FluxFactory/E+ via Getty Images

Investment Thesis

Polaris Inc. (NYSE:PII) is a designer and manufacturer of power sport vehicles headquartered in Minnesota, United States. In this thesis, I will primarily analyze the Q2 2022 results of PII and its future growth prospects. I will also analyze the risks faced by the company and their impact on its performance. I assign a hold rating for PII after taking into consideration all the growth and risk factors.

Company Overview

PPI designs and manufactures offroad and all-terrain power sports vehicles like Snowmobiles, Motorcycles, Boats, and Defense vehicles. The company operates under six business segments, namely snowmobiles, motorcycles, global adjacent markets, aftermarket, boats, and offroad vehicles (ORV). The company currently produces 58 different models of snowmobiles and sells these snowmobiles through a network of more than 580 dealers in the North American region and 300 dealers in International countries. When it comes to the motorcycle segment, the company currently produces three types of motorcycle cruisers, touring (including 3-wheel), and standard four motorcycles. It sells these motorcycles through 200 dealers in North America and 350 international dealers. The global adjacent market segment consists of commercial vehicles used for light industrial purposes. The aftermarket segment of the company takes care of the aftermarket parts, garments, and accessories to complement these vehicles. The boat segment includes powerboats and deck boats. It has a great advantage in the boat industry with over 600 active dealerships through which the company caters to its clients. The ORV segment is one of the most important segments of the company. It has a network of more than 1400 dealers in North America and 1100 dealers in the international region to distribute these ORVs.

Q2 2022 Results

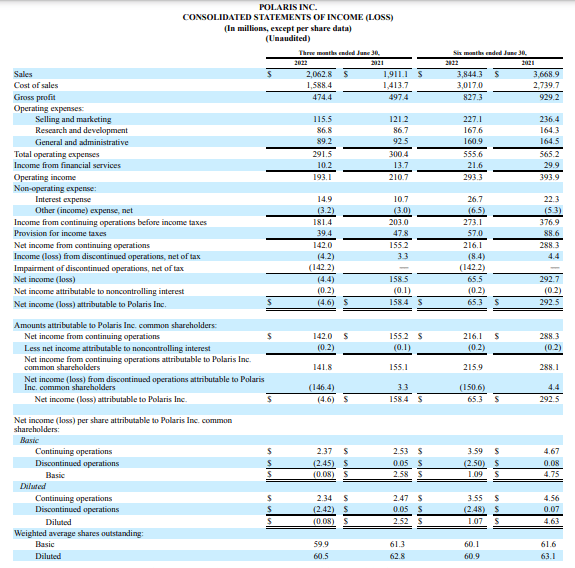

PII reported weak Q2 2022 results with underperformance on many parameters. The company experienced a decline in the gross margin as well as the net profit margins. The cost of sales increased disproportionately due to inflationary pressure. The company is estimating that the inflationary pressure to continue throughout FY22. Additionally, supply chain disruption has caused severe problems for the company and is limiting its growth. However, the company has revised its FY22 guidance and estimates the revenue to be 13%-16% more than FY21 sales from the previous estimates of a 12%-15% increase. The company has EPS estimates of $10.10-$10.30 for FY22. The company failed to impress with contracted margins and increased costs.

SEC:10Q PII

PII posted sales of $2.06 billion, an 8% increase from Q2 2021 sales of $1.91 billion. The primary revenue driver was an average increase in the product sales price and strong demand in the ORV segment. The company reported gross profit margin of 23%, a 303-basis point decrease in the gross margin compared to the corresponding quarter last year. As per my analysis, the main reason for this decline was an increased cost of production due to inflation. The company reported net income from continued operations of $142 million, an 8.5% decrease from $155 million in the same quarter the previous year. The company reported EPS of diluted EPS from continuing operations of $2.34, a $0.13 decrease from Q2 2021 diluted EPS of $2.47.

Overall, the results reflected the cost pressure the company is currently facing, but the company has given strong FY22 guidance, citing increased demand. I believe the company has to address the inflation and the supply chain issue, and before that, I wouldn’t be much confident in the company’s FY22 outcome.

Mike Speetzen, Chief Executive Officer of Polaris Inc, stated,

Our results during the second quarter reflect our team’s commitment to our customers through industry-leading innovation and exceptional execution, despite the ongoing supply chain constraints impacting the global economy. While we are closely watching a number of demand indicators to understand the resilience of the consumer in this environment, we continue to see a healthy consumer and stable demand. While this trend is expected to continue in the back half of the year, we remain diligent and prepared to respond if headwinds materialize. Our focused strategy of being the leading player in powersports, coupled with the significant opportunity to get back to optimal dealer inventory levels, gives us confidence in our ability to drive continued performance for Polaris and value creation for our shareholders.

Key Risk Factor

Raw Material Prices and Supply Chain Disruption: Aluminum, steel, petroleum-based polymers, some earth metals utilized in the company’s charging station, and diesel fuel to deliver the goods are the primary raw materials used in the production line. The cost of transportation and delivery to acquire materials, commodities, and other parts required to assemble products could impact the company’s profitability. These resources and commodities are becoming significantly more costly for the economy due to strong demand, a climate driven by inflation, and supply chain disruptions brought on by the Russia-Ukraine war. Additionally, shifting policies, trade restrictions, and trade agreements could further sabotage the supply chain or drive up the price of the commodities and raw materials used in product manufacturing. Current economic conditions can weaken the disposable consumer income, resulting in decreased demand for the products. All of these have the potential to raise operating costs and have a negative impact on business operations and financial health.

Valuation

The company currently trades at $117.2 with a market capitalization of $6.98 billion. Currently, the PE multiple of the company is 27.16x. The company saw a surge in demand, but because of the supply chain disruption, the sustainability of the demand is uncertain. I have kept my estimates conservative after considering this factor. I have estimated the company’s full year’s EPS for FY22 to be $10.15, which gives the leading PE multiple of 11.76x. At this valuation making new positions in this stock is not advisable because of the uncertainty due to supply chain disruption. The company has a dividend yield of 2.18% at the current share price levels, which is a good reason to hold the stock in the portfolio. After the supply chain disruption gets resolved, we might get the certainty about future growth.

Conclusion

PII experienced a strong demand across segments but the inflationary pressure and supply chain disruption has become a big challenge for the company’s future demand growth. After considering these factors, making a new position in this company is not advisable. The company has a stable dividend yield of 2.18%, which can be a good reason to hold the company if you already have a buy position in the company. I believe the company might resolve the supply chain issues by FY23, and after that, the company might experience better profit margins. I assign a hold rating for PII after taking into consideration all these factors.

Be the first to comment