DINphotogallery

Thesis

BlackRock Energy and Resources Trust (NYSE:BGR) is a closed end fund focused on Energy equities. As per the fund’s literature:

the trust’s investment objective is to provide total return through a combination of current income, current gains and long-term capital appreciation. The Trust seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its total assets in equity securities of energy and natural resources companies and equity derivatives with exposure to the energy and natural resources industry. The Trust may invest directly in such securities or synthetically through the use of derivatives. The Trust utilizes an option writing (selling) strategy to enhance dividend yield

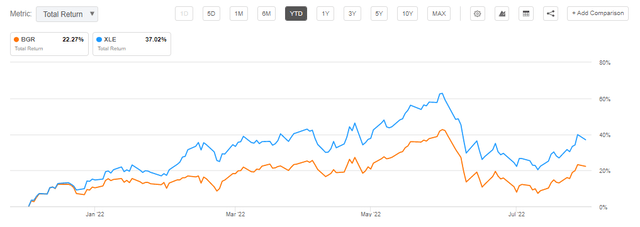

Currently the fund is fully invested in energy equities. Furthermore we can see from the fund’s literature that the CEF also employs a “buy-write” strategy to a certain extent, at the portfolio managers’ discretion. Currently approximately 38% of the portfolio is overwritten with call options. The call options are single name calls rather than index-level options. This strategy is partially responsible for the fund’s underperformance versus the sectoral ETF Energy Select Sector SPDR Fund (XLE) in 2022. When the market rallies significantly having a call option strategy impedes capturing the entire upside.

Another factor for the fund’s underperformance versus the sector ETF this year is the composition – BGR contains a number of European Oil & Gas majors such as Shell (SHEL) and TotalEnergies (TTE) which have underperformed in 2022 versus their North American peers. The reason for this underperformance is the impairment of their Russian assets as well as the lower P/E ratios, as they are exposed to the political issues associated with being a European entity (a good example is the windfall tax imposed this year).

The CEF is currently trading with a -10.9% discount to net asset value, towards the bottom of its historic range. We feel this is unwarranted given the current macro set-up where Energy is set to outperform during the next years on the back of strong balance sheets, record profits and the underinvestment in oil & gas development and capex in the past years. While having an option overlay can hamstring the fund’s performance in a sustained up move for the underlying equities, the strategy can also provide attractive yields when volatility is extremely high, as we are currently witnessing.

We believe we are in a multi-year Energy outperformance set-up and buying BGR on dips with a wide discount to net asset values is a good strategy to pursue. Once the market understands the supply side constraints for Energy and the robustness of forward earnings, even for European Majors, we might even see a higher P/E re-rating for the likes of Shell and Total which should put the wind behind BGR’s sails.

Holdings

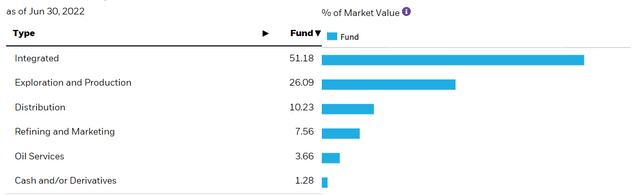

The fund is dedicated exclusively to the Energy sector:

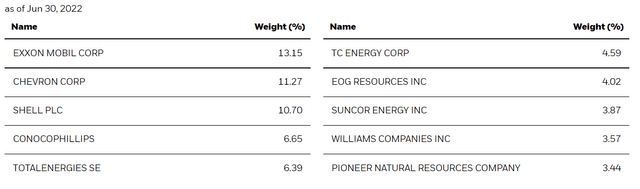

We can see the fund deploys its capital across a number of sub-sectors with Integrated Oil & Gas being the largest exposure. This sub-sector is composed of the major Oil & Gas companies, as we can see from the top fund holdings:

We can see Major Oil & Gas companies such as Exxon (XOM), Chevron (CVX) and Shell being the top holdings in this fund. BP (BP) is a glaring omission, signaling the fact that the fund managers do not believe the company is undervalued currently. With Oil Majors posting record profits, the fund is well set-up from a fundamental perspective to continue to take advantage of an energy super-cycle.

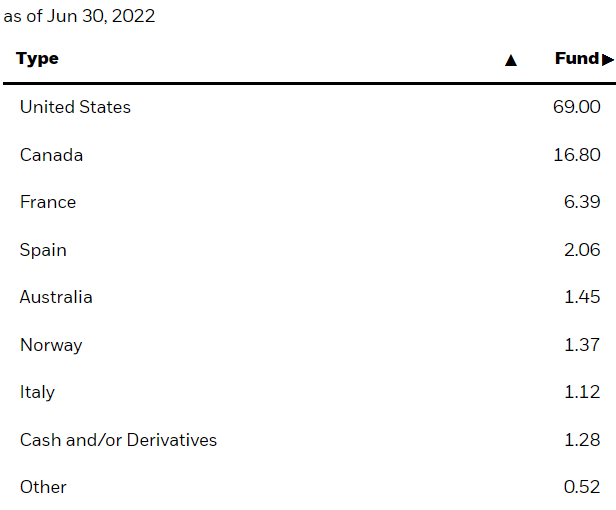

Most of the exposures in the fund are North America based:

Geographic Exposure (Fund Fact Sheet)

We like this set-up because it takes out the basis observed in some foreign jurisdictions around regulations and additional taxation. That being said we do have Shell in the portfolio which is a poster child for European regulators trying to tax large companies when consumers are feeling the pinch of higher energy prices.

Performance

The fund is up “only” 22% year to date, underperforming the sectoral ETF Energy Select Sector SPDR Fund (XLE):

YTD Performance (Seeking Alpha)

On a five year timeframe we can see a very close total return relationship up to 2022 when XLE started outperforming the CEF:

5-year Performance (Seeking Alpha)

The explanation lies in the fund composition – the European Oil & Gas majors Shell and Total have performed extremely poorly this year, whereas XLE is composed solely of North American names. In effect XLE contains a higher allocation to exploration & production names (North American) which have had an outstanding performance this year.

A ten year chart shows a similar relationship, with the two funds having similar performances throughout time (although XLE has outperformed historically), with the major divergence happening in 2022 on the back of the Ukraine war, European companies’ assets in Russia and the European windfall taxes:

10-year Performance (Seeking Alpha)

Premium / Discount to NAV

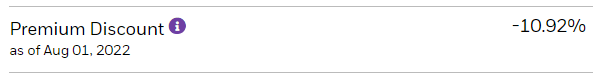

The fund is currently trading with a large -10.9% discount to NAV:

Premium / Discount (Fact Sheet)

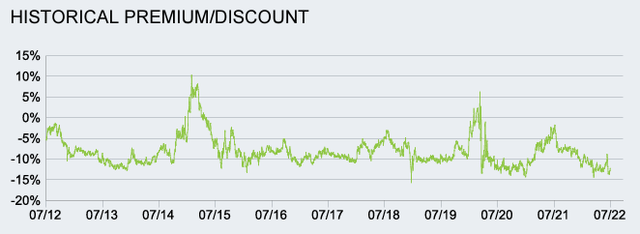

The fund has historically traded at discounts to net asset value:

Historic Premium / Discount (Fund Fact Sheet)

We can see a fairly well defined range between 0% and -15% discount to net asset value. We are today towards the bottom of that range.

Conclusion

BGR is an energy equities closed end fund. The vehicle has a high allocation to global Oil & Gas Majors (over 50% of the fund capital). The CEF also employs a buy-write strategy, with single-name calls written against some of the portfolio holdings. Currently approximately 38% of the portfolio is overwritten with call options. The fund is up more than 22% year to date and has a robust forward given the current energy super-cycle. The CEF is currently trading at a very wide discount to NAV of -10.9% and represents a good choice to buy on dips for a long term holder.

Be the first to comment