RiverNorthPhotography/iStock Unreleased via Getty Images

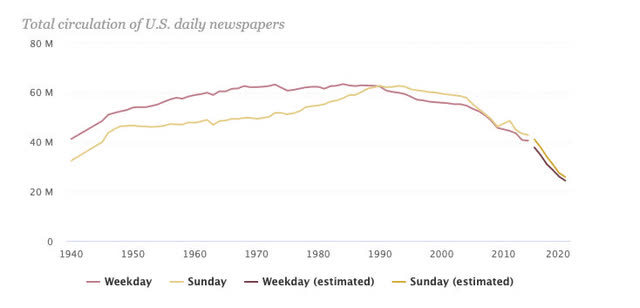

Lee (NASDAQ:LEE) is a newspaper business with 77 local media operations across the United States. At 2.5x 2021 Levered Cash Flow, the stock is unloved because the consensus is that the underlying business is a melting ice cube with a substantial amount of debt on its balance sheet. The issue is that the print newspaper continues to erode as the rapid dissemination of information on the internet has rendered print an inferior product.

Total Estimated Circulation of U.S. Daily Newspapers (pewresearch.org)

On the other hand, the company is undergoing a substantial transformation, converting subscriber and advertising revenue to digital. The bull investment thesis is simply that the market is overlooking this radical shift and is regarding it as a business that will evaporate within the next five to ten years. The thought is that the growth of higher-margin digital subscriber revenue will offset the legacy business decline, which will catapult its valuation through an increase in operating earnings, a paydown of nearly $500 million in debt with maturities over two decades away, and expansion on a low multiple of cash flow. With $106 million equity on a $532 million Enterprise Value, a slight change in the values of its asset can reward investors handsomely.

Unique Value Proposition of Local News

For decades, the local news businesses had virtual monopolies in their respective areas. If you were interested in what was happening in your area or the rest of the world, you would have to subscribe to a newspaper and have it delivered to your door or pick it up on your way to work at a newsstand. These organizations have had journalists with boots on the ground who have a unique position to report on regional news. This level of reporting has served a valuable role for local business owners, real estate investors, and your average joe looking to stay connected to their community.

Over time, competition and the economics of the business compelled newspapers to consolidate. Naturally, most people only wanted to read one newspaper. Cities eventually became one-newspaper towns. Ultimately, local newspaper media outlets have enjoyed a strong competitive advantage in their regions since they are often the singular source of news in the area. Lee believes this unique value proposition will persist in this new digital era, emerging as a more robust, asset-light business.

Lee Investment Thesis (September 2022 Investor Presentation)

While I don’t think it’s impossible for management to transform the business into a profitable digital enterprise successfully, I am skeptical that it will and believe investors should stay away.

There are four reasons for this:

- Deteriorating Competitive Advantage

- Lack of Pricing Power

- Legacy Industry Operators Leaving

- Leadership Concerns

Deteriorating Competitive Advantage Neutralizes Benefits Gained in Digital Transformation

In 2022, there is an abundance of options for news and information, such as Facebook (META), Twitter, Reddit, and NextDoor. While it goes without saying, there were fewer options for entertainment pre-internet era. Reading the newspaper was an essential staple to many households. Today, the overwhelming amount of news and entertainment alternatives has made local news media relatively less valuable, especially to the younger generation.

This secular shift to online news consumption has come at the expense of demand in the newspaper industry. For example, the number of newspaper journalists declined from 71k to 31k in 2020. Average units for Lee’s largest newspaper, the St. Louis Post-Dispatch, fell from 278k daily subscribers (population of 320k) in 2005 to 127k in 2021 (population of 293k). Lastly, consumer engagement on local news sites is trending down.

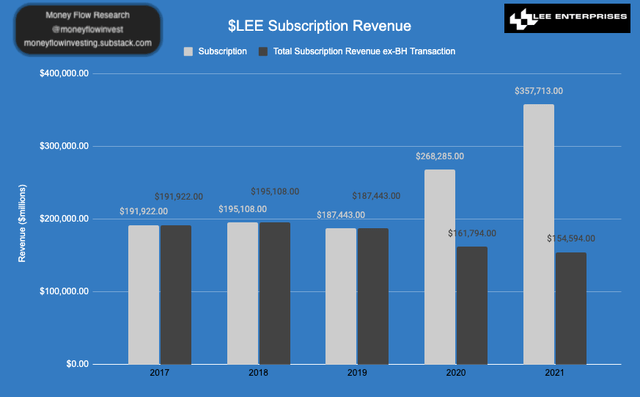

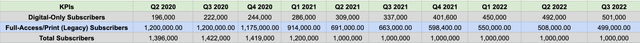

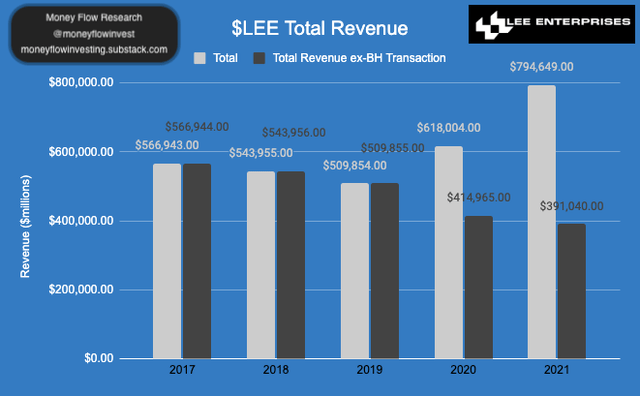

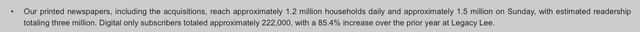

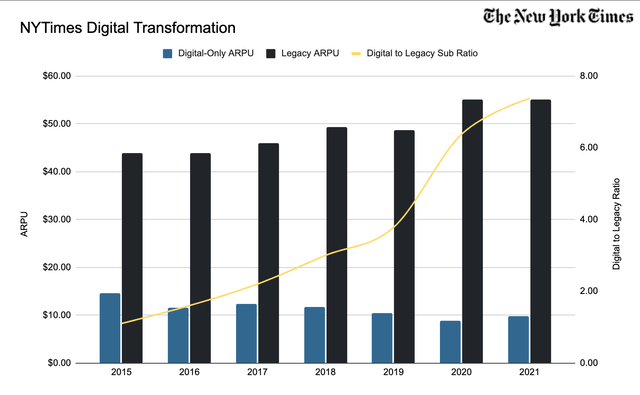

Despite this industry decline, the business has experienced growth. Digital-only subscribers expanded at a terrific 85% CAGR clip, growing from 79k in 2019 Q3 to 501k in 2022 Q3. Revenues jumped from $509 million in 2019 to $794 million in FY 2021. Subscription revenues nearly doubled from $187 million to $357 million, and the total subscriber count grew by 30%.

However, these seemingly great numbers do not reveal the entire story. The company purchased 30 daily newspapers and digital operations, including the Buffalo News, from Warren Buffett’s Berkshire Hathaway for $140 million in cash in Q2 2020. When you remove the BH acquisition from the equation, it is clear that the business continues to decline. For the time being, management can hide the descent through growth by acquisition. After backing out BH Media numbers, subscription revenue decreased from $191 million to $154 million.

Subscription Revenue (SEC Filings)

Quarterly Subscriber Breakdown (SEC Filings)

Similarly, overall revenue (ex-BH Media) has dropped $171 million to $391 million in the same time frame. In their communication to investors, the executive leadership has omitted the important detail that the total subscriber count has decreased since the BH Media transaction closed in 2020 from 1.4 million (1.2 million print circulation + 200k digital only) to ~1 million by Q2 2021.

Total Revenue (SEC Filings)

Advertising & Marketing is another main revenue stream for Lee, representing 47% of total revenue. It has suffered an even worse fate than subscription revenues, growing only 11.44% and dropping 40% when you remove the effect of the merger since 2017.

The company has so far succeeded in expanding its digital marketing revenue, growing 39% since 2019. Much of this growth is primarily through its full-service digital agency, Amplified. The future success of this segment is predicated upon circulation counts not dropping significantly and management’s execution of building a competitive ad-targeting product for advertisers. Advertising revenue is a function of the number of eyeballs the platform attracts. Therefore, advertising revenues will not bode well if organic subscriber counts continue to drop.

Management Concerns

If the business does have any chance to turn the ship around, it will require a strong management team to get it done. There are several red flags that are legitimate reasons for concern.

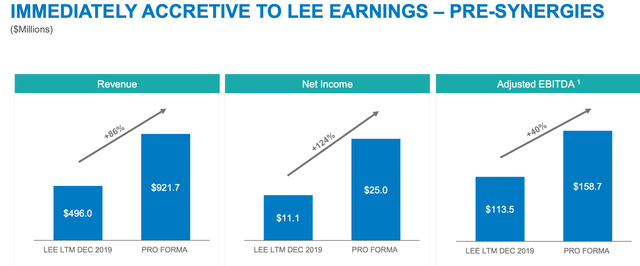

Management Synergy Growth Projections (2020 Investor Presentation)

First, in the 2020 annual meeting slide deck, management touted $921 million in sales and $178.7 million ($158.7 + $20 in synergies) adjusted EBITDA. The company did not come close to meetings its original projections. In the trailing twelve months, the business has delivered only $781 million (-15%) and $91.7 (-49%) million for sales and adjusted EBITDA, respectively. While the February 2020 presentation was given a month before COVID lockdowns, it is conceivable that some of the digital transformation growth was pulled forward by the pandemic. If management is unable to deliver in meeting financial projections from just a couple of years ago, it gives me reservations that it can fulfill its long-term profitability promises.

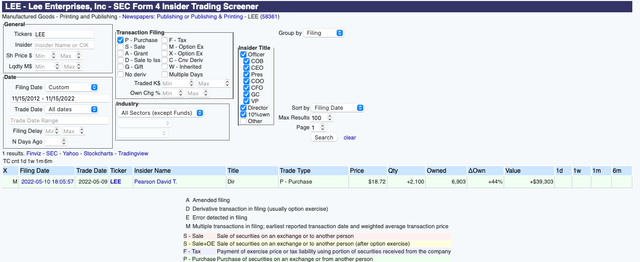

The second cause for concern is the lack of skin in the game.

Management is simply not putting their money where their mouth is. Over the past ten years, only one insider purchased shares on the open market. Other than that, the executive team received stock via SBC grants.

Lee Insider Open Market Purchases (openinsider.com)

Alden Capital, who attempted a failed hostile takeover of the business in early 2022, pointed out this misalignment of interests.

Lastly, management has not transparently explained the overall subscriber declines to investors. The subscriber count is a crucial KPI for the future success of the business. Thus, I would expect the executives to shed some light on it. For instance, there is inconsistent language in the financial reports. Until the Q1 2021 quarterly report, the company’s “Executive Overview” section reported total print subscribers and showed total Digital-Only subscribers separately.

Lee Q3 2020 10Q Executive Overview Section (SEC Filings)

Then suddenly, the wording changed in Q1 2021 to include both print and digital.

Lee Q1 2021 10Q Executive Overview Section (SEC Filings)

If you do not read the sentence carefully, you may think the subscriber count remained flat at 1.2 million instead of dipping by ~200 million.

Lack of Pricing Power

Lee’s transformation story relies on converting its legacy subscribers to digital and quickly growing those subs. The thesis is that the higher gross margin digital-only revenue will grow fast enough to cover the fixed costs of the legacy business in the short term and increase profitability in the long term as those costs eventually become eliminated.

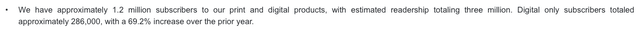

Lee ARPU (SEC Filings)

To maintain positive free cash flow, however, it will have to boost digital ARPU substantially and keep the pace in growing legacy ARPUs to compensate for unit declines. While reducing legacy subscriptions is core to the transformation story, it is tough to see those revenues fade, considering print ARPUs are ~3.6x digital. Investors should see that a contraction in legacy subs comes with a simultaneous reduction in associated expenses. Unfortunately for Lee, fixed costs are still growing as a % of revenue. For instance, other operating expenses were 35% of sales in 2017 compared to 43% in 2021. Legacy costs will remain a line item on the P/L while print subscribers still exist. The executive leadership must demonstrate that it can intelligently manage fixed costs as print operating leverage unwinds to offset the lost revenue. In my view, there is likely not much room for a significant increase in digital subscription ARPU since the product is competing with a near-infinite amount of substitutions for news and entertainment. The one saving grace could be digital advertising revenue, which would have to grow substantially to compensate.

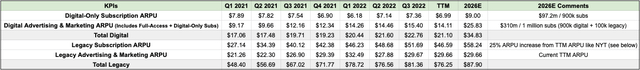

Lee is projecting 900k subscribers by 2026. Assuming that prices remain at current levels, ARPU could theoretically increase to ~$9 as introductory pricing (~$5.08 for introductory vs $10.88) becomes a smaller part of the mix. In this case, Lee will have $97.2 million in Digital-Only Revenue. This assumes two things. The first is that the 2026 target is realistic. While the CAGR for the digital-only subscriber growth rate is incredible, it should slow down. There is a percentage of readers who are stubbornly holding on to the print edition. In other words, many who wanted to convert have probably already done so. Management not hitting its most recent financial targets does not instill much confidence in its long-term execution. Secondly, this assumes that ARPU will grow or at least not decline. This is not guaranteed. For example, NYTimes was in a similar stage of digital transformation in 2015, with close to a 50/50 split for legacy and digital-only subs.

NYTimes Digital Transformation KPIs (SEC Filings)

Since then, ARPU has dropped from $14.62 to $9.80, more than offset by digital-only growth of more than 5x and total subscribers by 3.6x. I wouldn’t expect a similar sub-growth story. The NYTimes has more brand power from its global household name and a long history of delivering a breadth of valuable content to its readers. More importantly, the newspaper has a larger population pool due to its global focus. On the other hand, Lee’s focus on hyper-local newspapers means that its subscriber growth aspirations are limited to its specific markets, while the downward pressure on ARPU remains. Its customers’ price sensitivity means the business will have a tough time raising subscription prices without risking material churn.

Unappealing to Longtime Legacy Operators

Longtime operators of legacy newspaper businesses are either closing or selling out. According to Forbes, roughly 50% of all newspapers have changed ownership in the last 15 years. This trend makes sense, considering that the reality of the dwindling economics of the industry is forcing operators to consolidate to build economies of scale.

The obvious example here is Buffett selling his entire newspaper operation to Lee. In the 2012 Berkshire Hathaway shareholder letter, Warren indicated he was a willing buyer of newspapers and thought the economics made sense at the right price.

Eight years later, Buffett thought it was not in Berkshire’s best interest to hold onto the local news empire he had amassed over a few decades. Perhaps he felt that no juice was left to be squeezed.

Other recent examples include Alden Capital’s acquisition of Tribune Publishing and CherryRoad Media’s agreement to buy 20 newspapers from Gannett (GCI).

Financials

Secular Profitability Decline

The rationale of the BH deal ultimately makes sense considering the business needs to scale to improve profitability. If the company can maintain or grow its subscription base and convert them to digital, the incremental gross profit spread across a leaner asset base could pay off nicely.

Unfortunately for Lee, operating profit margins are declining quickly despite this acquisition and management’s best efforts to turn around the ship. Both free cash flow and operating income are dropping while sales increase.

Lee’s Profitability since 2016 (SEC Filings)

Even with the benefits of the larger scale, the long-term trend of lower profitability is intact. Except for 2021, the first full year of BH media revenue, both Return on Tangible Capital and operating margin continue their descent.

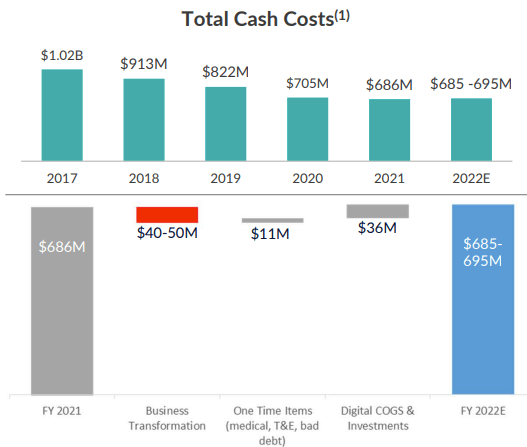

Cash Costs Waterfall Chart (2022 Investor Presentation)

A primary reason for this deterioration is the company’s inability to stop the rapid secular decline in print subscriptions while insufficiently cutting costs. Although the company has remarkably grown digital-only subs, total subscription counts have dropped 28% since the acquisition. Additionally, cash cost reductions are mitigated by digital investments.

Looking Ahead Until 2026

The main question is whether Lee can consistently generate enough operating earnings to cover the hefty ~$40 million in interest and pay down debt. In my view, there is a good chance that free cash flow suffers under conservatively optimistic assumptions, including management’s own 2026 targets. The business not hitting these targets would further exacerbate the situation.

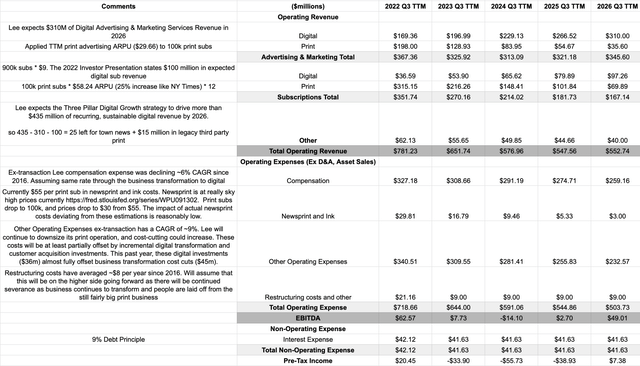

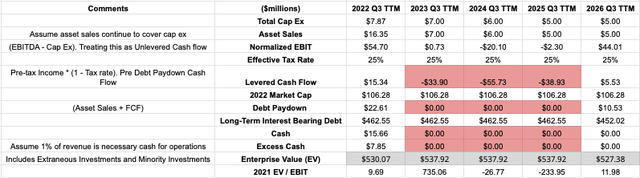

Earnings Model Based on Management Projections (Author/SEC Documents)

Conservatively, I estimate that total subs will stay flat at 1 million. Lee predicts 900k digital subs in 2026, which means 100k legacy. As mentioned, the company could reach $97.2 million in digital subscriber revenue (management expects $100 million). With a 25% increase in print ARPU, print sales will drop to $70 million.

On the advertising end, Lee projected $310 million of digital advertising revenue. Print advertising revenue will drop significantly to $36 million, assuming print ARPU remains constant.

Management should have plenty of room to cut expenses. For example, the $29 million in newsprint and ink should decrease rapidly due to declining print deliveries and record newsprint and pulp prices reverting to the mean. There is much more to gain from Compensation and Other Operating Expenses reductions. According to the 2022 Investor Presentation, there are roughly $300 million in direct costs associated with legacy revenue business. I have projected a decrease of $176 million until 2026. Since incremental digital investments should partly offset the legacy reductions, I believe I have more than adequately accounted for the expense side of the transformation.

Lee’s Projected Financial Picture Until 2026 (Author)

The projected reduction in EBIT from $54 million to -$20 million is a recipe for trouble. Unless Lee can maintain positive free cash flow, it may rely heavily on asset sales to stay afloat. However, these asset sales can only minimally offset cash burn and could cause issues with debt servicing.

Silver Linings

Although I am not particularly optimistic about the stock’s upside, there are a few positive items.

First, Lee’s fixed-rate debt does not mature until 2045. Thus, it has plenty of time to figure things out unless it starts burning cash and is unable to pay interest. Secondly, the firm has a book value of $228 million in equipment and $106 million in real estate on the balance sheet. The business seeks further opportunities to generate cash from non-core asset sales. It has already generated $23.3 million of proceeds over the past two years and targets $5-15 million in additional proceeds by the end of FY 2022. Management should be able to monetize a considerable portion of its real estate and equipment. What it is able to sell largely depends on the speed of the digital transformation. Also, since its equipment is fairly specific to printing operations, management may find it difficult to sell it without a large discount to book value.

Additionally, there are two pieces of legislation on the table that may provide Lee with a cash windfall if they are signed into law.

First, the bipartisan Journalism Competition and Preservation Act (JCPA) permits news organizations to bypass anti-trust laws and negotiate collectively. The bill vastly improves Lee’s bargaining power to attain better revenue-sharing terms with tech giants who currently distribute news content without adequate compensation. For example, Google (GOOG) (GOOGL) is expected to launch Google News Showcase, a product that will enable publishers to curate articles for readers. Lee’s rival, Gannett, reportedly counter-offered $300 million annually after rejecting a $6 million multi-year deal proposal from the tech giant. The two sides have yet to reach an agreement. If the JCPA becomes law, it will become more likely for local news companies like Lee and Gannett to reach favorably lucrative deals valued in the tens or hundreds of millions of dollars with big tech distributors. The stock would explode if Lee managed to negotiate a compensation package in the ballpark of what Gannett counter-offered.

Another bill is the Local Journalism Sustainability Act, which could result in Lee’s income increasing by millions of dollars. The bill has a provision for a five-year tax credit for each employed eligible journalist for up to $25k in year one and $15k annually in the next four years. It also has tax incentives for taxpayers to buy newspaper subscriptions and businesses to spend advertising dollars with local news businesses.

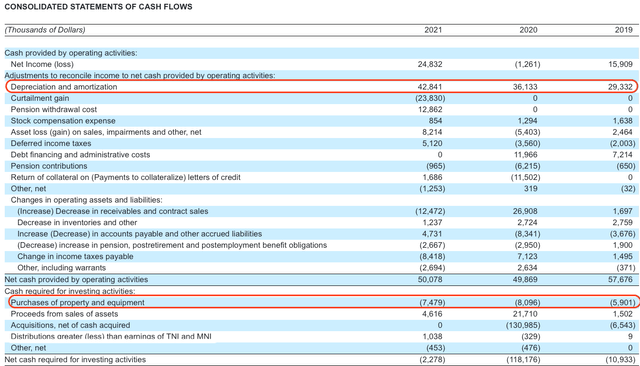

2021 Statement of Cash Flows (SEC Filings)

Lastly, the overall digital transformation also means that there will continue to be a positive cash flow spread tailwind for the foreseeable future between depreciation and capital expenditures due to the gradual liquidation of its newsprint manufacturing assets.

Conclusion

Lee’s management is emphatic that the business’s digital transformation will produce tremendous shareholder value and cause the stock to skyrocket. While this strategy has offset a rapid decline, the company may have trouble servicing its debt due to a worsening cash flow situation. On the surface, the stock is inexpensive. However, I believe it is cheap for a good reason. Investors should be skeptical of the turnaround story.

Be the first to comment