AlbertPego

A Quick Take On Blend Labs

Blend Labs, Inc. (NYSE:BLND) went public in July 2021, raising approximately $360 million in gross proceeds from an IPO that priced at $18.00 per share.

The firm provides software to support financial institutions to develop new services and improve their existing service offering presentation.

Until management can make substantial progress toward operating breakeven, given a higher cost of capital environment I don’t see a major upside catalyst to the stock.

I’m therefore on Hold for BLND in the near term.

Blend Labs Overview

San Francisco, California-based Blend was founded to develop a suite of lending, credit card and deposit account interfaces that enable legacy banks to present a more modern look to their service offerings.

Notably, the firm’s revenue model is not a standard software as a service (“SaaS”) revenue model, rather the firm only charges for completed transactions and doesn’t charge for abandoned or rejected applications.

Management is headed by co-founder and Head of Blend Nima Ghamsari, who was previously employed at Palantir Technologies.

The company’s primary offerings include white label interfaces for:

-

Mortgages

-

Home equity loans

-

Home equity lines of credit

-

Vehicle loans

-

Personal loans

-

Credit cards

-

Deposit accounts

Blend also provides marketplace and title insurance procedures and other related closing and settlement services.

The firm pursues banking relationships via a direct sales and marketing process targeting customers from the largest banks to smaller community lenders.

Management said the COVID-19 pandemic:

‘accelerated a shift in consumer behavior away from traditional branches and toward digital channels for banking services, resulting in a 30% increase in the use of mobile banking worldwide.’ (Source)

Blend’s Market & Competition

According to a 2020 market research report by Mordor Intelligence, the global financial services application market was an estimated $104 billion in 2019 and is forecast to reach $164 billion by 2025.

This represents a forecast CAGR of 7.89% from 2020 to 2025.

The main drivers for this expected growth are a need for financial institutions to modernize their infrastructure stack to remain competitive for younger demographic users.

Also, the industry needs improved business intelligence solutions as competitive pressures increase from newer fintech firms.

Major competitive or other industry participants include:

-

Tavant Technologies

-

Major consulting firms

-

Systems integrators

-

Institutional financial software companies

Blend Labs’ Recent Financial Performance

-

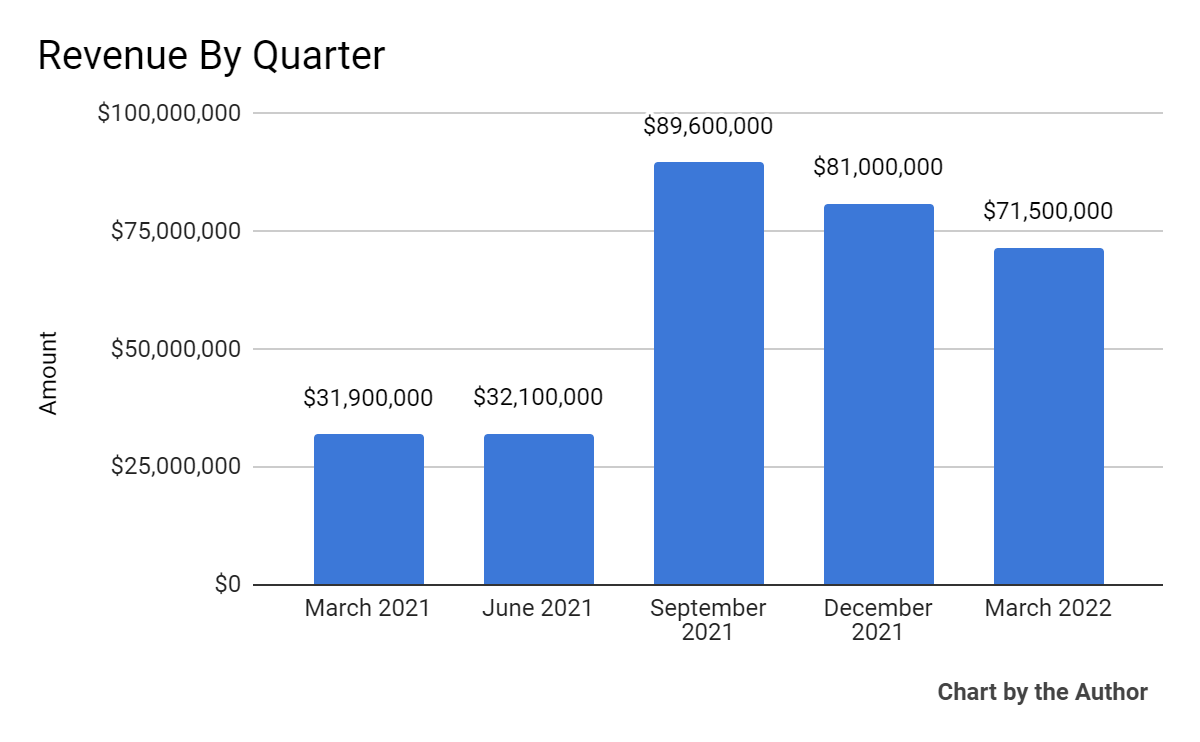

Total revenue by quarter has been highly variable in recent quarters, as the chart shows here:

5 Quarter Total Revenue (Seeking Alpha)

-

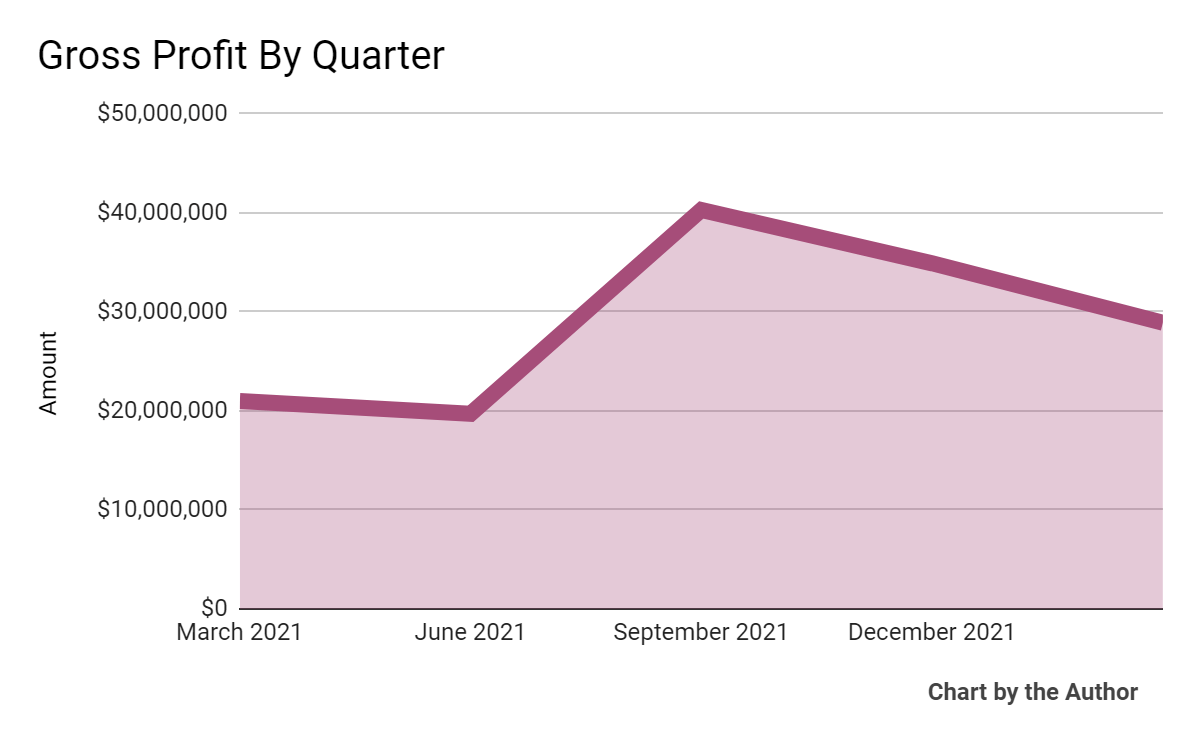

Gross profit by quarter has followed a similar trajectory to that of total revenue:

5 Quarter Gross Profit (Seeking Alpha)

-

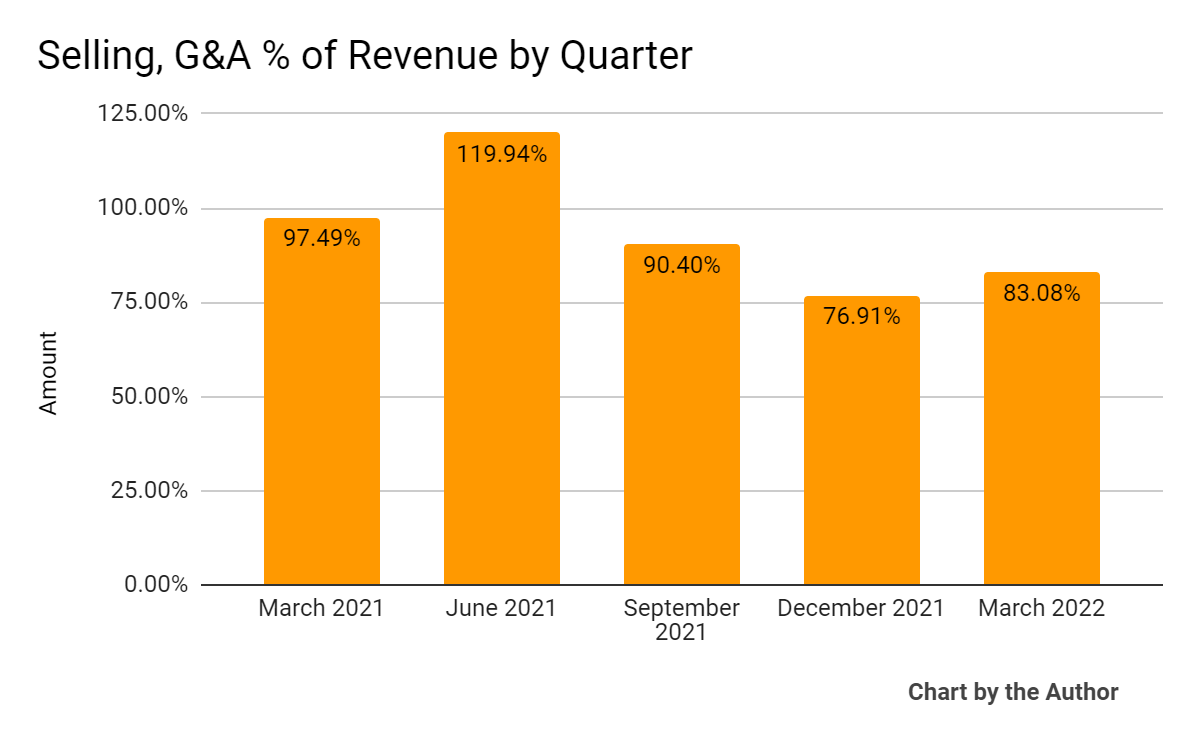

Selling, G&A expenses as a percentage of total revenue by quarter have trended lower in the past 3 quarters:

5 Quarter SG&A % Of Revenue (Seeking Alpha)

-

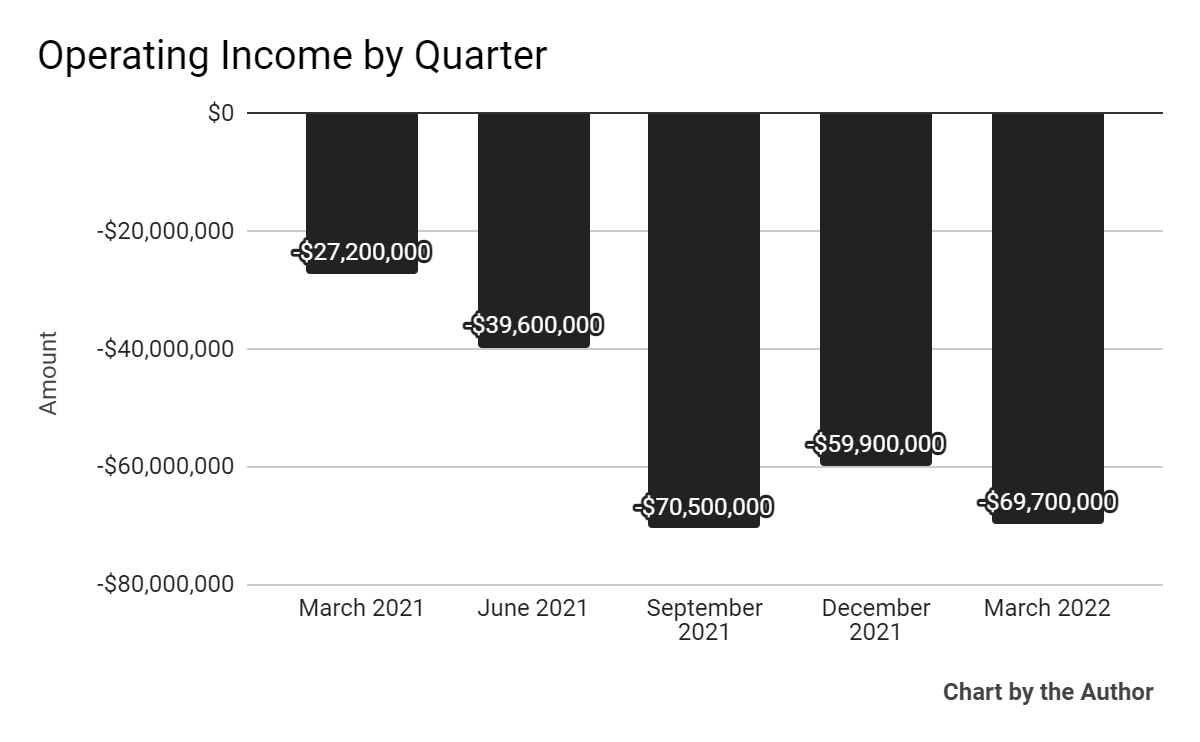

Operating losses by quarter have worsened of late:

5 Quarter Operating Income (Seeking Alpha)

-

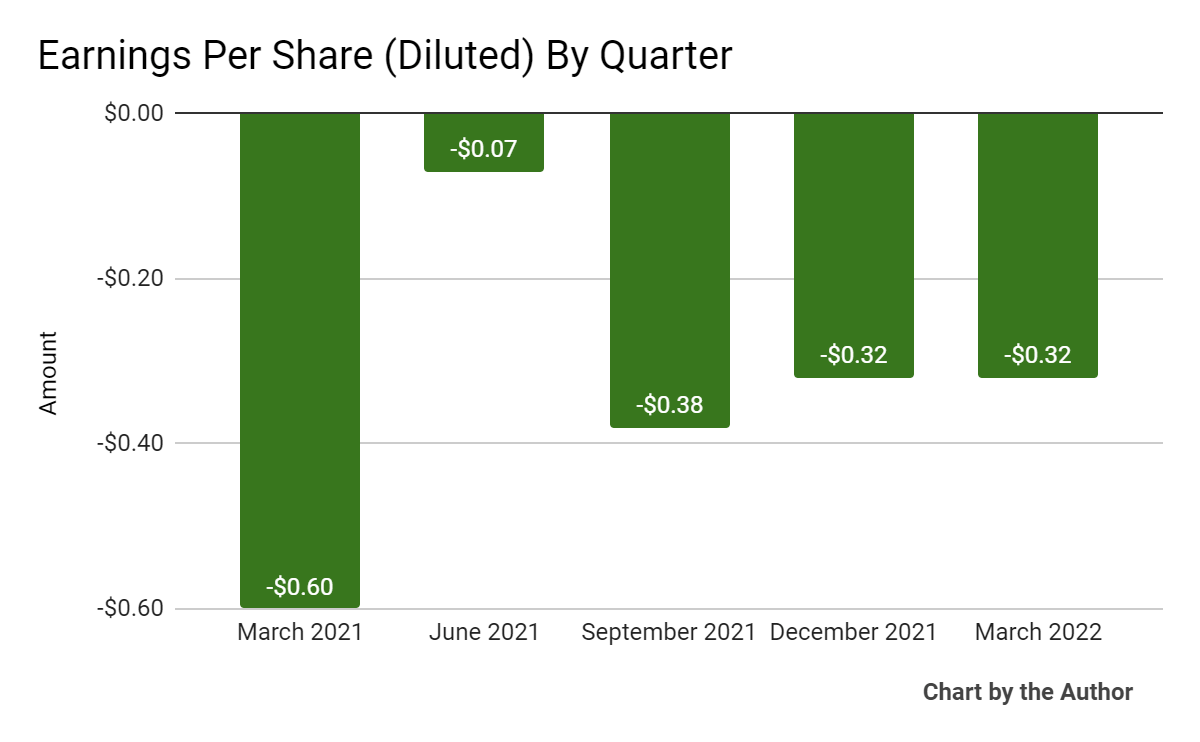

Earnings per share (Diluted) have remained substantially negative, as the chart shows below:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP.)

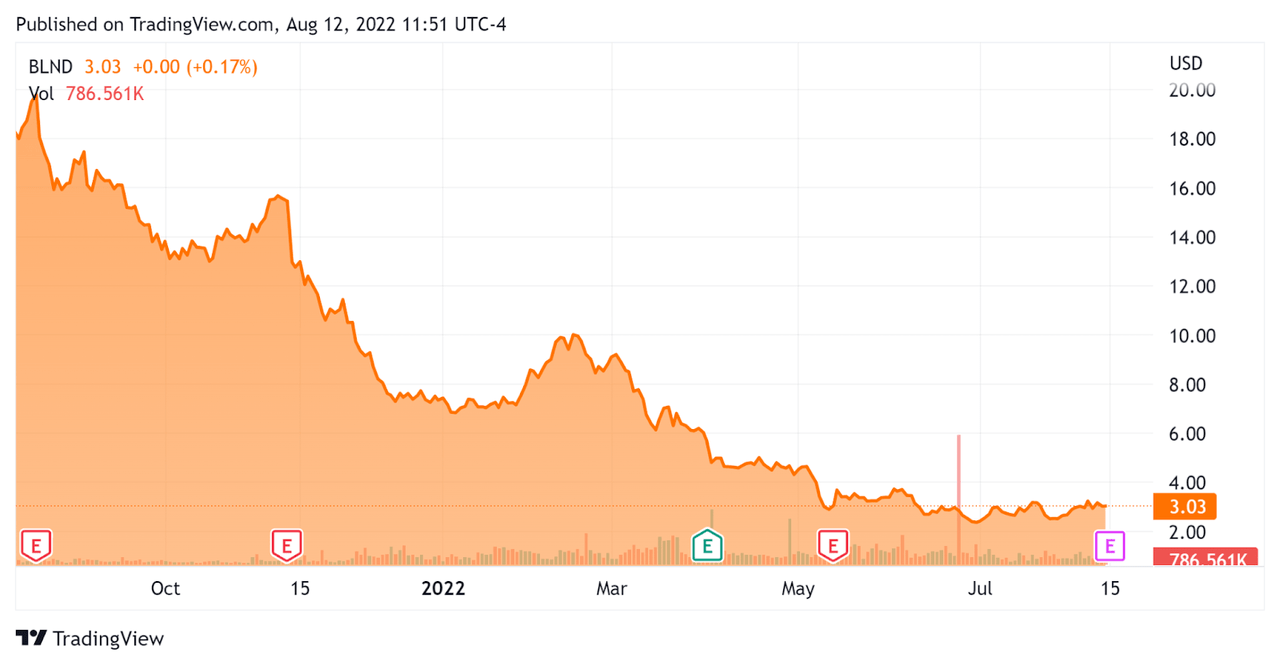

In the past 12 months, BLND’s stock price has dropped 83.5% vs. the U.S. S&P 500 index’ drop of around 4.7%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Blend Labs

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value |

$472,520,000 |

|

Market Capitalization |

$702,480,000 |

|

Enterprise Value / Sales |

1.72 |

|

Revenue Growth Rate |

144.1% |

|

Operating Cash Flow |

-$152,950,000 |

|

Earnings Per Share (Fully Diluted) |

-$1.09 |

|

Net Income Margin |

-78.4% |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

BLND’s most recent GAAP Rule of 40 calculation was 62% as of Q1 2022, so the firm has performed well in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

144% |

|

GAAP EBITDA % |

-82% |

|

Total |

62% |

(Source – Seeking Alpha)

Commentary On Blend Labs

In its last earnings call (Source – Seeking Alpha), covering Q1 2022’s results, management highlighted its growing share of wallet with its customers, of which “about two-thirds of our existing customers subscribe to two or more [of its] software products.”

However, management is projecting in 2022 a 41% reduction in mortgage origination volume, a higher drop than previously forecast due to higher mortgage interest rates.

The drop is disproportionately hitting the refinancing market, “a decrease that started in earnest in April.”

To that end, management is aiming to diversify its revenue base, with its Consumer Banking and Marketplace products seeing more growth.

As to its financial results, topline revenue was above its previous guidance range, however the firm’s Title365 product saw a significant revenue drop due to market conditions.

While the firm saw a decent volume of refinance closings in Q1, it has since seen a pronounced decline in Q2.

However operating losses rose markedly to a near record level and in response, management has reduced headcount in its Title365 unit and “certain corporate G&A functions.”

Leadership believes the financials will see the results of these headcount reduction in the second half of 2022.

For the balance sheet, the firm finished the quarter with $500 million in cash, equivalents and marketable securities and long-term debt of $225 million.

The company has used free cash flow of about $155 million over the past four quarters.

Looking ahead, management reiterated its full year 2022 revenue guidance as it said it will “prudently manage our expenses as we navigate the current downturn.”

Regarding valuation, the market is valuing BLND at an EV/Sales multiple of around 1.7x.

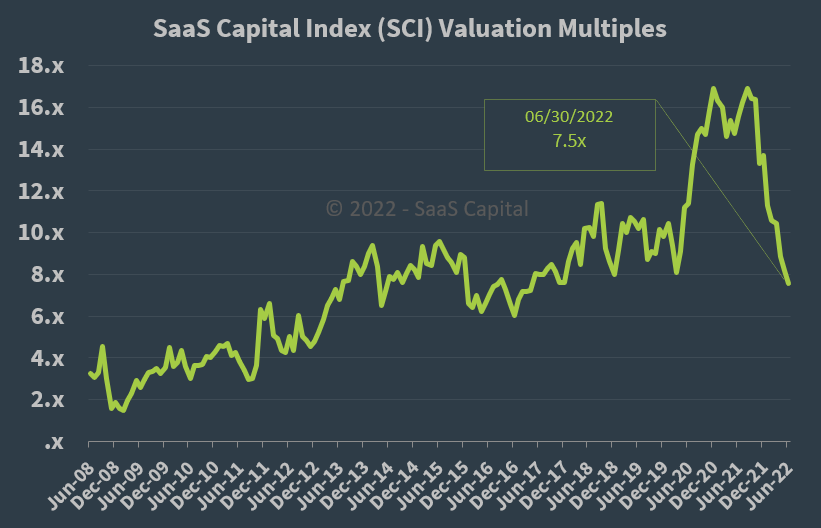

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 7.5x at June 30, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, BLND is currently valued by the market at a substantial discount to the SaaS Capital Index, at least as of June 30, 2022.

The primary risks to the company’s outlook is continued interest rate increases by the Fed or bond market participants or a deterioration in borrower creditworthiness due to increased debt.

A potential upside catalyst to the stock could include a plateau in interest rate rises as inflation turns over and proves ‘transitory’ in degree.

The firm has scheduled its Q2 2022 financial results release for August 15, 2022, after market close.

While management appears to be making some cost cutting efforts around the edges, I suspect that the company’s high operating losses will remain so.

Until the firm can make substantial progress toward operating breakeven, given a higher cost of capital environment, I don’t see a major upside catalyst to the stock.

I’m therefore on Hold for BLND in the near term.

Be the first to comment