BeyondImages

BHP Group Ltd. (NYSE:BHP), the Australian-based mining/basic materials and resources company, focuses on the extraction and production of iron, copper, nickel, potash, and metallurgical coal. These lines of business are poised for long-term secular growth driven by two key ideas: adoption of electric vehicles, and increased demand on global agriculture.

While some analysts warn of an impending dividend cut, I am less concerned relative to my peers. The company currently generates sufficient cash flow to cover the dividend, and while cyclical challenges may threaten this in the short-run, I believe that the secular trends mentioned above will dominate for long-term investors. The company currently pays out $7.00/share, or over 13% annually based on current valuations.

Recent Performance

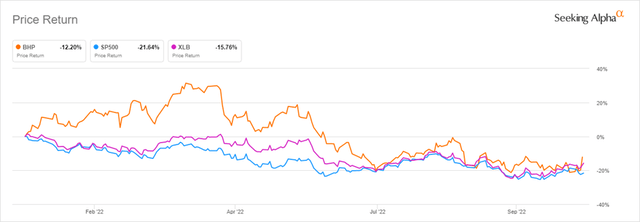

Recent performance, along with that of the broader market and the industry, has been terrible on a price return basis. Fortunately, we are looking beyond what has already happened and developing what we expect to happen moving forward. For long-term investor this means focusing on the next ten years, not the next ten days.

YTD Price Return (Seeking Alpha)

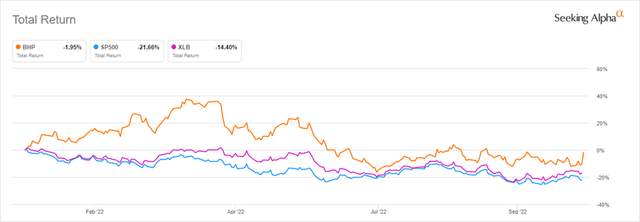

The same chart including dividends tells a much different story. Including the meaty dividend, the stock is lower by only about 2% so far this year, far outperforming the S&P 500 and the materials sector. The dividend has boosted the total return, contributing to its significant outperformance. If the company continues to pay its dividend, I believe that this outperformance will continue.

YTD Total Return (Seeking Alpha)

Valuation

Materials have historically been a cyclical industry. However, given the shift toward EVs and renewable sources of energy, a secular trend that is expected to last for decades, it is reasonable to expect the secular to dominate the cyclical. So, while there may be short-term volatility and losses, if anything, this creates an attractive entry point for long-term investors interested in investing in a secular trend.

At the current stock price, the company is trading at a large discount with respect to its own history and its sector across several metrics, with some exceptions.

|

Valuation Metric |

BHP |

Sector |

BHP 5-year Average |

% Difference to 5-year Average |

|

P/E GAAP (TTM) |

6.26 |

11.30 |

NA |

NA |

|

P/E GAAP (FWD) |

12.34 |

12.74 |

13.69 |

-9.89% |

|

Price/Sales (TTM) |

1.93 |

1.08 |

3.89 |

-50.26% |

|

Price/Sales (FWD) |

2.38 |

1.09 |

NA |

NA |

|

Price/Book (TTM) |

2.81 |

1.65 |

3.54 |

-20.65% |

|

Price/Cash Flow (TTM) |

3.93 |

7.80 |

9.44 |

-58.34 |

|

Price/Cash Flow (FWD) |

5.68 |

7.16 |

6.86 |

-17.10% |

In addition to the attractive valuation, there are factors that make it a contrarian play. Despite global inflation and significant growth forecast for the years to come, short-term economic uncertainty combined with a strengthening dollar have created headwinds. This creates an investment opportunity as the strength of the US dollar is likely to stabilize and eventually weaken, and cyclical trends will give way to the secular trends of ever-increasing demand for basic materials, and specifically the ones produced by BHP, not only for EVs and renewable energy, but for basic manufacturing globally.

Dividend

With depressed valuations, current yields are higher than ever. BHP has a payout ratio above its 5-year average, but only pays out about 55% of operating cash flow (TTM common & preferred dividends of $17.9 billion versus cash from operations of $32.2 billion). For this reason, I think that the fear about a dividend cut is overstated. While it might still happen, the company has more than enough operating cash flow to fund operations, a dividend, and future growth.

The company has been consistently paying down debt for longer than five years, with the total debt level at its lowest level in nearly ten years.

|

Dividend Safety Metric |

BHP |

Sector |

BHP 5-year Average |

% Difference to 5-year Average |

|

Cash Dividend Payout Ratio (TTM) |

68.49% |

45.56% |

57.18% |

19.79% |

|

Interest Coverage (TTM) |

66.28 |

12.13 |

29.62 |

123.79% |

|

Return on Common Equity (TTM) |

42.08% |

13.39% |

18.70% |

125.08% |

|

Total Debt/Capital (TTM) |

27.23% |

32.97% |

31.51% |

-13.58% |

Catalysts

Materials stocks have been brought down by the broader market. There are real concerns about inflation, rising interest rates, and slowing growth/future inflation. Generally, these conditions would create significant headwinds for materials, but I believe that most of these conditions will be short-term and will give way to long-term tail winds of secular growth including from continued investment in renewable power sources and electric vehicles.

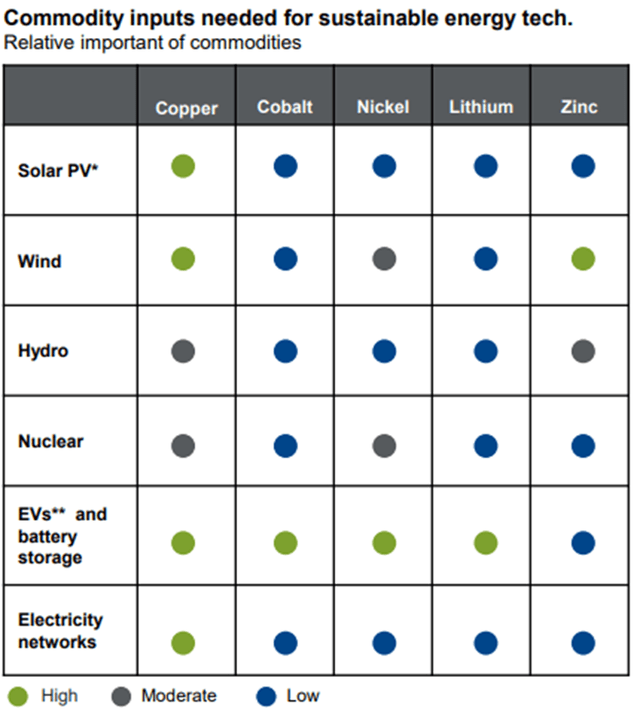

BHP produces all of the raw materials required for renewable electricity generation, power storage, and EVs. Furthermore, its agricultural products, including potash will rise in importance to improve efficiencies in feeding the growing global population.

Commodities for Renewable Energy (JP Morgan)

Risks

While I think the current valuation and meaty dividend are attractive for patient long-term investors, BHP faces several risks. If the dollar continues to strengthen, that will compound the challenges for the company and erode realized returns for U.S.-based investors. If we do slip into a recession globally, and it ends up lasting longer or is deeper than expected, then that would challenge some of the demand growth forecasts for raw materials. Contributing to the lower-than-expected demand could also include a stall in the transition to renewable energy sources and electric vehicles in favor of addressing more immediate concerns of inflation, stagnant growth, and war. Of course, the war in Ukraine continues to provide an uncertain backdrop for the global economy, a factor that would impact all markets, not just BHP.

Final Thoughts

I look for value in any and all markets. Generally, I attempt to capture that value through a combination of broad-based ETFs and individual stocks, an enhanced indexing strategy. Historically, this approach has yielded favorable results, both financially and emotionally. The returns are sufficient and taking positions in individual companies helps to keep me more engaged and interested. I think that a position in BHP will compliment an already well-diversified portfolio of global stocks. The global footprint of the business and the importance of the resources it produces should be expected to result in future growth and profits that will drive the stock higher. I am a long-term investor, I believe that patience is one of the only advantages remaining for individual investors, and that is what I advocate. Always be diversified in low-cost, liquid, and transparent investments. Thank you for reading, and I look forward to seeing your comments below.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment