LordRunar/iStock via Getty Images

After the recent backup in US bond yields, the iShares iBoxx USD High Yield Corporate Bond ETF (NYSEARCA:HYG) now offers a risk-return profile that is far superior to US stocks. The ETF tracks the performance of the Markit iBoxx USD Liquid High Yield Index and offers a yield to maturity of 5.7%, with a weighted average maturity of 5.2 years. While the ETF tends to move in line with US stocks in the near term, it has underperformed significantly over recent months amid the rise in Treasury yields. While the expense fee of 0.48% is on the high side, the HYG is likely to outperform the SPX over the coming years with much less downside risk.

The HYG ETF

HYG was the first mover in the high-yield corporate bond market and is one of the largest and most liquid junk bond ETFs, with USD15.1bn under management and average daily volume of USD3.5bn. This compares to USD7.6bn and USD1.1bn for its rival, the SPDR Bloomberg High Yield Bond ETF (JNK).

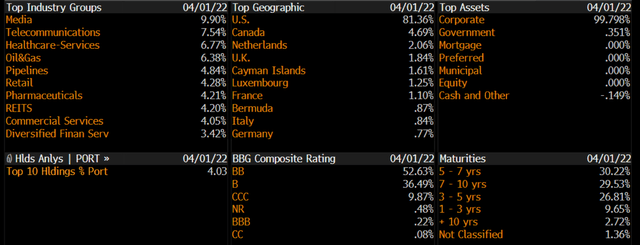

In terms of the HYG’s holdings, it is highly diversified, with 1,318 holdings and with no single bond comprising more than 1% of the index. Over 80% of the bonds held are in US corporations, the majority of which are rated BB. Industry exposure is also highly diversified, with Media, Telecommunications, and Healthcare Services are the three main industries.

The Yield Is Now Worth The Risk

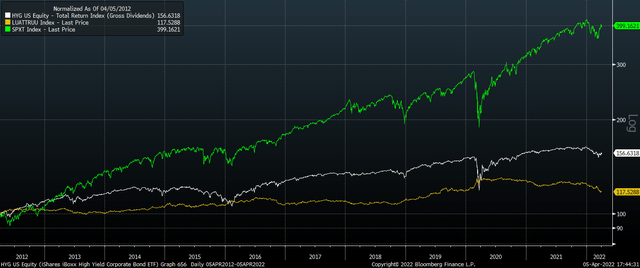

Over the past 10 years, the HYG has returned 4.6% annually, outperforming US 10-year Treasuries by almost 3% per year over this period. However, due to a combination of rising Treasury yields and surging US equity valuations, the HYG has underperformed the SPX by over 10% annually. I strongly expect to see a reversal of fortunes over the coming years, with the HYG likely to outperform the SPX significantly due to far superior starting valuations.

SPX, HYG, 10Yr UST: Total Returns Rebased (Bloomberg)

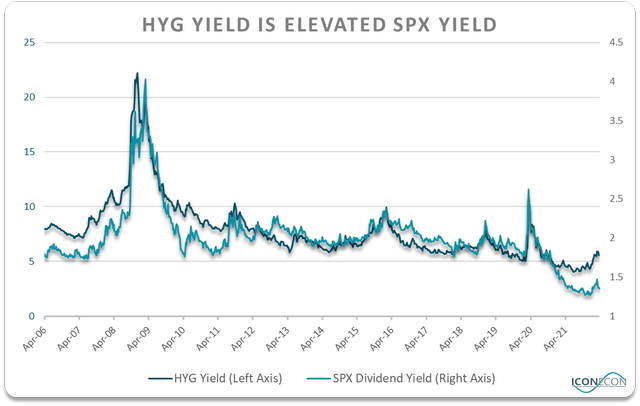

The yield on the HYG has tended to move closely in line with the dividend yield on the SPX, as both are driven in large part by risk appetite. Over the past few months, however, despite the SPX rising back to within a few percent of its all-time highs, the HYG has weakened as falling credit spreads have been more than offset by rising Treasury yields. As a result, the yield on the HYG is now significantly higher than its fair value implied by the SPX dividend yield.

With an SPX dividend yield of 1.4% and a HYG yield of 5.7%, the SPX would have to grow its dividends by 4.3% annually in order for total returns to outperform the HYG, setting aside losses from any bond defaults. With dividend payments at a record share of sales thanks to record high profit margins, this would be no mean feat. Even if this does occur, for the SPX to outperform the HYG we would also need to see the SPX dividend yield remain at extremely low levels over the long term. Otherwise, stocks would suffer significant losses.

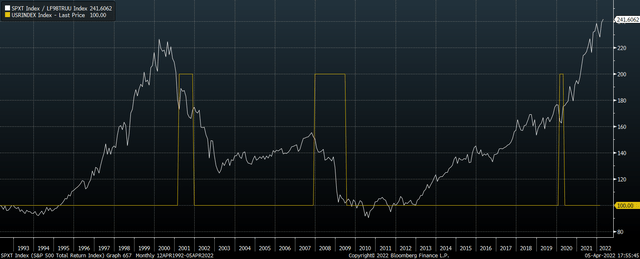

It is during periods of declining appetite for risk and declining equity valuations where the relative attractiveness of the HYG stands out. For instance, during the global financial crisis, while the HYG lost 33%, the SPX lost 55%. More recently during the 2021 Covid crash, the HYG suffered a 22% drawdown while the SPX lost 34%. Note that during this period, the HYG outperformed despite UST yields actually rising marginally amid the global liquidity crunch.

SPX Vs HYG And Recessions (Bloomberg, NBER)

The main risk to the HYG, like most bond funds, comes from continued elevated inflation. While equity earnings benefit in nominal terms during such periods, corporate bonds tend to get undermined by rising Treasury yields and rising default risks. It is the recent rise in inflation that has been largely responsible for the underperformance of the HYG versus the SPX. However, even if we factor in the current elevated rate of inflation expectations as measured by 10-year inflation-linked bonds, the HYG’s yield is still 1.5% higher, which is higher than the rate at which real SPX dividends are likely to grow over the coming years.

Summary

After the recent rise in Treasury yields, the HYG now offers return prospects commensurate with the risk, which is not something that can be said for US stocks. The HYG is not only priced to outperform the SPX over the coming years, but it should do so with much less volatility, particularly during times of economic weakness.

Be the first to comment