Kar-Tr

Digital Turbine, Inc. (NASDAQ:APPS) was one of those stocks that was on everybody’s radar in 2020 and early 2021, as clearly visible by the stock performance: from January 2020 until the peak of the bubble for growth stocks in February 2021, APPS appreciated over 1,000%. Nevertheless, that didn’t last long and the stock now sits around 80% down from the all-time high. What is interesting about Digital Turbine is that its stock was not the only one having a crazy year: the company itself was literally revolutionized in the past year or so thanks to the three acquisitions of AdColony, Appreciate, and Fyber. A lot is going on, meanwhile, the stock trades at a very reasonable valuation on the surface; is that an opportunity? It honestly could be, but not for me, as it does not suit my risk-reward profile. Let’s dive deeper on what is the story with APPS.

Second quarter 2023 results

APPS released its second quarter 2023 results on November 9 and the market reaction to it was euphoric. The stock shot up more than 60% in one day while also raising some more in the following days, reaching a high of $19.71. From there the stock retreated some, which is perfectly understandable as many people took the chance of some quick profit and exited their position. Nevertheless, the stock is still up more than 50% since before releasing the earnings report. Were the quarterly results that good?

The headline numbers looked actually quite mixed as Revenue was down 7.3% from the same quarter a year ago to $174.8 million. Non-GAAP Gross Margin was actually quite good, coming in at a record 52%. The main surprise was on the bottom line, as the company reported a record Non-GAAP adjusted EBITDA margin of 28% and positive GAAP Net Income of $11.7 million.

The main headwind for revenue came from the On Device Media (ODM) business, which suffered a steep 16.2% decline YoY. The primary culprit was the Content Media segment, caused by a decrease in Daily Active Users (“DAUs”) of prepaid phones. Management however provided some color on how the segment was impacted by a strategic shift in priorities as well:

We are reorienting our headcount towards future versus legacy products. And specifically, we’re migrating portions of our legacy performance and reseller ad tech businesses, towards more focus on growing things like the brand business and improving performance on leveraging SingleTap on our demand side platform or DSP.

This is having a short-term headwind on pro forma overall top-line performance, but the changes should continue to help both our margin profile and sharpen our focus by doing fewer things better

I believe the strongly positive market reaction gives an insight into what investors in APPS were really looking for. Since management revolutionized the business and went into an acquisition spree during 2021, the idea was that by doing so the company was building a clear path toward profitability. By expanding Digital Turbine capabilities and entering new markets, the idea was that existing and new technologies could be leveraged across the board to create synergies between legacy businesses and acquired ones. Having posted positive GAAP net income and consistently generating healthy Free Cash Flow is an early indication that the company is on a good path while navigating an extremely difficult quarter as exemplified by negative revenue growth.

Digital Turbine Analyst Day Presentation

The reason why the company is experiencing terrible top-line performance is a testament to how quickly the advertising market is drying up. Not that it came as news to anybody: during the earnings season there has been a chorus of bad news in a plethora of reports, both from giants such as Alphabet (GOOG, GOOGL) and Meta (META), as well as smaller players such as Snapchat (SNAP) and PubMatic (PUBM). Despite the economic slowdown and the reduction in ad spending is here to stay for the moment, management highlighted some silver lining during the call:

Since the beginning of the first ad dollar spends hundreds of years ago, continuing to today and ultimately tomorrow, ad dollars have always followed where our eyeballs are, and today our eyeballs are on digital devices and we don’t see that changing. In fact, we see that growing. So while there are some modest decelerations in the short-term, as advertisers figure out how to best optimize their spends in an inflationary and slowing macroeconomic environment, the dollars are there and will be there over the mid and long term.

The good and the bad

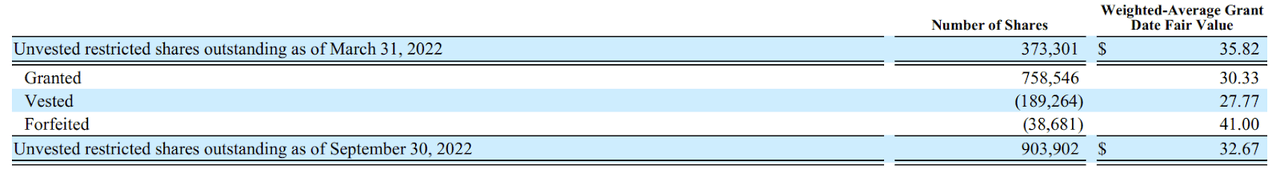

If there’s one thing APPS has demonstrated in this quarter is flexibility to operate more nimbly. Facing a difficult economic environment, the company kept expenses under control and managed to grow cash from operations substantially. Even Stock-Based Compensation (“SBC”) expense, usually the Achilles’ heel of tech companies, was somewhat under control: during the second quarter, SBC expenses came in at $5.8 million, marginally down YoY from $5.9 million. I am still, however, cautious on this front due to two reasons: first and foremost despite the drop in SBC, total shares outstanding grew YoY 2.45% which is still diluting shareholders. Additionally, the company has disclosed a big increase in unvested restricted stocks granted to employees and consultants in the last 6 months, as shown in the slide below. It seems to me this indicates that SBC will potentially be increasing in the future once again.

Stock-Based Compensation could rise again in the future (Digital Turbine 10-Q SEC Filing)

What I like the least about APPS is the balance sheet. The company has a very small cushion of $82.7 million of liquidity compared to $447.2 million of long-term debt, which was necessary to complete the numerous acquisitions during 2021. Management has expressed confidence in APPS’ ability to meet its financial obligations, which is also corroborated by the numbers: in the most recent quarter, for example, management has used the FCF generated to repay $26 million of debt. Nevertheless, any hiccup in execution or even worsening of economic conditions could be very detrimental for a company with such a small cash position and is a risk that investors have to take into consideration. Cost of capital today is much higher than just a year ago, and APPS has disclosed that they already pay a steep 4.57% interest on the £447.2 million of debt on the balance sheet. If management is forced to raise more capital, it would be even more costly for sure.

Valuation and key takeaways

How to value a company like Digital Turbine? The reason why growth stocks in general are so volatile is because they are so difficult to value based on any model. The company is clearly not optimized for profitability yet, and is also experiencing an economic downturn in the advertising market. None of the traditional metrics appear too expensive considering a Price to Sales of just about 2 and Non-GAAP Price to Earnings of 10.26 as per Seeking Alpha data; in particular, TTM Price to FCF of around 14.1 appears very interesting considering that the company might be able to resume growth once the economic cycle turns. The problem is that nobody knows when that will be.

I am personally struggling with Digital Turbine, and for this reason, I am going to be on the sideline. I believe that the balance sheet adds too much risk in this environment and I much rather deploy my capital elsewhere; nevertheless, for investors that have still room in their portfolio for a speculative play, that could very well be Digital Turbine. On the surface, the company seems to be working towards the goal set with the triple acquisitions in 2021: expand margins by creating synergies between businesses and entering new markets. However, it cannot be stressed enough that this process is just at the beginning and a lot can go wrong.

Be the first to comment