arild lilleboe

Growth Is Getting Steady

Oceaneering International (NYSE:OII) provides engineered services to the offshore energy, defense, aerospace, manufacturing, and entertainment industries. I suggested investors hold the stock in my previous article because of operating cost escalation and balance sheet risks. In the Russia-Ukraine conflict, there has been a strategic change in the energy mix outlook. Because countries are looking to strengthen energy security, the offshore energy market is set to witness an increased demand in the medium term. The company should also benefit from increased ROV (remotely operated vehicle) utilization and a rise in aerospace and defense businesses. I expect the operating margin to improve steadily in the near to medium term.

Although the stock is reasonably valued versus its peers, I expect a positive bias at this level. However, headwinds from inflationary pressures on costs in some of its non-energy businesses can lower the operating margin. Plus, negative cash flows can complicate an overleveraged balance sheet. Considering many balancing factors, I think investors would do well to hold the stock for a medium-term gain.

Analyzing Outlook And Estimates

Oceaneering International’s Filings

In 2022, OII’s management expects strong market dynamics to benefit the offshore market. Given the renewed importance of energy security, the offshore energy market will likely strengthen soon. The management also sees growth opportunities in the aerospace and defense (or ADTech) and mobility solutions businesses. However, timing uncertainties in the ADTech segment can mitigate some of the gains. During Q2, a critical entertainment business project was not completed in time. So, adverse timing in the ADTech businesses contributed to the muted quarterly results and margins.

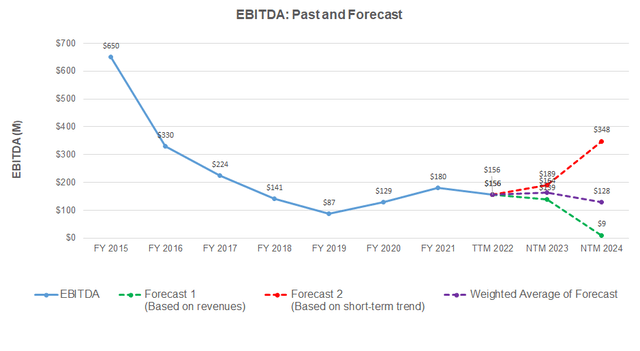

In FY2022, the company expects to generate $210 million to $240 million of EBITDA, which would be 25% higher than in FY2021. Over the long term, the management anticipates offshore energy activity to improve. Plus, it sees growth opportunities in the ADTech and mobility solutions businesses. Recently, OII, along with Raytheon Technologies, was selected by NASA to develop next-generation extravehicular spacesuits. So, the medium-to-long-term prospect remains robust for OII.

Subsea Robotics Segment Outlook

Oceaneering International’s Filings

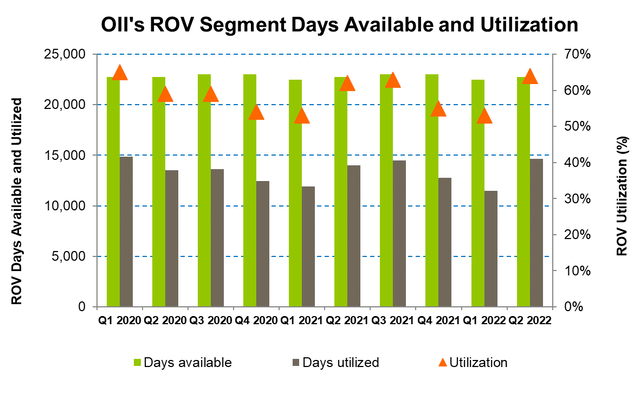

In FY2022, increased ROV days on hire, pricing improvements, and increased levels of personnel utilization can improve the segment operating results. ROV utilization can rise to the high 60% to low 70% range. So, the EBITDA margin can decline to a high 20% range compared to the 28% recorded in Q2. However, a shift in the geographic mix can partially offset the gains.

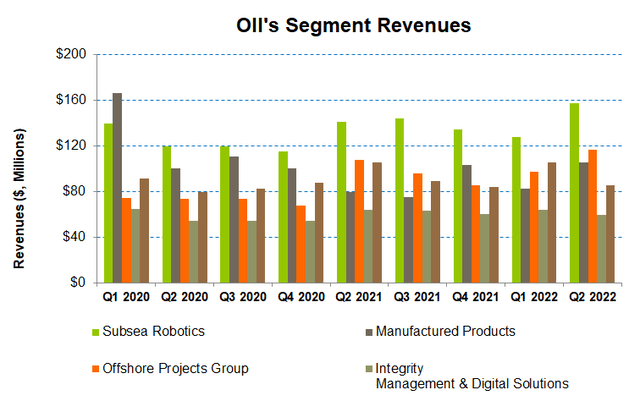

During Q2, revenues in this segment increased by 23% quarter-over-quarter. A favorable seasonal activity in ROV, survey, and tooling services led to the revenue rise in Q2. The share of the ROV business increased marginally to 77% in Q2 from 76% in Q1.

Manufactured Products Segment: Performance And Outlook

Revenues in the Manufactured segment recorded a steep rise (28% up) in Q2 2022 compared to Q1. However, the backlog on June 30 remained nearly unchanged at $335 million. Its book-to-bill ratio was 1.1x. Less profitable work in the mobility solutions businesses led to a fall in the adjusted operating income in Q2 compared to Q1.

In Q3, the management expects operating margin to improve to the “low to mid-single digit” range, although revenue may not change much. Revenues, however, may get a shot in the arm by the end of 2022 as high quotation activity in the energy businesses can translate into robust bookings while opportunities in the mobility solutions businesses rise. So, the segment book-to-bill ratio can inflate from 1.1x to 1.3x.

Non-Energy Business: Performance And Outlook

OII’s Offshore Projects Group segment also had a strong Q2 (revenues 15% up) following the increased inspection, maintenance, and repair in the Gulf of Mexico. Increased demand for vessel-based services in the GoM and better pricing led to a considerable jump in the operating margin in Q2. In Q3, the topline and operating margin should remain steady following the sustained demand.

The company’s Integrity Management and Digital Solutions can see a slight improvement in its operating results in Q3. However, by the end of 2022, it faces headwinds from inflationary pressures on costs, which can lower its operating margin. So, the company may reduce costs and implement contractual increases to mitigate the adverse effects.

Debt And Cash Flows

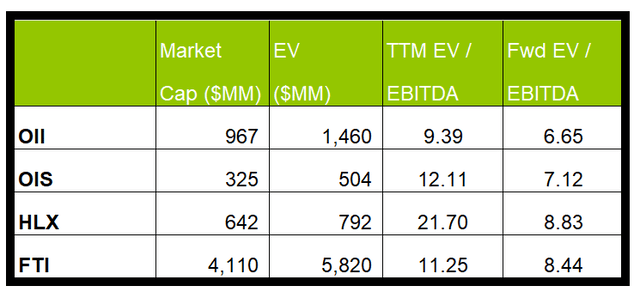

OII’s debt-to-equity (1.347x) is much higher than the peers’ (OIS, HLX, FTI) average of 0.29x. During Q2, it entered a new revolving credit facility, providing access to substantial liquidity through 2026. On June 30, 2022, its liquidity was ~$583 million (excluding working capital).

Its cash flow from operations (or CFO) depleted radically in the past year to negative related to higher accounts receivable and contract assets. So, its free cash flow (or FCF) went significantly negative in the past year. Despite that, in FY2022, it expects to generate positive FCF ($25 million and $75 million), which would be substantially lower than the previous year.

Linear Regression Based Forecast

Author created, Seeking Alpha, Baker Hughes rig count, and EIA

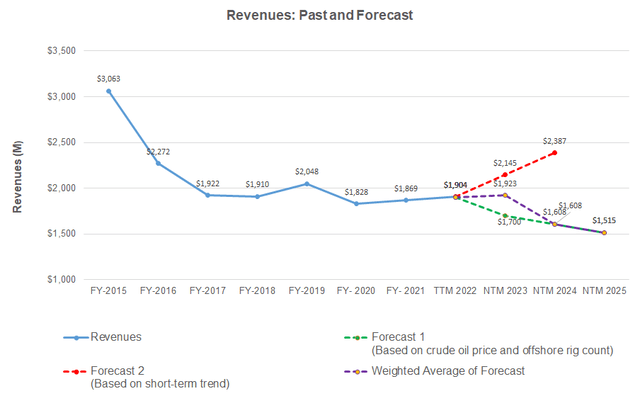

The crude oil price increased in 2022, while the offshore rig count remained nearly unchanged. Based on a regression equation among crude oil price, offshore rig counts, and OII’s reported revenues for the previous four quarters and the past seven years, revenues can remain unchanged in the next 12 months (or NTM) 2023. It can decline in NTM 2024 and NTM 2025.

Author created and Seeking Alpha

Based on the regression model, I expect the company’s EBITDA to increase in NTM 2023 but decrease significantly in NTM 2024.

Target Price And Relative Valuation

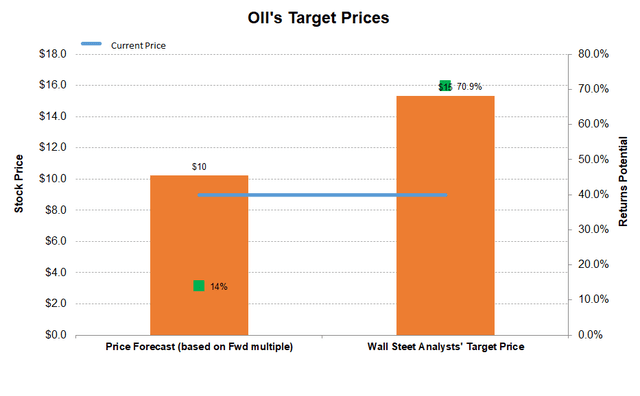

Author Created and Seeking Alpha

The returns potential using the Wall Street analysts’ price forecast (71% upside) is higher than the returns potential (14% upside) using the forward EV/EBITDA multiple (6.7x). Four sell-side analysts recommend a “Buy” on the stock, while two recommend a “Hold, ” according to Seeking Alpha. None of the analysts recommended a “Sell.”

OII’s forward EV/EBITDA multiple contraction versus the current multiple suggests lower EBITDA in the next four quarters. The company’s EV/EBITDA multiple (9.4x) is lower than its peers’ (OIS, HLX, and FTI) average. So, its relative valuation discount is justified at the current level.

Why I Kept My Stance On OII?

In my previous article, I saw more downside than upside in OII, particularly related to the operating cost escalation and balance sheet risks. I wrote:

The energy business faces seasonality headwinds while operating results can deteriorate in the ADTech segment in Q1. Higher personnel costs and the cost of mobilization of equipment following a significant increase in activity will lead to a higher operating cost.

The value drivers, after Q2, have witnessed qualitative changes. While the balance sheet remains leveraged, the debt and liquidity profile present better optics. The operating margin outlook is much better in the middle of 2022. Some concerns over the ADTech business remain, but I figure the overall industry recovery has cleared the path for a rapid recovery. Despite many positives, the rising concerns over cash flows have tethered my call to a “hold.”

What’s The Take On OII?

Oceaneering International’s offshore energy business benefits from favorable seasonal activity in ROV and increased survey and tooling services. High quotation activity in the energy businesses can translate into robust bookings. The company should also benefit from increased ROV utilization and a rise in aerospace and defense businesses.

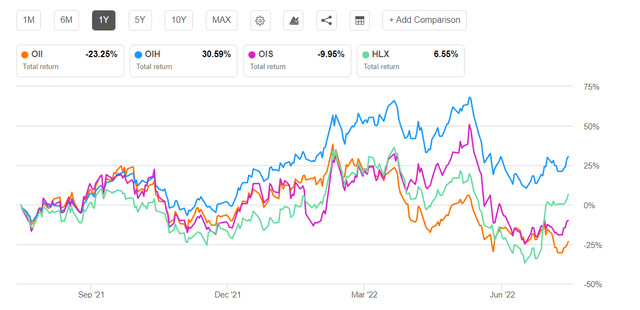

However, the operating margin in the Subsea Robotics segment can decline due to adverse geographic mix. Also, timing uncertainties in the ADTech segment can mitigate some of the gains. Its cash flows came under tremendous pressure in 1H 2022 following an increase in accounts receivable and contract assets. So, the stock underperformed the VanEck Vectors Oil Services ETF (OIH) in the past year. I would reiterate my “hold” call on the stock for the short-to-medium term.

Be the first to comment