Tanarch

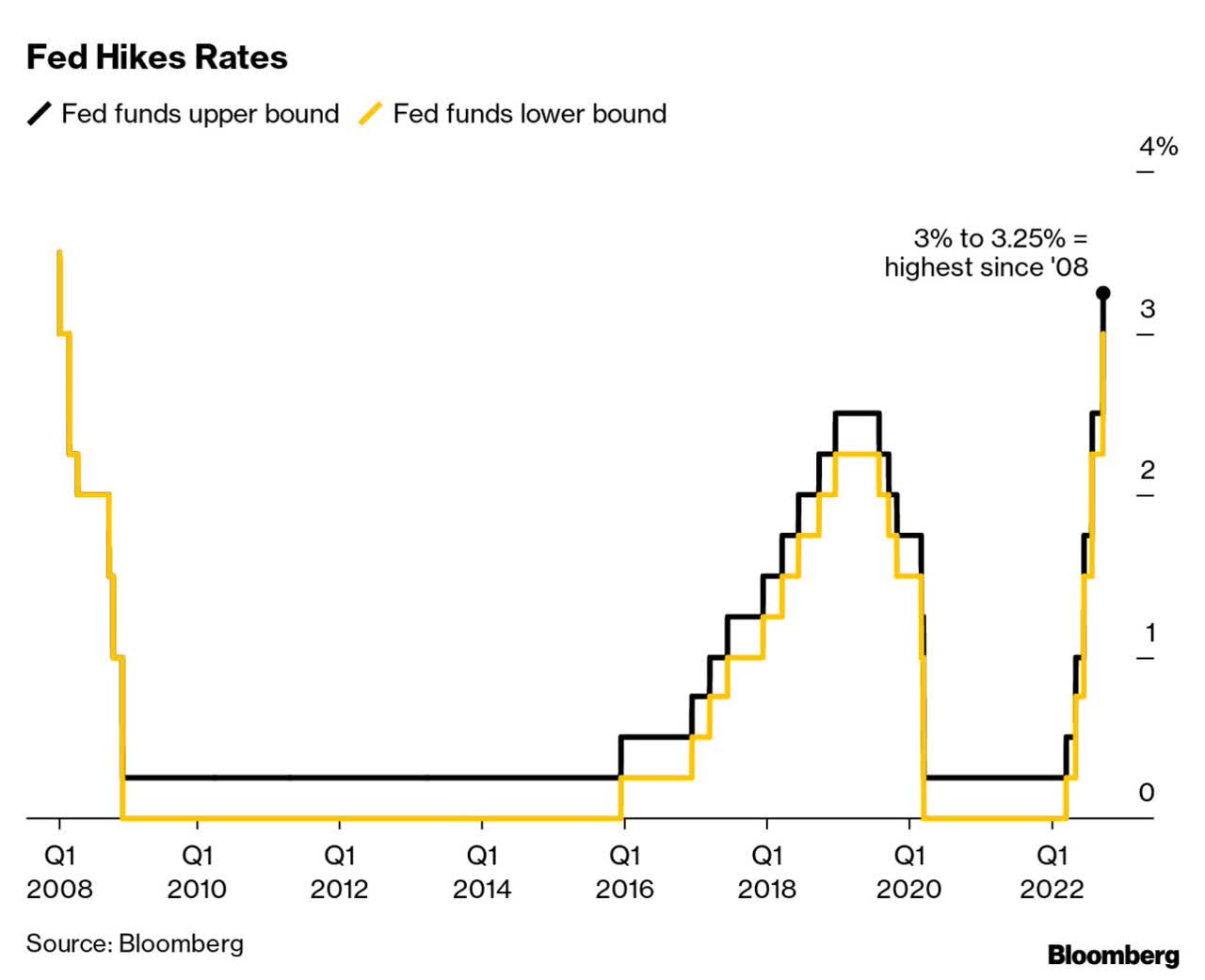

As expected, the Fed raised its benchmark interest rate by 75 basis points to 3% yesterday afternoon. Initially, the stock market’s response was muted, but then a rally ensued during Chairman Powell’s press conference that followed. That didn’t last long, as the major market averages reversed course in the final hour of trade to close at their lows for the day. The 2-year Treasury yield inched just above 4%, but long-term yields fell, as investors digested the Fed’s updated forecasts for short-term rates and the economy.

Finviz

The Fed was too late in starting to raise rates earlier this year and based on its updated projections it looks like it could repeat that mistake by raising them too high and for too long in its effort to lower the inflation rate. That is what concerns investors and why risk assets sold off late in the day. Still, the most important statement made by Chairman Powell during his press conference was that the pace and size of future rate increases will depend on the “incoming data and evolving outlook” for the economy. I still believe that data will show a more rapid decline in inflation than the Fed is now forecasting, which will not necessitate tightening financial conditions to the degree investors, or the Fed now expect.

Bloomberg

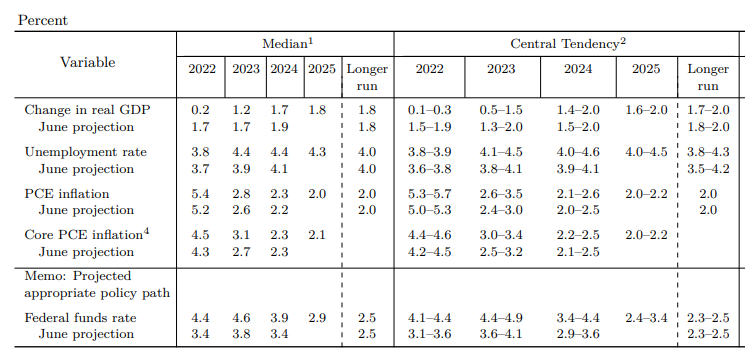

The updated Summary of Economic Projections from the Fed is what roiled markets yesterday, but it is important to remember that this is a forecast with a horribly inaccurate track record. The Fed lowered its expectations for economic growth (GDP) and increased its outlook for the unemployment rate, which is due to its forecast for a much higher Fed funds rate than it was anticipating would be needed in June to lower inflation. The central bank now sees short-term rates rising to a median of 4.4% this year and 4.6% next year with no rate cuts until 2024. It sees the core rate of inflation falling at a slower pace to 3.1% next year. The obvious concern is that their policy will result in a recession in 2023.

Federal Reserve

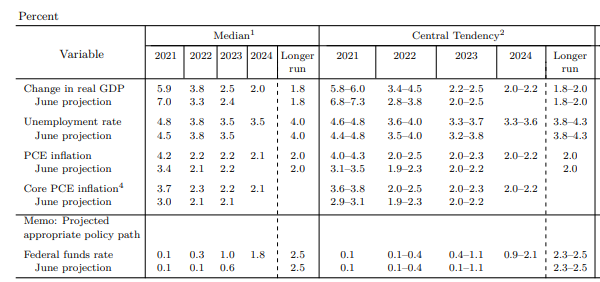

I think it is ridiculous to place any value on the Fed’s projections. To that point, look at its projections below from one year ago. It expected the Fed funds rate to be near zero today. It saw the core rate of inflation at 2.2% and the rate of economic growth at 3.8%. Granted, there were unforeseen events that impacted all of these numbers, but that is my point! There are always unforeseen events, but even excluding those over the past year it was fairly predictable that inflation would rise from last year’s level and not fall.

Federal Reserve

I don’t think the bond market is convinced that the Fed will tighten policy as aggressively as shown in its updated outlook, which should help the stock market hold its June lows. The 2-year Treasury yield remains close to where it stood before yesterday’s rate decision. If incoming data shows a more pronounced decline in the inflation rate, as I expect, the futures market should lower rate expectations and further support risk asset prices. I think markets will be a far more accurate predictor of Fed action than what members of the Fed say they will do.

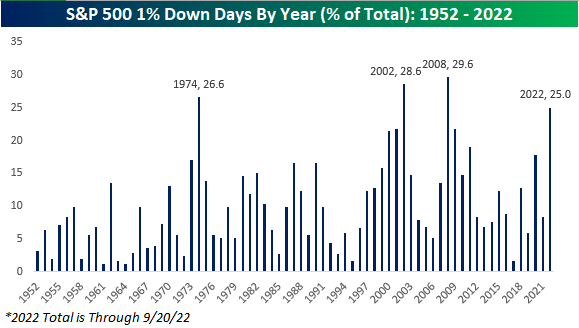

On that front, the volatility we have seen this year has only been matched three times going back decades. In all three of those years the S&P 500 performed extremely poorly, but in each year that followed the index was up more than 20%. Will this time be different? I don’t think so.

Bespoke

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment