blackdovfx

As market interest in a year-end rebound builds, I continue to emphasize that prudent stock-picking in high-quality, beaten-down growth names should be a top priority. Many enterprise software companies are still trading well off their highs, despite the fact that the year-to-date crunch has been predicated almost entirely on sentiment with no impact to fundamentals.

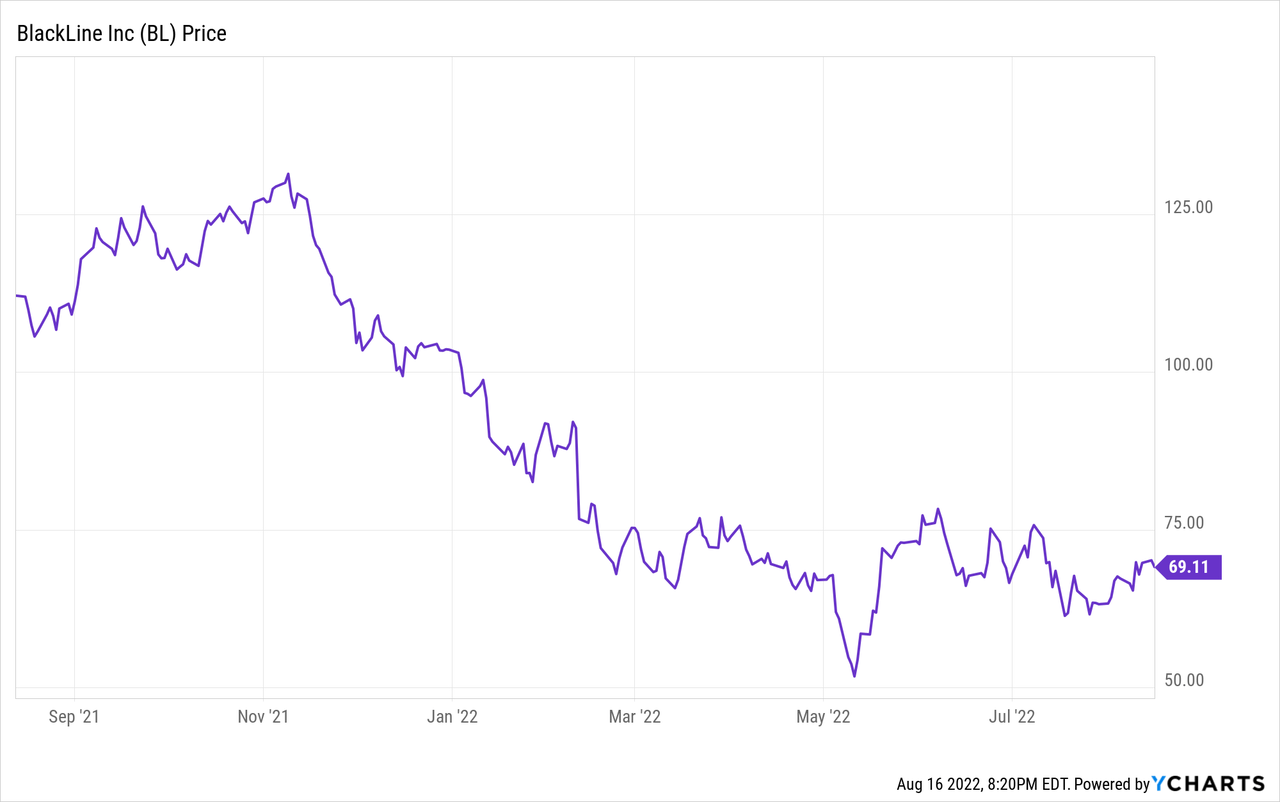

BlackLine (NASDAQ:BL) is one growth stock that deserves a close second look. This financial software provider, which focuses on the period-end accounting close process, has seen its share price dip more than 30% year to date, approximately in-line with other SaaS names. At the same time, its fundamental performance has continued to soar, and management has so far cited no material impacts from tightening macro conditions.

BlackLine recently reported Q2 results that exceeded Wall Street’s expectations on both the top and bottom lines. Revenue growth accelerated (which is a nice surprise for a company that has already achieved meaningful scale), and while margins slimmed down due to expected inflationary pressures, BlackLine still managed to turn out a profit. Shares are up modestly since the earnings release, and I think there is still room for further upside.

I am retaining my bullish recommendation on BlackLine. I continue to view the company as a software vendor with a differentiated offering, and one that has consistently demonstrated strong execution.

As a reminder for investors who are newer to this stock, here is what I view to be the key bullish drivers for BlackLine:

- Despite niche features, BlackLine is a true horizontal software product with big-hitting clients across industries. Finance departments are prevalent in every industry, and BlackLine’s customer base counts heavy manufacturing giants like Boeing (BA), energy companies like Chevron (CVX), fellow tech companies like Salesforce (CRM), and hospitality names like Hyatt (H). The diversity of BlackLine’s customer base, plus its name-brand recognition across industries, is a big plus for this company’s expansion potential, especially into smaller middle-market companies where its next leg of growth opportunities lies.

- Large TAM. Despite its positioning as a niche company, BlackLine estimates its total addressable market (“TAM”) at $28 billion, meaning the company’s current ~$500 million revenue run rate is only a fraction penetrated into this market opportunity.

- Rich margin profile. BlackLine has pro forma gross margins in the ~80% range, which skews toward the higher end among software companies. This means that nearly every incremental dollar of revenue will flow into the bottom line.

- Free cash flow growth. BlackLine is now in the profit-expansion stage as its growth matures to the ~20% range, and the company’s burgeoning FCF profile may make it look more attractive in this risk-averse market environment.

The one slight downside here is that BlackLine isn’t exactly a value stock anymore, even after the 30% year to date slide. At current share prices near $69, BlackLine trades at a market cap of $4.01 billion. After we net off the $1.03 billion of cash and $1.38 billion of debt on the company’s most recent balance sheet, BlackLine’s resulting enterprise value is $4.36 billion.

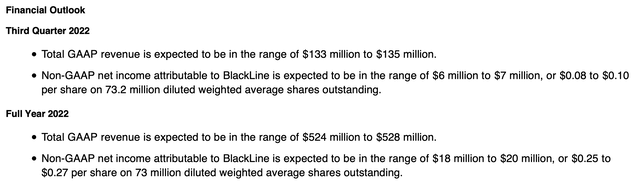

For the current fiscal year, BlackLine has guided to revenue of $524-$528 million, representing 23-24% y/y growth and in-line with the guidance that the company previously gave in Q1.

BlackLine outlook (BlackLine Q2 earnings release)

Against the midpoint of this revenue estimate, the company trades at 8.3x EV/FY22 revenue. If we look ahead one more year to FY23, where Wall Street consensus is expecting $630.6 million in revenue (+20% y/y; data from Yahoo Finance), BlackLine’s multiple goes to 7.0x EV/FY23 revenue.

Neither is a slam-dunk value multiple. That being said, BlackLine’s combination of consistent revenue growth (and in Q2, even acceleration), clearly defined product niche, and ability to balance top-line growth with profitability make it a standout in the SaaS sector.

The bottom line here: in my view, there’s still upside for BlackLine. My year-end price target on the stock is $79, representing 8x EV/FY23 revenue and 15% upside from current levels. Continue riding the upward wave here.

Q2 download

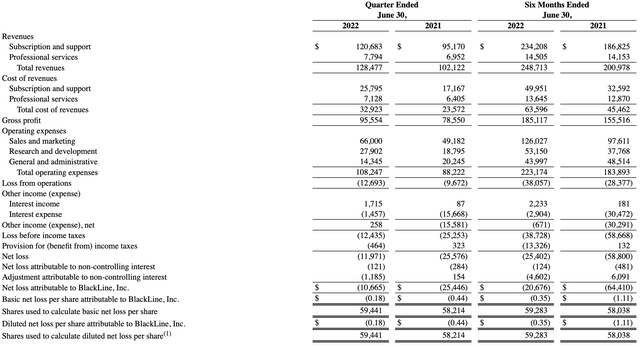

Let’s now cover BlackLine’s latest Q2 results in greater detail. The Q2 earnings summary is shown below:

BlackLine Q2 results (BlackLine Q2 earnings release)

BlackLine’s revenue in Q2 grew 26% y/y to $128.5 million, beating Wall Street’s expectations of $126.6 million (+24% y/y) by a two-point margin. Revenue growth also accelerated versus 22% y/y growth in Q1.

We note as well that revenue mix came in more favorably this year as well. Subscriptions represented 94% of Q2 revenue, versus 93% last year. On top of that, BlackLine achieved a 110% net dollar-based retention rate in the quarter, indicating an average 10% upsell for the existing customer base (in line with Q1).

The company also added 106 net-new customers in the quarter to end with 4,003 total customers – a sequential improvement in net adds versus 73 in Q1, indicating strong go-to-market traction and sales cycles.

More to the point above, so far management has cited that impacts from tightening macro conditions have been minimal. The company is conservatively assuming that sales cycles will elongate in the back half of 2022, but the overall demand for digital transformation (especially as software can ultimately lead to opex savings if it can eliminate headcount) is high enough to offset any current gingerness on enterprise spend.

Per CEO Marc Huffman’s prepared remarks on the Q2 earnings call:

Taking a step back from our Q2 performance, we recognize that businesses around the world, again, are experiencing a challenging operating environment due to a variety of macroeconomic and geopolitical circumstances. These challenges manifest themselves acutely within the back office where manual legacy processes still dominate.

Over the past few quarters, we’ve seen an acceleration in digital transformation initiatives. There are still far too many businesses running manual processes, which create unnecessary friction, limits strategic decision-making and expose companies to unnecessary risk and missed opportunities. Taking all of these together, the cost of doing nothing is rapidly rising.

For BlackLine, specifically, the demand environment for back-office automation software remains resilient, albeit with pockets of noise. Through ongoing customer interactions, prospect conversations and partner insights, we received real-time insight into where the market is, where it’s going and the challenges our customers are facing. As a result of these conversations, we expect that near-term growth may be influenced by broader market conditions including the possibility of lengthened sales cycles. Despite these potential conditions, our confidence in the longer-term opportunity remains strong.

Our go-to-market and customer success teams are fully engaged with our customers, prospects and partners, focusing on the value that our solutions provide and how they can be leveraged quickly during volatile periods like today.”

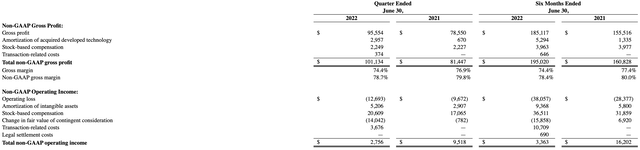

We note as well that in spite of the inflationary environment in which companies have had to materially ramp up their opex spend, BlackLine retained profitability on a pro forma basis, though operating income is down y/y.

BlackLine pro forma profitability (BlackLine Q2 earnings release)

Pro forma operating margins in Q2 were 2.1%, down from 9.3% in the year-ago Q2. The company does intend to a mindset of “targeted hiring”, but it noted that most of its hiring targets were met in the first half of FY22 and hiring in the back half of the year would slow.

Key takeaways

In my view, BlackLine remains a relatively “safe” rebound play that has consistently pleased Wall Street with its quarterly beats and nice balance of growth and profitability. Stay long here and use any dips as buying opportunities.

Be the first to comment