Leestat/iStock via Getty Images

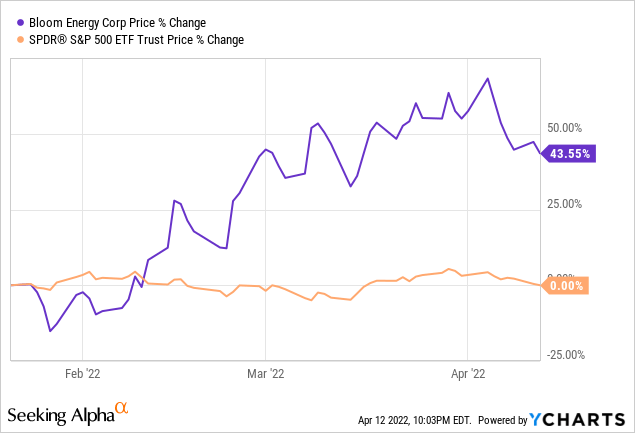

Since my initial article on Bloom Energy (NYSE:BE), there were multiple factors that have served as tailwinds for the stock price. Since then, the stock has managed to gain 44%, outpacing the S&P 500 which was flat during the period. As such, Bloom Energy outperformed the S&P 500 by 44%. I continue to think that Bloom Energy will be able to outperform the S&P 500 and continue to generate positive alpha. Clean energy ideas like Bloom Energy that are able to execute well and have strong competitive advantages and unique value propositions will likely generate substantial outperformance in the future.

Investment Thesis

As highlighted earlier, I have done a deeper dive and researched into Bloom Energy in my initiation article, and I reiterate my target price of $30.90, implying an upside potential of 38%. The reasons for this include:

- Quality, high growth profile in multiple segments from power generation, to carbon capture and hydrogen.

- Strong value proposition to enterprise customers, including lower and more predictable costs, more resilient and reliable power and better ESG profile.

- Bloom Energy’s customer profile is increasingly becoming more diversified and more international, while acquiring larger sites and expanding volumes from existing customers.

- Rare profitability profile for a hydrogen related company due to improving cost dynamics and cost control initiatives.

Solid 4Q21 Financial Results

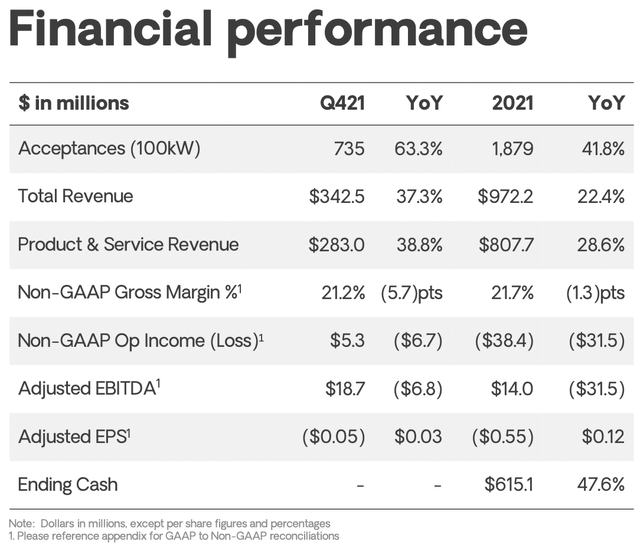

Bloom Energy financial performance (Bloom Energy PPT)

Overall, Bloom Energy’s 4Q21 was better than expected. Revenues in 4Q21 was up 22%, while acceptances were up 42% to a record high of 73.5MW. Gross margins were 21%, above consensus expectations. Adjusted EBITDA was $19 million, implying 5.6% adjusted EBITDA margins for the quarter, better than consensus.

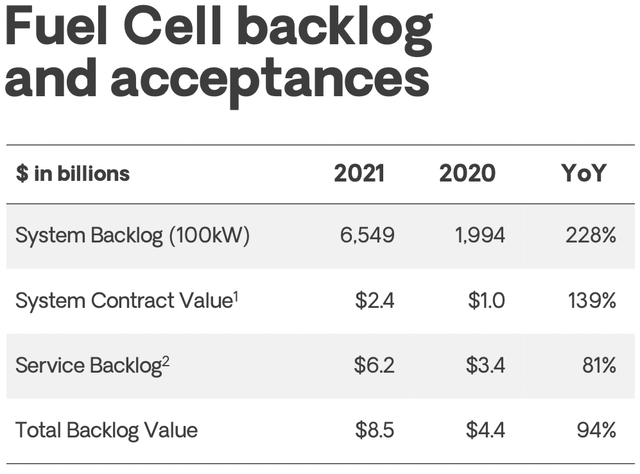

More impressively, in my view, Bloom Energy increased system backlogs from 199MW in 2020, to 655MW in 2021, which showed an increase of 228% year over year. This is the strongest backlog that Bloom Energy has as well as its strongest commercial pipeline, as it expands into new geographies, new markets and new customers. An example of this is Bloom Energy’s deal with SK Ecoplant of a contract of a minimum of 500MW of power from Bloom Energy through 2024 that is estimated to bring approximately $4.5 billion in revenues for Bloom Energy.

Bloom Energy fuel cell backlog and acceptance (Bloom Energy PPT)

This huge increase in backlog and commercial pipeline for Bloom Energy further strengthens my conviction for Bloom Energy and supports my investment thesis that Bloom Energy has a strong competitive advantage that is able to provide enterprise customers with an attractive value proposition, as well as its customer base becoming increasingly diversified and resilient as more customers become interested in Bloom Energy’s offerings.

For 2022, management expects Bloom Energy’s revenues to grow 16% year on year, while non-GAPP gross margins are expected to be 24% and 1% respectively. Furthermore, management expects to be positive cashflow from operations in 2022.

Doubling Capacity By End Of 2022

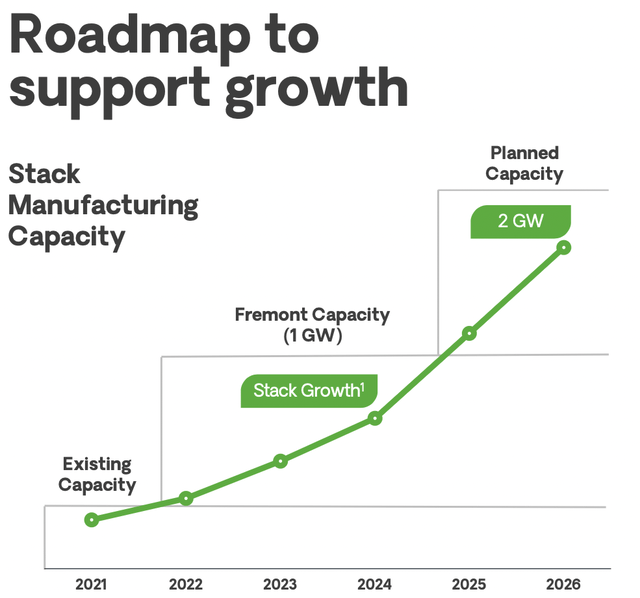

In order to keep up with the outpaced growth in backlogs and commercial pipeline, Bloom Energy needs to increase capacity rapidly to meet the growing demand. As such, the newly operational Fremont stack manufacturing facility that started operations in January of 2022 will double Bloom Energy’s existing manufacturing capacity by the end of the year. This new facility will have an equivalent of 1 GW electrolyzer capacity and can support both Bloom 5.0 and 7.5 platforms. In terms of ramp up, management expects that it will be able to add nearly 300 MW of stack capacity by end of the year and to reach 1 GW capacity by end next year in 2023.

Roadmap to support Bloom’s growth (Bloom PPT)

As seen above, management is cognizant of the fact that it is of paramount importance to grow capacity in order to service and meet the growing demands of its customers. As such, beyond the current Fremont stack manufacturing capacity, management has plans to grow capacity beyond its Fremont capacity sometime in 2025. It was also noted that expansion of capacity utilizes the same manufacturing lines as current existing capacity, with a very favorable return profile of 1 year payback. For 1 GW expansion, Bloom Energy only needs to expend $200 million investments and the current capacity is expected to support growth until 2026.

Increasing Long Term Revenue Growth Forecast

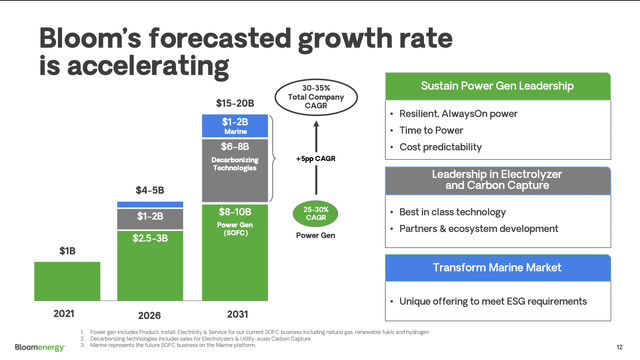

Bloom Energy provided further long term guidance by incorporating into the long term forecasts an upside growth rate potential from its growing electrolyzer business, its carbon capture business and its marine business.

Bloom’s forecasted growth rate (Bloom Energy PPT)

Management expects to grow revenues from $1 billion in 2021 to $4 billion to $5 billion in 2026, and subsequently, to $15 billion to $20 billion in 2031. This implies a total company CAGR of 30% to 35%, largely driven by assumptions of new growth addressable markets like the carbon capture, electrolyzer and marine businesses.

For its 2026 targets, it sees revenues of between $4 billion to $5 billion which arises from $2.5 billion from Solid Oxide Fuel Cells (SOFC), $1 billion to $2 billion from electrolyzers and carbon capture and the remainder from marine.

For its 2031 targets, Bloom hopes to achieve $15 billion to $20 billion in revenues, including $8 billion to $10 billion from SOFC, $6 billion to $8 billion from electrolyzers and carbon capture, and the last $1 billion to $2 billion from marine.

Management expects to achieve a 20% market share of the global electrolyzer market over time and I think that this could be achieved given that Bloom Energy has a differentiated technology.

As highlighted in the long term forecasts and upon further checks with the company, Bloom Energy’s strategy for hydrogen is to be a product company selling hydrogen electrolyzers. It does not intend to enter the hydrogen fuel service industry. Management expects sales from electrolyzer business to start trickling in from demonstration sales in 2022, and some commercial sales in 2023, and then a gradual ramping up of sales until its 2026 targets.

Apart from increasing the long term growth forecasts, management also announced an Analyst day in May, which might be a potential catalyst if new information is released then.

All in all, I think that management’s tone was rather positive in the earnings call when talking about where Bloom Energy’s business is currently and where management sees it is going. I gain conviction from the performance of Bloom Energy’s execution for the quarter and continue to monitor the company as it reaches for its longer term goals.

Customer Diversification

As interest for Bloom Energy’s products continue, management sees that the concentration of its US business on commercial customers within the hospital and data center space is increasingly becoming more diversified.

One example is the increase in demand from industrial customers like semiconductor manufacturers with larger system sizes ranging from 20MW to 40 MW.

Increasing Need For Reliable, Predictable And Low Cost Power

Russia’s invasion of Ukraine made Europe wake up to the harsh reality that they are severely behind the curve in reducing reliance on Russia oil and gas and also, in the move towards renewable energy. As such, there is now a joint European action to reduce the reliance EU’s reliance on Russia for energy to increase energy security in the region. To do this, EU will be moving as fast as it can into renewable energy, and also boosting its gas storage capabilities to enable sufficient gas supplies in EU. These actions bode well for Bloom Energy as commercial and industrial customers move away from traditional power generation companies to move towards clean energy players like Bloom Energy which uses SOFC to generate energy from multiple fuel sources like natural gas, hydrogen or biogas. Likewise, the US has realized the importance of always on, reliance power sources and the need for the US to move faster on the clean energy transition.

Thus, there are now strong tailwinds for the need for reliable clean energy in both the US and EU that supports demand for Bloom Energy’s offering to provide lower cost, reliable and more predictable energy source to commercial and industrial customers.

Valuation

I assume a multiple of 29x FY2023F EV/EBITDA (in my view a rather conservative number), and with that derived a target price of $30.90, implying an upside potential of 38%. In my opinion, the 29x EV/EBITDA multiple is justified given that Bloom Energy’s growth profile, shift towards profitability and strong product interest, backlog and customer list. With the scale at which it is growing, I think we will see EBITDA growth outpacing revenue growth from 2023 onwards.

Risks

Execution risks

The company has much going on in the next 2 to 3 years that are in the ramp up phase and to commercialise its hydrogen fuel cell and electrolyzer business, along with its international strategy.

Government policy

Government policy could be supportive of hydrogen efforts. However, the lack of or removal of these hydrogen incentives could be negatively affecting Bloom Energy’s plans and profitability.

Competition

Competition could worsen in the next few years, particularly from both fuel cell companies and traditional generation companies, which may result in alternatives to Bloom Energy’s products.

Conclusion

I am increasingly confident in the value proposition that Bloom Energy’s products bring to its customers, as evident from the huge growth in backlog orders in 2021, and with the improving diversification in its customer mix as more industrial and commercial customers see the need for Bloom Energy’s products.

With its further elaboration of long term growth forecasts for its several businesses, Bloom Energy is targeting a wide total addressable market and growing rapidly in the next decade. Furthermore, I expect that we will see Bloom Energy be the first hydrogen or fuel cell related company to move into profitability, demonstrating its strong financial position. Finally, the tailwinds of the green energy transition and increasing need for a resilient and more predictable power source will enable Bloom Energy to continue to outperform the S&P 500 in the decade to come. With that, I derived a target price of $30.90 for Bloom Energy, implying an upside potential of 38%.

Be the first to comment