BD Images/iStock Editorial via Getty Images

Recently, we decided to analyse the US refineries sector. We have undertaken a full analysis on the Oil & Gas segment in particular looking at Phillips 66, HF Sinclair, and Valero Energy Corp.

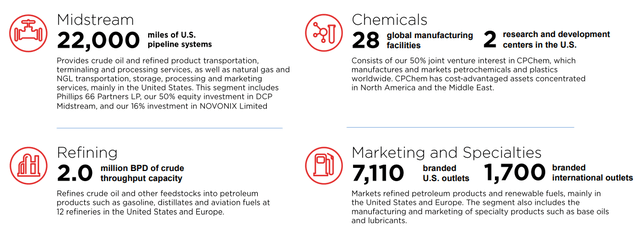

Phillips 66 (NYSE:PSX), together with its subsidiaries, engages as a diversified energy manufacturing and logistics company. The Company operates thanks to four divisions: Marketing & Specialties, Refining, Chemicals and Midstream. Phillips 66 is mainly exposed in the US but with operation in Europe as well as in the Middle East. To further investigate the company assets and operations, we suggest checking out the latest Phillips 66 update in February 2022.

After our extensive deep dive, we have concluded that we prefer Phillips 66 over HF Sinclair for the following reasons:

- Better exposure to Europe which drives margins and cash flows in the downstream segment;

- The dividend has risen constantly and it is for the most part covered by the marketing segment versus HF Sinclair that has interrupted dividends and it will reinstate the payment in 2022 after the Sinclair acquisition;

- Phillips 66 at a lower P/E ratio without the execution risk of Sinclair integration;

- Consolidated presence in downstream;

- HF Sinclair has less scale compared to Phillips 66 and it might be more exposed to variations in soybean oil prices;

- Higher margins have been driven mainly by the refining segment for HF Sinclair, which now accounts for 85%+ of company revenues, with the introduction of Sinclair that should get down to ~70%;

- With Phillips 66, we have a better performing chemicals segment thanks to CPChem which has superior bottom line profit compared to the Lubricants and Specialties in HF Sinclair;

- Phillips 66 owns a material stake in Novonix (16%) which could provide an interesting upside in battery material technologies that right now are much needed for applications in wind and solar energy, and of course in EVs.

- Having listened to the different company statements and Q&As, we feel like the Phillips 66 management is more capable in communication than HF Sinclair’s. Phillips 66 has demonstrated better capability in choosing and managing investment opportunities, a more valuable approach in shareholder remuneration and also in inorganic growth opportunities.

Phillips 66 results and the company upside

At the end of January, the Company reported its Q4 and FY results, beating Wall Street expectations (after-tax EPS was at $2.68 vs $1.96). Looking deeper at Phillips 66’s earnings, we note a more positive view in Oil Marketing that is clearly benefitting from reopening after COVID-19 outbreaks. In addition, all US refueling stations have been updated to support renewable fuels. Phillips 66 has always been a bit late into renewable fuel opportunities but now they are partnering with British Airways to change the mix of renewable jet fuels as the industry is shifting towards a more sustainable model. To note, the joint venture announced with H2 Energy Europe to develop 250 hydrogen refueling stations between Germany, Austria and Denmark by 2026.

Marketing Division (Investor Update – February 2022)

Last year, the company paid out $1.5 billion and at the end of October increased the DPS to 0.92 dollars per share. Given the free cash flow generation, our internal team is confident that they will restart a share repurchase program.

Conclusion, valuation and risks

The company provided a very confident outlook for 2022. Management is optimistic that they will generate $6/7 billion in cash at a mid-cycle level. We see a possible upside on aviation as the economy reopens, a better exposure in Europe to drive margins and we forecast that pipelines will enjoy higher margins from higher oil prices. On a financial basis, as already mentioned that we forecast a buyback, further reductions in debt and no more major investment in midstream since the focus is on the reconversion of refineries for biodiesel production. Based on a Sum-of-the-Parts valuation and taking into consideration debt obligations and corporate cost, we arrived at a target price of 100 dollars per share, implying an upside of 18% plus an enjoyable and stable dividend yield.

The main risks that might affect target price are delays in renewable fuels opportunities, lower cracks spread, narrower Brent-WTI, Nat Cat and unplanned plant suspension.

Be the first to comment