Andrii Dodonov

All values are in CAD unless noted otherwise.

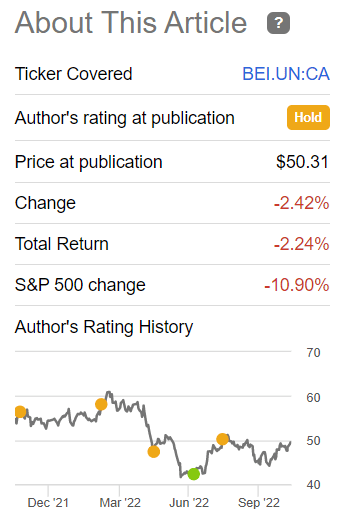

We had to boost our fair value estimate the last time we wrote on Boardwalk Real Estate Investment Trust (OTCPK:BOWFF). We still went with a hold instead of a buy rating since the stock price had almost caught up to our higher fair value number and we did not see significant capital appreciation prospects from that point. This was just after the Q2 results in August.

The key takeaway is that Boardwalk maintained its numbers through a very challenging period. Based on all of this, we are boosting our fair value to $52.50 at about 17X 2022 FFO. This is a jump from our $48 numbers just a little while back. The stock has almost caught up to that, and we don’t see big prospects for capital appreciation here. Hence, we are downgrading this to a hold. Interest rate jitters and/or recession fears might set up a better buy point down the line, and we will be on the lookout for that.

Source: Boardwalk: Mission Accomplished Again

While the stock price has pretty much remained in the same ballpark, it has avoided the drubbing meted out to the broader market.

Seeking Alpha

The third quarter results (press release) are fresh off the oven, and the word on the street is that this residential REIT has had a great quarter. But when have we ever blindly trusted the streets? Time for us to get granular and tell you what we really think.

Q3 Results

The year over year same property rental revenues increased 4.9% and the overall rental revenue increased by 5.9%. The hot rental market helped, and their new and renewal leasing spreads continued experiencing an upward momentum. The new leasing spread increased from 6.8% in Q2 to 9.7% in Q3, whereas the renewal leasing spread increased from 5.0% in Q2 to 5.7% in Q3. There was further good news in the form of limited incentives being offered on new leases in Edmonton and Calgary.

The Net operating income, or NOI, evidenced a year over year increase of 6.4%, while the same property NOI grew by 5.2%. Similar to Q2, the operating margins came in higher than 2021 at 60.8% (versus 60.6% in Q3-2021).

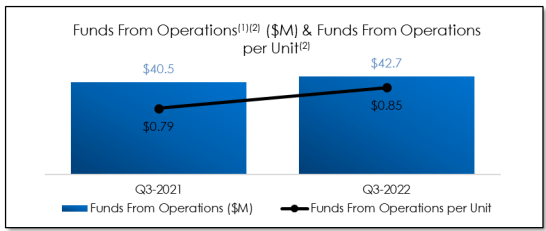

Leveraging the above, the overall Funds from operations (FFO) increased by 5.4%. The FFO per unit, on the other hand, increased by 7.6%. Most of this was a pass down from topline growth, but the small buybacks (62,500 units in the quarter) contributed a little as well.

Q3-2022 Presentation

This theme carried over to the Adjusted FFO (AFFO) and while the overall AFFO was up 7.5%, the per unit counterpart was up 9.5%.

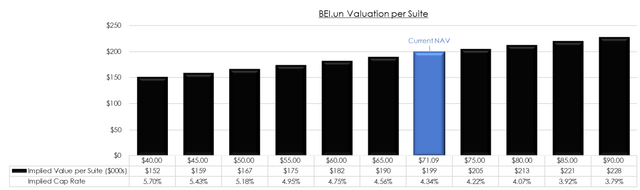

The higher rental rates resulted in another upward adjustment to Boardwalk’s calculations of the net asset value or NAV per share. It had already breached $70 in Q2, it increased by another $1.06 in Q3.

Interestingly, as the slide shows, the market is currently valuing Boardwalk at close to $167,000 a suite and an implied 5.18% cap rate. This does appear to be a marked discount to the market. Boardwalk bought an apartment building in Calgary this quarter for $41.9 million at close to $265,000 a suite and an approximate cap rate of 4.75%.

Outlook

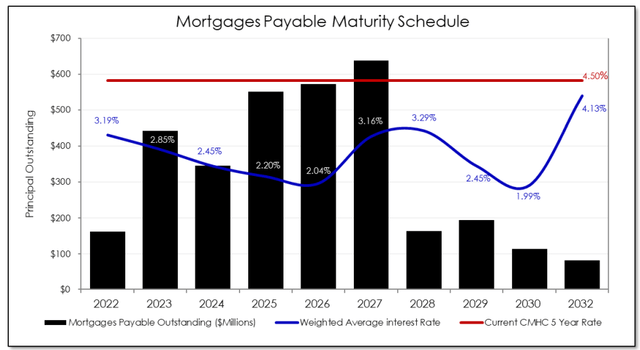

We had expressed some concern about the interest rates in our previous piece and noted that we thought the REIT could handle 4%-4.5% rates, albeit with minor unpleasantness. This was after the Q2 results when the weighted average interest rate for 2022 was 2.81%. With the refinancings since then, the rate has jumped to 3.19%. The CMHC rate made an even bigger leap from 3.70% to 4.50%.

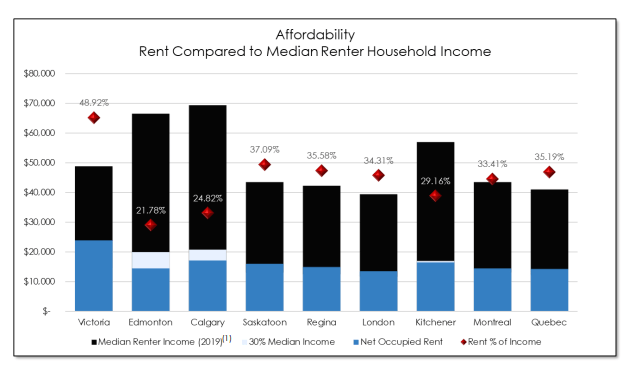

The 2023 maturities are up next ($443 million total) and moving those close to 4.5% will get annual interest up about $10 million in 2023 vs the 2022 base. With revenues expected to be close to $500 million for 2022, we can likely see a 3% total revenue bump more than offsetting this. The key will be whether other expenses can be controlled enough to improve NOI and ultimately FFO. Our thinking is that it will be next to impossible with the current trends. So, our expectation for 2023 is that Boardwalk will deliver at close to the fourth quarter run-rate of 80 cents, or $3.20 for the year. This is not a bad place to be, especially with the REIT having offset a good deal of the rate hikes. Readers may recall that Boardwalk was the most vulnerable to higher interest rates as it had one of the lowest average interest rates on its mortgages. So far, it has navigated this aggressive hike cycle rather well. It also has the highest flexibility among apartment REITs as its payout ratio is extremely low. So retained cash is always an option to help it out in a crunch. A final positive here is that Boardwalk is positioned primarily in Alberta and Saskatchewan, two of the most affordable provinces for renting relative to income.

Q3-2022 Presentation

Verdict

Apartment markets will remain tight as the home buying activity has come to a standstill. It will take some time for the housing market to reprice lower and people to try and budget for 6.5% interest rates. 3% price hikes are going to be easy and rental incentives should drop to minimal levels. The bulk of Boardwalk’s portfolio is also insulated from rent control markets and it can hike rents at will. If there is a bearish slant here, it comes from trying to figure out where 4.00% cap rates fit in a world where risk-free rates are higher. This remains a difficult question to answer and one that is best done using a wide margin of safety and stress testing investing assumptions at 6% cap rates. It would also not be unusual to see it trade at 12-13X FFO in this climate. Boardwalk looks ok here, and we think there are a couple of better relative bargains in Canadian space. We rate it a hold and would get excited if we saw it under $45.00.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment