Thibault Renard

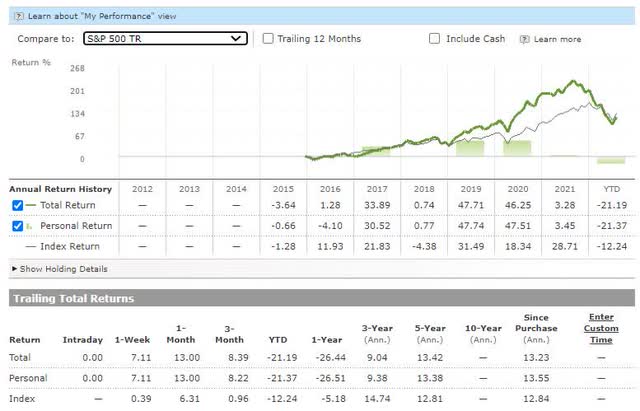

The Project $1M portfolio, represents my effort to grow a fix sum of approximately $275,000 into $1M within 10 years. At the midpoint of 2022, the portfolio is nearing the end of its 7th year since inception. Unsurprisingly, this has been the worst year to date.

A prolonged bear market in growth businesses and technology stocks over the last 18 months has significantly hit the progress made last year. As a reminder, I have primarily structured the Project $1M portfolio as a substantially buy and hold portfolio. Most core portfolio positions have remained intact since I first added them.

The portfolio primarily consists of cash-generating, profitable businesses with solid rates of return on invested capital, and dominant market positions protected by substantial barriers to entry. Of course, within the mix of portfolio companies, I have a few smaller positions that don’t fully meet those criteria but still offer significant promise.

The portfolio is a substantially concentrated portfolio, with the top five positions accounting for more than 50% of the portfolio’s value. When I selected the elements for the portfolio, I did so in an environment of relatively low inflation, benign interest rates, and a stable economic climate. 2022 has flipped all of this on its head.

2022 Has Been Challenging So Far

In 2022 so far, the portfolio has experienced some pretty ugly results. Currently, the portfolio has declined by almost 21.3% since the end of 2021 update, where it closed at ~ $825k. Since the highs of August ’21, where the portfolio stood at $906k, and within ear shot of the portfolio goal, several years ahead of schedule, it is now down nearly 33% to $616k.

While not the low point for the year, it’s fairly close. The portfolio’s low point for 2022 occurred midway through June, and it has seen some modest reprieve in the last couple of months. Of course, it’s uncertain if that may last, and if so, for how long.

Changes to the portfolio composition have been relatively modest. This has largely been by design because I am reluctant to interrupt the portfolio compounding by switching out positions and substituting the relevant “flavor of the month” for an enduring business.

For this reason, the portfolio still doesn’t contain commodity businesses, reopening plays, or anything else that has performed well this year. Underperformance in select years is a feature, not a bug of this program. It’s all to deliver a favorable long-term result at the expense of chopping and changing in the short term.

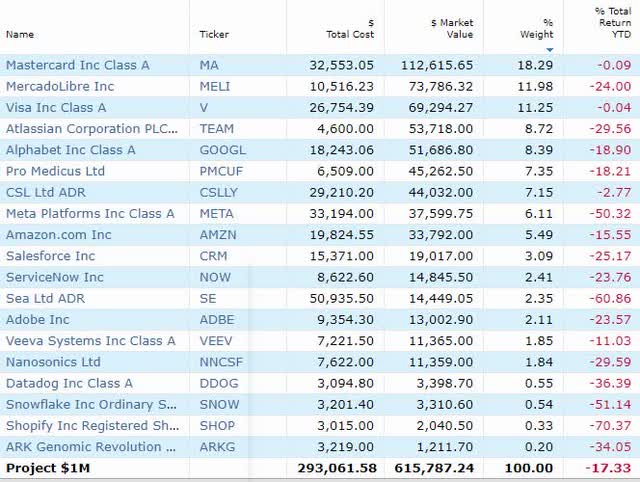

The main reason for the portfolio underperformance so far this year is share price declines for the long tail of the portfolio. Visa (V) and Mastercard (MA), which account for nearly 30% of the portfolio, substantially outperformed the S&P 500 year to date, each largely flat on the year so far, while the S&P500 Index has declined.

While I did not construct the portfolio for a high inflation environment, if I were to pick two names that would survive and thrive in such times, these two would be my names every time.

Mastercard and Visa protect the portfolio in such a scenario and benefit from meaningfully higher revenue with a largely stable fixed cost. Even global biotechnology company CSL (OTCPK:CSLLY), a 7% position in the portfolio, held up reasonably well, recording a slight decline year to date of less than 3%.

Unfortunately, moving beyond these names, most positions have been somewhat ravaged by the market, resulting in a meaningful underperformance of the S&P 500 for this year, yet interestingly not enough to derail an accumulated advantage since the portfolio inception over the last 6 1/2 years. How long this lasts remains unclear, though I’m still optimistic about what 2025 will ultimately bring.

Table created by Author, includes Veeva (VEEV), ServiceNow (NOW), Alphabet (GOOGL), Meta (META), Adobe (NASDAQ:ADBE), Amazon (AMZN), Salesforce (CRM), Sea (SE), ARK Genomic (ARKG), Pro Medicus (OTCPK:PMCUF).

Portfolio Changes & Commentary

The portfolio as it stands today is substantially similar to the one that I ended 2021. However, there are a couple of notable changes. I have exited Teladoc and reduced the size of the Nanosonics position. In their stead, I have recently added small positions in Datadog, Snowflake and Shopify.

Teladoc exit

I came into the Teladoc (TDOC) position via the Teladoc acquisition of the Livongo chronic care business. The Livongo business was an absolute gem; however, I feel Teladoc’s management has managed to butcher whatever good was there. The more I looked into Teladoc’s performance and ability to acquire new clients, the less confident I felt that this would lead to an excellent long-term result.

Teladoc has shown no ability to add net new customers meaningfully. The investment thesis now rests entirely on Teladoc’s ability to monetize more from existing customers and increase product penetration within those customers.

With the company unable to do that even when it had a relatively clear run, the arrival of new competitors into the space left me feeling even less confident that it would be able to do so. I exited the position after most recent earnings at a significant loss. Fortunately, the position was sized relatively modestly and didn’t do substantial damage.

Trimming Nanosonics

Unlike Teladoc, Nanosonics (OTCPK:NNCSF) remains a business that I believe has a great deal of long-term promise, with a near monopoly in the US market for disinfection control for hospital ultrasound units. The company has the majority market share within the US, and is seeing increasing success throughout Asia Pacific and Europe.

Yet the firm is also early and highly nascent. The advantage of recent aggressive pullbacks is that higher quality, lower risk-adjusted returns are available at relatively lower prices. On this basis, I chose to trim the Nanosonics allocation in the portfolio and add alternative positions that were further on the quality and maturity scale.

Adding Datadog

Datadog (DDOG) is a business that I have long wished to accumulate more substantially. Yet its share price was always too rich for my liking, and the recent pullback provided an opportunity for entry. The business is unique in a fairly crowded field, which is enterprise observability.

In simple terms, Datadog monitors applications, application environments, and internal network resource utilization for potential issues or anomalies that may require the attention of IT teams. It makes all of this available in a “single pane of glass” to allow for the fastest path to troubleshooting and resolution.

Datadog is a high-growth business that expects to grow revenue at nearly 57% for the full year. Additionally, the business generates strong margins and positive free cash flow margins of close to 35%.

In the SaaS universe, where a rule of 40 (the combination of revenue growth and free cash flow margin) is considered good, Datadog comes in at over 100 on this metric. The market opportunity for this business is large, and I believe Datadog can capture much of it.

Adding Snowflake

I believe that shifting on-premise workloads to the cloud is still in its early stages and will only continue over the next decade. Results from AWS, Azure, and Google Cloud prove this out. Yet providing the infrastructure to share cloud data and secure it in a manner that is independent of the underlying cloud platforms is something that enterprises are increasingly asking for. It’s here that I believe Snowflake (SNOW) will play an enduring long-term role.

Snowflake enables businesses in regulated and non-regulated industries to securely store and share sensitive data with other independent participants. Best of all, it does this with a framework that separates the underlying cloud infrastructure platform from the mechanics of storing and sharing data.

Snowflake has been growing frantically, with revenue growth north of 100% in recent quarters. The business generates positive free cash flow and has a market opportunity north of $100B.

It is increasingly aligning with the sales motion of the hyperscale cloud provider such as Amazon to generate opportunities for the Snowflake Cloud. The price for this high-quality business was too steep to interest me in the past. That changed over the last couple of months, and I have taken a small position here in this business.

Adding Shopify

Finally, Shopify (SHOP) is a business that I have long admired. I consider Shopify to be the operating system of choice for online merchants. To launch an online storefront, merchants increasingly look at two distinct pathways. One of these is to use Amazon (AMZN) for product listing and logistic services, as well as to access Amazon’s large retail base.

This invariably involves merchants having to choose to give up brand control and customer control to be commoditized within the Amazon experience. This approach very happily works for a large portion of merchants. However, increasingly some merchants want to go “direct to consumer” while maintaining control over their own brand identity.

They want the flexibility to market to these customers in their way, own them, and service them in a manner consistent with a unified, omni-channel experience. Initially, this was largely the desire of small and midsize merchants.

However, increasingly, even large merchants desire to control this experience themselves. That is where Shopify comes in. Shopify has a full stack of product offerings that enable a hosted online store, allow merchants to accept payments, sell internationally, and manage logistics and delivery within two days across much of the US.

While Amazon is the hundred-pound gorilla in the space, Shopify is no slouch and now has a market share above 10% within North America. Shopify isn’t quite there yet regarding the full monetization of its platform offerings in the same way as MercadoLibre (MELI).

Yet recent initiatives such as Shopify Capital and Shop Pay, Shopify Audiences , a product that aims to deliver low-cost customer acquisition for merchants, represent good steps in that direction.

Shopify has a huge opportunity to increase its take rate on overall spending that it is enabling for merchants, and this is where I believe the long-term opportunity lies. I didn’t hit bottom as far as the prices offered by the market for these positions. I made the Shopify purchase at levels meaningfully higher than where the business trades today.

Yet I see an opportunity over the next 12 months to gradually increase these positions, and they are all ones that I could see holding onto for an extended duration beyond even the conclusion of this Project.

Concluding Thoughts & Outlook

Managing money independent of an index fund is no easy task. In bear markets, the virtues of an index fund shine in being able to blindly buy and hold a broad basket of companies during market turmoil and sit tight. Bear markets make one question active portfolio positions, mainly where significant declines beyond an index occur.

This is certainly what’s happened to me with the Project $1M portfolio over the last 18 months. Still, I’m pleased to say that I have stuck to the process, and the journey thus far is one that I am pleased to continue. The names I currently hold are ones I have owned for quite some time.

I’ve built up a strong conviction, particularly in positions held since the portfolio’s inception, including names like MercadoLibre, Atlassian (TEAM), and Mastercard, which remain well above their acquired prices despite the recent aggressive declines.

I believe the Project is set up for solid returns over the next few years, and I won’t be surprised to see the portfolio outperform the index over this time. It’s tough to see how portfolio performance will track over the year’s second half, though I believe that the worst declines are likely behind at this point. The portfolio may still end up in an negative position for the entire year though I believe recovery from current depths is likely to be achieved.

Regarding portfolio composition, I am mindful that the combined Visa and Mastercard exposure is now nearly 30%. This is something that I aim to reduce over the next year actively, and the new additions, including Shopify, Datadog, and Snowflake, are likely to see some dollars flow to them with the Visa position in line to be reduced.

The year so far has not been dull, and I’m almost sure that the second half will be likewise not lacking in excitement. I look forward to seeing how things shake out for the Project $1M portfolio for the rest of the year.

Be the first to comment