JohnCarnemolla

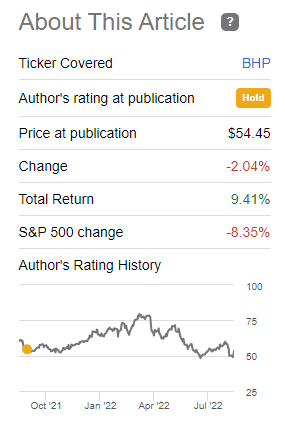

When we last covered BHP Group Limited (NYSE:NYSE:BHP), we rendered a Neutral Rating and suggested option plays offering returns as high as 14.85% would do better than going long the stock. While the stock laughed in the face of our conservative stance and ran up a lot, those options have actually outperformed the stock, even including dividends.

Returns Since The Last Article

The Company

One of the biggest and most prosperous businesses in the natural resources sector is BHP. The business mines copper, silver, zinc, molybdenum, uranium, gold, iron ore, and metallurgical and energy coal.

When we last covered it, it also was exploring for and developing oil and gas properties. This part has since been sold off. Copper, Iron Ore, and Coal are the three main segments under which it discloses its performance. Additionally, it has recently ventured into the potash industry. Australia, Europe, China, Japan, India, South Korea, North America, and South America are all places where BHP has activities. BHP also operates in smelting and refining in addition to mining.

Recent Results

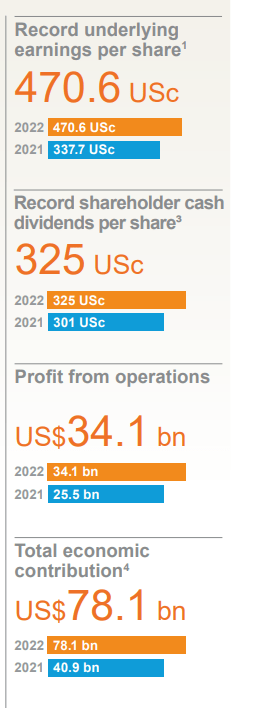

The recently released numbers were exceptional, and shareholders were rewarded with a massive dividend.

BHP Presentation

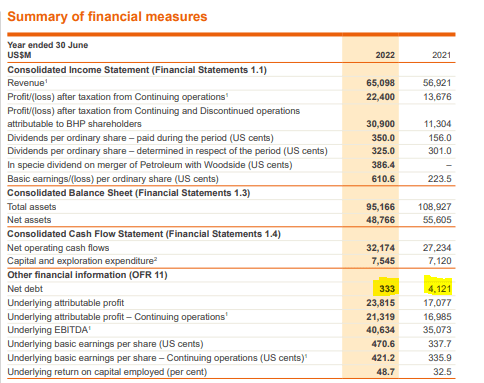

The company also reported a reduction in operational greenhouse gas emissions from adjusted FY2017 baseline. This exceeded their own internal five-year target and is currently on track to meet the goal of 30% reduction by FY2030 (from FY2020 levels). One final noteworthy point was that net debt was reduced to a rounding error for a company the size of BHP.

BHP Presentation

Segmental Review & Outlook

BHP has always been an Iron Ore company and just like Rio Tinto Group (RIO), it is very hard for it to reduce the dependency on this one resource. For the fiscal year just ended, almost half of its total revenues came from Iron Ore.

EBITDA contribution was even greater than 50%, and this was despite Coal and Copper having a resounding performance. Hence, what happens to iron ore will determine what happens to this company’s performance and stock price.

On that front, we believe that Iron Ore remains incredibly overvalued relative to fundamentals. Depending on which source you use for your data, you get that China consumes about 70-75% of total iron ore produced in the world currently. That translates into it pulling almost the entire export market to its shores.

On the surface, it may seem like a no-brainer to try and set the terms of purchases if you are the buyer of 70% of global supply of a commodity. For example, China’s imports from the two countries in May totaled 83.7 million tonnes, which is 87% of seaborne arrivals, according to data compiled by commodity analysts Kpler.

There are several miners in each country, but, once again, supply is concentrated – among a handful of major companies. Rio Tinto, BHP and Fortescue Metals Group accounted for 58 million tonnes of China’s May imports, or about 61% of the total. Brazil’s Vale supplied 14 million tonnes of China’s May imports, for a 14.6% share. Adding the big-three Australian producers to Vale (VALE) means that four companies are meeting 75.6% of China’s imports, given that the May import figures are largely typical of the longer-term supply trends.

Source: Reuters

The consumed Iron Ore, besides upgrading the country’s infrastructure, is used to build a vast swath of housing. That housing bubble continues to implode at a rather brisk pace. For many months, a heavy percentage of buyers in China have refused to make mortgage payments for incomplete projects; and recently, the refusals came together as a collective movement.

And millions of “presold” apartments that buyers have paid for remain unfinished, leading some purchasers to threaten to withhold mortgage payments. Home buyers could refuse to pay back up to $370 billion in home loans if their apartments aren’t finished, analysts estimate. Most Chinese banks, they say, should be able to absorb the losses, making a financial crisis unlikely.

The bigger risk is to China’s economy. Bank of America research analysts noted in a report last month that approximately 9% of the housing floor space that was presold in 2020 and 2021 risks not being completed on schedule because of developers’ financial troubles, affecting roughly 2.4 million households.

Source: Wall Street Journal

So far, no one is acting overly worried in the west. Everyone appears to be more concerned about the Western Housing bubbles than what is happening in China. Sure, we see headlines like this, but none of them remotely identify the scale of the problem that is several fold higher than the worst levels we saw in US in 2007-2009.

There are several paths that China can take here, but none of them will involve building more houses at the pre-2022 pace. None of them will involve adding housing inventory to a bloated market and none of them will involve consuming Iron ore like the past.

In such a scenario, we see Iron Ore as easily the most oversupplied among commodities.

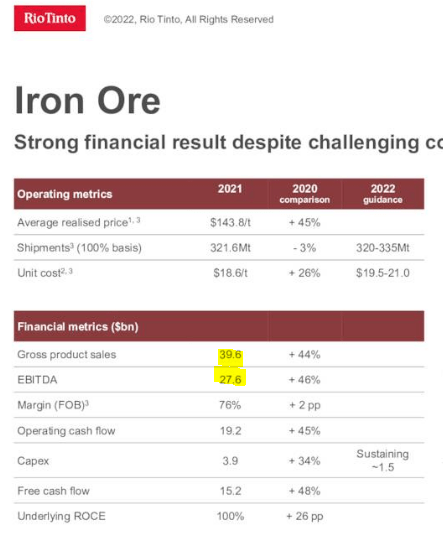

What makes the pricing outlook worst for Iron Ore is also the fact that most mines have a very low cost basis. We can see BHP’s data from above, where it reported Iron Ore EBITDA margins at more than 70% of revenues.

BHP is hardly unique here. RIO’s EBITDA margin is about the same.

Rio Tinto Presentation

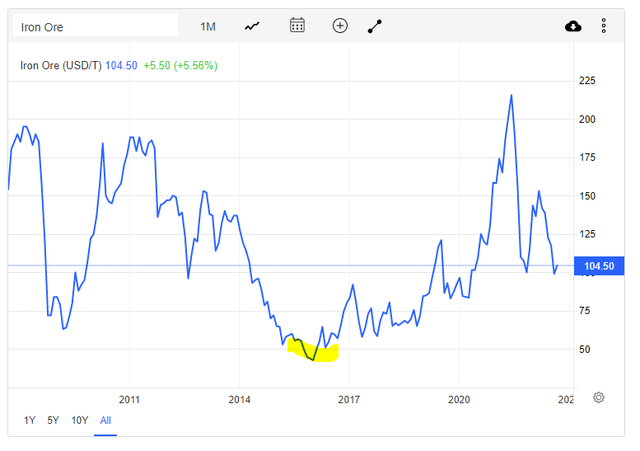

Hence, there is going to be a zero supply response, even if prices fall 50% from here. That is actually our outlook, for Iron Ore to move down to $50/tonne. While that may sound outlandish, keep in mind that we were there in 2016 and 2017, without an imploding China Property market and without a global recession.

Verdict

If our scenario comes to pass, Iron Ore segmental EBITDA should drop to under $5.0 billion annualized run rate whenever prices hit the $50/tonne level. Our outlook for both Copper and Coal is relatively more optimistic but BHP would likely run at a sub $15 billion EBITDA number. Factoring in taxes and capex, we would look for a $2.00-$3.00 dividend run rate and some point soon. All things considered, we see BHP’s risks here to the downside. The stock has come off its $80 highs, and if we were writing the article then, it would probably get a Sell rating. Since it is closer to our fair value of $40/share, we are maintaining a Hold/Neutral rating here.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment