Taiyou Nomachi

Companies dedicated to the housing and general construction space may not be viewed as particularly appealing at this point in time. After all, rising interest rates aimed at combating inflation may lead to weaker demand for these types of goods. But one company that has performed exceptionally well in this environment and that continues to generate strong performance is Boise Cascade Company (NYSE:BCC), a producer and seller of laminated veneer lumber, laminated beams, and I-joists, as well as a distributor of strand board, plywood, lumber, and other related products. Even in the event that financial performance for the company reverts back to what it was prior to the pandemic, I don’t believe that shares of the enterprise should be considered overpriced. And even with management warning about the 2023 fiscal year, I do think that some additional upside might still be on the table. Because of that, I have decided to keep my ‘buy’ rating on the company for now, reflecting my belief that it should generate performance that is greater than what the broader market should achieve for the foreseeable future.

Great performance continues

The last time I wrote an article about Boise Cascade was back in early September of this year. In that article, I talked about how cheap shares of the company were. I acknowledged that there was some pessimism from investors that was warranted because of current industry conditions and a recent decline in profitability and sales the company had reported. But all things considered, I felt as though it would be unlikely that even a downturn would make shares look overpriced. This led me to keep the company a ‘buy’. Since then, things have gone along quite nicely. While the S&P 500 is up by 1.6%, shares of Boise Cascade have generated a return for investors of 18.2%.

For investors to remain informed, it’s critical to dig into the numbers and understand why the market might be rewarding Boise Cascade during these uncertain times. In this particular case, I would like to point to financial results covering the third quarter of the company’s 2022 fiscal year. This is the only quarter for which new data is available that was not available when I last wrote about it. During that quarter, sales for the firm came in strong, totaling $2.15 billion. That’s 14.7% higher than the $1.88 billion generated the same time last year. Interestingly, this increase in revenue came even at a time when the number of housing starts in the US fell, totaling 388,200 during the quarter compared to the 419,100 reported the same time one year earlier. Despite this headwind, the company benefited from increased sales volumes across a couple of different categories.

Under the Wood Products operations of the company, the volume of laminated veneer lumber the company sold rose from 4.6 million cubic feet to 5.2 million cubic feet. In addition to this, the company went from selling 314 million square feet of plywood to selling 329 million square feet. Selling prices also improved, with laminated veneer lumber climbing from $22.30 per cubic foot to $33.82 per cubic foot. For I-joists, pricing increased from $1,575 per 1,000 equivalent lineal feet to $2,429 per 1,000 equivalent lineal feet. Only plywood pricing weekend, falling from $561 per 1,000 square feet to $477 per 1,000 square feet. The company also saw a nice improvement in sales associated with its Building Materials Distribution operations, with revenue climbing 13.7% year over year from $1.72 billion to $1.96 billion. This increase, management said, was driven by a 15% average price increase on the product sold, some of which was offset by a 1% decline in volume. General line product sales were particularly robust, shooting up by 19% year over year.

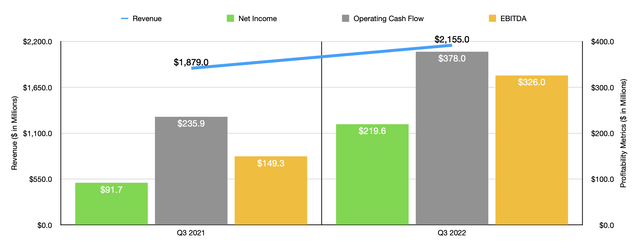

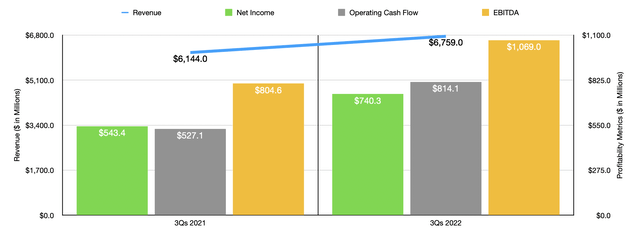

With this increase in revenue, the company also reported a nice increase in profits. Net income rose from $91.7 million in the third quarter of last year to $219.6 million the same time this year. Operating cash flow rose from $235.9 million to $378 million. And EBITDA for the business rose from $149.3 million to $326 million. These results were very important in pushing up financial performance for the first three quarters of 2022 as a whole. Revenue of $6.76 billion beat out the $6.14 billion reported the same time last year. The company saw net income rise from $543.4 million to $740.3 million. Operating cash flow went from $527.1 million to $814.1 million. And EBITDA for the company improved from $804.6 million to $1.07 billion.

When it comes to the future, we don’t really know what to expect for this firm. Management has not provided any real guidance for this year or beyond. Having said that, they did give something of a warning covering next year. The company reiterated that the demand for its products is heavily correlated with new residential construction, residential repair and remodeling activities, and light commercial construction. But with rising interest rates aimed at combating high levels of inflation, management believes that the pace of new residential construction is slowing and that, as a result, we are likely to see single and multifamily housing starts in the country drop by between 15% and 20% next year relative to this year. Though they did say that the primary drivers of repair and remodeling activities are likely to be supportive during this time.

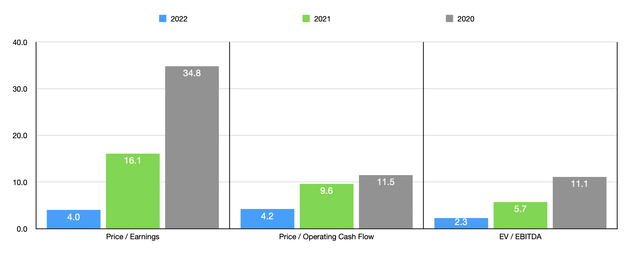

Due to these concerns, I don’t believe that projecting out financial results for this year would be appropriate. That would give a picture of the company that is overly bullish given how strong performance is. Instead, I decided to price the company based on data from 2021, 2020, and even 2019. These results can be seen in the table above. With the exception of the price-to-earnings multiple for the 2019 fiscal year, I have a hard time believing that shares would be overly pricey to the extent that they would warrant meaningful downside from current levels should financial performance revert back to what it was in the past. From a cash flow perspective in particular, the company looks to be on solid footing. It also helps that it has cash in excess of debt totaling $422.9 million. As part of my analysis, I did also compare the company to five similar firms. As you can see in the table below, using each of the three valuation metrics for the 2021 fiscal year, our prospect is the cheapest across the board.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Boise Cascade Company | 4.0 | 4.2 | 2.3 |

| Martin Marietta Materials (MLM) | 39.3 | 24.2 | 22.3 |

| Summit Materials (SUM) | 31.6 | 13.1 | 11.4 |

| TopBuild (BLD) | 28.2 | 22.7 | 19.3 |

| Installed Building Products (IBP) | 34.8 | 29.9 | 16.1 |

| Eagle Materials (EXP) | 18.9 | 13.1 | 11.9 |

Takeaway

Based on all the data we are seeing right now, I do believe that the financial performance for Boise Cascade would be somewhat worse next year than it should be this year. Having said that, shares of the company do look cheap and I believe that it offers investors attractive upside in the long run. Admittedly, I do think the easy money has been made by this point. But for those who want a firm that can still outperform the market, I don’t think that Boise Cascade would be a horrible prospect to consider.

Be the first to comment