Sundry Photography/iStock Editorial via Getty Images

By Brian Nelson, CFA

It’s hard not to like Yum! Brands (NYSE:YUM). The company has three of the most recognizable restaurants with its KFC, Taco Bell and Pizza Hut franchises. Certainly the company’s franchisees face cutthroat competition in each of these verticals, but it’s not a stretch to say these restaurants are leaders in their respective categories (chicken, Mexican-style food, and pizza). Lacking a burger franchise, Yum! Brands recently expanded into chargrilled burgers with The Habit Burger Grill, and we like that it has gained exposure to the burgeoning made-to-order burger market as well.

Though we’re huge fans of the storied histories behind its three main restaurant brands, what we like most about Yum! Brands, particularly in a rising input and labor cost environment, is that roughly 98% of its restaurants are operated by franchisees or under license agreements. That means that, for the most part, its franchisees are its major customers as it passes a lot of the operating and inflationary risks to them, collecting franchise fees as it goes. KFC and Pizza Hut are 99% franchised, while Taco Bell is 94% franchised. Here’s how lucrative these franchise agreements are, as referenced in the firm’s latest 10-K:

Franchisees supply capital by purchasing or leasing the land, building, equipment, signs, seating, inventories and supplies and, over the longer term, by reinvesting in the business. In certain historical refranchising transactions the Company may have retained ownership of land and building and continues to lease them to the franchisee. Store-level franchise agreements typically require payment to the Company of certain upfront fees such as initial fees paid upon opening of a store, fees paid to renew the term of the franchise agreement and fees paid in the event the franchise agreement is transferred to another franchisee. Franchisees also pay monthly continuing fees based on a percentage of their restaurants’ sales (typically between 4% to 6%) and are required to spend a certain amount to advertise and promote the brand.

Almost all of the operating risk under such agreements is passed to the franchisee, including having to absorb rising food and labor costs. Yum! Brands sits back and collects a hefty percentage of restaurant sales, which may only be augmented as franchisees may be forced to raise prices as restaurant-level margins get squeezed. Nearly six years ago, Yum! Brands spun off its China business to Yum China Holdings (YUMC), and it collects a continuing fee of 3% of system sales on that business, too. It’s simply hard not to like the franchisee business model, and Yum! Brands has worked hard to optimize and de-risk its business by acting more like a toll-road operator collecting a portion of sales as opposed to taking on outsized operating risks. As one might be able to gather, we’re huge fans of Yum! Brands’ business model in these uncertain times.

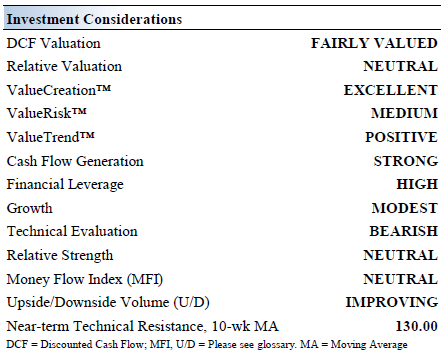

Yum! Brands’ Investment Considerations

Image source: Valuentum. The key investment considerations we look at when evaluating Yum! Brands.

Yum! Brands is the owner of KFC, Taco Bell, Pizza Hut, and The Habit Burger Grill. It is the world’s largest quick service restaurant company based on number of system units. Yum! Brands has a compelling portfolio, and management continues to invest around the world. The company was founded in 1997 and is headquartered in Louisville, Kentucky.

Yum! Brands is opening stores at an incredible rate, and the resurgence of Taco Bell in the U.S. (Cantina menu and breakfast initiatives) has been remarkable. The firm continues to bolster its digital operations and has had plenty of success on this front of late.

The reorganization of Yum! Brands’ operating performance was a precursor to the separation of its China division (completed in 2016). It had a franchise mix of ~98% as of the end of 2020 (was ~93% after the split in 2016), a move that should improve ROIC, as we explain later in this article. Its Taco Bell division was only ~94% franchised as of the end of 2020, offering room for additional upside.

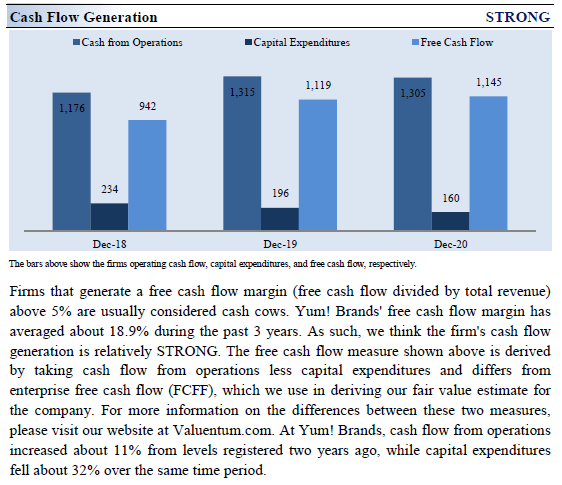

Yum! Brands is targeting a free-cash-flow conversion rate of 100%+ over the long-term, aided by its asset-light business model and relatively tame capital expenditure requirements. In March 2020, Yum! Brands acquired the firm behind The Habit Burger Grill concept for ~$0.4 billion in cash.

Yum! Brands’ capital allocation priorities are as follows: invest in the business with an eye towards digital and delivery operations, keep its leverage ratio contained, pay a competitive dividend, and return excess cash to shareholders via stock buybacks. At the time of this writing, Yum! Brands sports a dividend yield of ~2%.

We pay close attention to Yum! Brands’ operating results in China through its relationship with Yum China. As a bellwether for the health of the consumer in mainline China, Yum China is exposed to myriad risks, including largely unpredictable legal, geopolitical and regulatory trends as well as rising U.S.-China tensions in the wake of the Russia-Ukraine conflict. Though Yum! China may not be as exposed to such risks as some of the U.S. listed Chinese tech names and while Yum! Brands exposure is limited to its franchised relationship with Yum! China, investors should still be aware of this key risk.

Inflationary trends are hard to ignore these days, and rising food and labor costs will have implications on the profitability of Yum! Brands’ franchisees. Though such trends are ominous, under the assumption that franchisees may only be squeezed and not sent into bankruptcy, Yum! Brands may be a key beneficiary of rising cost structures within its franchised operations, as franchisees raise prices to increase sales, and therefore pay a larger absolute fee to Yum! Brands. Though counterintuitive, inflation may be a positive to Yum! Brands’ revenue and profit levels on a go-forward basis.

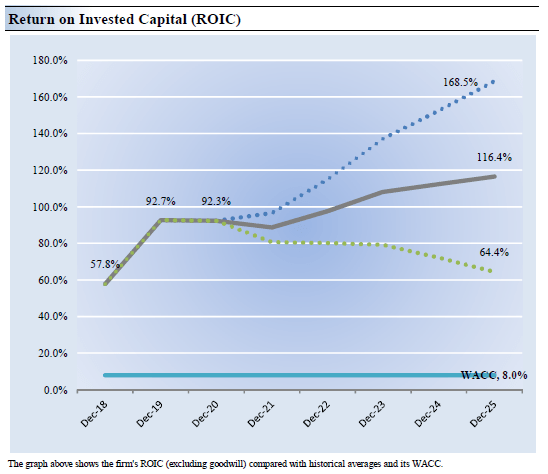

Yum! Brands’ Economic Profit Analysis

The best measure of a company’s ability to create value for shareholders is expressed by comparing its return on invested capital with its weighted average cost of capital. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. Yum! Brands’ 3-year historical return on invested capital (without goodwill) is 80.9%, which is above the estimate of its cost of capital of 8%.

As such, we assign Yum! Brands a ValueCreation rating of EXCELLENT. In the chart below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate. We expect Yum! Brands’ return on invested capital and its economic profit stream to widen in our base-case scenario due in part to reaping the benefits of its mostly-franchises business operations.

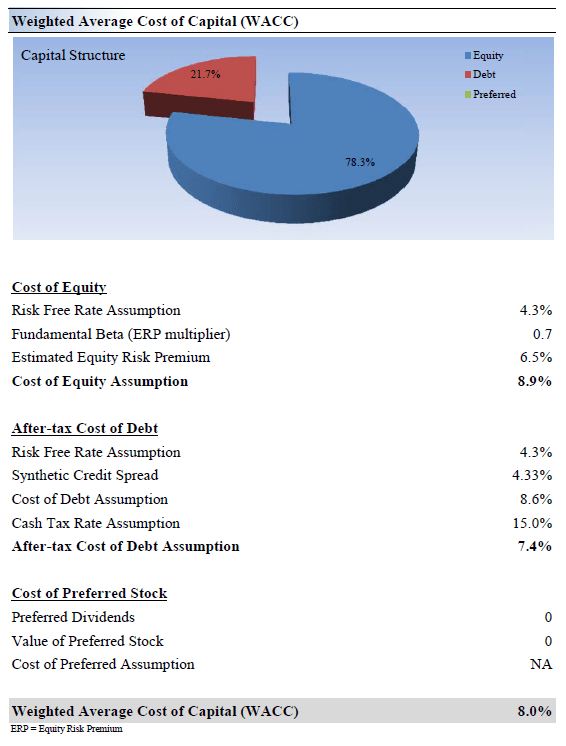

Image source: Valuentum. Our forecasts for Yum! Brands’ return on invested capital in coming years. Image source: Valuentum. How we derive Yum! Brands’ weighted average cost of capital.

Yum! Brands’ Cash Flow Valuation Analysis

Image source: Valuentum. Yum! Brands free cash flow generation is robust.

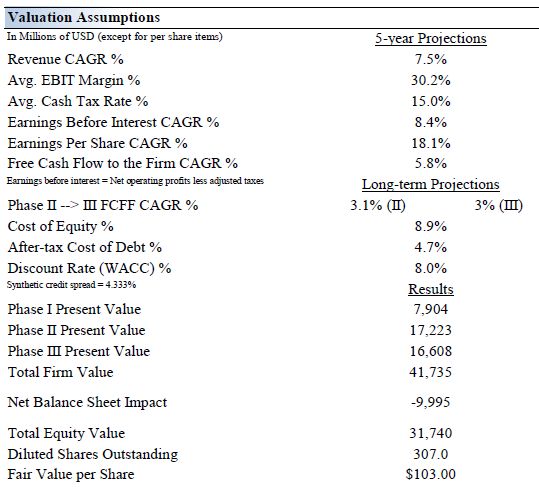

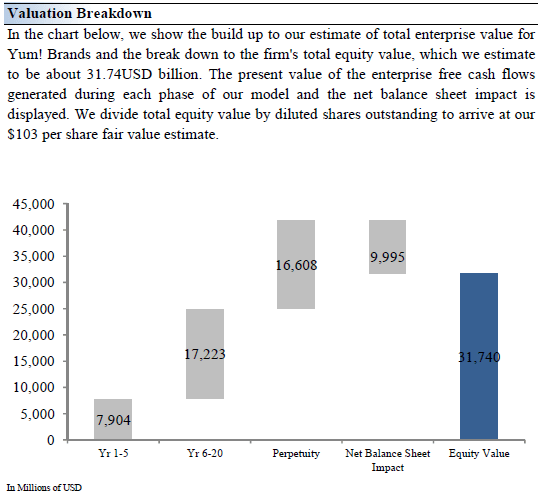

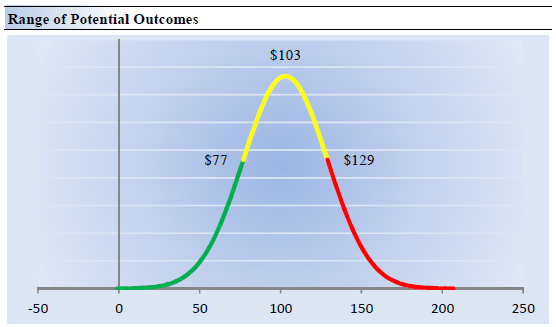

We think Yum! Brands is worth $103 per share with a fair value range of $77-$129. The margin of safety around our fair value estimate is driven by the firm’s MEDIUM ValueRisk rating, which is derived from an evaluation of the historical volatility of key valuation drivers and a future assessment of them.

Our near-term operating forecasts, including revenue and earnings, do not differ much from consensus estimates or management guidance. Our model reflects a compound annual revenue growth rate of 7.5% during the next five years, a pace that is higher than the firm’s 3-year historical compound annual growth rate of -1.3%.

Our valuation model reflects a 5-year projected average operating margin of 30.2%, which is below Yum! Brands’ trailing 3- year average. Beyond year 5, we assume free cash flow will grow at an annual rate of 3.1% for the next 15 years and 3% in perpetuity. For Yum! Brands, we use an 8% weighted average cost of capital to discount future free cash flows.

Image source: Valuentum. The key valuation assumptions that derive our fair value estimate of Yum! Brands. Image source: Valuentum. The duration of value composition for Yum! Brands.

Yum! Brands’ Margin of Safety Analysis

Image source: Valuentum. The fair value estimate range for Yum! Brands.

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows. Although we estimate Yum! Brands’ fair value at about $103 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

Our ValueRisk rating sets the margin of safety or the fair value range we assign to each stock. In the graph above, we show this probable range of fair values for Yum! Brands. We think the firm is attractive below $77 per share (the green line), but quite expensive above $129 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

Concluding Thoughts

Yum! Brands’ restaurant concept portfolio includes KFC, Pizza Hut, Taco Bell, and The Habit Burger Grill. Its ROIC and free cash flow generation should benefit from its pivot towards a franchise-heavy business model. At the end of 2020, ~98% of its restaurant locations were franchised. Yum! Brands aims to convert at least 100% of its net income to free cash flow moving forward, a goal supported its relatively modest capital expenditure requirements to maintain a certain level of revenues. Yum! Brands is focused on improving its digital and delivery operations while expanding its franchised store base, and we expect the firm will steadily grow its payout going forward.

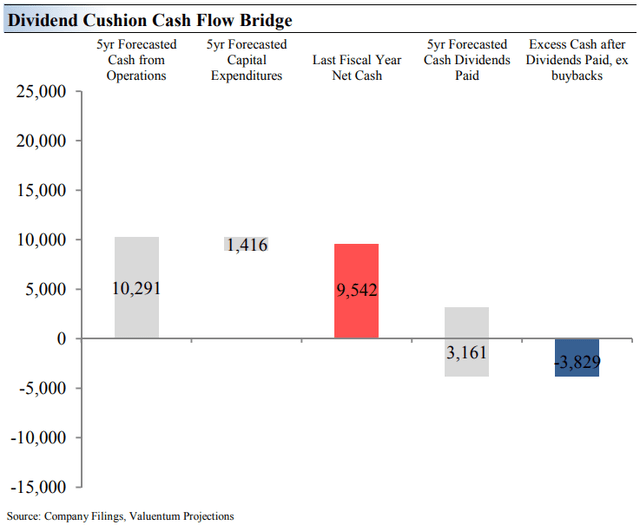

Image Source: Valuentum. The Dividend Cushion Cash Flow Bridge illustrates the components of the Dividend Cushion ratio and highlights in detail the many drivers behind it. Yum! Brands’ hefty net debt position weighs on its Dividend Cushion ratio, driving it into negative territory.

The separation of Yum! Brands’ China business has changed the economics of the entire franchise. KFC faces unprecedented competition from Chick-fil-A in the U.S., Pizza Hut continues to bump heads with Domino’s (DPZ) and Papa John’s (PZZA), and while Taco Bell has executed a fantastic turnaround, new concepts are brewing and trade-ups to fast-casual are a real threat. Yum! Brands acquired The Habit Burger Grill restaurant concept in March 2020 to revamp its portfolio and add lucrative exposure to the burger market. We’re most concerned about Yum! Brands’ net debt load, which weighs negatively on its Dividend Cushion (-0.2), though we note its free cash flows are impressive. Share buybacks will compete for capital against its dividend program going forward, but the company’s ~2% dividend yield may be hard to pass up if inflation counterintuitively turns into a tailwind for the firm through higher franchise fees.

Be the first to comment