Jozsef Soos/iStock Editorial via Getty Images

For dedicated freighter airlines, the past three years have been extremely good times. Because belly freight capacity was virtually eliminated overnight in March 2020 when large parts of the world went into lockdown, the unit revenues for airfreight increased significantly. One of the airlines that is now insolvent is CargoLogicAir, a Boeing (NYSE:BA) customer with a very troubled order with Boeing. In this report, I will have a look at why CargoLogicAir collapsed and explain that the collapse has little to no consequences for Boeing.

Good Times To Be A Freighter Airline

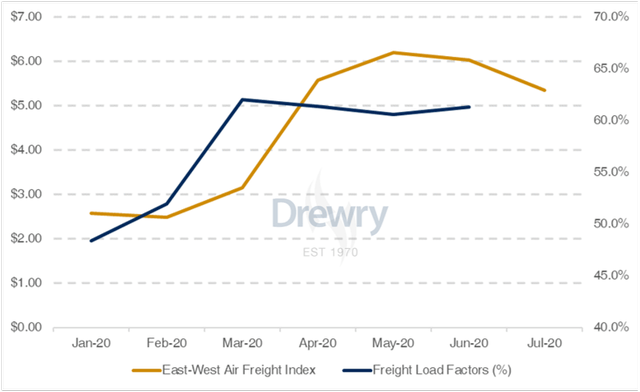

East-West Air Freight Index (Drewry)

As mentioned earlier, the past three years have been extremely good times for freighter airlines. On any normal day, 50% of the air freight is transported inside the bellies of passenger aircraft. When in mid-March large parts of the world started imposing travel restrictions, that capacity was virtually eliminated overnight. Many airlines did start freighter operations using passenger jets, but the total capacity took a hit and sent air freight revenues higher also driven by increased e-commerce spending. East-West, indicative for product flowing to customers, unit prices for airfreight increased from roughly $2.50 to over $6.00 in May 2020 and climbed even higher, exceeding $8.00, and prices for Asia-North America routes were even higher. By now, air freight rates dropped significantly, but are still above pre-pandemic levels.

Problems for CargoLogicAir

Against the backdrop of increased air freight rates, one would not expect a freighter airline to collapse but it still happened. That collapse was not driven by weakening in the air freight rates or higher oil prices but has everything to do with the war in Ukraine. CargoLogicAir is a British company on paper but it is part of Russian Volga-Dnepr Group. As a result, operating the airline became challenging. Initially, the airline was not banned from the operating in European airspace as was the case for the Volga-Dnepr Group, but due to its financial ties to the Volga-Dnepr Group, the financial situation quickly deteriorated and CargoLogicAir ceased operations in March 2022. Next to that, Alexey Isaykin, who was a majority owner of CargoLogicAir and President of the Volga-Dnepr Group, was sanctioned as European sanctions increasingly started targeting Russian oligarchs. Due to a freight deal signed with the mayor of Moscow under pressure of President Putin, Isaykin, who has a Cypriotic passport, was put on the sanction list adding another layer of complexity for CargoLogicAir.

Isaykin cut ties with the Volga-Dnepr Group, but the financial gap that remained was not filled. For some time it seemed that Etihad Airways was looking to acquire AirBridgeCargo, the biggest company of the freight airline, but ultimately the Abu Dhabi based airline did not proceed with an acquisition and also for other airlines such as CargoLogicAir no buyer was found.

Earlier, CargoLogicAir Germany already entered into bankruptcy proceedings, and in November, the company was declared insolvent. The same fate now awaits the part of CargoLogicAir that operated under the British flag. In 2020, the airline already ceased operations due to the pandemic but it was successfully reducing costs by sizing down its fleet which led to costs being lowered by 50% while revenues only dropped 6%, leading to a $41.2 million profit.

So, CargoLogicAir was executing well as it aimed for profitability and it was even looking to expand in cost efficient ways. However, the invasion of Ukraine completely changed things and one of the two Boeing 747 freighters was taken by owner Aircastle and put on lease with National Airways while the other aircraft has been parked in Frankfurt for months.

A Very Small Hit For Boeing

While CargoLogicAir was looking to expand its fleet and operations, for Boeing the hit is relatively small. In 2018, during the Farnborough Airshow, CargoLogicAir signed a tentative agreement with Boeing for up to 29 Boeing 777F aircraft which are valued over $4.5 billion at base value. Ultimately, Volga-Dnepr Group signed for only 9 aircraft, giving the impression that the tentative agreement was for 9 firm Boeing 777Fs with options for 20 more. The first aircraft were likely to be delivered more than a year later, but in a meeting with Boeing, it was communicated to Boeing that the airline group would not be taking delivery of the aircraft and Boeing should seek new customers for three Boeing 777Fs and one Boeing 747-8F as the airline group had not been able to secure adequate financing for the jets.

Boeing terminated the contract for the jets and started remarketing them. The company successfully found new customers for the jets including for three Boeing 777Fs that were initially expected to enter service with CargoLogicAir. Due to the pandemic, Volga-Dnepr Group wanted to take the jets after all but Boeing had already sold the jets to other parties at the time. Boeing and Volga-Dnepr Group clashed in court over the order as Volga-Dnepr Group did not consider the order cancelled while Boeing did. The judge ultimately decided in Boeing’s favor and the three out of the nine ordered Boeing 777Fs were scrapped from the Volga-Dnepr orders from May 2020 through June 2020. Boeing also placed the remaining orders in a tally for aircraft that are ordered but are unlikely to be delivered based on additional criteria beyond the existence of a firm purchase agreement.

So, the pain for Boeing is limited to six aircraft that are in the order book valued slightly over $930 million but one can wonder how big that pain really is for Boeing. The US jet maker had already deemed the jets unlikely to be delivered in March 2020 and sanctions against Russia in 2022 made it even less likely that CargoLogicAir could ever pay for these jets. Apart from that, the Boeing 777F is a popular aircraft of which Boeing already sold 35 aircraft in 2022 and 42 aircraft in 2021 and those jets are likely being sold at better pricing terms than the ones agreed on with CargoLogicAir back in 2018.

Conclusion: No Problem For Boeing As Freighter Aircraft Market Leader

With the demise of CargoLogicAir, a company that was looking to expand its operation is ceasing operations. However, the sanctions against Russia which led to the demise of CargoLogicAir already made it even more unlikely that the Boeing 777Fs that the Volga-Dnepr Group had on order would ever be able to be delivered. Boeing will likely ultimately scrap the remaining order from Volga-Dnepr Group and will be able and possibly already has remarketed the production slots. With the elimination of CargoLogicAir, it seems that a circle is closing with an airplane order placed in 2018 from which Boeing and CargoLogicAir as a centerpiece of dispute. Boeing likely will be able to keep the signing money for the aircraft and possibly even a significant portion of prepayments that were made, and combined with better market conditions for selling freighters, this is actually a financial win for Boeing. However, it is also a good time to realize that not all orders placed ultimately lead to delivery due to a wide variety of complex reasons.

Be the first to comment