DedMityay/iStock via Getty Images

A Solid Path For Tenaris

Read my previous article here to learn more about Tenaris S.A.’s (NYSE:TS) product strategies. In the middle of 2022, a lower steel price and an increased selling price can ease up TS’s profit and push the EBITDA margin up. The recovery in the energy industry is reflected in the tube sales in growth in North America, which outperformed all its other regions in Q2. Outside of the US, I expect some parts of the Latin American market to ride the positive momentum in the coming quarters. However, the supply chain issues can affect Mexico’s auto market, one of its key markets in the region.

The most remarkable change in TS’s health came through the spectacular rise in cash flows in 1H 2022. The acquisition of the Benteler group company will enhance its presence in the US and increase its pipe rolling capacity. The company has low leverage. The stock is relatively undervalued. I think investors might want to buy the stock for an upside in the near-to-medium term.

Steel Price And End Market Performance

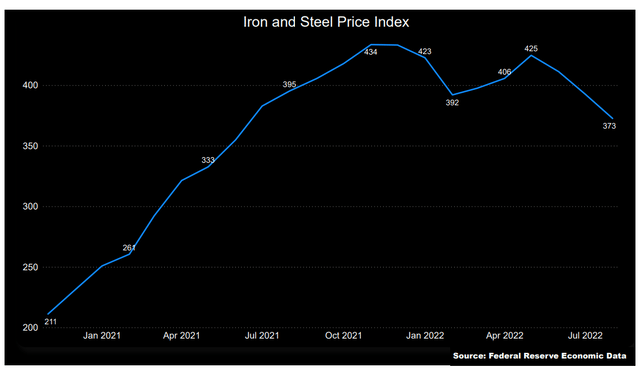

In Q2, the input cost trend reversed and eased up the challenge TS faced for the previous few quarters, as reflected in lower Pipe Logix. Year-to-date August 2022, the U.S. iron and steel price index has declined by 14%, according to Federal Reserve Economic Data. A steel and iron ore price reduction affects margin adversely TS Following the improvement in the scenario, the company is ensuring product certification in its new hot rolling mill in Mexico because HVAC and electrical motors industries would do well in this environment.

TS’s management believes the steel industry will stabilize in the medium term, although the volatility may continue soon. Mexico, one of its key markets, the auto industry suffers from supply chain disruptions, while China’s lockdowns continue to affect these global supply chains. Plus, demand weakened due to a destocking process following the decrease in steel prices and the increase in interest rates. However, the market is expected to recover as restocking would follow the low inventory level.

Q3 Outlook And Acquisition

Although quarter-over-quarter steel shipment volume declined in Q2, the company’s management expects shipments to stabilize in Q3. Revenue per ton improved in Q2 and is expected to improve further. In Mexico, steel prices should decrease and will reflect in a large set of contract prices. In Argentina, steel demand has remained unchanged and will continue due to the strong agribusiness sector, auto industry, white goods industry, and energy sector. Apart from the supply chain issues, the uncertainty regarding the macro situation in Argentina and the rise in interest rates in the U.S. would keep the demand side volatile.

TS agreed to acquire Benteler North American Corporation in July for $460 million. The acquisition would extend Tenaris’ production capacity and its U.S. presence. The company manufactures seamless steel pipes. It has an annual pipe-rolling capacity of 400,000 metric tons.

What Were The Drivers In Q2?

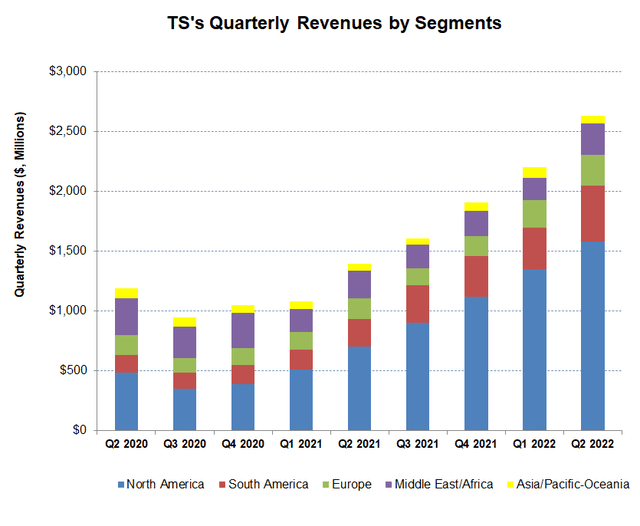

As the energy industry recovered, tube sales in North America outperformed all other regions in Q2 with a 60% quarter-over-quarter revenue rise. South America was the distant second (18% up) during the same period. Sales growth was equal in other regions (10% up in Europe and the Middle East/Africa).

In Q2, TS recorded $806 million in EBITDA, up by 28% quarter-over-quarter, which included a $78 million settlement charge with the SEC, a $71 million gain from the reclassification of NKKTubes’s income statement, and a gain from the sale of land in Canada. The adjusted EBITDA margin expanded by over 200 basis points. The margin gain reflects higher realized steel prices in Mexico and Argentina. Although labor costs increased, it was offset by lower purchase slab costs. TS has an equity interest in Ternium, a steel producer with production facilities in Mexico, Argentina, Brazil, Colombia, the U.S., and Guatemala. Ternium’s adjusted EBITDA can decrease sequentially in Q3 due to lower margins and stable shipments.

Cash Flows And Net Debt

TS’s cash flow from operations (or CFO) increased several folds in 1H 2022 ($73 million) compared to a year ago. Revenues nearly doubled during this period. Despite a steep rise in working capital requirements, cash flow from operations improved significantly. Although capex increased in the past year, free cash flow turned substantially positive in the past year.

TS’s net debt was $108 million as of June 30, 2022. It had sizeable short-term debt due to short-term borrowings. Nonetheless, its leverage (debt-to-equity) is very low (0.06x). TS now pays a dividend ($1.12 annualized), which amounts to a dividend yield of 3.96%.

Target Price And Relative Valuation

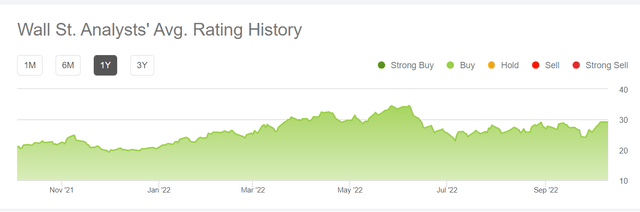

During the past 90- days, eight Wall-street analysts rated TS a “Buy” (including “Strong Buy”). Three analysts rated it a “Hold,” while one recommended a “Sell.” The consensus target price is $35.5, which yields 28% returns at the current price.

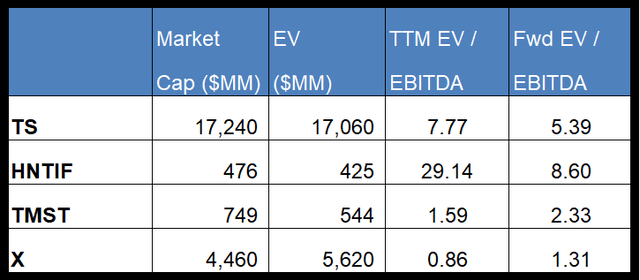

The company’s EV/EBITDA multiple (7.8x) is lower than its peers’ (HNTIF, TMST, and X), with an average of 10.5x. TS’s forward EV-to-EBITDA multiple contraction against the current multiple means its EBITDA can expand more sharply than its peers. This typically results in a higher EV/EBITDA multiple compared to peers. So, the stock is undervalued versus its peers at the current level.

Why Do I Upgrade TS?

I noted many advantages Tenaris had in my previous iteration of the company, including increased demand for new welded and seamless pipeline projects and the rise in average selling prices. However, I was also cautious because of the rising input costs, negative cash flows, and the stock’s relative overvaluation at that time. I wrote:

However, as reflected in higher Pipe Logix, the rising input cost puts pressure on the margin. The cash flows have turned negative in Q1, spelling worries for the investors. A relatively high inventory level can lead to higher working capital in the near term.

After Q2 2022, I have been more optimistic about its outlook. The input price (steel price) has been reduced. Revenue per ton improved in Q2. In Argentina, demand will remain robust due to strong agribusiness, auto, white goods, and energy sectors. The balance sheet and relative valuation-wise, the stock look attractive, the supply issues notwithstanding. So, I upgrade it to a “buy.”

What’s The Take On TS?

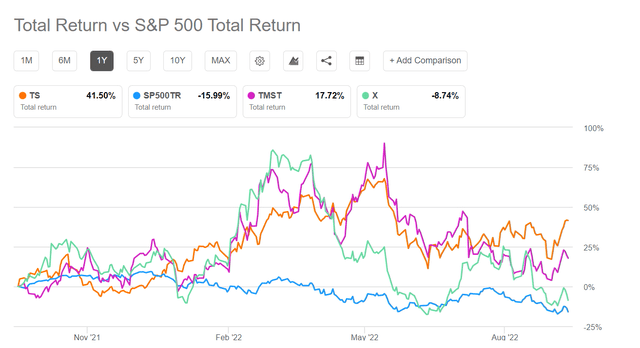

As indicated by lower Pipe Logix, a course change in steel price has given Tenaris a break after many quarters of steady rise. This, coupled with increased selling price, can ease profit and push the EBITDA margin. In Mexico, steel prices should decrease and will reflect in a large set of contract prices. In Argentina, steel demand may continue due to strong demand from various end markets, including the energy sector. The recovery in the energy industry is reflected in the tube sales in growth in North America outperforming all other regions in Q2. So, the stock price outperformed the SPDR S&P 500 Trust ETF (SPY) in the past year.

Tenaris has low leverage. However, some key markets can continue to suffer from supply chain disruptions as China’s lockdowns will affect these global supply chains. Also, the U.S. interest rate rise would keep the demand side volatile. Nonetheless, given its low relative valuation, I think the stock has an upside at the current level.

Be the first to comment