Stephen Brashear/Getty Images News

On the 4th of April, Air Lease Corporation (NYSE:AL) announced that it would be ordering 32 Boeing 737 MAX aircraft, which is a good sign for Boeing. The order brings the Boeing 737 MAX backlog for Air Lease Corporation to 130 units, which is significant. However, I do think it’s very important to provide some context to the recent order activity.

Important order in context for Boeing

So, the order for the 32 Boeing 737 MAX aircraft consists of aircraft from the MAX 8 variant and the MAX 9 variant. This would indicate a current market value between $1.45 billion and $1.55 billion. Without doubt it’s a good sign that Boeing is receiving support for the Boeing 737 MAX from lessors, it shows continued confidence of the value retention of the jet and market appeal. So, this is good for Boeing, and since the crashes with the Boeing 737 MAX I have continuously heard a very small but very vocal group of readers claiming that the MAX wouldn’t sell anymore. Those people are being proven wrong on various occasions now.

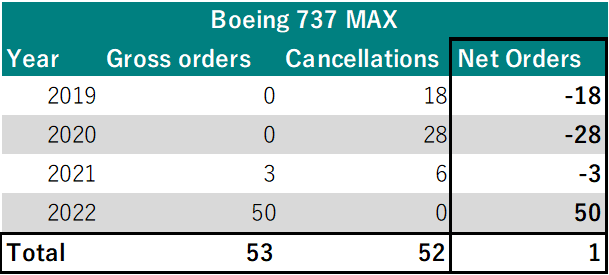

Boeing 737 MAX net orders for Air Lease since start MAX crisis (The Aerospace Forum)

However, we need some context. That context is provided in Figure 1. It shows that since the start of the Boeing 737 MAX crisis and the course of the pandemic Air Lease Corporation has been canceling orders for the Boeing 737 MAX and it did not start to add orders until this year. From March 2019 until April 2022, we see that the Air Lease Corporation order book has been more or less flat for the MAX. So, what you can say is that Air Lease Corporation simply re-ordered the aircraft that it cancelled during the MAX crisis and pandemic. At base market values, the net addition in value has been in the range of $50 million to $150 million. However, if we also consider that the aircraft for which the purchase agreement was terminated had a higher value than for the newly ordered jets according to current market values, the net value change has been negative $240 million.

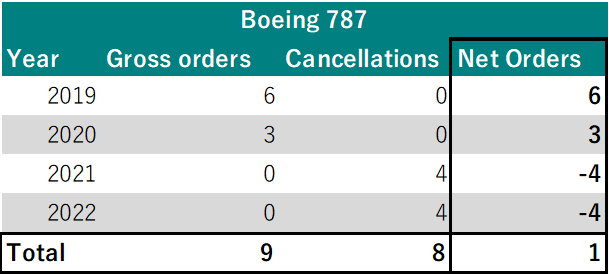

Boeing 787 net orders for Air Lease since start MAX crisis (The Aerospace Forum)

It doesn’t stop there, because to offset the MAX deliveries Air Lease Corporation had been ordering Dreamliner aircraft instead, which stopped once the Boeing 787 deliveries were halted. These Dreamliner deliveries had a positive impact of $120 million overall.

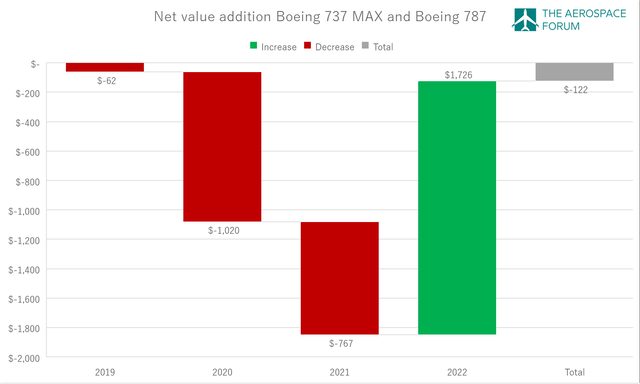

Net value change Air Lease Corporation orders (The Aerospace Forum)

Figure 3 shows how the combined purchases and cancellations for both programs added to the backlog. What we see is that in 2019 through 2021, the net addition was negative. In 2020 and 2021, cancellations were partially offset by order inflow for the Boeing 787. This changed in 2021 on the back of reduced demand for air travel and the continued delivery stop for the Boeing 787 leading to net negative orders on both programs. So far in 2022, much of the value lost in the past three years was offset even when accounting for the fact that Air Lease Corporation is likely acquiring the newly ordered Boeing 737 MAX at a significantly lower price than the aircraft it previous cancelled. This brings the net value reduction to just $122 million.

Conclusion

For Boeing, the purchase is a bullish sign. It provides a base for future production rate increases, which at this time are still challenging. Furthermore, the continued support from a lessor is a big sign of confidence in the Boeing 737 MAX and that is something that should be highlighted as well because there have been way too many naysayers when it comes to the long-term sales recover of the Boeing 737 MAX. The road ahead is a long one, but Air Lease Corporation has already re-ordered the jets it previously cancelled and that is something does not deserve enough attention. At the same time, being too cheerful about the orders also is not completely appropriate as Air Lease Corporation simply re-ordered previously cancelled jets at a lower price thereby also rendering some of the compensation it negotiated with Boeing. So, the purchase from Air Lease Corporation for the Boeing 737 MAX is a good sign but should also be viewed in the broader context. Any new orders from this point onward for Air Lease Corporation will be a net addition to the books when taking the March 2019, when the grounding of the Boeing 737 MAX started, as the reference points.

Be the first to comment