Technical Outlook:

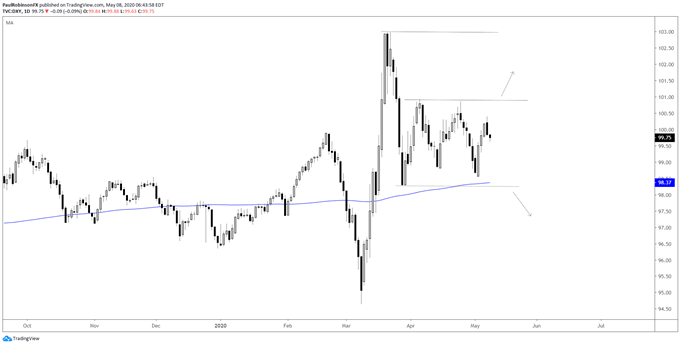

The US Dollar Index (DXY) has been hacking around for the past five weeks making no headway in either direction. It has been somewhat frustrating to watch, but with a little more time it is likely that this all sorts itself out.

Right now the range for the DXY is set from 98.27 up to 100.93. The support level from late March is in confluence with the 200-day MA, so it is sturdy. The resistance level was obtained on a couple of occasions during April. Once we get out of the range we should be able to run with a clear trading bias.

Recommended by Paul Robinson

Check out the Mid-Q1 USD Update.

US Dollar Index (DXY) Daily Chart (rangebound for now)

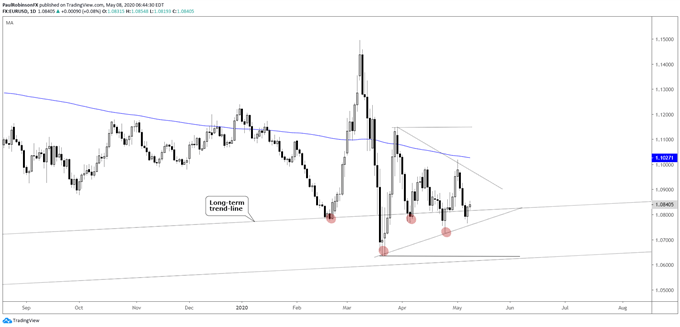

We have spent a lot of time recently discussing the 35-year trend-line in EUR/USD, and rightfully so – it’s 35-yrs old! That is, when reconstructing the Euro before its existence from the constituents that make it up now. So far the Euro is finding little life at this massive level of support. For now though it is indeed support with the 10635 level as the critical level to watch. How things play out here will be very important for the Dollar as the Euro accounts for roughly 57% of the DXY index.

EUR/USD Long-term Chart (acting weak around 35-yr trend-line)

USD/JPY posted a nice descending wedge not long ago, then finally broke. But the spill from the pattern has highlighted the return of low volatility in FX and has been a bit of a disappointment as such. But nevertheless the pair is still heading downhill and unless it can trade above 10750 the outlook is set to remain neutral to bearish.

USD/JPY Daily Chart (looking headed lower)

For all the charts we looked at, check out the video above…

Resources for Forex Traders

Whether you are a new or an experienced trader, DailyFX has several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, and trading guides to help you improve trading performance.

—Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX

Be the first to comment