Blue Planet Studio

Introduction

In this article, we get to discuss a wide range of issues related to the Blink Charging Co. (NASDAQ:BLNK). The company is currently seeing strong political tailwinds as Democrats are pushing hard for progress in the field of electric mobility – and everything related to it. While this is yet another tailwind for an already fast-growing company, we also need to discuss the competitive industry as well as headwinds related to the rush for net zero, which is overwhelmingly critical infrastructure. And on top of that, we need to assess whether the market is ready to bet on money-losing stocks again, after all, that’s what Blink Charging will be for the foreseeable future.

So, without further ado, let’s dive into this interesting topic, and even more fascinating company as it is truly the go-to place for investors looking for charging exposure.

More Government Funding

Electricity is the thing. There are no whirring and grinding gears with their numerous levers to confuse. There is not that almost terrifying uncertain throb and whirr of the powerful combustion engine. There is no water circulating system to get out of order-no dangerous and evil-smelling gasoline and no noise. – Hagerty.com

The quote above isn’t from 2021 or 2022. It’s from 1903 when Henry Ford worked on electric mobility. More than 100 years before global net zero efforts became the driving factor behind the switch from “dirty” ICE cars to “clean” electric vehicles.

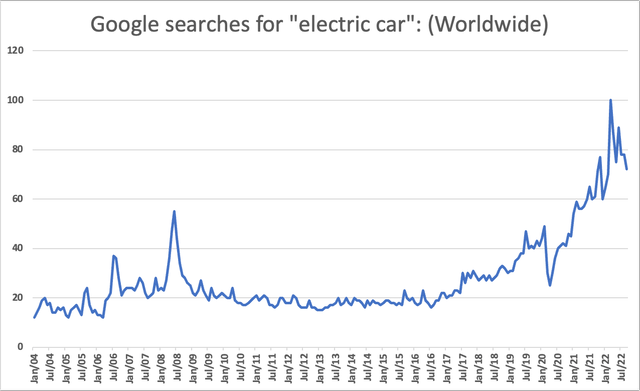

More recently, people started to really become interested in electric cars after many (global) government subsidies were introduced on top of the even more important fact that car companies started to offer electric alternatives.

Now, we’re at a point where multiple countries around the globe have started to ban the sale of new ICE cars in the not-too-distant future while McKinsey & Company looks into “Why the automotive future is electric”.

2030 seems to be the first milestone. According to McKinsey:

In addition to the European Commission target, which requires around 60 percent EV sales by 2030, several countries have already announced an end to ICE sales by 2030. In line with this, seven OEM brands have committed to 100 percent EV sales by 2030 within the European Union.

By 2035, we’ll likely see a scenario where at least 80% of car sales in the big markets (EU, US, and China) are electric. That’s under the reference scenario. A strict net-zero trajectory would push this number to 90%.

McKinsey & Company

The problem is that I believe that total auto sales will implode under any of these situations as it’s simply not feasible to combine affordability and mass adoption of EV mobility, as we’re currently finding out the hard way.

This opens up new possibilities for government intervention. It helps the consumer – at least to some extent – while it also boosts support ahead of key elections.

In this case, I’m referring to the upcoming Midterms and the decision to boost the EV charging network as Seeking Alpha reported in great detail.

Essentially, the white house is approving the first $900 million in federal funding for electric vehicle charging stations in 35 US states.

Related to my aforementioned comments on the outlook of global EV sales, the Biden Administration wants 50% of all new vehicles sold to be electric or plug-in hybrid electric cars by 2030. This includes 500 thousand charging stations. Moreover, he has directed the government to purchase almost exclusively EV or hybrid vehicles by 2027.

The theoretical framework, so far, sounds good.

Unfortunately, the reality is an issue. Over the past few days, people on social media made a lot of fun of California’s situation. On the one hand, it is using regulation to limit the sale of ICE vehicles in the future. On the other hand, it’s now asking residents to limit charging their EVs due to the ongoing drought.

As reported by the New York Times:

Experts acknowledge that moving to more electric vehicles in the coming years will present a challenge, and part of that challenge is building a grid that is up to the task. But they said it was laughable to call a few hours of voluntary charging limits a sign of failure.

The electric grid is struggling, the fact that the EV transition will be extremely expensive (affordable cars are likely to slowly fade from the market), and charging problems are making promising political promises a pipe dream. At least, that’s what it’s looking like so far.

On top of that (yes, there are more problems), the EV charging buildout has another major issue: a lot of stations do not work.

Bloomberg reported last month that a survey of close to 12,000 drivers showed that one in five had charging issues during a visit to a station. 72% blamed faulty equipment.

In 2021, the Biden Administration signed a much bigger deal than the current $900 million EV charging buildout as it dedicated $5 billion to expand the nationwide charging network with ports along all major travel corridors, not further than 50 miles apart.

Bloomberg reported that this may not be enough to fuel the EV boom as (potential) new EV customers still don’t trust the efforts to create a reliable network for charging needs.

Now, there’s one major player looking to benefit from two issues:

- The aforementioned push from the government to turn the charging network into a success.

- Benefiting from Biden’s “Buy American” agenda.

That company is Blink Charging.

What Makes Blink Charging Special

Founded in 2009 and headquartered in Miami Beach, Florida, Blink has become one of America’s largest electric charging companies with a current market cap of $1.2 billion.

The company offers a number of solutions for a wide variety of customers, depending on who bears the cost of installation, equipment, maintenance, and revenue share.

The company’s four business solutions are:

Blink-owned turnkey business model- Blink incurs the costs of the charging equipment and installation. They own and operate the EV charging station and provide connectivity of the charging station to the Blink Network.

Blink-owned hybrid business model- Blink incurs the costs of the charging equipment while the Property Partner incurs the costs of installation. They own and operate the EV charging station and provide connectivity of the charging station to the Blink Network.

Host-owned business model- The Property Partner purchases, owns and operates the Blink EV charging station and incurs the installation costs. Blink works with the Property Partner, providing site recommendations, connectivity to the Blink Network, payment processing, and optional maintenance services.

Blink-as-a-Service model- Blink owns and operates the EV charging station, while the Property Partner incurs the installation costs. The Property Partner pays to Blink a fixed monthly fee and keeps all the EV charging revenues after deducting network connectivity and processing fees.

In June, the company bought SemaConnect to boost its EV infrastructure capabilities. This includes benefiting from the aforementioned “Buy American” deal.

This $200 million cash and stock deal added 13,000 chargers to Blink as well as 1,800 host locations and 150,000 members. This way the company follows the “Buy American” guidelines, which means it can use the additional capacity to benefit from higher EV-related infrastructure spending.

Moreover, in the UK, the company bought Electric Blue Ltd. in April of this year, adding 1,150 chargers to its global footprint. In May of last year, the company bought Blue Corner, allowing the company to start focusing on the European market as well.

With that said, the market is extremely competitive. Tesla (TSLA) has high-quality charging points, and the company is dealing with competitors like ChargePoint (CHPT), ABB, EVgo (EVGO), Electrify America, Wallbox (WBX), and a wide range of potential competitors that have not made the effort to invest in charging.

In this month’s technology conference, Blink spent a lot of time explaining why it is superior. In this case, it’s because of experience, which is worth a lot in a young industry. The company’s board members have worked with major automotive OEMs, governments (EV initiatives), and other corporates when it comes to developing charging and EV projects. Chief Operating Officer, Brendan Jones, for example, worked with Nissan on its first electric car, the LEAF.

While the company acknowledges that its competitors have great managers as well, it believes its own experiences give it an edge. On top of that, by buying SemaConnect, the company has one major advantage: manufacturing.

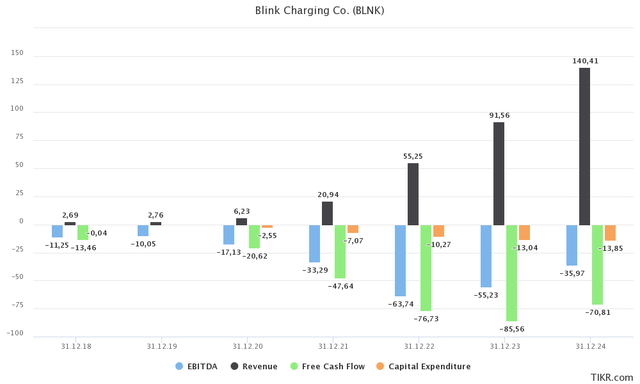

Prior to the deal, Blink outsourced all of its production. Now, it has facilities in India and Maryland where it can produce close to 20,000 units per year with very limited investment. As the chart below shows, annual CapEx is not expected to exceed $14 million in the years ahead. This production capacity can be boosted to 50,000 units.

The chart below also shows that the company is indeed a “growth” stock. It generates sky-high revenue growth and it doesn’t make any money in the process – at least for the foreseeable future.

With that said, let’s look at some more numbers. The company is getting $0.80 on the dollar for any products it is deploying that comply with government programs. These projects need to be commissioned, which requires a lot of upfront investments.

The company is not making it a secret that it will be one of the biggest winners of government programs:

[…] we’ve already taken down $32 million and there hasn’t been any real serious programs. Wait till the $7.5 billion, and you are talking substantial amounts of money. And by the way, out of this $7.5 billion there are pockets of money in all these different groups of the government, in the department of the agriculture for charging infrastructure. It’s a lot more than $7.5 billion.

Moreover, the government is looking to spend more money in disadvantaged communities, which is important. In this case, Blink will be the biggest winner as it has focussed on these communities before the current Administration started to boost funding.

So far, we have established that a lot of funding is needed to support the EV transition – likely much more than we’re currently seeing. Moreover, Blink is in a good position as it benefits from funding like no other company and because it now has its own manufacturing.

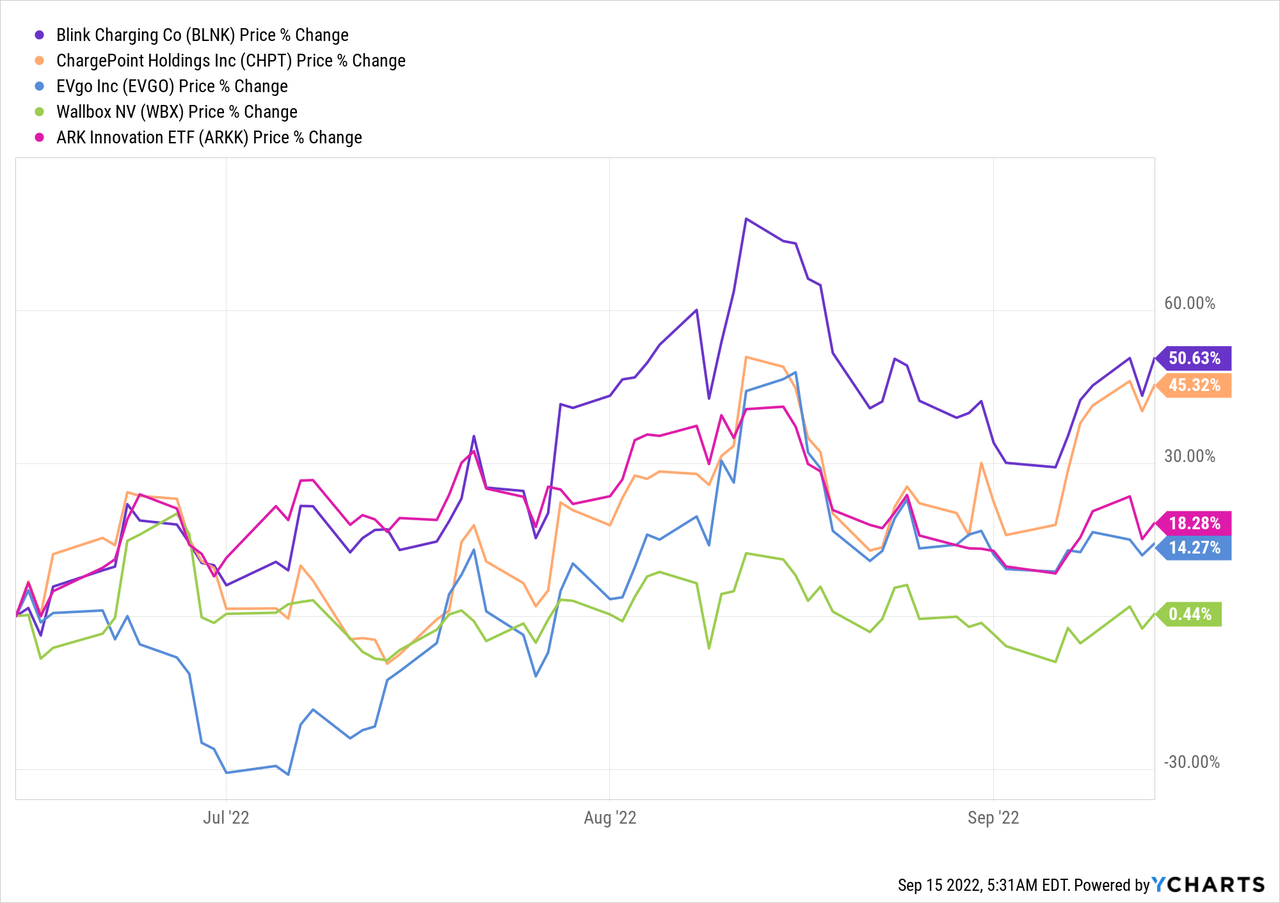

This has allowed the company to become one of the top performers in the ongoing rebound in growth as the chart below shows.

BLNK Stock Valuation

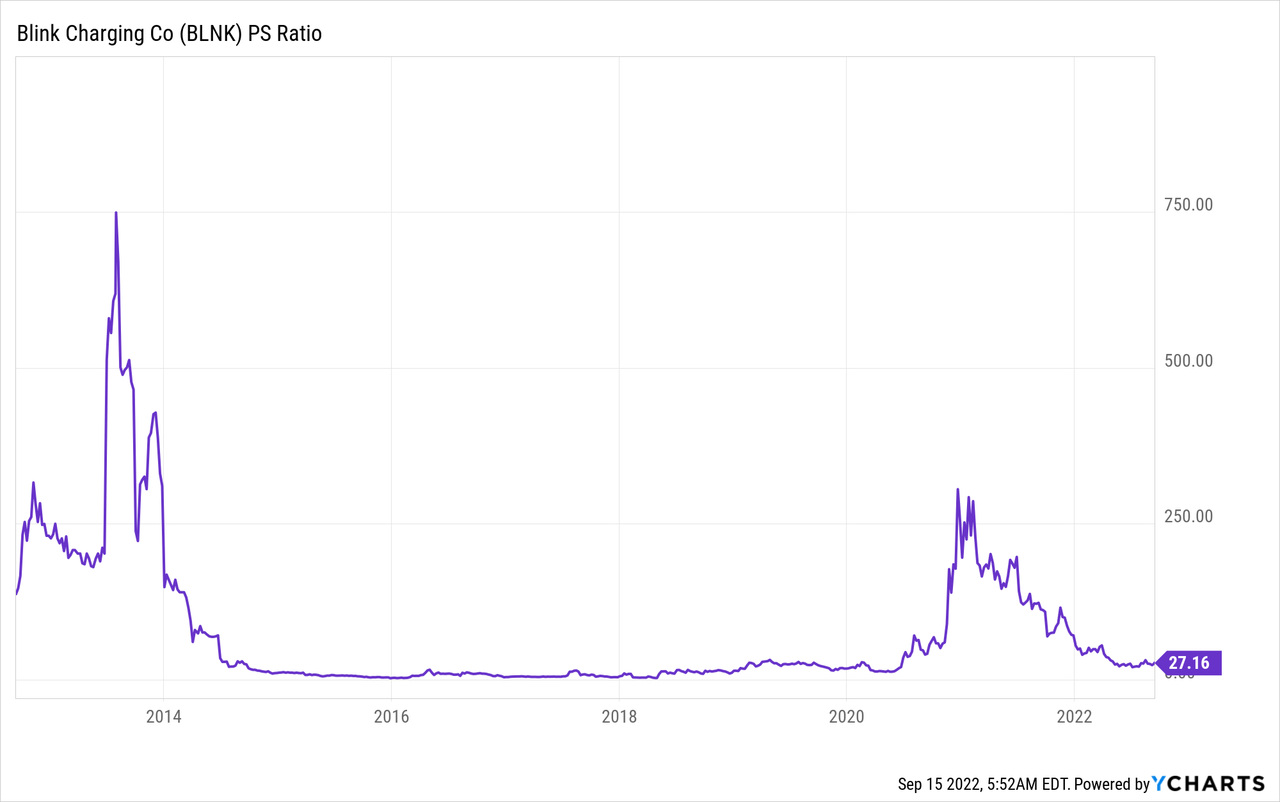

Valuing a company that will continue to lose money in the upcoming years is hard. Especially because we’re dealing with a market with strong (and rising) competition, growth driven by government initiatives (uncertainty factor), and the fact that “growth” stocks are relying on market sentiment more than anything else.

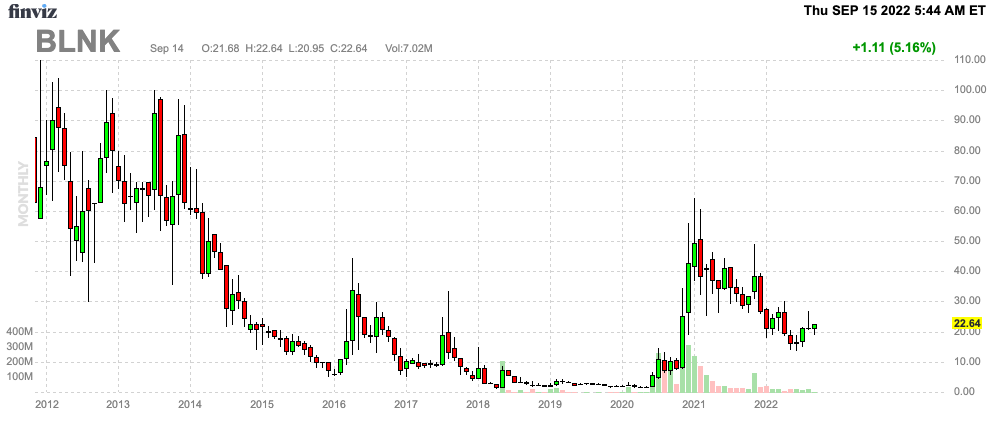

Blink is one of the companies with an absolutely horrible long-term chart. This makes sense as the company has never been mature. It needed a lot of external financing, including secondary share offerings to stay afloat. This has caused the stock price to collapse from roughly $100 in 2012 to almost zero prior to the pandemic.

Since then, the stock has rebounded to $23 per share after almost making it to $70 when investors were buying pretty much every growth stock on the market in 2020 and 2021.

FINVIZ

The good news is that the balance sheet is rather healthy. The company will end this year with roughly zero net debt. That number is set to grow to more than $150 million in 2024 as a result of no profit and investments in growth. That’s a manageable amount of debt. As of June 30, 2022, the company has total assets worth $384 million. Total liabilities are just $91 million. Less than $800 thousand of this comes from notes payable. This means there is a good foundation to take on more leverage.

Going back to the valuation, the company is trading at 27.2x LTM sales. Using 2024E sales of $140 million, Blink is trading at 8.2x sales. That’s more than two years from now.

The question: “is this cheap or not”? Can be answered by the Fed. The only reason why the stock came crashing down from its 2021 highs is aggressive tightening (expectations) fueled by high inflation.

It put tremendous pressure on growth stocks. After all, stocks that lose money with high sales growth rates need low rates and low inflation to become attractive (discounting factor). It’s much more attractive to own a stock that is expected to generate free cash flow somewhere in the future when rates and inflation are close to zero. When inflation is high, investors prefer stocks that make money now.

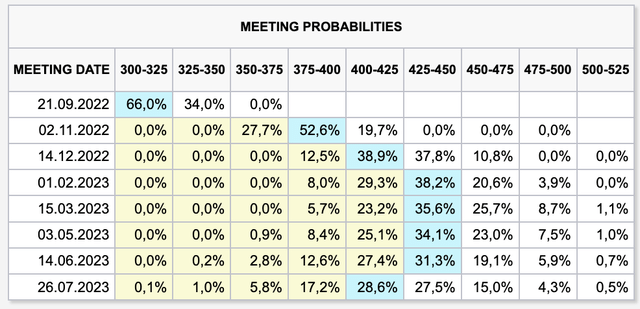

This week, I highlighted these issues as the Fed is now encountering higher than expected inflation, which is causing Fed Funds Futures (interest rate expectations) to jump – hurting growth stocks in the process.

Core inflation is now north of 6%, exceeding anything we have seen in recent history. The Fed will need to get this under control without damaging the economy too much. As economic indicators are already weakening, it now seems that the Fed will have to hike even more aggressively into an economic slowing cycle.

Wells Fargo

A 75 basis points hike in September is now widely accepted to be a done deal later this month as futures price in a 66% probability of a hike that big. However, the remaining 34% aren’t to the downside, but to the upside. There’s now a 34% probability that the Fed hikes by 100 basis points.

In other words, I believe that Blink can take off as soon as the Fed is hinting at a pivot. I expect that to happen close to the second half of 2023 when I expect that economic growth is too slow to warrant further rate hikes. At that point, we’re likely at a great risk/reward for riskier growth stocks like Blink.

Takeaway

The EV transition is one of the most fascinating subjects as it is broad and involves governments, non-government organizations, corporates, and everyone in between. The problem, for now, is that the transition isn’t going as fast as expected. Material shortages make the transition expensive, grid issues in certain areas prevent a fast charging network expansion, and the public isn’t as keen to turn in their ICE vehicles yet.

However, governments are keen to make it a success nonetheless as accelerated funding programs prove. This week, the Biden Administration revealed another program of close to $1.0 billion to improve the charging network in the US. That’s a smart plan as it provides them with positive PR ahead of the midterms and it addresses one of the major reasons why the adoption is so slow: charging.

In this highly competitive industry, Blink Charging is standing out. This Florida-based company has made some smart acquisitions that allow it to produce a large part of its own charging needs, it benefits from government funding like no other company, and it addresses specific needs like infrastructure in “less privileged” communities.

Moreover, it has a business model that addresses a wide range of issues from both corporate and government customers.

The problem is that Blink won’t be profitable in the foreseeable future. It also doesn’t help that the industry is extremely competitive and that the macro environment gives growth stocks, in general, a very hard time.

I’m also not a fan that this industry is (almost) completely driven by subsidies. This makes it a very political play dependent on who’s in charge.

So, my message is that Blink isn’t a must-own. I think it is best to wait until the Fed pivots before buying growth stocks again. That also goes for stocks that seem to have a strong tailwind from ongoing developments. However, if you want exposure in the industry and if you’re more bullish than me on growth stocks, I think Blink is the best way to play the “charging” bull case.

For now, I remain “neutral”.

(Dis)agree? Let me know in the comments!

Be the first to comment