Beautifulblossom/iStock Editorial via Getty Images

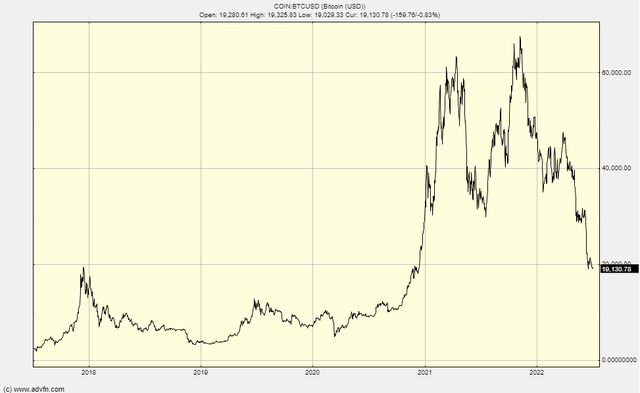

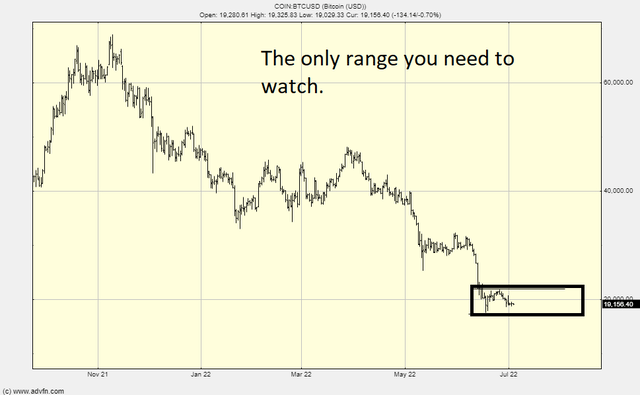

So, this is the current Bitcoin chart:

It is a chart I’ve predicted here on many occasions; this is the one from May, here on Seeking Alpha:

Not bad if I say so myself.

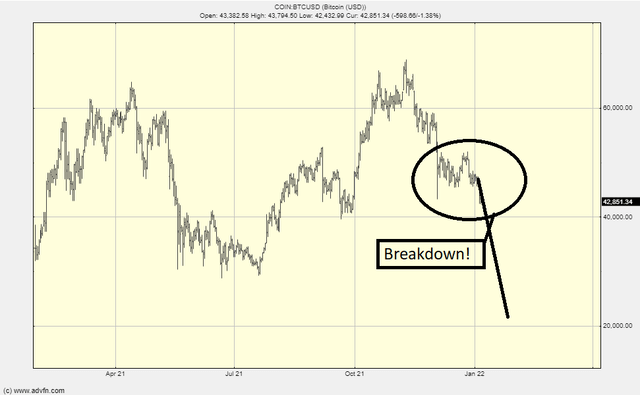

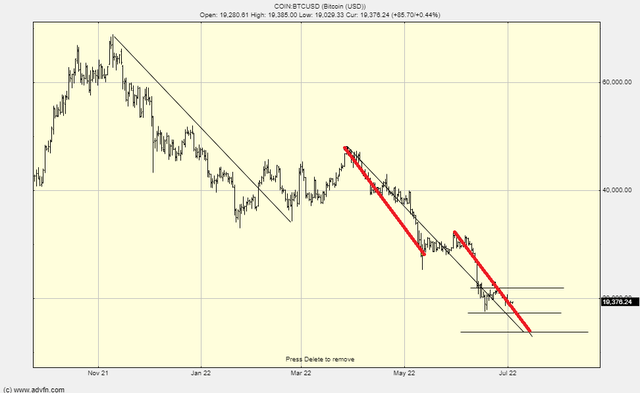

In January, I posted this:

ADVFN

I pointed to $20,000 as being a destination point. It took longer but here we are currently.

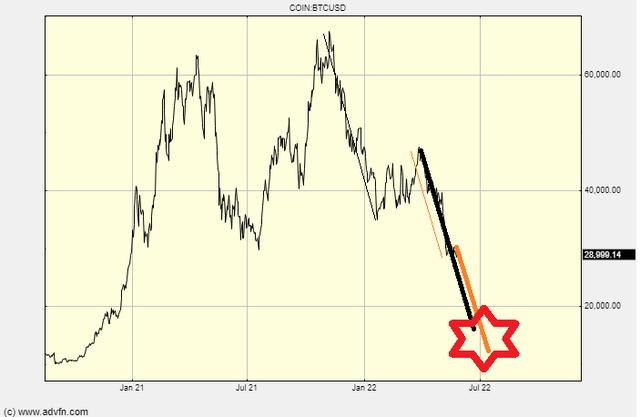

So, what now?

My favourite low projection is still $13000, or rather the ‘low’ being the level it sticks around after the crash hits its absolute bottom.

Here is why:

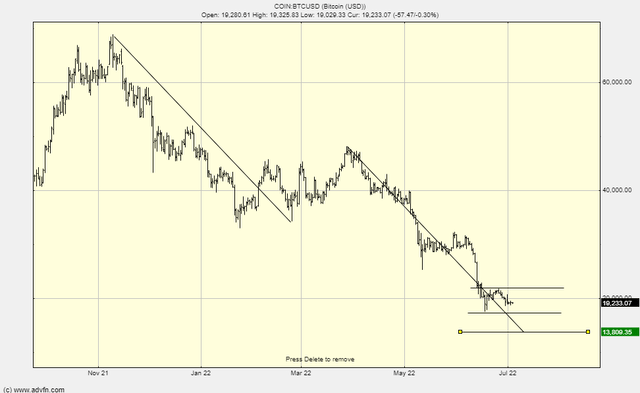

It could spike down a lot lower, but the critical signal is, if there is a breakout of this range shown below, it will move a long way in that direction:

It’s a tight range, so it will give a clear signal either way.

If it breaks down, we are off towards $10000. As a bear, I’m not too interested in a break upwards, though I have to say such a move would be a strong signal for a run to $30,000. However, it is not clear to me whether that would be a dead cat bounce or whether it would signal the bottom has passed. Consequently, it wouldn’t make me want to start buying back in. It will take a lot to break this bear trend and probably a long passage of time, so a break-up through the range is not definitive as a sign the bad news is behind us.

This is my road map and as per the previous prediction in January, the more time passes and/or the less tempo in the market, the more this model will decay.

That baseline is around $13-$14000, but the final capitulation can be far lower. I say that because most crashes end in a moment where the low is untradable; the ‘real low’ is where the bulk of the market can enter, and that is often a fair bit higher. You simply cannot expect to be there at that moment when the market pukes and for a few moments offers extremely low prices. Even if you are there, you may well find your platform broken and inaccessible. That goes for highs too, but I am sure many have suffered the problem of fast markets breaking the ability to get in or out. That will be the situation for the bottom of Bitcoin for sure.

If you are a Crypto-believer, now is not the time to fret. In three years, Bitcoin will be far higher. If you want to know when to buy, the answer is little and often once you feel it is safe. If you want to try and get to the very bottom, then good luck. However, for me, if this new range is broken, I will look to re-enter after that action has passed. That final leg should be followed by a period of sideways trading that will break the bear trend and that will be the sensible time to average in.

We will see the bottom this year and when we have passed it, there will be plenty of time to tiptoe back in. I thought I’d be buying in now, but with such a clear range to guide me, I am going to let the market tell me the direction it is going rather than guess it.

I think it is about to go the next leg down, but the first rule of speculation is to know that you should listen to the market because the market surely doesn’t listen to you.

Be the first to comment