gremlin

Humanity has always looked to the stars, both in wonder and for answers. And yet, the portion of the world’s capital allocated to the sector has fluctuated widely since the heyday of the Space Race. This is despite the plethora of direct and indirect fiscal, social and technological benefits from investing in space.

For example, in 1980, 14% of the U.S. government’s research and development budget was allocated to NASA and by 2010, it declined to 7%. This is all despite 2021 estimates placing a return of $8 added to the economy for every $1 spent on NASA. But all is not lost, where governments have dropped the ball, private companies have come to pick up the slack.

Still, the global space economy has a long way to go with private investment only $14.5b in 2021, a record increase of approximately 50% from 2022, according to Space Capital. These new companies have offered investors other alternatives to indirect listed opportunities like Boeing (BA) and Lockheed Martin (LMT). However, the sector rightly draws a lot of attention, frequently driving up valuations for major players like Virgin Galactic (SPCE). Therefore, I will be looking at a lesser-known stock called Kleos Space SA (OTC:KESPF). Kleos is a nanosatellite owner and operator based in Luxembourg, but primarily listed on the Australian Securities Exchange [ASX] and traded on the U.S. OTC markets.

Nano + satellite

Despite what you see in the movies, there are many different types of satellites. In the case of Kleos, the company uses Low Earth Orbit [LEO] nanosatellites, but before we continue, let’s quickly explain what that means.

LEO explained

LEO satellites fly between 160km [99.4 miles] and 1,000km [621 miles] above the earth. For comparison purposes consider flying between New York City and Sydney, during that trip your plane will move between 5.9 and 8 miles above the Earth’s surface. Therefore, LEO satellites orbit over 16.8x the height of your flight.

LEO satellites have two key advantages over satellites in geostationary orbit [35,786km / 22,236 miles]. The first is their lower orbit allows for rapid changes in path, the trade-off being a lower coverage area. The second is the reduced fuel needed to achieve LEO orbit, this places the upfront cost significantly below its GEO competitors. These two benefits have led current estimates to place 80% of existing satellites within LEO.

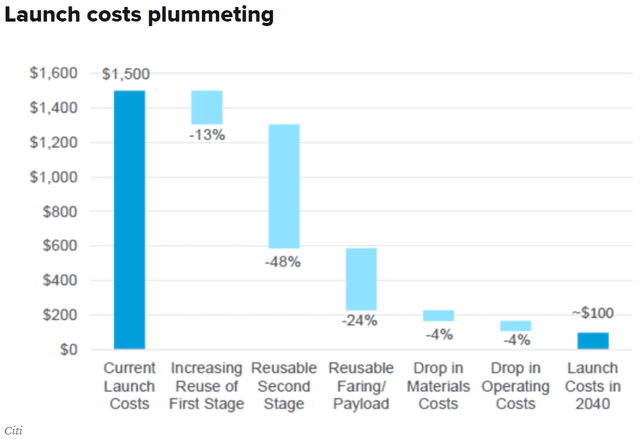

However, it’s important to note that launch costs have been trending considerably lower over the last ten years, and most analysts expect they could move as much as 40x lower by 2040. Still, LEO satellites should see the bulk of these savings before their heavier and higher orbit cousins.

Space launch cost estimates 2040 (Citigroup)

Nano explained

Nanosatellites are part of a classification of small spacecraft known as SmallSats. SmallSats are classified by NASA as having a mass smaller than 180kg and have five subcategories listed in the table below:

|

SmallSat Type |

Mass Requirements |

|

Minisatellite |

100-180 kilograms |

|

Microsatellite |

10-100 kilograms |

|

Nanosatellite |

1-10 kilograms |

|

Picosatellite |

0.01-1 kilograms |

|

Femtosatellite |

0.001-0.01 kilograms |

Kleos’ nanosatellites

Kleos exclusively uses nanosatellites which operate at an altitude of 550km and in clustered formations of four. The company is currently operating three clusters, providing clients with the frequency, time, Latitude & Longitude, and ECEF Coordinates of signals with an estimated average accuracy of 300 meters. However, this precision relies on acceptable operating conditions from factors like weather and interference from other satellites.

Currently, Kleos’ nanosatellites cover the VHF frequency between 155MHz and 165MHz but plans to expand into the X-Band 9GHz frequency.

Prepping for launch

In my opinion, Kleos has many similarities to a start-up telecom company. Before it can generate operating revenue, sufficient infrastructure is required.

While Kleos’ nanosatellite infrastructure is still years away from its goal of 20 clusters, it began making consistent progress in 2020. The company has launched one nanosatellite cluster a year, and since four nanosatellites make a cluster, that’s a total of 12 nanosatellites currently in orbit.

April 2022 saw the last cluster launch aboard a SpaceX Falcon 9 rocket. For a company as small as Kleos, failure to achieve a stable orbit would be devastating. Therefore, while the past does not guarantee the future, the lack of any launch issues puts my mind at relative ease.

With success at its back, Kleos has increased its rate of deployment, with the fourth cluster set to launch by the end of 2022.

Preparing for the future

Assuming Kleos successfully deploys its fourth nanosatellite cluster, its data collection capability with improve by up to 119m km2 per day. While Kleos continues to expand its capabilities, it seems three clusters is enough to begin commercialization. The company has launched both Mission-as-a-Service [MaaS] and Data-as-a-Service [DaaS] plans, generated A$167,000 in revenue during March 2022.

For those unfamiliar with the concepts, MaaS asks customers to pay for customisable and “exclusive access to Kleos’ dedicated, in-orbit radio frequency reconnaissance satellite clusters for fixed periods of time and capacity.”

DaaS offers customers access to Kleos’ historical and live database for a fee. For obvious reasons, MaaS is a far more expensive and, in my opinion, a non-recurring service. I expect DaaS will be the primary source of revenue for Kleos going forward due to its wider appeal and recurring nature.

Demand is proven

On 31 May 2022, Kleos announced a joint data experimentation Cooperative Research and Development Agreement [CRADA] with the U.S. Naval Surface Warfare Center Division, Crane [NSWC Crane].

Under the CRADA agreement, Kleos will provide its radio frequency [RF] geolocation data in realistic test scenarios to improve maritime domain awareness for real-world challenges, including sanctions reporting, embargo, transhipment monitoring, search and rescue, resource management, fisheries control, smuggling, and border control.

Phase 1 of this CRADA began in mid-2022 and is cost and revenue neutral to Kleos. This means there will be no revenue or costs generated during the three to six month period. From Kleos and investors’ perspectives, this CRADA is still a massive win as it provides significant cost-free awareness and undisputable real-world proof of its data’s value via the U.S. government. As the saying goes, if it’s good enough for the military, it’s good enough for you!

On 6 October 2022, Kleos announced another contract win as part of the Strategic Commercial Enhancements Broad Agency Announcement [SCE BAA] Framework through the National Reconnaissance Office [NRO].

Kleos’ Chief Revenue Officer Eric von Eckartsberg described the project best in the announcement when he said:

This study project represents a significant opportunity for Kleos to help the NRO assess the operational and decision-making usefulness of commercial RF GEOINT and understanding how our unique data set can be leveraged and fused with NRO’s operational capabilities through a combination of modelling and simulation, and analysis of collected data from our growing constellation of satellite clusters.

While both these contracts are early stage, the willingness of the U.S. military and intelligence apparatus to engage a company as small as Kleos indicates to me long-term demand.

Revenue lifting off

Kleos generated €106,848 in revenue from ordinary activities during the first half of 2022, significantly below its €6.4m loss after tax during 2021. I don’t expect the company will be profitable during 2022, and I would be surprised if it’s profitable by the end of 2023, although it’s possible. What I do know is the U.S. government is not the only one interested in Kleos at this time, as evident in management’s commentary in the Q3 2022 report.

Q3 2022: read the fine print

Q3 2022’s report was released to the market 31 October 2022 announcing cash receipts from customers were up to €342,000 for the quarter and €1.3m for the last nine months.

But most important was management’s announcement that Kleos had over 260 government and commercial qualified deals in its pipeline. These deals span a broad range of industries including defence departments, national security agencies, coast guards, sanctions agencies and data aggregators.

Management explained that its contracts only recognise revenue once complete, while cash is sent at specific milestones. Management also stated “cash receipts and revenues forecast to accelerate by end Q4 in line with operational status.” While we were not provided with specific details, it’s clear that Q4 2022’s report will provide investors with some much needed clarity as to the pace of future growth.

The downside of potential: risk

In my opinion, the largest risk facing Kleos is not lack of adoption, but rather space debris. Don’t get me wrong, both of these are risks we will cover, but what makes space debris so concerning is it’s almost impossible to quantify.

Space debris

Think of space debris [aka orbital debris or space junk] as space’s version of the Great Pacific Garbage Patch, except each piece of waste is traveling 7km [4.3 miles] per second. At these speeds, even a piece of debris the size of a marble can punch through a satellite with a result similar to that of a hollow point bullet. Current estimates place debris larger than a marble at over 1m and 330m between 1mm and 1cm in size, the vast majority of these pieces are not properly tracked.

Granted satellites can and are moved when the need arises, the International Space Station itself was moved 25 times since 1999 to avoid debris. Unfortunately for investors, at this point, the risk of Kleos’ satellites being hit cannot fully be quantified. However, since they operate in clusters, one being knocked out would not destroy operations. For more information on this risk, I recommend The Changing Risk Landscape in LEO vs. GEO Differences Impact Service, Response, Mitigation and Sustainability by Anne Wainscott-Sargent and Satellite mega-constellations create risks in Low Earth Orbit, the atmosphere and on Earth by Aaron C. Boley and Michael Byers.

Lack of adoption

While I believe the evidence shows Kleos is likely to continue growing its client list, we are still in the company’s early days. This means investors need to be aware of two risks, the first is there are no guarantees in life besides death and taxes. What I mean by this is Kleos could lose its growth momentum and never achieve sufficient demand for its data to justify its expenses. If this happens, the company is unlikely to provide shareholders with any form of return. Basically, the company would likely go bankrupt.

The second risk is closer to a certainty, shareholders will most likely be diluted at least once more through a Share Purchase Plan [SPP]. In Australia, most companies that aren’t profitable will fund their losses through share issuances known as SPPs, not through debt. Kleos has taken on debt, specifically a A$10m debt facility with PURE Asset Management. But the company has issued new shares in the past, and with Q3 2022 ending with net cash used in operations at negative €1.5m, continued expected investment in additional nanosatellites and other property, and only €3.9m in cash, I expect shareholders will be diluted at least one more time.

Conclusion

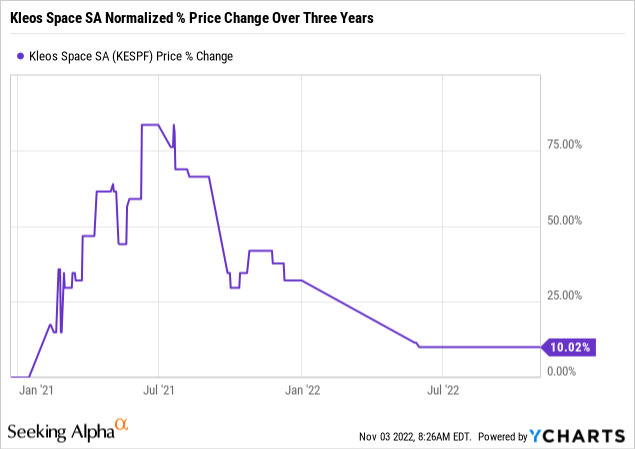

In my opinion, predicting Kleos’ future revenue is more or less pointless, as management has not issued guidance, has just begun receiving orders for its data products, and the industry is too new. However, demand for this type of product is real, and despite the company’s early commercialization success, the stock has plunged far more than the market.

While I expect the company to remain volatile, it has opened up an opportunity for a dollar-cost averaging strategy. If you look at the stock’s current valuation of approximately A$46.4m and compare it to the construction cost of the satellites in orbit and under contract as of 30 June 2022, that’s a multiple of 3.5x [assuming €1 equals A$1.55].

| Cost | € |

| Satellite equipment – at cost | 4,492,379 |

| Less: Impairment | 2,994,919 |

| Satellite equipment [construction-in-progress] | 7,162,737 |

| Total | 8,660,197 |

Source: Note 12. Property, plant and equipment

This is far below its historical average, and despite the unusual nature of this metric, I believe the risk and cost associated with launching three nanosatellite clusters into orbit warrants a multiple higher than 3.5x. Don’t forget, management has over 260 deals waiting and another launch planned before the end of the year. For those willing to take on the risk, I believe the time and valuation are right for to dip your toe into this rocket, especially with the promise of Q4 2022’s report in our sights.

Be the first to comment