gorodenkoff/iStock via Getty Images

CuriosityStream Inc. (NASDAQ:CURI) operates a specialty streaming video service focusing on topics related to science, history, and nature through exclusive documentary-type of programming. Growth has been impressive over the last few years with the company last reporting 25 million paying subscribers, up 25% from last year. Unfortunately, profitability has been elusive with the stock plagued by a widening loss sending shares down more than 70% this year amid the broader market volatility.

We last covered CURI with an article back in February, taking a view that the stock had an interesting story but faced some deep challenges. In the period since CuriosityStream has reported two-quarters of results highlighted by limited progress towards turning the financials around. Today’s update reaffirms a bearish view towards the stock noting that, in our opinion, some type of equity raise or convertible financing will likely be necessary over the next few quarters. CURI remains high risk with the potential for more downside.

Why Did Shares Of CURI Drop?

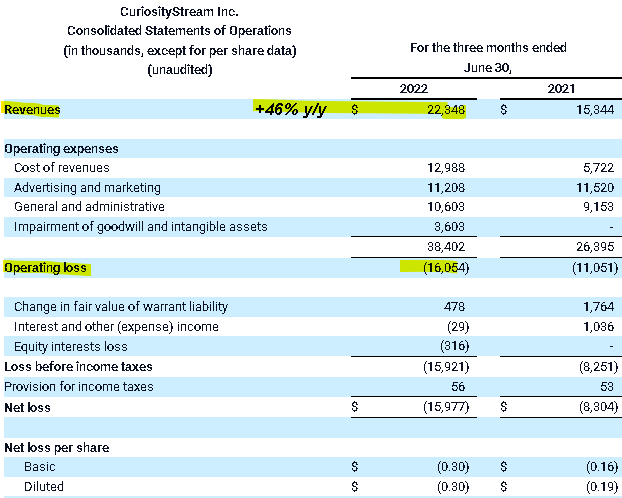

The key metrics for CURI are a mixed bag with the strong point being a 46% year-over-year revenue increase to reach $22.3 million in Q2 driven by the larger subscriber base. On the other hand, the operating loss of -$16.1 million widened from -$11.1 million in the period last year. In this case, growth just hasn’t been strong enough to make up for significant expenses for content, along with intense advertising and marketing spending.

source: company IR

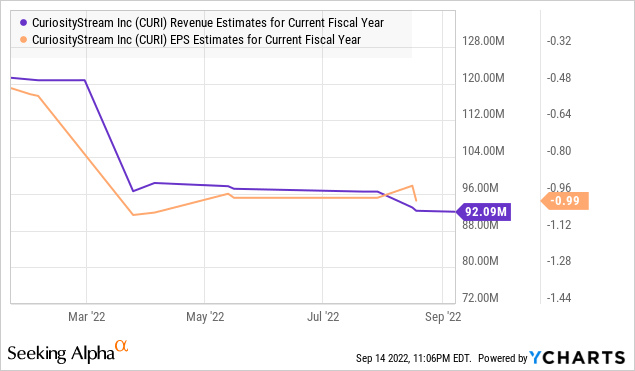

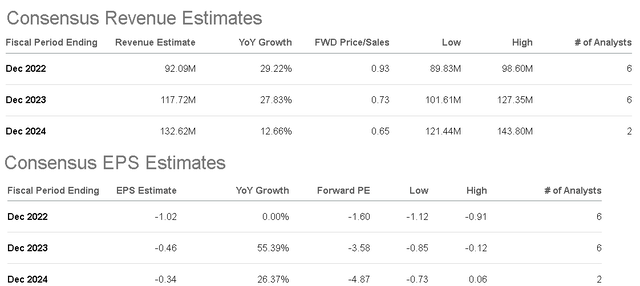

As it relates to the stock price, the biggest issue has been the growth slowdown compared to what was a boom for the business during the pandemic. For reference, the 2022 consensus revenue forecast at the start of the year was above $120 million, up 70% y/y which has been revised lower to the current level of $92 million, or 29% from last year. In 2021, revenue climbed by a stronger 80%. Similarly, the estimates for an EPS loss of -$0.99 is more than double the loss expected back in early Q1 explaining much of the stock repricing over the period.

In terms of the balance sheet, CURI ended the quarter with $78 million in cash and investments against zero long-term financial debt. While this is positive for the company, that cash cushion only goes so far considering a trajectory of losing more than $30 million in cash from operations this year. Over the first six months of 2022, the cash bleed was at -$18.1 million just modestly better compared to -$23.4 million in Q2 2021.

Recognizing this crutch, management committed in Q1 to focus on reaching positive cash flow, although the timetable is unclear or possible only an aspirational goal. Unless the trend improves materially, some form of equity raise or convertible financing will be necessary by the end of 2023 as companies take some action long before its liquidity ends.

In 2021 CuriosityStream raised $88 million by selling 6.5 million shares at a stock price of $13.50. At today’s price of $1.63, the company wound needs to sell more than 53 million shares, nearly equal to its entire outstanding share count, to raise the same amount. Whether the next capital raise is smaller than the previous secondary, some type of shareholder dilution can be expected that can pressure shares lower.

Is CURI A Good Long-Term Investment?

The trends for CURI are not new. The strategy has always been to invest on acquiring subscribers to eventually scale into a position where the business is viable and self-sustaining. It’s just taking longer than previously imagined. The question that matters for investors is if the current challenges have already been priced in or if there’s another shoe to drop.

On the upside, the bullish case for the stock is that management finds success in generating materially stronger margins with a path to profitability. We don’t see it happening, but that’s the plan. One initiative is the company’s “Smartest Bundle In Streaming” deal that combines five other similar-minded niche streaming services into one plan. Comments during the conference call noted a positive reception with many subscribers effectively upgrading to the higher monthly rate.

The company is also making progress in generating advertising revenue from the platform as a separate growth driver, although the breakdown is unknown. There is also an effort to expand internationally, which remains a smaller part of the business, although this creates some other problems considering the need to invest in foreign language content.

The path ahead is difficult. By our estimate, assuming a steady gross margin and generously holding other expenses flat from Q2, revenue would need to more than double from the current level to approach breakeven operating income. Consensus estimates see the top-line growth slowing towards an annual rate of 13% by 2024 while EPS remains negative over the period.

One problem we see for CURI is the relatively low price point of its streaming options starting at just $1.67 a month for the standard annual plan that climbs to $5.83 for the smart bundle or $9.99 for the premium 4k option at the monthly rate.

We make the case that this particular category of factual docuseries video content has limited pricing power compared to larger and broader entertainment streaming platforms like Netflix Inc (NFLX) and even “Disney+” from The Walt Disney Company (DIS). CuriosityStream is fine at $2.00 a month but becomes a harder sell if CURI attempts to push those rates significantly higher.

The company will need to continuously invest in content to keep subscribers engaged which has been difficult even for the streaming leaders to manage. On this point, the more casual audience may already find enough similar docuseries content on other platforms, even for free considering options on “YouTube” by Alphabet Inc (GOOGL) (GOOG).

Ultimately, we believe current growth expectations have a downside as subscriber growth slows based on a view that the low-hanging fruit of its target audience has already been picked. Access and distribution here are not the problems. CuriosityStream is widely available through major platforms like ROKU Inc (ROKU), Apple TV (AAPL), and Amazon Prime (AMZN) among others. We just don’t see a renaissance of new subscriber growth emerging.

CURI Stock Price Forecast

With a market value of just under $90 million, CURI is firmly in the category of being a speculative “penny stock”. Wide swings of volatility are to be expected which would also include the possibility of some momentum-based rally for whatever reason. The prudent call is simply to avoid this ticker until there is some real evidence that financials are stabilizing.

In our view, the best case scenario over the near term for shareholders would be some type of acquisition of the company by a larger player, although nothing has been announced. This type of deal would be tricky in the current market environment defined by poor investing sentiment. Even still, the upside would likely fall short of returning the stock to levels from 2021.

The next few quarterly reports will be critical. Shares have been threading water around this current level of $1.60 going back several months which could end up being a weak area of support. We won’t be surprised if a reverse split type of corporate action is announced to adjust the share price higher. Monitoring points over the next few quarters include the trend in subscriber growth, the gross margin, along with cash flow levels.

Be the first to comment