feellife/iStock via Getty Images

Investment Thesis

Perion Network (NASDAQ:PERI) is a highly profitable and cheaply valued adtech player.

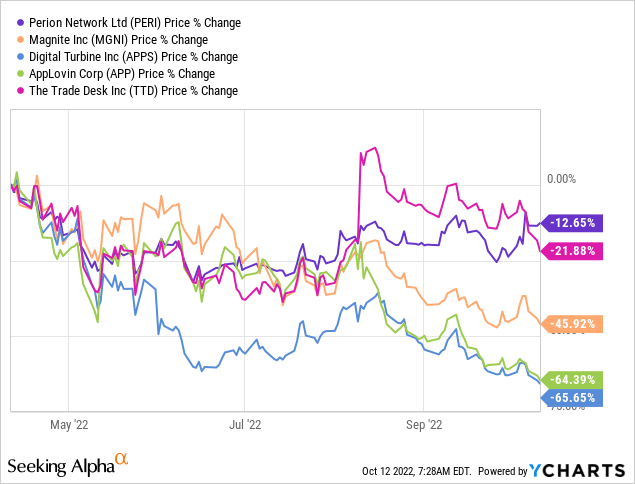

What’s more, Perion has substantially outperformed nearly all its adtech peers, from small to large (and even very large) cap companies; this small Israeli advertising company has been nothing short of impressive of late.

I make the case that despite all the uncertainty and turmoil in the markets right now, Perion’s valuation of 6x EBITDA still offers a compelling risk-reward.

What’s Happening Right Now?

Perion has succeeded in holding up a lot better than nearly all adtech players. In a truly fascinating 6 months where the world appears to the falling apart at the seams, with investor worries ranging from inflation, higher interest rates, and high energy costs, to a slowing US economy, and the list goes on (and on), Perion someway, somehow isn’t faring all that bad.

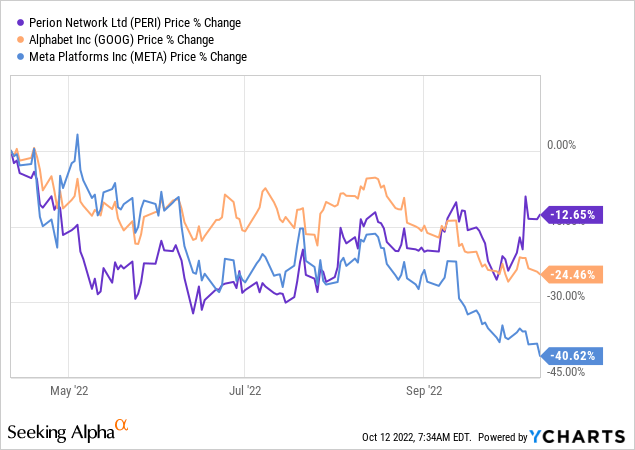

Indeed, astoundingly, even against both its tera-cap peers, Alphabet (GOOG) (GOOGL) and Meta (META), Perion has outshined all in this space. Simply wow!

What gives?

Perion’s Prospects

Perion is a high-impact advertiser.

Perion has two main products responsible for its strong performance, iHub and SORT.

Here’s how Perion describes iHub,

iHub sits in the center of the supply and the demand side of the market. This is an innovative model that no one else in the industry has, aggregate data signals from all channels and from both sides of the open web to create the model that eliminates waste and rewards clients. The data goes into Perion’s privacy first cookieless solution known as SORT. So the iHub is both a source of data and operational platform.

Simply put, iHub works by aggregating the demand side of the equation, that is brands’ message to the best supply side digital assets, think of websites that have inventory available to show an advert.

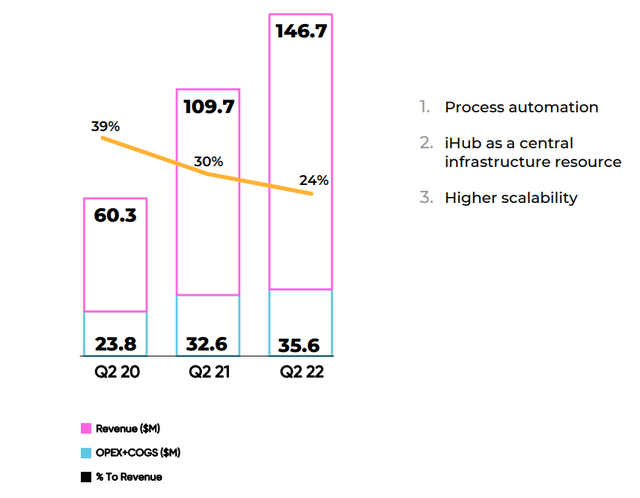

Perion contends that through its iHub platform it can lower its operating costs, as iHub’s central infrastructure squeezes out margins from the system:

What you see above is that operating expenses plus COGS are coming down as a percentage of total revenue.

Next, Perion’s SORT allows brands to gather some information about consumers in a cookieless world. This is how Perion describes SORT as ”delivering privacy without sacrificing performance”.

SORT makes up 14% of Display Advertising revenues, and saw customers double y/y from 65 to 126. Meanwhile, average spending on SORT increased by 62% y/y (Slide 19).

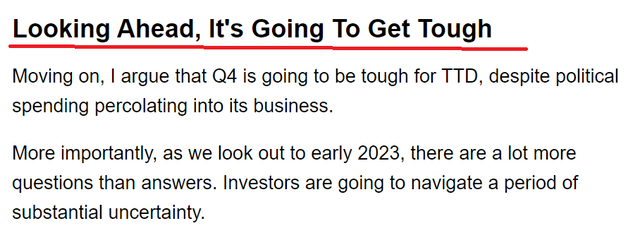

Incidentally, roughly one week before Perion preannounced its Q3 2022 results, I wrote about The Trade Desk (TTD), see below:

My analysis was capturing the zeitgeist of the past few weeks. And with that in the public domain, Perion stated in its press statement:

Indeed, this is the ultimate reality. We are all navigating an unprecedented period. Volatility is now the new norm. And advertising companies are at the bleeding edge of the economic downturn.

Therefore, advertising companies are going to be the first to fall when things slow down. However, they’ll also be the first to come back, as brands seek out ways to get their message out.

What distinguishes Perion from its peers is that some way, somehow, even though everything is hitting the fan, Perion somehow has managed to guide for Q3 to be up 31% y/y.

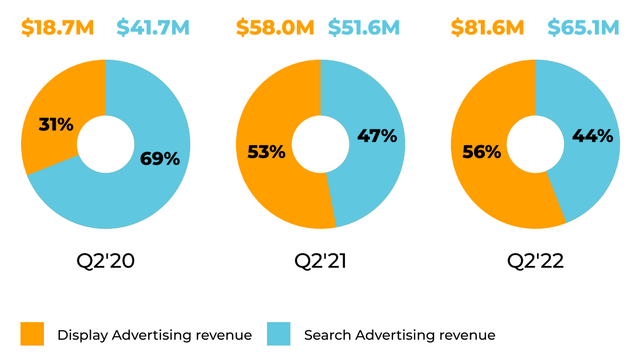

What you see above is that Perion’s Display Advertising business today comes close to 60% of its underlying business. This is being driven by strong growth in CTV and Video. As a reference point, Video is growing the fastest for Perion and makes up 44% of Display Advertising revenue.

Companies of all shapes and sizes are today turning to video advertising, as brands can see significant ROIs from targeted advertising. Humans are creatures that resonate very positively with video advertising.

Next, we’ll discuss Perion’s profitability.

Profitability Profile Shines Through

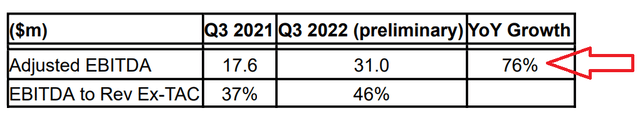

What we see above is that Perion’s Q3 2022 adjusted EBITDA is expected to be up 76% y/y. For a company that guiding for just over 30% y/y revenue growth, to be seeing such strong bottom line performance goes to the core bull case of what iHub delivers for Perion.

PERI Stock Valuation – 6x EBITDA

We know that Q4 is typically the high season for advertising companies. Furthermore, we know that this quarter there’s going to be a lot of political advertising flying around. Consequently, I believe that it’s entirely possible that Perion’s EBITDA could grow by 30% y/y relative to Q4 of last year.

This would put Perion’s full-year 2022 adjusted EBITDA at approximately $166 million. Thus, PERI stock today is still not expensive at 6x EBITDA.

The Bottom Line

Perion argues that the bull case for Perion can perhaps be best summed up as this,

our [profit] margin demonstrates the continuing value we bring to our advertising

And indeed, anyone that’s spent any time weighing up Perion will immediately be drawn to its very high-profit margin. This company is small, and obviously, investors should adequately consider this when weighing up Perion as a potential investment. But that aside, there’s a lot to like here, even now.

Be the first to comment