MF3d/E+ via Getty Images

Addressing My Previous Analysis

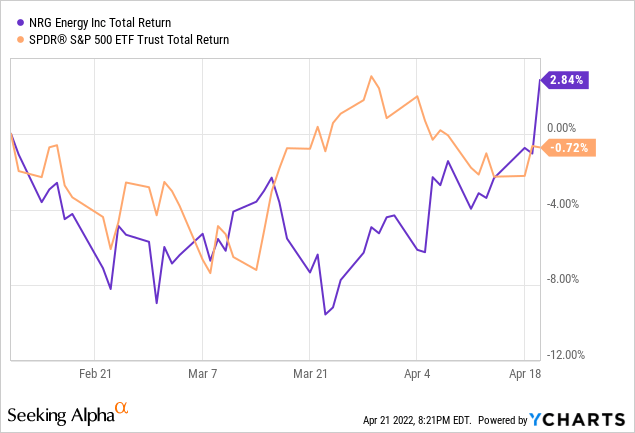

Since my last dissertation, NRG Energy (NYSE:NRG) shares have slightly outpaced the market, returning -2.84% vs. the S&P 500’s -0.72% return.

In my article, I suggested shares were 11% undervalued, with a share price of $44.12, and continue to believe that shares are underappreciated by the market. After the company reported Q4-21 earnings, however, I am further encouraged by the company’s revenue growth and progress on its debt reduction. I’ve therefore raised my price target to $46.32 (I will discuss my valuation further below). In a nutshell, I continue to see the company’s $1B share repurchase program as a buffer to its current valuation, guidance remains strong, and I am optimistic the company will be able to partially pass on costs to its customers, offsetting the majority of the impact from higher gas prices. This is in direct contradiction to BofA who came out with a note downgrading the stock from ‘buy’ to ‘neutral’ today with a $43 PT.

Q4-21 Earnings Update

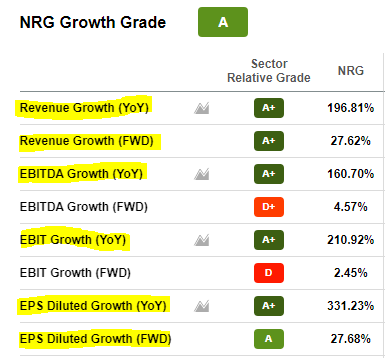

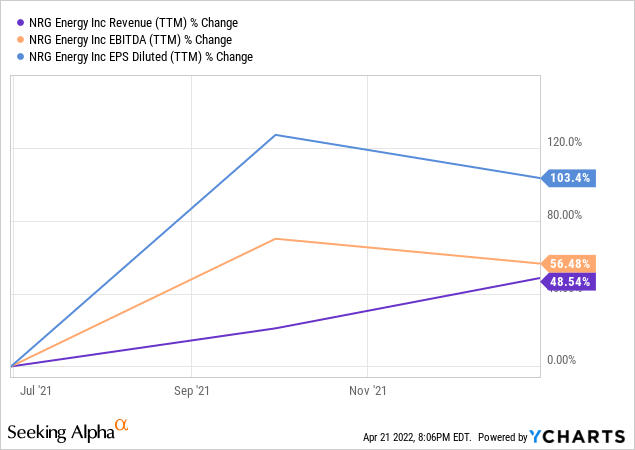

NRG’s Q4-21 earnings were strong, reporting revenue of $26.99B and GAAP EPS of $8.93. Growth continues to remain strong as outlined in the chart below.

NRG Growth Grade (Seeking Alpha Premium Feature)

Seeking Alpha has maintained its “A” score for its growth grade and the highlighted metrics prove why the score is warranted. Revenue Y/Y (on a TTM basis) grew 196.81%, EBITDA grew 27.62%, and diluted EPS grew 331.23% Y/Y.

While these metrics remained strong, EBIT and EBITDA forward growth rates remain grim and are scored in the “D” range due to the expectations that profitability will be largely hit from higher gas prices. This was outlined in Bank of America’s recent note which will be addressed below.

A Note On BofA’s Recent Downgrade

BofA recently downgraded NRG shares from ‘buy’ to ‘neutral’ based on growing concerns that the recent volatility in gas prices will lead to higher costs. My rebuttal to this claim comes from NRG’s Q3-21 earnings call in which management stated that “we want to make sure that we maintain that we pass some of the cost, but not all of the cost. Obviously in the mid and the long-term, you can pass all the costs.” While NRG does not want to pass the entire cost right away to customers (which would create a bill shock and scare customers away) management notes that in the long run, costs can pass through. Therefore, for investors with a long-term time horizon, while on a quarter-to-quarter basis margins could take a slight hit, the long run still remains bright for margin resilience.

Share Repurchases Remain Strong

In December, 2021, NRG announced a $1B share repurchase program that was put into effect immediately. Within that share repurchase program, $955M remains, representing ~10% of the company’s current market cap.

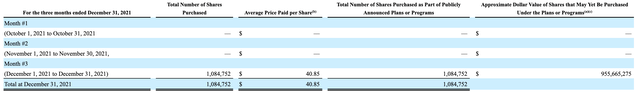

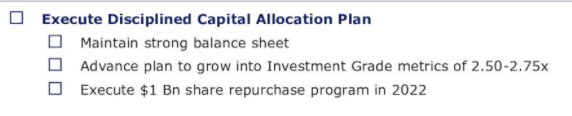

NRG Energy Share Repurchases (10-K SEC Filing)

The company noted in its Q4-21 call that it expects to execute the remainder of its share repurchases within FY22, as shown in its Q4-21 investor presentation below.

Commitment To Repurchase Shares – NRG (Q4-21 Investor Presentation – NRG)

Executing this $1 billion will provide a strong valuation buffer for current shareholders, limiting the possible downside for shares.

An Update On My Valuation

As I mentioned, I’ve upped my price target for NRG shares from $44.12 to $46.32 based on NRG’s impending spree of share repurchases that will continue in 2022.

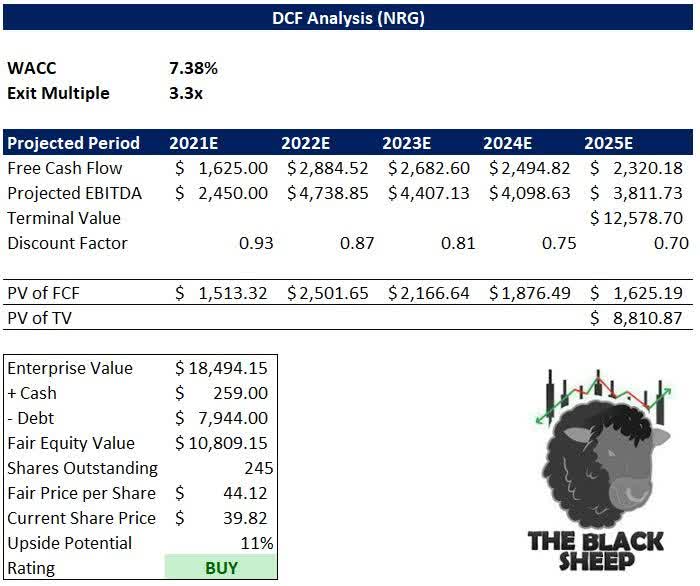

For those who have not yet read my previous report, I will insert my DCF model below.

DCF Model – The Black Sheep (DCF Made by author using own calculations)

As you can see, my fair share price for NRG is $44.12. The only tweak that I am making is a 5% valuation buffer given my outlook for further share repurchases in FY22. The 5% buffer comes from ~$500M in share repurchases I anticipate in 2022. This estimate is conservative given management has outlined in its Q4-21 investor presentation that it anticipates $961B of repurchases. This would represent a ~10% buffer. I have taken the mid-point, however, to remain conservative. Applying my 5% buffer to the pre-calculated $44.12 price target and I derive a fair share price of $46.32. This was not implied in my previous valuation as Q4-21 results had not been released yet. Now that it has and I’ve learned the company has a vast amount of shares to still repurchase in FY22, I am revising up.

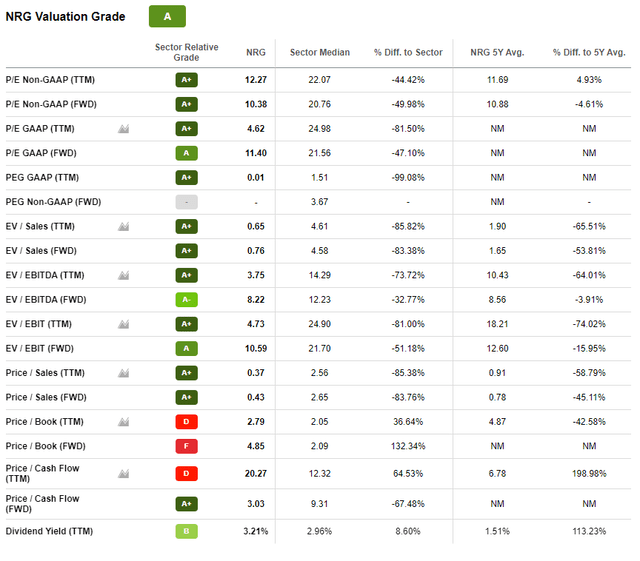

Seeking Alpha seems to agree, scoring NRG an “A” valuation grade.

NRG Valuation Grade (Seeking Alpha Valuation Grade)

As you can see, NRG is trading at a steep discount to its peers on a multiple basis. The company has a P/E of 12.27, 44% below the sector median. Additionally, the company’s price/cash flow is well below the sector median of 9.31.

Debt Reduction

In terms of debt reduction, NRG Energy reduced its total debt by $752M Y/Y.

| Total Debt 2020 | Total Debt 2021 |

| 9.039B | 8.287B |

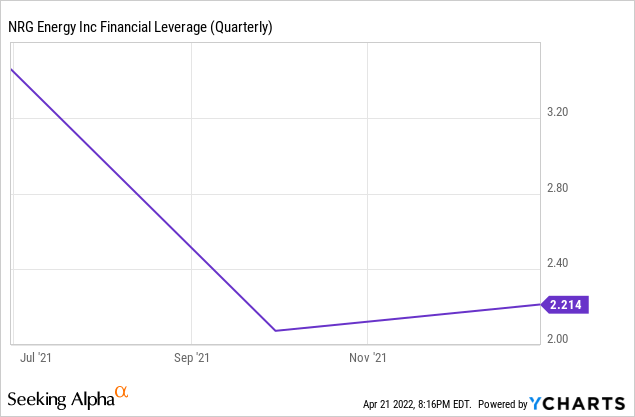

This reduction has allowed the company to deleverage as shown below.

Given leverage has decreased and my future outlook for free cash flow remains strong, NRG should have no issues returning capital to shareholders.

Notably, the company should be able to handily meet its goal of 7-9% annual dividend increases for the foreseeable future. This also increases the prospects for further share repurchases after the current $1B program expires.

Conclusion

Overall, NRG Energy remains an undervalued energy stock that is poised to breakout in 2022. Wall Street is pessimistic about the company’s margins, but I remain optimistic that management will deliver in the long run. I reiterate my ‘buy’ rating despite BofA’s recent constructive note, with the belief that the recent pullback is a buying opportunity for the stock. I assign a fair share price of $46.32, representing 16.5% upside from current levels.

Be the first to comment