Terry Wyatt/Getty Images Entertainment

Digital health and wellness platform Beachbody’s (NYSE:BODY) headline Q3 results cleared a low bar, but efforts to unlock profitability while sustaining growth have yet to pay off against a challenging macro backdrop. As a result, the Q4 revenue guidance was revised lower to $140m to $150m, along with the EBITDA loss range at -$9m to -$14m.

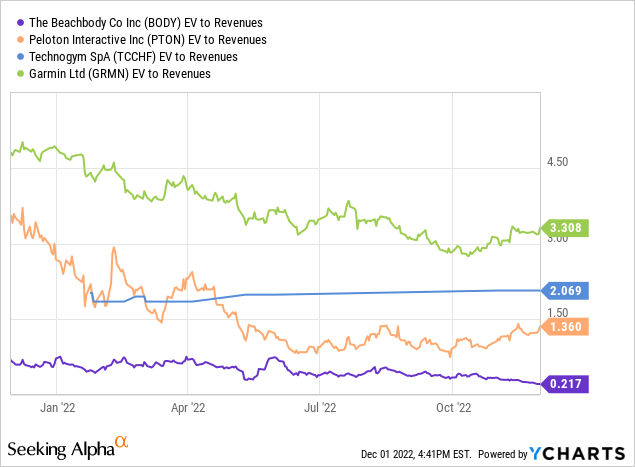

Beachbody has had success with evolution in the past, moving from its success with workout programs like P90-X and Insanity to nutrition products with Shakeology and digital today. Yet, walking the growth/profitability tightrope will be challenging near term. For one, the underlying profitability of its core business will be limited by rising post-COVID churn and a weaker macro/consumer. As for connected fitness, higher rates and capital markets volatility limits the company’s access to funding, and thus, growth will also be hard to come by. So while Beachbody’s exposure to the secular fitness trend is attractive, I would hold off on the stock. The current valuation discount to comparables like Technogym (OTCPK:TCCHF) and Garmin (GRMN) for fitness device makers, as well as Peloton (PTON) for fitness hardware/software, seems justified due to the prospect of below-par growth and expected losses through the year ahead.

Managing Costs to Mitigate a Liquidity Crunch

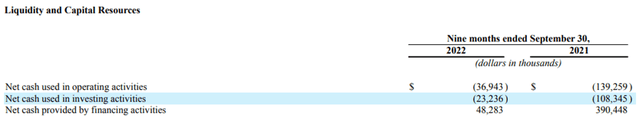

With the liquidity position deteriorating, management is turning to cost cuts to extend the runway. With spending still elevated, all opex line items are on the chopping block, with variable marketing costs likely to see the deepest cuts in the coming quarters. Other cost-saving initiatives include optimizing the nutrition offering to improve margins, as well as rationalizing the organizational structure to realize more savings in FY23. Capex has also been cut to the bone, with the ~$37m YoY decline in Q3 translating into a +$110m YoY operating cash flow swing. Beachbody is still in a net operating cash outflow position, however, at -$4m, so cost cuts are unlikely to stop anytime soon.

From here, expect most of the cost-cutting benefits to flow through to the P&L in FY23. At the very least, management should be able to get SG&A back to pre-COVID levels at ~70% of sales. The key concern, in my view, is whether the spending discipline will come at the cost of revenue growth, given the level of investment needed to build out a digital app business.

Plus, the company is nearing a potentially high churn period when subs onboarded during the pandemic (still a significant % of the subscriber base) are seeing their renewals come due. As these users become less loyal and less engaged in a post-COVID world, the potential implications for nutrition subscription attach rates will be worth monitoring as well. Net, more revenue disappointments could be on the horizon, and unless management navigates the tricky growth/profitability tightrope, the funding risk is material.

Revamping Connected Fitness but is it Enough?

The Beachbody ‘connected fitness’ business remains the long-term growth driver, leaning on secular growth trends across wearables and other connected exercise equipment, as well as Beachbody on Demand (BOD/BODi) digital content (i.e., live and pre-recorded workouts and workout programs). While this segment has yet to live up to promises thus far, the company’s revamped pricing and new bundles could lift near-term sub growth ahead of rising churn in the coming months. New bundles offer customers on-demand and interactive content via the BOD+BODi bundle at $15/month, along with an additional bike for $50/month. Adoption of the latter is key – via its partnership with ‘buy now, pay later’ provider Affirm (AFRM), Beachbody will be able to recognize bike revenue upfront, providing a nice PnL boost at a crucial time.

New sub bundles are a step in the right direction, but the long-term impact on customer lifetime value and churn remains unclear, in my view. In its latest quarter, the company also saw digital subs decline a worrying ~8% QoQ, so stemming the declines will take a few more quarters at least. My key concern is that digital subs remain significantly above pre-COVID levels, and with rolling expirations ramping up in the coming quarters, the latest revamp may not be enough.

Elevated Governance Risks

Senior management departures are never a good sign, so with the CFO and COO leaving the company earlier this year, investors will need to factor in the governance risks as well. The voting power concentration is a concern as well, given co-founder and CEO Carl Daikeler has effective control of the company with >85% of the voting power (based on his Class X shareholding). Shareholders, therefore, have limited say in any significant operational or strategic changes during a turbulent period for the business.

The company’s M&A track record is an added concern. Beachbody’s most recent acquisition of connected fitness business Myx, for instance, has seemingly taken a backseat amid the pivot away from direct marketing. While Myx’s low penetration entails ample room for unit sales and revenue to grow from here, management commentary suggests the pace could well underperform initial expectations.

A Warranted Valuation Discount

Following a COVID-driven spike in demand and subscriber growth, Beachbody’s outlook has turned for the worse amid a combination of post-COVID churn, supply chain headwinds, and a challenging macro. The company has made some positive moves in the meantime, for instance, by introducing new subscription bundles to reignite connected fitness growth.

Yet, this needs to be balanced with profitability. With the company actively cutting back on opex and marketing spend heading into a period of elevated churn (driven by upcoming subscription plan renewals for the wave of users onboarded during the pandemic), it’s hard to see how things don’t get worse before they get better. Net, Beachbody offers exposure to attractive secular fitness trends, but given the concerns around growth, margins, and the liquidity position, a discounted valuation multiple seems warranted at this point.

Be the first to comment