MF3d/E+ via Getty Images

Boredom is the root to curiosity.” – soulevian

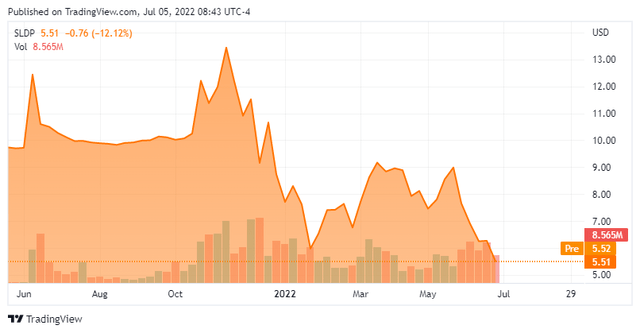

Today, we are taking our first look at Solid Power, Inc. (NASDAQ:SLDP). The company came public in 2021 and the stock of this electric vehicle component concern has quickly sunk into ‘Busted IPO’ territory. What lies ahead for the company and shareholders? We explore that question via the analysis below.

Company Overview:

Solid Power, Inc. is based just outside of Denver, CO. The company is focused on the development and commercialization of all-solid-state battery cells and solid electrolyte materials for the battery-powered electric vehicle market. The stock currently trades around $5.50 a share and sports an approximate market capitalization of $960 million.

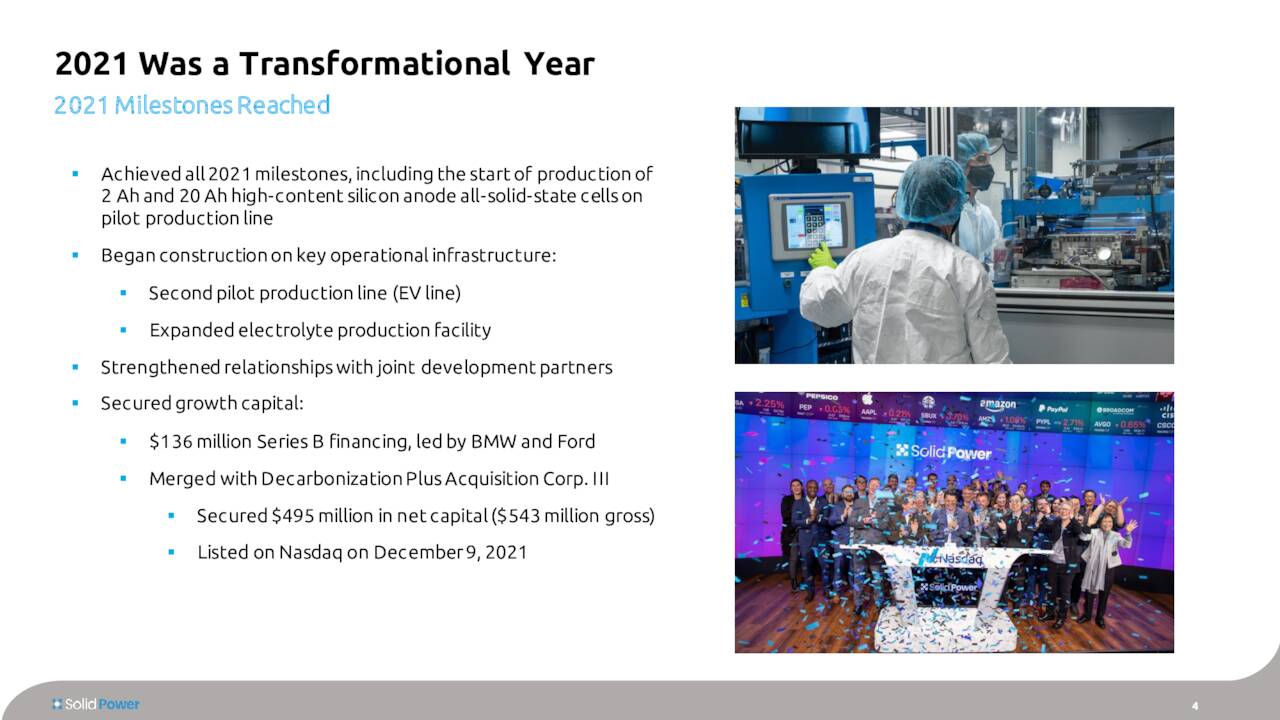

The company came public late in 2021 via a merger with a SPAC called Decarbonization Plus Acquisition Corp III (DCRC). Solid Power had some 44 million shares when it came public. In addition, it had ~18m warrants outstanding, which granted holders the option to buy a share of Solid Power for $11.50. These options carry a 5-year duration. Ford (F) and BMW (OTCPK:BMWYY) were among the OEMs that were original investors at the time of Solid Power’s debut on the market.

March Company Presentation

It is important to note that the company is in the early stages of its journey to a full-fledged manufacturing concern. It is still building out its facilities and can expect little in the way of revenues while it does so over the next couple of years.

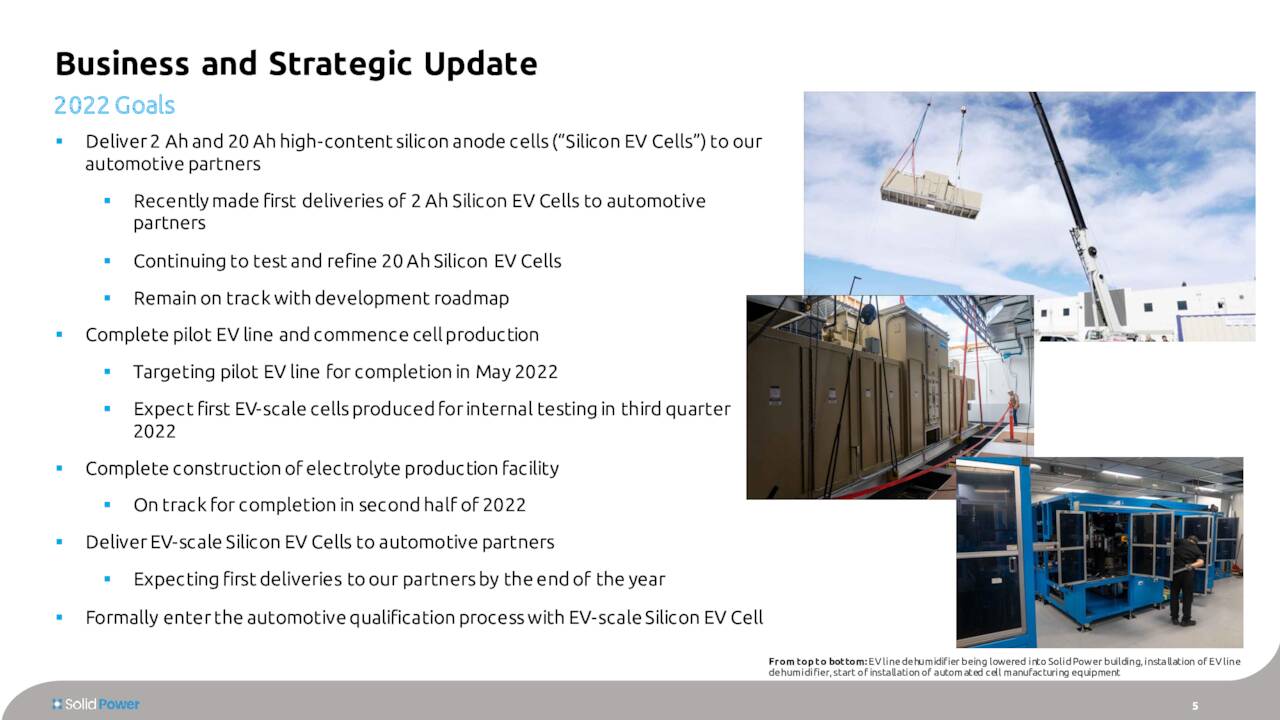

Last month, the company completed the installation of its pilot production line. This effort is meant to build EV scale cells in a high throughput manner that mimics today’s lithium-ion manufacturing. This facility is designed to produce EV-scale solid-state cells and when fully operational should be able to produce 300 large-format sulfide-based cells per week. The next step is to build and get these batteries for validation to partners Ford and BMW.

The company is also building an electrolyte production facility which is targeting completion by the end of 2022. This facility is projected to have the capacity to produce up to 2,500 kilograms of electrolytes per month. Currently, the company has 150 kilograms of capacity a month.

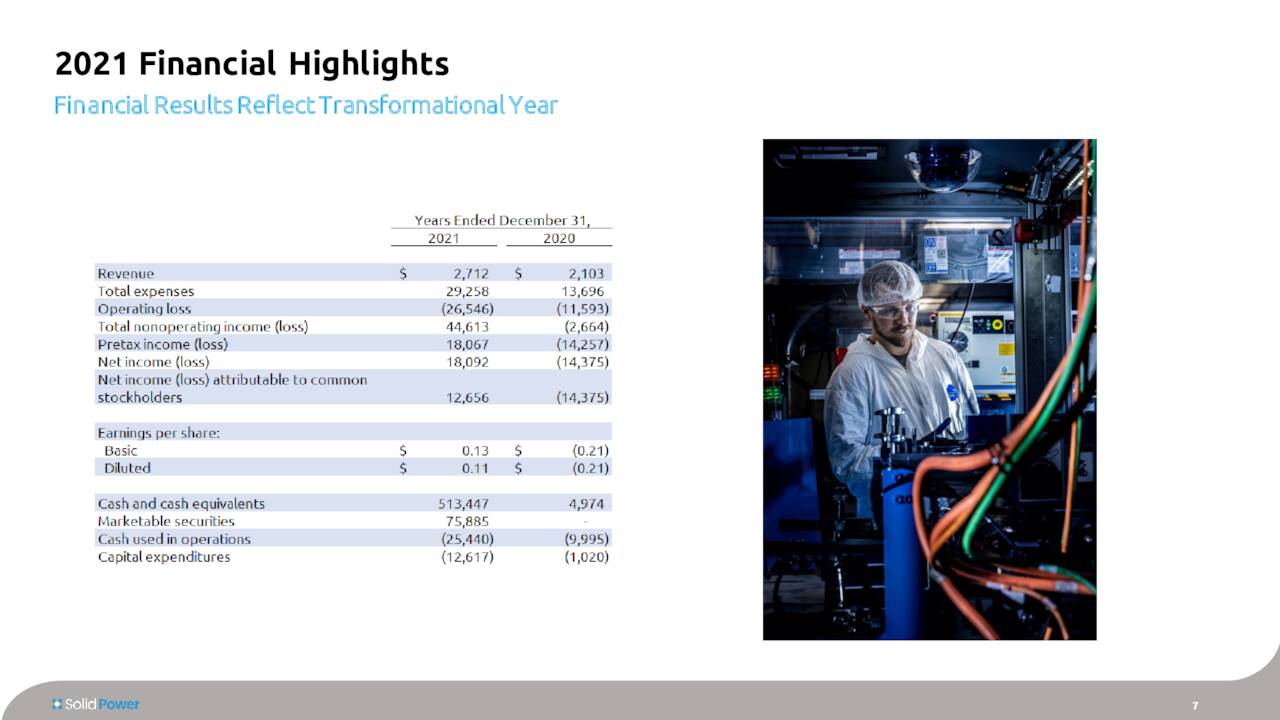

First Quarter Results:

The company posted first quarter numbers on May 10th. Solid Power had a net loss of $10.3 million. This is up from a net loss of $7.1 million in the same period a year ago. The larger loss can be mainly attributable to a ramp up in operational expenses as the company builds out its manufacturing capabilities. Revenues came in at just $2.2 million and management only expects $3 million to $5 million in overall revenues in FY2022.

Analyst Commentary & Balance Sheet:

The company gets sparse coverage from Wall Street. On May 11th, Needham maintained its Buy rating and $13.00 price target on the stock. Last week, Chardan Capital initiated the shares as a new Buy with an $8.00 price target. Those are the only analyst ratings I can find on the stock so far in 2022.

Just over four percent of the outstanding shares are currently held short. A beneficial owner sold just over $3 million worth of shares via several transactions last month. That has been the only insider activity in the shares since the company came public.

March Company Presentation

Solid Power ended the first quarter with just over $550 million worth of cash and marketable securities and no long-term debt on its balance sheet. The company provided the following cash usage guidance in its last earnings press release.

Solid Power estimates that in 2022, capital expenditures will range from $85 million to $95 million and cash used in operations will be between $65 million and $75 million. Total cash investment will range between $150 million and $170 million.”

Verdict:

The current analyst consensus has the company losing some 40 cents a share in FY2022 on just under $5 million of revenue. Similar results are expected in FY2023.

March Company Presentation

2022 will be a year the company continues to build its manufacturing facilities and perfects its core product line. The first deliveries of which to OEMs is expected late this year. The company’s balance sheet is in a good place and funding is in place to put Solid Power’s manufacturing footprint in place.

That said, it will be years before real revenues start to accrue. Given this, the stock of Solid Power is likely to move with the ebbs and flows around the EV space. Given the current dismal state of the overall market right now, I see no reason to own SLDP at the current time.

Some sentences take seconds to read, but take minutes, hours, days, weeks, months, or even years to understand.” – Mokokoma Mokhonoana

Be the first to comment