GoodLifeStudio/E+ via Getty Images

Investment Thesis

One is the seventh-largest US pharmaceutical company by market cap valuation – >$132bn – generating revenues of $26bn in 2021, and a net income of $5.9bn, for a price to earnings (“PE”) ratio of ~20x.

The other is a clinical stage drug developer with a market cap valuation of $4.6bn that has never had a drug approved, with an accumulated deficit of >$2bn.

Amgen (NASDAQ:AMGN) and Mirati Therapeutics (NASDAQ:MRTX) may represent different ends of the drug development / pharmaceutical spectrum, but both are pinning their hopes for future success on a gene known as KRAS, that codes for a protein called K-Ras, part of the RAS/MAPK pathway.

KRAS is responsible for cell signaling and proliferation and it’s one of the most commonly mutated genes found in solid tumor cancers, responsible for ~85% of all RAS family mutations, which themselves account for ~25% of all human cancers and, therefore, ~1m deaths per annum (data from Mirati’s website).

KRAS was once considered “undruggable” – too inaccessible to bind to with high specificity – but both Amgen and Mirati have found a way to target a specific KRAS mutation known as G12C with small molecule drugs, and “switch off” the gene, preventing it from initiating uncontrolled cell proliferation. This could have a potentially seismic effect on the way that lung cancer, primarily, can be targeted and treated.

Amgen’s drug, Lumakras, has already secured FDA approval – three months ahead of schedule in May last year – for the treatment of adult patients with KRAS G12C-mutated locally advanced or metastatic non-small cell lung cancer (“NSCLC”). NSCLC accounts for ~84% of the 2.2m lung cancer diagnoses made globally each year, and 236k in the US, with ~13% expressing the KRAS G12C mutation.

With a list price of ~$18k per month, and an addressable patient population of ~50k – I estimate, based on a 13% share of ~198k patients diagnosed with NSCLC per annum, doubled to account for pre-existing patients – Lumakras ought to have a market opportunity of ~$11bn in the US alone, and let’s speculate $20bn globally.

As I discussed in a recent note for Seeking Alpha covering Amgen’s current products and pipeline, the pharma badly needs to inject some fresh life into a portfolio that faces a number of threats and key patent expiry issues. Best-selling arthritis drug Enbrel’s sales were down 11% year-on-year in 2021 to $4.5bn, while Prolia, which drove sales by 18% year-on-year to $3.25bn faces a patent expiry in 2025, as does bone therapy Xgeva, while Otezla faces increasingly intense competition in auto-immune markets, and sales of Neulasta – developed to stimulate white blood cell count – fell 24% last year.

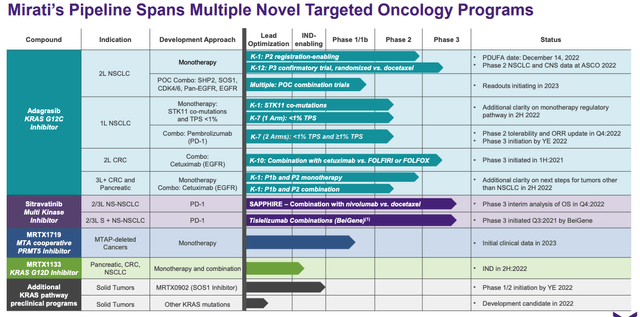

Meanwhile, although it has other pipeline assets in Sitravatinib – a multi kinase inhibitor in Phase 3 trials as a combo therapy alongside PD-1 inhibitors – including Bristol Myers Squibb’s $7bn per annum selling Opdivo – a monotherapy targeting MTAP detected cancers, and several preclinical KRAS pathway inhibitors, Adagrasib is absolutely central to Mirati’s plans, and its Prescription Drug User Fee Act (“PDUFA”) date – when the FDA will rule to approve the drug for commercial use – arrives on Dec. 14.

The analyst and scientific community view is that Lumakras and Adagrasib are very evenly matched, but if one of these drugs is able to prove its superiority over the other, then that drug will likely go on to make at least $1 – $2bn in sales while the other may struggle to find favor with physicians, who will obviously favor the better-performing drug.

There will be opportunities for both Amgen and Mirati to try to secure approvals in other indications, and potentially as a combo therapy, alongside immune checkpoint inhibitors – you could almost compare the two drugs to the two best-known ICIs Opdivo and Merck’s (MRK) Keytruda, which have competed in the same solid tumor markets for nearly a decade, with Keytruda ultimately out-selling Opdivo by more than 2 to 1, racking up $17bn of sales in 2021.

It’s unlikely that either Lumakras or Adagrasib will make those kinds of sales, but both are key to their company’s strategy and their performance will, partially in Amgen’s case and completely in Mirati’s case, dictate the direction of the company’s share prices.

In this post I’ll recap on the data generated by both drugs to date, what investors should look out for next, and whether it’s worth backing either company based on their significant first mover advantage in the KRAS-targeting oncology market. Given Amgen stock has just fallen to a six-month low, and Mirati stock trades at a >50% discount to its September 2021 price of $160, and a 66% discount to its all-time high price of $240, a speculative bet made at this time may just pay off.

Lumakras Vs. Adagrasib – Current State Of Play

First of all, let’s take a look at the clinical progress of both drugs to date, beginning with Adagrasib.

Adagrasib progress in clinic to date. (presentation)

As we can see above, Mirati’s near-term approval shot is in 2nd line NSCLC – the same indication in which Lumakras is already approved. The registrational data comes from a Phase 2 trial in which Lumakras achieved an objective response rate of 43%, with 1 complete response (“CR”), 47 partial responses (“PR”), 41 stable disease, 6 Progressive Disease, and 17 non-evaluable patients.

An objective response is defined by the FDA as a patient with a ≥30% decrease in tumor size. In its own CodeBreaK 100 study, Amgen’s Lumakras achieved an ORR of 36%. That may suggest that Adagrasib is the superior treatment, but there are other variables in play.

At the American Society of Clinical Oncology (“ASCO”) conference in Chicago in June this year, Mirati presented more data from its Phase 2 KRYSTAL study, showing a durability of response (“DoR”) of 8.5 months – inferior to Lumakras, whose, DoR stands at 11.1 months.

It’s not always a good idea to compare clinical trials conducted by different companies on different drugs – Mirati CEO David Meek told FierceBiotech for example that a Phase 1/1b study of Adagrasib showed a DoR of 12.5 months – and Mirati could point to other perceived advantages, such as its median progression-free survival (“PFS”) was 6.5 months, marginally superior to Lumakras 6.3 months PFS.

Mirati has also compiled pooled analysis of a 600mg dose of Adagrasib from its Phase 2 study plus a Phase 1/1b study, which saw the overall ORR increase to 44% from 128 patients evaluated, with three confirmed complete responses, and the aforementioned 12.5m DoR. Median PFS was 6.9 months, and median Overall Survival was 14.1 months.

Over to Lumakras, and just a few days ago, presenting at the European Society for Medical Oncology’s annual conference in Paris – for good measure, Lumakras has now also been approved in Europe – Amgen was able to show that in a head-to-head trial with the chemotherapy Docetaxel, Lumakras cut the risk of disease progression or death by 34% compared to Docetaxel. After 12 months, 25% of Lumakras takers were alive with no signs of disease worsening, whilst in the Docetaxel arm the figure was just 10%.

On the other hand, the PFS fell to 5.6m in this latest study, and tumor response rates declined, although they were still clearly superior to Docetaxel – 28% vs. 13%.

Perhaps most interestingly, Amgen’s latest study – CodeBreaK 200 – has the potential to persuade the FDA to convert its accelerated approval – which is conditional on further trials backing up registrational data – in to a full approval. Were that to happen, Mirati’s Adagrasib would no longer be eligible for an accelerated approval based on the tumor shrinkage endpoint.

How The Rivalry May Play Out In The Market

Frankly speaking, the fact that Lumakras has secured approvals in both the US and Europe hands the drug a major advantage over Adagrasib, so long as the data delivered by both drugs does not conclusively establish the superiority of one over the other, as seems to be the case at present.

Back in January, GlobalData suggested that Lumakras’ first mover advantage would result in a sales difference of ~$822m in 2029, when it anticipates Lumakras generating $1.1bn of revenues, and Adagrasib – so long as it’s approved – just $292m. Despite the fact that Mirati told analysts on its Q222 earnings call that it had hired a >100 strong customer facing sales force to market and sell Adagrasib upon approval in December, the company obviously lacks the commercial infrastructure of a big pharma concern such as Amgen.

Amgen has recently acquired two more oncology-focused biotechs in Five Prime Therapeutics – developer of gastric cancer drug bemarituzumab – and Teneobio, a bispecifics and multispecifics specialist, so Amgen clearly has ambitions to build a global oncology franchise, however the company has a substantial level of debt – ~$13bn versus a cash position of ~$7bn – and nine other major drugs to market and sell. Mirati can allocate substantially all of its SG&A resources to Adagrasib, and had a cash position of $1.2bn as of Q222, although unlike Amgen, which is profitable, Mirati burned through >$175m of cash in Q222 alone.

Lumakras has got off to a strong start commercially, generating $77m of sales in Q222, reflecting 24% quarter-over-quarter growth. According to a statement in Amgen’s earnings press release:

LUMAKRAS has been prescribed to over 3,000 patients by over 1,900 physicians in both academic and community settings. Outside the U.S., LUMYKRAS has now been approved in over 40 countries around the world. We are actively launching in 25 markets and pursuing reimbursement in the remaining countries.

Personally I would think it unlikely that Mirati will be able to match that pace of sales growth in 2023 if / when Adagrasib is approved, although it will push the fact that the drug can successfully treat four out of 10 patients who express G12C mutations.

A point to consider about both companies is that presently patients don’t generally undergo tests to determine if they are expressing KRAS / G12C mutations, which is a problem – you cannot prescribe either Lumakras or Adagrasib without first establishing if these are present.

Amgen has been working with diagnostic testing companies including Qiagen (QGEN) and Guardant Health to develop the appropriate tests and will be encouraging patients to request them and physicians to recommend them. Mirati will doubtless do likewise – both companies will likely support each other in this mutually beneficial endeavor.

Future Battlegrounds

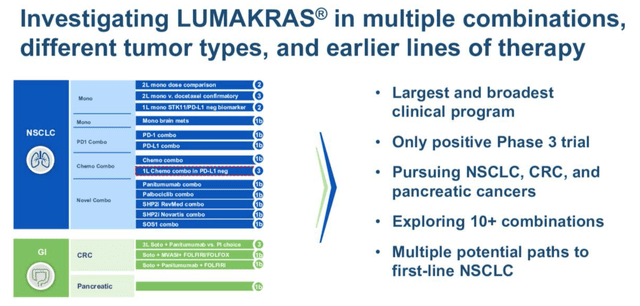

What’s certain is that neither Mirati nor Amgen will stop at 2nd line lung cancer treatment with their drugs. The table I shared above demonstrates how many more opportunities Mirati is pursuing, and Amgen is no different as we can see below.

Slide from Amgen ESMO 2022 presentation. (presentation)

Merck’s Keytruda is the dominant player in NSCLC, with BMY’s Opdivo also a major force, and many observers believe the only way for either Amgen or Mirati to generate blockbuster (>$1bn per annum) sales in this indication is to find ways to work in combination with these powerhouses, ideally in a first line setting. Both companies have such trials ongoing. Mirati says it will have ORR data for a Keytruda combo trial in Q422, and hopes to initiate a Phase 3 in 2023.

In one study, Adagrasib plus Keytruda achieved ORR of 77% (7/9) in patients with PD-L1 Tumor Proportion Score (“TPS”) ≥50%, and 50% (4/8) in patients with PD-L1 TPS 1-49% (according to an investor presentation), although this data is early stage and bigger and longer studies may be more challenging. Meanwhile, Amgen has revealed that in a combo trial with Keytruda,

combining LUMAKRAS with immunotherapy showed an objective response rate (ORR) of 29% (17/58 patients across all cohorts). Among the 17 confirmed responders, five patients had an observed duration of response greater than 10 months, with eight ongoing responders.

The safety profile in the Lumakras study also was challenging, with more adverse events occurring of Grade 3 severity or higher.

Outside of NSCLC, Adagrasib appears to have the edge in other solid tumors, reporting an ORR in colorectal cancer of 46%, in combo with Eli Lilly’s Erbitux, an EFGR inhibitor, whilst Lumakras delivered a 30% ORR in a combo study with Amgen’s EGFR inhibitor Vectibix. Pancreatic cancer is another target, although it should be noted that KRAS G12C mutations are expressed in just ~3%-4% of colorectal cancer cases, and ~2% of pancreatic cancer cases (according to Mirati research). These are smaller markets anyway, so the market opportunities here may not be compelling.

Conclusion – No Clear Winner On Efficacy, Amgen Ahead Commercially, Mirati The Riskier Buy With Greater Rewards On Offer

To summarize all of the above – and I have only touched on some of the available data in this post – it’s difficult, and perhaps premature, to declare a winner in this particular face-off between 2 KRAS pioneers in terms of safety or efficacy.

Commercially speaking, Amgen has a significant advantage that could prove critical – the pharma could even deny Mirati an accelerated approval. On the other hand, should Mirati establish a clear superiority on efficacy – and the data leans slightly toward Adagrasib it could be argued – that advantage could be eroded very quickly. Mirati has made much of the fact that Adagrasib may be able to cross the blood brain barrier for example, giving it the ability to treat e.g. brain metastases.

Both companies are under some pressure – Amgen needs to revive a flagging portfolio of commercial drugs, while Mirati needs to commercialize a first drug and relieve its quarterly cash burn.

When it comes to picking the better investment opportunity, we can say that the effect of a December approval for Adagrasib would be a significant upside catalyst for Mirati, whilst there is no such near-term catalyst for Lumakras and Amgen at this time.

Looking further ahead, Mirati may have the edge as a combo therapy, although both companies have struggled slightly to make headway in this most lucrative area, with 1st line therapy status the goal.

As such, it’s difficult to be exceptionally bullish on either company – neither will enjoy their first mover advantage forever, given the progress being made by other biotechs and pharmas – but if I had to back one, I would take money I could afford to lose and buy Mirati stock, given how much the transition from a clinical to commercial stage company ought to please the market.

You won’t get a dividend with Mirati like you will do with Amgen – paying ~3% per annum – and you will be embracing a much higher level of risk, but I would not altogether rule out a surge back toward prior highs of $240, meaning, theoretically at least, there’s >175% upside in play in an optimal scenario.

There’s no such risk reward with Amgen, although the company knows how to defend its assets against rival drugs – witness the rivalry between the company’s Repatha and Regeneron’s Praluent, which was won hands down by Amgen. Such an outcome in the Adagrasib / Lumakras battle would be disastrous for Mirati.

Be the first to comment