Michael M. Santiago/Getty Images News

Investment Thesis

Bed Bath & Beyond (NASDAQ:BBBY) sold off on the back of its Q1 2022 results, and the stock had returned back to the Covid lows of sub-$5 per share.

The highly shorted stock continues to give naysayers plenty of ammunition after the company seriously mishandled its capital allocation.

Simply put, this is a flawed business model. And if there is any upside to be made from this stock, it will only come from the occasional short squeezes. There’s very little value here.

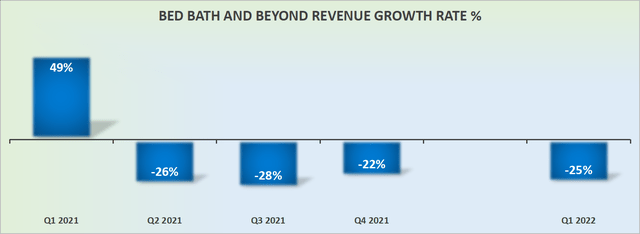

Revenue Growth Rates Remain Negative

Last week, BBBY reported yet another uninspiring set of results. The company reported negative 25% top-line revenues, and negative 23% comparable sales growth.

Meanwhile, BBBY contends that the second half of fiscal 2022 should see sequential comparable sales. If the business is expected to go from negative 25%, against what are super easy comps, and BBBY still expects to report somewhere around negative 10% to 15% comparable growth, this can only point to one thing. A very flawed business model.

And I believe that management probably knows this. Or I should say, management should know this. Nevertheless, this hasn’t stopped a lot of capital going up in flames.

Capital Allocation Fiasco

Over the past twelve months, BBBY repurchased more than $500 million worth of stock. Indeed, not only did BBBY repurchase $589 million during fiscal 2021, but it went on to repurchase a further $43 million worth of stock during fiscal Q1 2022.

As you can know, these repurchases amounted to precious capital that went out the door at a very wrong time. It’s not only that those shares were clearly not accretive to long-term shareholders, but more importantly, the capital that went out the door is more than the company’s total market cap.

This is clearly a less than optimal capital allocation strategy.

And now, to add insult to injury, recall that back in Q4 2021, it had a net cash position of $150 million. And more recently? BBBY’s latest results show a business with a net debt position of approximately $1.3 billion.

The business is now very much over-leveraged.

BBBY Stock Valuation: Difficult to Value

As noted in the section above, BBBY’s balance sheet carries approximately $1.3 billion of net debt. Think about this for a moment. Not only is its debt outstanding larger than BBBY’s market cap, I now struggle to see a path to unlocking shareholder value.

This time last year, when the stock was more expensive, I actually believed at the time that there was value in BBBY. You had a business model that was reporting breakeven cash flows and had a strong balance sheet with ample cash. Yes, I was wrong to have thought that. But alas, that’s what I thought.

Today, you are eyeing up a business that is rapidly burning through cash and has very little cash on its balance sheet.

The Bottom Line

Bed Bath & Beyond’s stock is roughly 30% shorted. That means that there are likely times when there are going to be short squeezes along the way.

But as I look through and consider the prospects of a business that is reporting negative comparable sales growth and gross margins that are 1,100 basis points worse off, I struggle to find much, if any, meaningful upside in this stock.

Next catalyst for the stock? BBBY has approximately $285 million worth of debt due 1 August 2024. At this moment in time, management will have to work very hard to get ahead of this debt stack.

Given that BBBY has no realistic manner to repay this outstanding debt at maturity, it will be fully at the mercy of creditors to refinance this debt.

Consequently, the question is not whether or not this debt will be paid off or rolled forward. It’s simply a question of what sort of coupon will the new notes carry? Anything at about 8% interest rates will be a clear indication to all stakeholders that this business is slowly being put to bed.

Be the first to comment