Maks_Lab/iStock via Getty Images

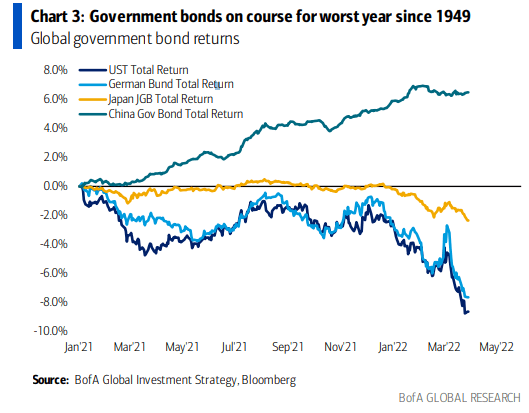

What a quarter it was! The global bond market endured its worst losses in decades. The U.S. and ex-U.S. sovereign fixed income areas are on pace for their worst years since 1949, according to Bank of America Global Research.

BofA Global Investment Strategy: Government Bond Returns

Bank of America Investment Strategy, Bloomberg

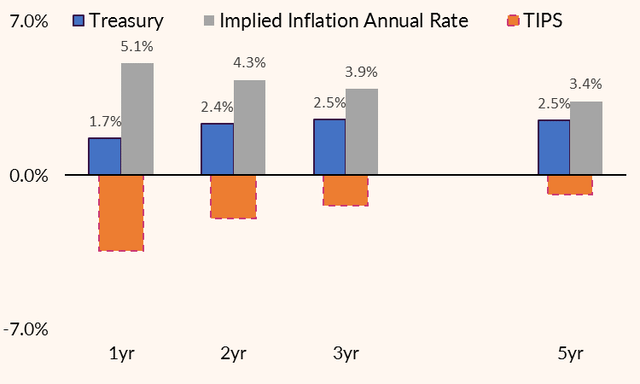

Making returns feel much worse in the credit arena is inflation. We all know that U.S. headline CPI is cruising along near 8%, but the future paints a much better picture. Using Treasury yields and the current rates on TIPS, we can figure out what the market thinks inflation will be. Over the next 12 months, inflation is expected to verify at 5.1%. Step out a few years though, and the annualized climb in consumer prices should ease considerably. Five-year inflation expectations are 3.4% while, according to the St. Louis Federal Reserve’s database, 10-year inflation should be “just” 2.8% per annum.

Gauging Expected Inflation Using Treasurys and TIPS

St. Louis Federal Reserve, U.S. Treasury

Positive Real Returns in the Bond Market – You Heard That Right

Shocking to most investors is that you can own a diversified, low-cost bond fund today and beat inflation if market participants are correct in their bets. The current yield to maturity (YTM) on the iShares U.S. Aggregate Bond Market ETF (AGG) is a whisker under 3% – above the 10-year expected inflation rate. It’s important to look at a bond fund’s YTM when trying to figure out what your future return might be.

Moreover, it is wise to ignore people who dismiss investments simply because of high inflation. How often do you hear, “Why own bonds? You are locking in a guaranteed loss after inflation!” This is a very flawed argument since said loud-voicer is referring to historical inflation and historical bond yields. Any reasonable investor would surely be forward looking.

Reviewing Yield to Maturities

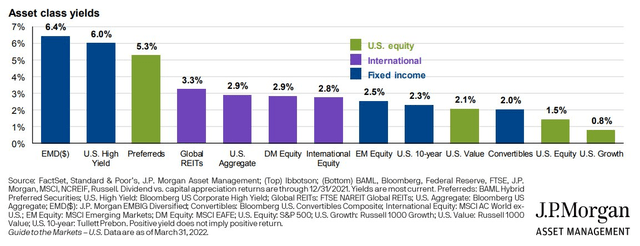

Where else might you find a decent yield? Credit-risky areas, like emerging market debt, carry a YTM of 6.4% while domestic high yield (junk) bonds offer a 6.0% rate. Domestic investment-grade credit’s YTM is above its 10-year average-currently about 3.5% (easily above the anticipated inflation rate using comparable-duration Treasurys).

Stock Market Dividend Yields

Some folks like to eye the difference in bond yields and equity market dividend rates. While I consider that to be an apples-to-oranges approach, it can be a gauge of relative valuations (known as the equity risk premium, at least when comparing Treasurys and the S&P 500 dividend yield). Right now, U.S. growth shares sport a measly 0.8% yield while U.S. value is a shade above 2%. The broad domestic stock market has a 1.5% yield but go overseas, and you will find heftier dividends.

International equities pay out relatively large cashflows to shareholders to the tune of 2.8%. The yield differential between U.S. and ex-U.S. markets is not far from all-time highs. Maybe that’s a sign of value overseas.

J.P. Morgan: Asset Class Yields

J.P. Morgan Guide to the Markets Q2 2022

You don’t have to accept credit-risky fixed income areas or volatile stocks in order to get some yield, though. You can own short-term Treasurys by way of ETFs (such as SHY and VGSH) and capture the potential benefits of an inverted yield curve. The rates on near-dated Treasurys are north of 2% and interest-rate risk is low due to the short maturity.

An Opportunity for Your Emergency Fund?

The effective duration of a two-year Treasury note is, of course, about two years. That means for every 1% rise in market rates, a short-term Treasury fund will only lose perhaps 1-3% in its NAV. If rates stay unchanged, you can simply capture a 2-2.5% interest rate (which beats the pants off high yield online savings accounts right now).

Conclusion

My take: First-quarter returns were sour across the global stock and bond markets. But that creates some opportunities both in the near and long term. If we are indeed in peak inflation this month and next, real bond market returns should improve while dividend yields, after inflation, should begin to turn respectable, too.

Investors should consider the safety of fixed-income right now, even with its volatility. Bond funds, while being down on the year, offer much more attractive yields after a tumultuous Q1.

Be the first to comment