DNY59

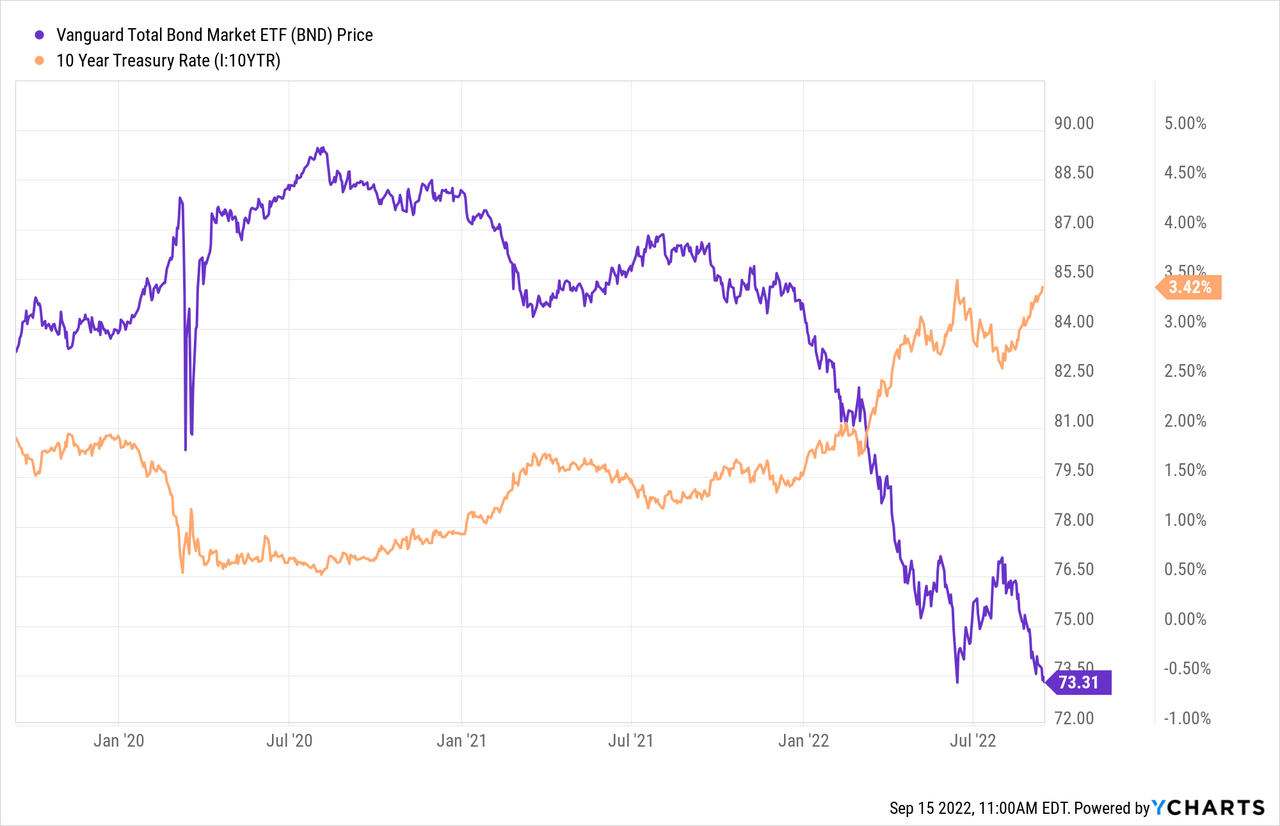

The past two years have been challenging for bond investors. Most fixed-rate bond funds, such as the popular (NASDAQ:BND), are down by 15% or more over the past twelve months as high inflation has triggered a considerable rise in bond yields. I have covered the bond crash with a bearish outlook since mid-2020, recently publishing “BND: The Bond Market Collapse Is Accelerating” in July. Bond prices have continued to decline since then, and BND has now re-traced toward its June low, potentially opening the door for a more significant decline in bonds as support levels are broken. See below:

With the 10-year Treasury rate returning to its June peak, the bond market will likely bounce on its support level or break much lower. With this in mind, I believe it is a crucial time to take a closer look at the bond market. Over the coming days and weeks, actions in the bond market will be necessary not only for bond investors but all investors since interest rates significantly impact all assets.

BND’s Exposure To Corporate Bond Spreads

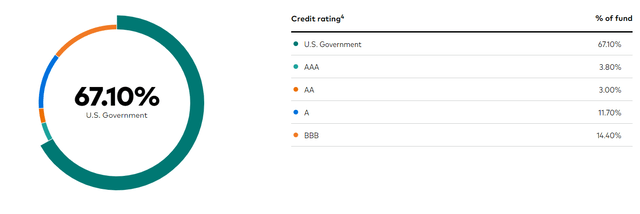

BND is a good proxy for the bond market since it owns medium duration (~8-9 year maturity) low-risk bonds. Two-thirds of the ETF is currently allocated to U.S government bonds, and the remaining third is split between investment-grade corporate bonds. Notably, much of its corporate holdings are in the lower investment-grade tiers, such as BBB and A, which carry high downgrade risk in the case of a widespread economic slowdown. See below:

BND Portfolio Composition (Vanguard)

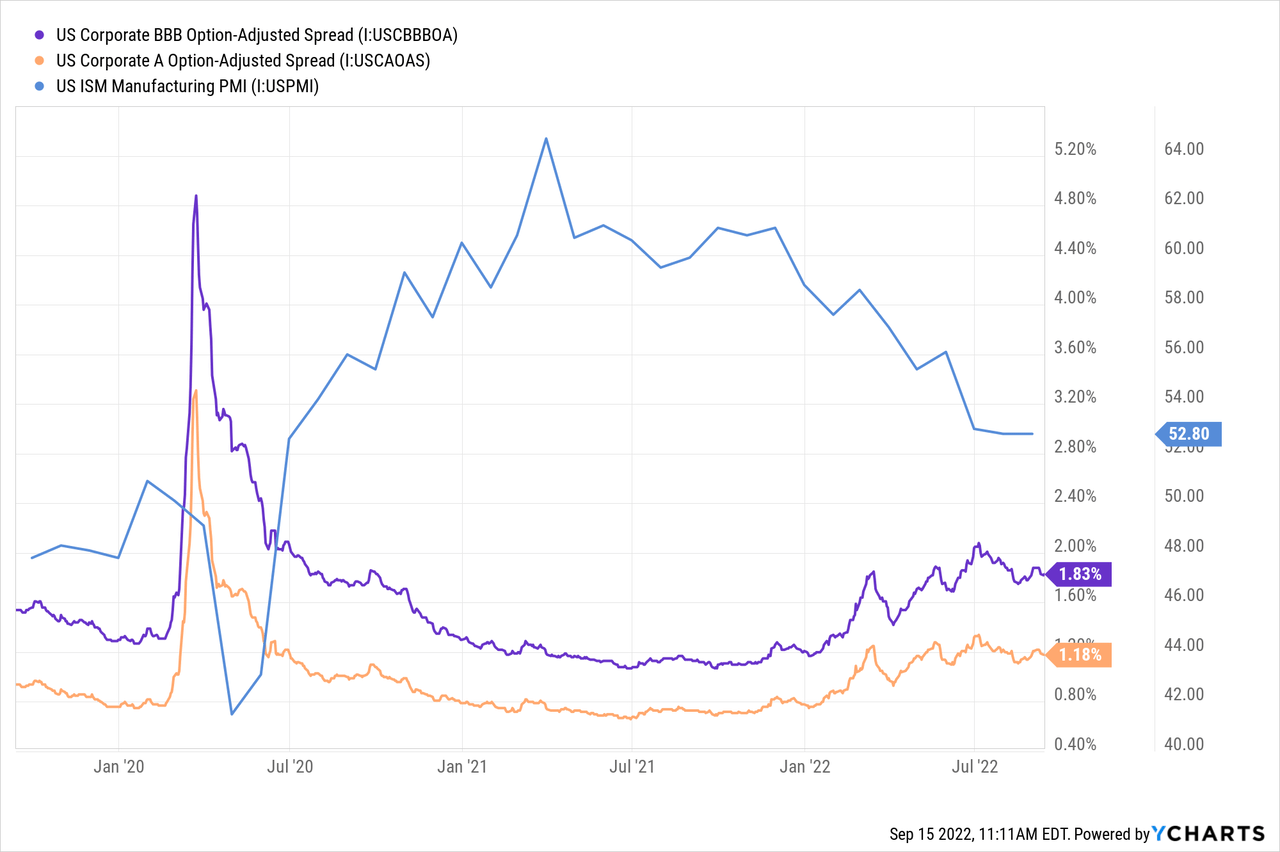

BND fluctuates inversely to the five-to-ten-year Treasury rates. Since a third of the fund is allocated toward corporate bonds, it may also decline if corporate bond spreads widen. The ongoing decline in the U.S. manufacturing PMI (a solid economic indicator) signals some minor growing risk to investment-grade corporate bonds. See below:

Thus far, corporate bond spreads have not risen quickly enough to trigger a sell-off in BND. However, as we saw in 2020, BBB and A-rated corporate bonds have the potential to see spreads widen very quickly in the case of a financial storm. For now, I do not believe investors should concern themselves too much with BND’s risk of widening corporate spreads. Still, if the economy continues to slow or there is a sell-off in stocks, BND may face rapid declines. Given the Federal Reserve’s insistence on fighting inflation, I do not believe they will bail out “fallen angels” (corporate bonds that lose investment grade status) as they did in 2020, so BND’s potential losses could be permanent in my opinion.

The Bearish Case For Treasury Bonds

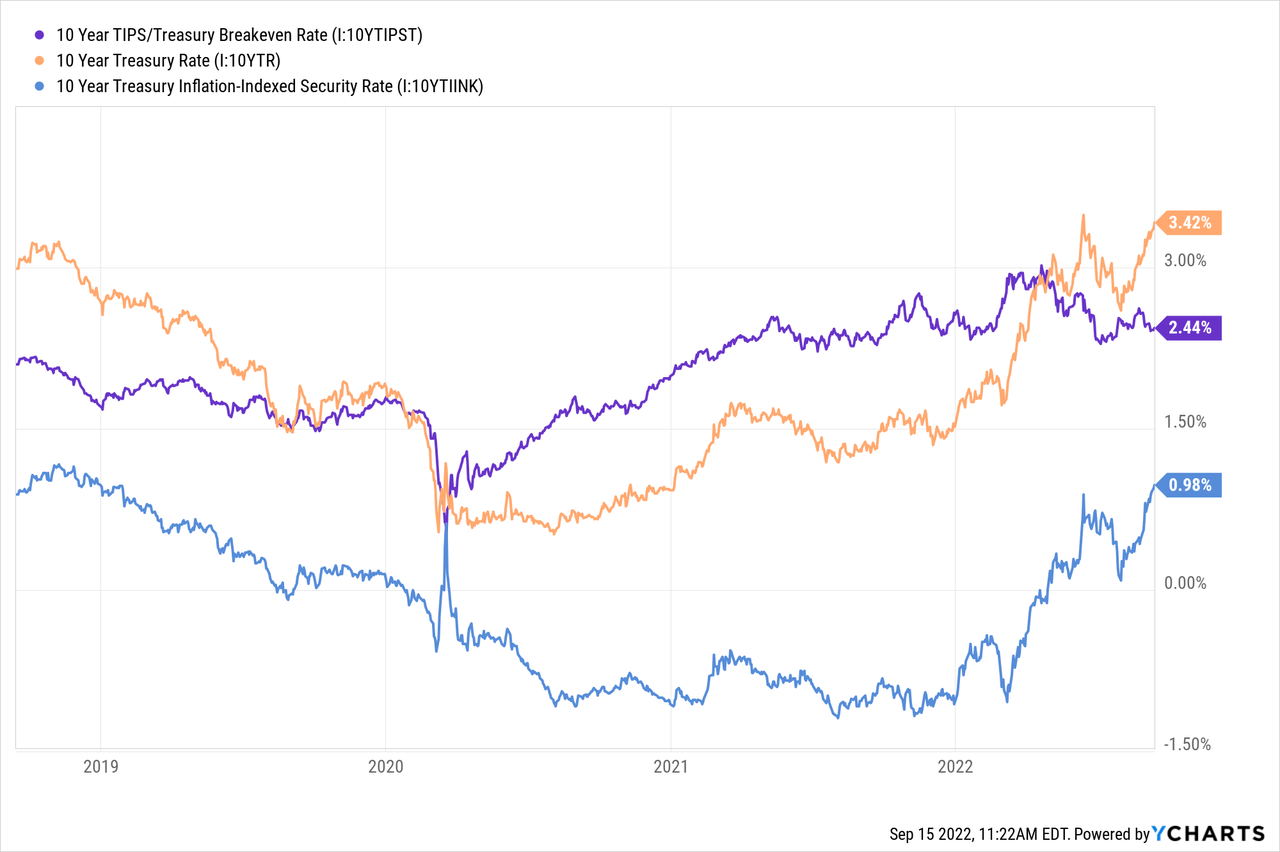

Over the past two years, I have been extremely bearish on the Treasury bond market due to its negative exposure to inflation. BND has a 3.4% maturity yield, far higher than in recent years. However, with inflation at 8%, BND’s real yield is around -4 to -5%. That said, the bond market is priced to discount a 2.44% average inflation rate over the next decade, giving 10-year Treasury bonds a hypothetical long-term real return of nearly 1% (from inflation-indexed bonds). See below:

The “breakeven” inflation rate is calculated by subtracting the non-inflation hedged 10-year Treasury rate from the inflation-indexed Treasury bond’s yield. Today, a 10-year inflation-indexed Treasury bond pays 0.98% plus the annual CPI growth. In my view, this feature makes inflation-indexed Treasury funds such as (TIP) attractive and makes BND very unattractive since the current ~8% CPI growth is well above the 2.44% long-term expected level.

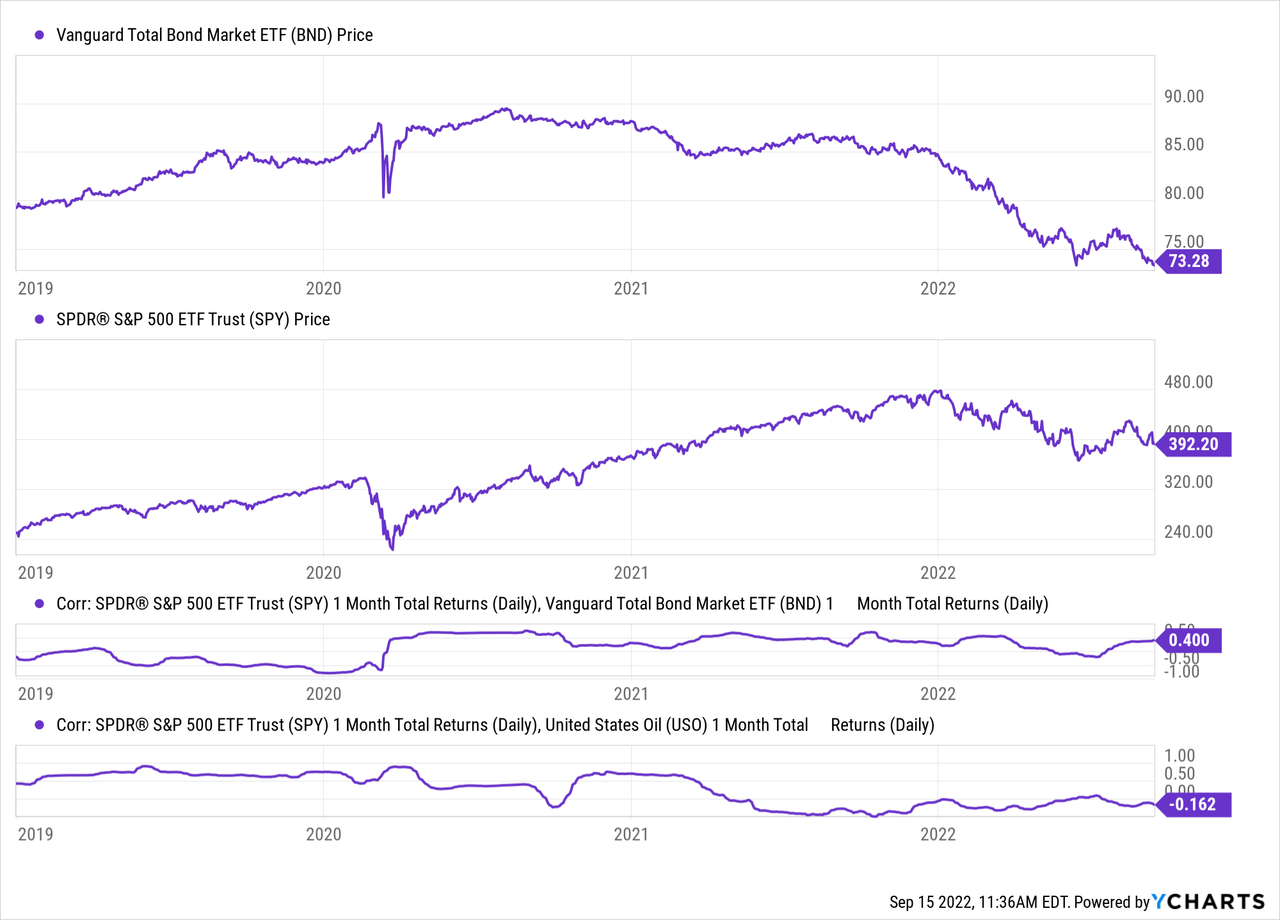

That said, inflation-indexed bond yields have continued to rise despite the slowing economy, causing TIP to decline with BND over the past month. This point is crucial as it suggests higher long-term interest rates will be necessary for inflation to be moderated. In my view, this factor may rise if crude oil and gasoline prices return to new highs, as I believe. Crude oil’s correlation to the S&P 500 has decreased and been partially negative over the past year. At the same time, BND’s correlation to the S&P 500 has become somewhat positive over the past two years. See below:

Historically, crude oil and bonds negatively correlate due to their opposite inflation exposure. Stocks typically depend on the economic growth outlook, which is usually positively correlated to inflation, giving stocks and bonds a historically negative relationship. By owning both, many investors exploit the inverse relationship between stocks and bonds, creating lower portfolio volatility.

However, since 2020, the correlation between stocks and bonds has become generally positive, while the relationship between stocks and oil (and commodities in general) has become negative. This is important because it means BND is no longer a hedge against stocks. Both the bond market and the stock market are trading opposite inflation expectations. If inflation remains above expectation, as we saw on Tuesday (Sep. 13th), stocks and bonds will likely crash together. In my view, this is a considerable risk factor for BND since I believe commodity-driven inflation will likely rise as the U.S government looks to refill the strategic petroleum reserve in November.

Yield Curve Reversal Extends BND’s Downside

As inflation becomes more “sticky,” the Federal Reserve will need to take more aggressive steps to slow the economy to tame inflation. This effort will likely be bearish for both stocks and bonds, but as long as commodity and labor shortages exist, economic demand must decline to stabilize prices. Considering there are few signs indicating persistent output growth, I believe inflation is unlikely to average 2.4% this decade as the bond market currently discounts. As the inflation or interest-rate outlook rises, BND may fall around 6.5% for each 1% rise in 10-year interest rates (based on its current duration).

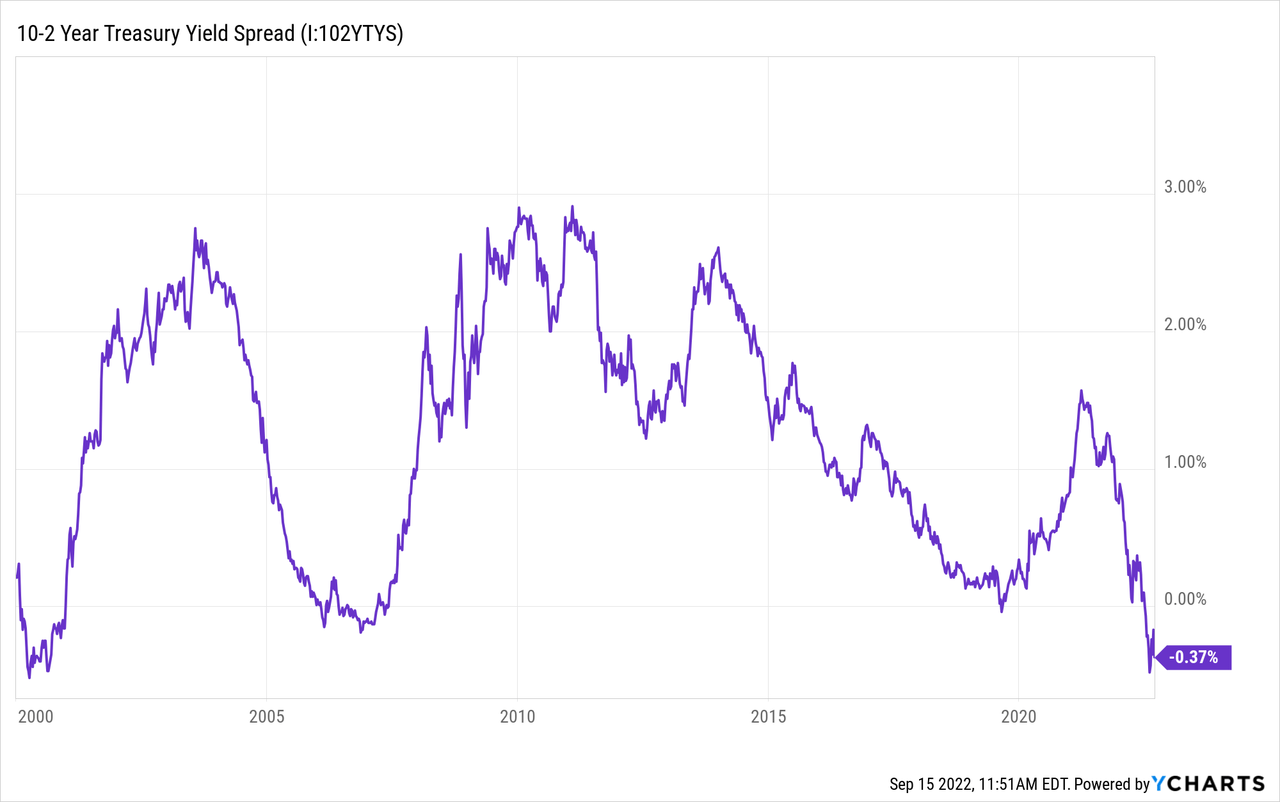

Eventually, BND may also face extra losses if the yield curve finally normalizes. The yield curve is currently at its long-term ultra-low range of nearly -0.40%. See below:

Such inversion indicates an impending recessionary dynamic; however, with high inflation, such a dynamic is not necessarily bullish for bonds. Considering BND’s weighted-average maturity is more prolonged, a rise in the yield curve (by itself) would create some losses for BND. The curve’s flattening has softened BND’s losses over the past year. While the yield curve could hypothetically continue to invert, it usually rises from such extreme lows. Given no change in short-term interest rates, a ~1.5% rise in the yield curve (to bring it back to average levels) should cause BND’s price to decline by around 7-9% (given BND’s 6.5% duration).

The Bottom Line

I have a bearish outlook on BND and believe the fund may be on the verge of a more considerable decline. At the time of writing, BND is resting on its June low. While this offers some potential support, current trends suggest that long-term interest rates are on the verge of another wave higher. This view is supported primarily by the fact that inflation remains well above the yield available on BND (and virtually all bonds). This factor might not be necessary if inflation were quickly falling. Still, recent data suggests it will be more persistent and, in my view, may soon rise higher if crude oil (and other energy commodities) rise following OPEC cuts and the SPR reversal.

Often, strong emotions can get in the way of sound investing decisions. While many today are quick to press blame, the bond market’s decline is fundamentally not driven by the policies of any one person or group. Rising inflation and interest rates are a phenomenon seen in almost every country today, particularly in developed western economies that have undergone decades of deindustrialization combined with immense public and private debt growth. In my opinion, there is nothing Jerome Powell, Biden, or any other leader can do to quickly fix this core issue since it is decades in the making, created by ingrained structural economic problems (such as the long-term decline in U.S. manufacturing).

As wages rise in countries like China and India (where manufacturing was exported), U.S. imported goods will likely continue to become more expensive until there is no longer a significant purchasing power parity. I believe inflationary pressures will generally remain high for a decade or longer until the U.S. manufacturing base grows significantly. As such, BND may face much more significant long-term declines as the current 2.4% long-term inflation outlook does not reflect this reality.

Be the first to comment