead to an intrinsic value of $90.09 for Darden Restaurants and the stock would be overvalued right now.

Conclusion

Darden Restaurants could be fairly valued if we assume that the company will be able to withstand the coming recession. As the different restaurants under the brand name offer rather affordable dining choices the chances are high that the business won’t be affected as hard by a recession as many other businesses. But I don’t want to count on it.

And I would be cautious right now as it looks more and more like the bear market has begun and if we don’t see a final wave up (with new all-time highs), we will only see bear market rallies that are followed by several steep declines and in total the S&P 500 might easily decline 70% or more.

Be the first to comment