Justin Sullivan

Walgreens Boots Alliance (NASDAQ:WBA) had somewhat of a difficult quarter but the run-rate situation looks reasonably good. With resilient retail exposures and several vectors of recovery from waning COVID-19 forces the outlook is not too bad, especially in the face of what has become a pretty low multiple. Everyone loves an ample dividend too, and WBA’s is well covered. The outlook has elements that trend positive and should mitigate whatever negatives we can expect from the macroeconomic environment. At the very least it’s a good income play.

WBA Overview

The company is a retail pharmacy and beauty product company. It runs this model through the Boots and Walgreens brands that used to exist independently. There were plans to sell Boots to a willing buyer, but difficulty in raising capital for such a large deal when the market jitters hit torpedoed those plans, and the company plans to run with the Boots assets for the foreseeable future.

On a reporting basis they operate in two segments: United States and International. Boots is contained in the international segment while Walgreens is reserved to the United States segment. The split is about 85:15 in terms of revenue between the segments. Investments are focusing on Walgreens and not so much on Boots, in particular investment into Shields for specialty pharmacies and the VillageMD investments which started in tandem with CVS (CVS) in 2020 to get ready on capitalizing on vaccinations but also trying to make WBA a more comprehensive offeror as per their omnichannel strategy.

Q3 Update

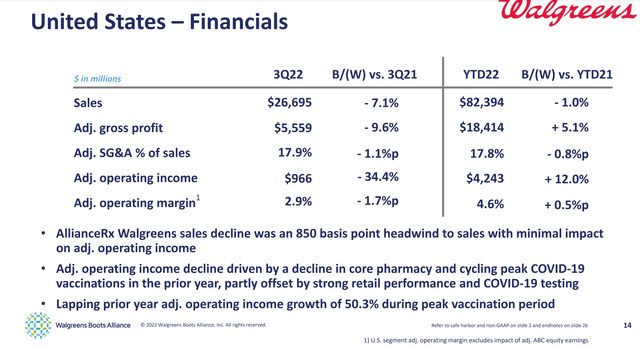

The most recent results came out this month and they look challenged on the surface but pretty reasonable when squaring it with the multiple and the YTD trends. Because of strong comps from last year, the US segment is suffering, with AllianceRx taking a major hit on account of falling vaccination numbers.

The EPS declined 29% YoY and 18% is coming from these falling vaccination figures. Most of the rest of the headwinds are also coming from expenses related to the increasing footprint of VillageMD which is growing quickly and despite its small size making a modest contribution to the topline. These negative effects from AllianceRx offset good performance in terms of sales in retail and the growing VillageMD clinic footprint which tripled over the last year. Sales growth would have been 3% YoY this quarter were it not for AllianceRx and related vaccination declines, where the actual sales growth was -3% on a constant currency basis.

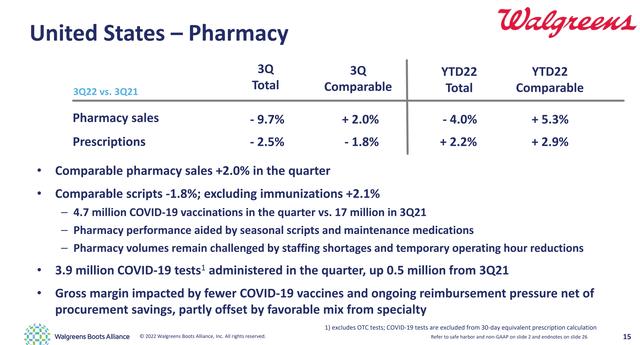

The other headwind in the US was pharmacy. Ordinarily pharmacy and script volumes should be solid, and indeed this is an area that gives the company stability in the negative macro environment we’re expecting but labor shortages are making it difficult to capitalize on a recovery in traffic and mobility. Automatic fulfilment systems are mitigating the impacts here at least.

Pharmacy Subsegment (Q3 2022 Pres)

Finally, the moving away from tobacco revenues, especially coming off strong COVID-19 comps, has been a headwind for general merchandise, but a recovery in personal care is helping volumes and stabilizing the picture. Granted, these volumes were coming from at home testing kits for COVID-19, which while a reliable contributor now could be subject to uncertainty as attitudes around COVID-19 change. As long as isolation on diagnosis is mandated by workplaces we think WBA will be safe on this one. Moreover, things like photo services are also seeing a recovery and contributing back into the margins as mobility returns.

The Walgreens Health business which contains the VillageMD exposure grew by 65% excluding AllianceRx impacts, but did so unprofitably for now as a rapidly expanding footprint still needs to mature into being a profit contributor after the growth phase.

In the international segment, which hasn’t been discussed yet, there is growth in both profits and sales thanks to a good recovery primarily in Boots UK. Pharmacy was a still a bit of a languisher as normal healthcare utilisation becomes restored, although it did grow, but all other retail categories grew as well as the wholesale business in Germany.

Valuation

The Q3 accounts for about 16% of the typical Q3 share of annual revenues. Taking YTD figures therefore and annualizing them by implying another quarter at the current run-rates, where YTD evolutions on both sales and operating income were positive, creates a more credible picture for building what will still be a conservative multiple. With a P/E just below 7x, and therefore an earnings yield that covers with substantial margin the 5% dividend yield, the company doesn’t have a heady multiple and provides a safe income.

Annualizing like this isn’t a stretch. We should have similar headwinds onto EPS from the Walgreens Health expansion, lapping vaccination levels from 2021, as well as working through investments to mitigate and restore the labor situation in stores. While VillageMD will likely keep incurring expansion expense the other headwinds should start to dissipate somewhat, but the vaccinations do remain an unknown. We think we may have arrived at more normalized rates as of now, since some COVID-19 vaccination will continue as there will be more variants, but besides this difficult to predict area EPS headwinds are coming off.

Conclusions

The macro concerns exist for all companies, and disposable income declines that are expected to be brought on by the interest hikes should see some impact on WBA profits through the retail segment. Pharmacy should recover regardless and provide resilience. Moreover, with logistics costs being high, people are optimizing by attending the retail footprint more, maintaining its position in their omnichannel approach. Any pent-up demand not being met due to labor shortages should become captured in a couple of quarters’ time. The company trades at a low multiple and at a discount from CVS which admittedly benefits from more robust exposures owing to Aetna. The income is there too with a 5% dividend.

Be the first to comment