photoman/iStock via Getty Images

Three economic reports released on Thursday point to a rising possibility that a recession is near for the US economy. The threat of a contraction still doesn’t appear imminent, and there’s still room for debate on the question of whether a recession is fate. But as new data on jobless claims, the Leading Economic Index and the Philly Fed Manufacturing Index remind, the trend continues to soften. At the very least, the latest numbers show that economic activity continues to slow.

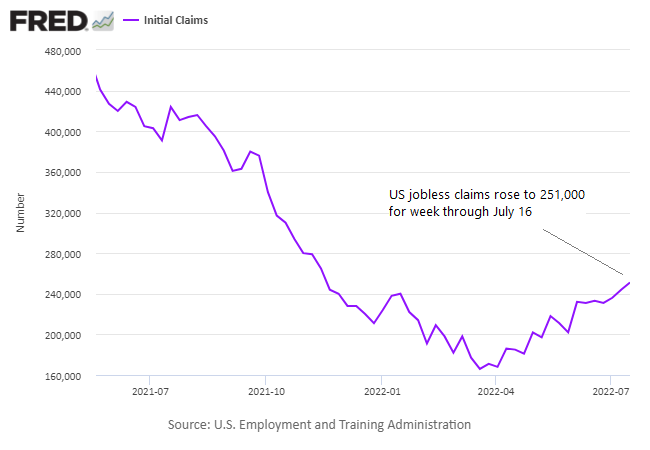

Here’s a quick review of each of these three indicators, starting with jobless claims. New filings for unemployment benefits in the US rose to 251,000, marking a new 8-month high. The upside trend is worrisome, but keep in mind that claims are still close to multi-decade lows and so the current level of new filings – a leading indicator for the economy – still has a way to go on the upside before clearly signaling that a recession is imminent or has already started. A stronger warning sign would be a rise that lifts claims to the 300,000 mark.

For additional context, consider how the rolling one-year change in claims compares, in unadjusted terms. This measure of filings has historically proven to be a useful indicator of recession risk. In particular, the one-year change typically spikes positive during recessions. At the moment, however, the one-year change remains deeply negative at roughly -40%, a decline that suggests that claims are still far from decisively signaling high recession risk.

The Conference Board yesterday published the June update of its Leading Economic Index (LEI) for the US. “The US LEI declined for a fourth consecutive month, suggesting economic growth is likely to slow further in the near-term as recession risks grow,” says Ataman Ozyildirim, senior director of economic research at the consultancy. “Consumer pessimism about future business conditions, moderating labor market conditions, falling stock prices, and weaker manufacturing new orders drove the LEI’s decline in June.”

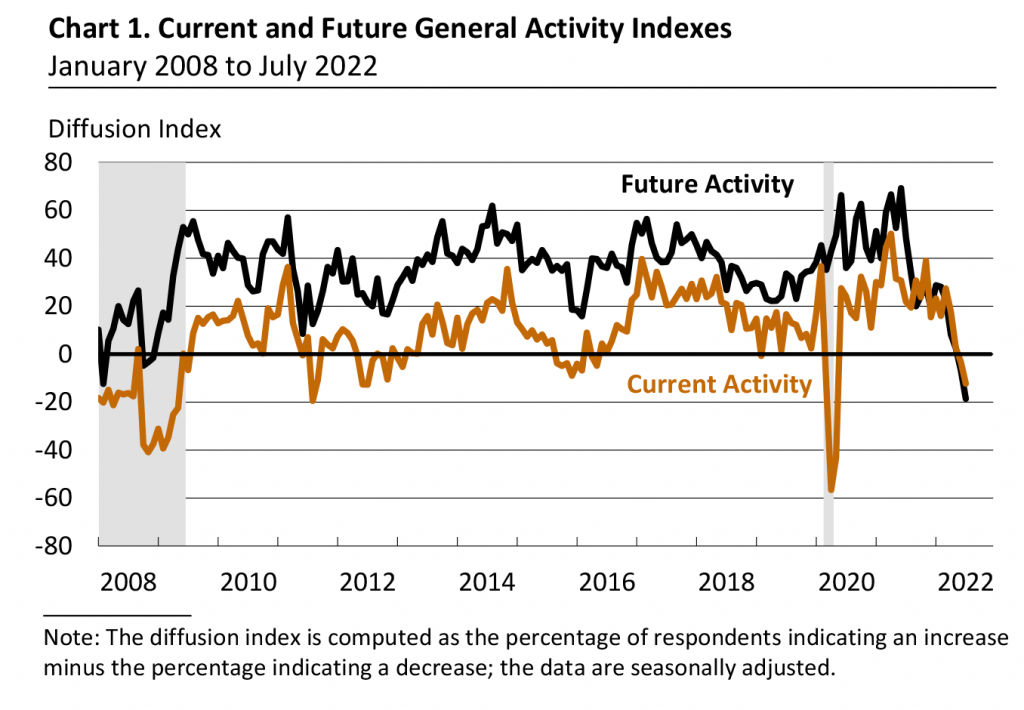

Indeed, the Philly Fed’s benchmark of manufacturing activity in its district posted a sharp decline in July. Notably, indexes for current and future activity took a dive, falling deeper into negative territory.

As an early, albeit incomplete estimate for July business activity, the results certainly paint a worrisome profile. But note that the previously released data for the New York Fed Manufacturing Index reflects a somewhat more upbeat (or at least mixed) picture. For this Fed district, current manufacturing conditions rebounded to a slightly positive reading, although that was offset by a decline into negative terrain for expected conditions.

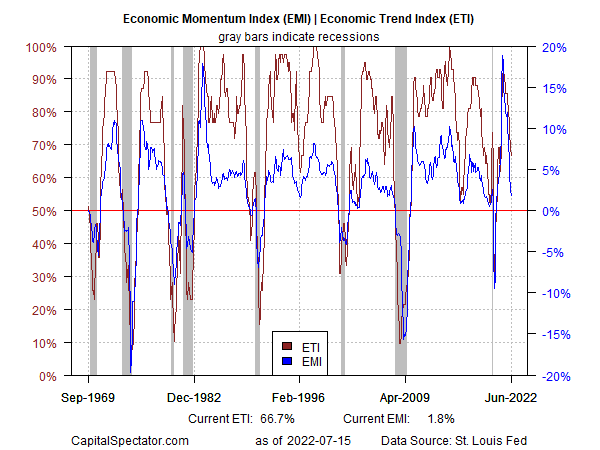

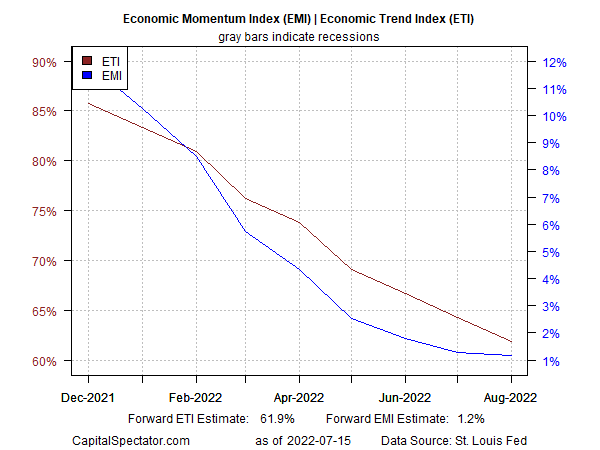

Looking at a broader set of US economic data still reflects growth in terms of modeling business-cycle conditions. As reported in this week’s edition of The US Business Cycle Risk Report, a pair of proprietary indicators continue to show the expansion is slowing but at a pace that still reflects modest growth, as shown in the chart below.

The growth trend appears set to hold above the trigger points that mark recessions. (Looking beyond the next couple of months is far more speculative.) Using an econometric model to estimate forward values for the two business cycle benchmarks hints at the possibility that the slowdown may stabilize in August, per EMI (blue line).

What we do know for sure is that the US macro trend continues to slow, based on data published to date. We may be approaching the point of no return re: a new recession, but we’re not there yet. That said, the next few weeks could be decisive, one way or another, as the forces of growth and contraction play out in the next round of economic updates.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment