JuSun

Picking individual stocks isn’t right for everybody. For one thing, it takes an active engagement with the market, which I happen to like, but it may not be right for everyone. Perhaps that’s why Warren Buffett wants his heirs to just put their inheritance in the S&P 500 Index (SPY).

While the S&P 500 may be a no-brainer choice for total returns over the long run, its current yield of just 1.6% simply isn’t going to cut it for most retirees and income investors. That’s because most investors have heard of the 4% rule to fund retirement expenses, and getting such a low yield will almost certainly require an individual to sell some of their principal to fulfill this requirement.

That’s where the SPDR Portfolio S&P 500 High Dividend ETF (NYSEARCA:SPYD) comes in, with its mix of high yield combined with broad diversification, all in companies that belong to the prestigious S&P 500 index. The recent dip in price has pushed the dividend yield back up to 4%, and I highlight why the ETF is a worthy candidate for income investors.

Why SPYD?

SPYD is an ETF that’s issued by State Street (STT) Global Advisors and seeks to track the performance of the S&P 500 High Dividend Index, which is comprised of 80 high dividend yielding companies. The vast majority of the portfolio is fully invested in stocks, with just 0.3% sitting in cash.

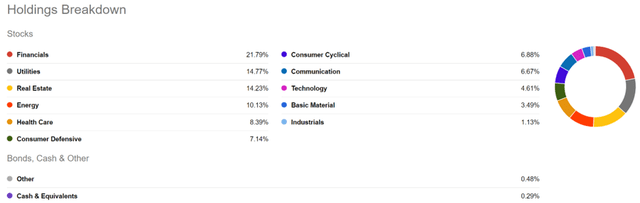

Unlike the tech-heavy S&P 500 index, with high exposure to either non-dividend paying or low dividend paying names such as Tesla (TSLA), Amazon (AMZN), and Microsoft (MSFT), SPYD is more concentrated on those sectors that are well known for capital returns to shareholders. This includes Financials, Utilities, REITS, and Energy, which as shown below, comprise well over half (61%) of SPYD’s holdings.

SPYD Sectors (Seeking Alpha)

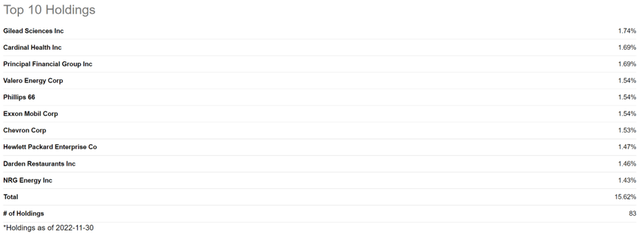

SPYD’s top 10 holdings are also comprised of a well-respected list of dividend payers, including Gilead Sciences (GILD), Cardinal Health (CAH), Exxon Mobil (XOM) and Darden Restaurants (DRI).

SPYD Top 10 Holdings (Seeking Alpha)

Don’t worry if you’re not particularly interested in these names. That’s because each of these names represent less than 2% of SPYD’s total holdings, and as you can imagine, the top 10 list is constantly changing depending on which stocks have seen price appreciation recently. For example, Cardinal Health made the list because it’s share price has materially risen in recent months due to the disclosure of a stake from activist investor, Elliot Management.

Risks to SPYD include the potential for a recession in the near term. However, many economists are predicting the next recession to be a mild one, if we get one at all. Moreover, financial institutions today are in far better shape than they were heading into the Great Recession of 2008 – 2009, since many of the Dodd-Frank rules were implemented. While higher interest rates may pressure the Real Estate sector, many of these concerns are largely priced into REITs, as this is now considered to be “old news”.

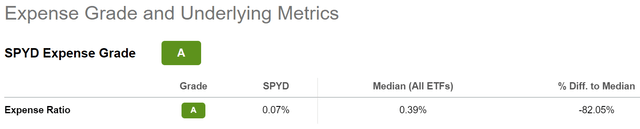

Meanwhile, SPYD maintains a low expense ratio of just 0.07%, sitting far below the 0.39 median for all ETFS. As shown below, SPYD scores an “A” Expense Grade.

SPYD Expense Grade (Seeking Alpha)

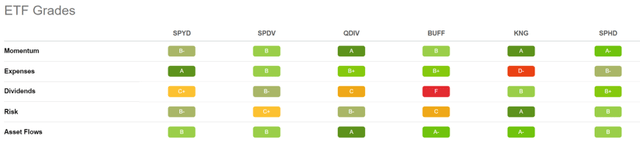

Moreover, recent price weakness has pushed SPYD’s dividend yield up to 4%, thereby helping investors to meet their 4% rule without having to dip into principal. SPYD stacks up well compared to its peers, score B grades for Risk and Asset flows.

SPYD ETF Grades (Seeking Alpha)

Investor Takeaway

For income investors looking to invest in the S&P 500, SPYD can be an attractive choice due to its high dividend yield and focus on those sectors that are known for capital returns. With a low expense ratio, strong performance scores, and a wide variety of holdings, this ETF is worthy of consideration. For those looking for a high-dividend yielding ETF to fulfill their 4% rule, SPYD appears to be a solid choice at the moment.

Be the first to comment