Douglas Rissing

Most news headlines concerning insider trading usually portray the activity in a negative light and ultimately lead to allegations suggesting some sort of fraud or other ill-doing. That being said, with respect to this article the act of insider trading is nothing more than an individual committing to purchasing or selling securities of the company at which they are an insider, and most of the trading done this way is perfectly legal.

Who is considered an insider? Federal law defines an insider as a company’s officers, directors, or someone in control of at least 10% of a company’s equity securities. Company employees with significant access to privileged information report their trades to the Securities and Exchange Commission by filing S-4 forms in a timely manner. In fact, we believe that insiders supply the market with high-quality investment information every time they decide to trade their own company’s shares in the open market. An investor that is better informed than their competition can generate higher returns, and in the end, the one who possesses the ultimate level of corporate-specific knowledge is none other than the corporate insider themself.

So the objective shifts towards identifying if investors can use corporate management’s legal insider trading in order to form a profitable investment strategy and attempt to deliver alpha over the overall market. Many books and academic works have been dedicated to this subject. One of the more popular ones is “Investment Intelligence from Insider Trading” by Nejat Seyhun, who is a Professor of Business Administration at the University of Michigan. Another comprehensive guide to the subject is “Profit from Legal Insider Trading” by Jonathan Moreland. There is also a study titled “Estimating the Returns to Insider Trading” published by Leslie A. Jeng and Richard Zeckhauser of Harvard. All of them share the basic idea that the people who have the most knowledge of the inner workings and future prospects of a company know best when and at what price to buy.

In today’s article, we bring you the latest update in our recurring series based on companies that enjoy major corporate insider interest during the third quarter of the year. Our second-quarter articles based on mid-cap companies can be accessed through this link.

What corporate insiders were buying

We analyzed thousands of S-4 filings to find companies that have experienced periods of unusually concentrated purchasing activity by their corporate insiders. We have attempted to place emphasis on companies that enjoyed buying across the board from multiple insiders, in quantities that were not recorded previously, often after a period of selloffs.

Today, we’ll discuss mid-cap stocks only, but we will follow up this series with additional articles covering both small-cap and large-cap data for the third quarter in a similar manner. For the purposes of this analysis, we defined mid-cap as having a market capitalization between $2 to $10 billion. This is our short list of research-worthy mid-cap companies that in our view enjoyed a period of unusual and atypical interest from corporate insiders during the third quarter:

Comstock Resources (CRK)

-

Active Corporate Insiders: 4

-

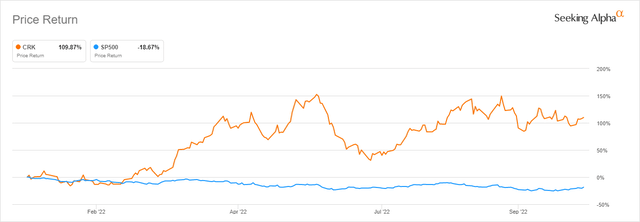

YTD Performance: 109.87%

- Total Bought Back: $3,123,853

Comstock Resources is a Frisco, Texas-based independent energy company that engages in the acquisition, exploration, and production of natural gas sites primarily located in the North Louisiana and East Texas regions of the United States. A boom in worldwide energy prices alongside the European energy security crisis opened the way for one of the best years for Comstock Resources in almost a decade. This has been the only company beating the market this year that actually made it to our list.

As mentioned previously, unlike the other companies on this list, Comstock has outperformed the S&P 500 (SPY) significantly and delivered a 109.87% year-to-date return. Even after having its share price doubled, thanks to the boom in the energy sector we have witnessed in the past year, CRK was selling for an NTM EV/EBITDA of 2.62x, NTM P/E of 3.52x, and an NTM P/FCF of 3.38x. Many on the other hand disagree with the valuation and were willing to bet against the prospects of CRK, which led to a short interest build-up of 19.87%. Seeking Alpha Authors are still very much positive about the prospects in the sector, and have assigned the company a “Buy” rating with an average score of 4.00/5.00. Wall Street Analysts are also bullish and have assigned the company a “Buy” rating as well, scoring it slightly lower at 3.90/5.00.

This has attracted significant interest during the third quarter from corporate insiders including the CEO Jay Allison, VPO Patrick McGough, and directors Morris Foster as well as Jim Turner. They bought back a total of $3.12 million worth of CRK shares at an estimated average price of $17.54. The company currently trades at $20.61 per share.

Comstock Resources vs S&P500 YTD Return (Seeking Alpha)

Kohl’s Corp. (KSS)

-

Active Corporate Insiders: 3

-

YTD Performance: -45.22%

- Total Bought Back: $1,146,791

Kohls Corp represents one of the three largest department store chains operating in the United States, with the other two being Macy’s (M) and Nordstrom (JWN). The Wisconsin-based company was founded all the way back in 1927 and grew to operate 1,162 retail locations across all states with the notable exception of Hawaii. Alongside many retailers, it encountered struggles during the past couple of years. The retailer even got into discussions about being sold earlier in the year, most notably with Franchise Group (FRG) which extended an offer to purchase it for $60 per share. However, the talks fell through amid a declining macroeconomic situation which ultimately saw the potential buyer lower their offer to $53 per share, which was in the end unacceptable for the management of the company. Even earlier in the year, the department store chain refused several offers, going as far as to implement the poison pill, claiming the offers were undervaluing the business. Kohls had a troublesome year in the markets and generated a negative year-to-date return of 38.56%, combined with a negative one-year return of 36.22%. Even after the significant decline in price, the valuation isn’t necessarily something to write home about. KSS is currently trading at an NTM EV/EBITDA of 6.79x, an NTM P/E of 9.71x, and an NTM MC/FCF of 14.52x. The retailer does offer a 5.81% dividend yield for the time being. Seeking Alpha Authors are somewhat positive about the general outlook and rate Kohl’s as a “Buy” with an average score of 3.85/5.00. Wall Street Analysts are less enthusiastic and have assigned the company a “Hold” rating with an average score of 3.17/5.00.

In the third quarter, shares of the Wisconsin-based company were purchased by Directors Peter Boneparth, Prising Jonas, and John Schlifske. Jointly, they bought back a total of $1.14 million worth of KSS shares at an average estimated price of $29.65. The company is currently selling for $26.39 per share.

Kohl’s vs S&P500 YTD Returns (Seeking Alpha)

The Macerich Co. (MAC)

-

Active Corporate Insiders: 6

-

YTD Performance: -36.97%

- Total Bought Back: $853,884

Macerich is the only company that found its way back to our shortlist from the second-quarter article we did a couple of months ago. Back then, corporate insiders cast their vote of confidence in MAC and bought back a total of $1.17 million at an average estimated price of $9.50. It would seem they have just kept buying ever since. The mall-oriented REIT was forced to endure multiple headwinds over the past couple of years but appears to be coming out on the other side with a stronger hand. However, shares of the REIT are still noticeably underperforming the market, as Macerich generated a negative year-to-date return of 36.97% and a negative one-year return of 38.18%. Seeking Alpha Authors have been long bullish on the prospects of Macerich, rating it as a “Strong Buy” with an average score of 4.50/5.00. Wall Street Analysts on the other hand have been much more cautious, assigning the REIT a “Hold” rating with an average score of 2.85/5.00. Still, the pure value proposition is very convincing. Macerich is currently selling at 5.29x FWD P/FFO while offering a 5.86% dividend yield.

In the third quarter, shares of MAC were bought by CEO Thomas O’Hern, EVP Kenneth Volk, CFO Scott Kingsmore, President Edward Coppola, Senior VP Doug Healey, and General Counsel Ann Menard. Altogether, they bought back another $850 thousand during the third quarter at an average estimated price of $8.24. MAC is currently selling for $11.83 per share, proving both purchases were well-timed.

Macerich Co vs S&P500 YTD Return (Seeking Alpha)

Elanco Animal Health (ELAN)

-

Active Corporate Insiders: 4

-

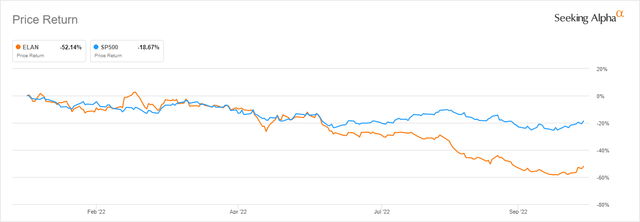

YTD Performance: -52.14%

- Total Bought Back: $987,840

Elanco Animal Health is an Indiana-based animal health company, involved in the development and manufacturing of a wide variety of products intended for pet and farm animals. The company sells its products to 3rd party distributors, veterinarians, and farm animal producers. For much of its life, Elanco was a subsidiary of the much better-known Eli Lilly and Company (LLY) but was spun off from the core business in an IPO back in 2018. It owns and operates brands such as Advantage, Seresto, Advocate, Galliprant, Rumensin, Claro, and others. Elanco hasn’t provided stellar returns for the past year. It generated a negative year-to-date return of 52.14% accompanied by a negative one-year return of 59.41%. ELAN is currently trading at an NTM EV/EBITDA of 10.48x, an NTM P/E of 12.22x, and an NTM MC/FCF of 7.27x. Both Seeking Alpha Authors on one end and Wall Street Analysts on the other remained unconvinced and have assigned the company a “Hold” rating with an average score of 3.38./5.00.

Active corporate insiders in the third quarter were President and CEO Jeffrey Simmons, and Chairman Rajeev Modi, alongside directors David Hoover and Paul Herendeen. Insiders bought back a total of about $990 thousand worth of Elanco shares for an average estimated price of $14.91. The company is currently selling at $13.41 per share.

Elanco Animal Health and S&P500 YTD Return (Seeking Alpha)

Douglas Emmett (DEI)

-

Active Corporate Insiders: 5

-

YTD Performance: -49.93%

- Total Bought Back: $8,761,416

Douglas Emmett is another real estate investment trust that found its way to the list for the third quarter. DEI is a fully integrated, self-administered, and self-managed REIT that mainly focuses on the coastal submarkets of LA and Honolulu, where they own and operate a portfolio of premium office and multi-family properties. Alongside the rest of the sector, DEI has been hammered in the markets for the past couple of quarters, and its exposure to office properties has not helped the REIT one bit. Douglas Emmet is significantly underperforming in the market, as it managed to generate a negative year-to-date return of 49.93% and a negative one-year return of 47.13%. The pullback in price led to a very interesting valuation, as the REIT is currently selling at an 8.42x FWD P/FFO, while at the same time offering an enticing 6.52% dividend yield. Seeking Alpha Authors remain very positive on DEI and have rated it a “Buy” with an average score of 4.00/5.00. Wall Street Analysts do not necessarily share the opinion, assigning Douglas Emmet a “Hold” rating with an average score of 3.4/5.00.

In the last quarter, shares of Douglas Emmet were purchased by CEO Jordan Kaplan and Directors William E. Simon, Shirley Wang, David Feinberg, and Leslie Bider. They bought back $8.76 million worth of DEI shares during the third quarter at an average estimated price of $20.08. The company is currently trading at $16.67 per share.

Douglas Emmett vs S&P500 YTD Returns (Seeking Alpha)

Final thoughts and conclusions

Many guides to fundamental analysis of companies suggest that reviewing corporate insiders’ sentiment remains an extraordinary resource at the disposal of the individual investor. However, instead of simply relying on insider trading data as a resource to add on top of an already mounting conviction during the process of researching a company, the average investor nowadays has the ability to turn the tables and instead utilize insider data as a starting point for research into potentially lucrative investment opportunities by relying on quant data. We stand firm by the belief that investors should remain open to the idea of utilizing alternative data during their due diligence process in order to level the playing field between themselves and the institutional investor.

Be the first to comment