Frazer Harrison

Investors couldn’t have asked for more from Ulta Beauty’s (NASDAQ:ULTA) Q3 results. The company delivered strong revenue growth, operating margin expansion, and double-digit earnings growth. Comparable sales increased a jaw-dropping 14.6%, of which price increases contributed ~500 basis points. Sales increases have been significantly outpacing inflationary cost pressures, and the company can boast of having one of the strongest operating margins in all of retail. These results reaffirm our belief shared in a previous article that Ulta Beauty is one of the most resilient retailers out there.

The brick-and-mortar side of the business was particularly strong, with store traffic trends accelerating this quarter and exceeding pre-pandemic levels for the first time. As a result the company plans to continue with an ambitious plan to open about 100 stores over the next two years. This is a meaningful expansion to the current base of 1,343 stores. The company made some progress on store openings during the third quarter, opening 18 new stores, relocating one store, and remodeling eight stores.

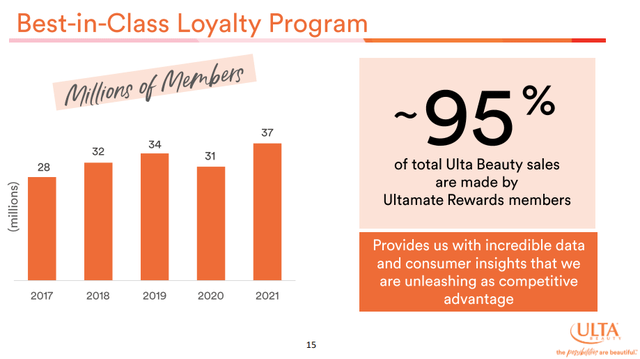

The strong results show not only the resilience of the beauty category, but also highlight the strong competitive moat the company has that has allowed it to gain market share. One of the competitive advantages the company has is its very successful loyalty program which ended the quarter with a membership of 39 million members, 9% higher than the third quarter last year. This program increases loyalty and provides the company with very valuable data and consumer insights to make better decisions.

Ulta Beauty Investor Presentation

While results for the quarter were excellent, it did sound during the earnings call like management was trying to temper expectations with respect to the fourth quarter as well as 2023. For example, management pointed out that the gross margin benefit from the timing between price increases versus the inventory change will probably be less significant next year. Other headwinds to consider include a strong upward pressure on wages, significant company investments on strategic initiatives which the company plans to ramp-up, and an increase on shrink. With respect to this last item, the company pointed out that when times get tough, shrink goes up. It should also be noted that the 6% to 8% guidance for the fourth quarter means the company is anticipating some deceleration from what it was able to deliver in the third quarter.

Q3 2022 Results

For the third quarter net sales increased 17.2% to $2.3 billion, and comparable sales increased 14.6%. Operating margin increased to 15.5% of sales, and diluted EPS increased 35.5% to $5.34 per share. Other revenue increased $20 million, primarily due to credit card income growth, higher loyalty point redemptions, and an increase in royalty income from the company’s partnership with Target (TGT).

Financials

Gross margin increased 160 basis points to 41.2% of sales compared to 39.6% last year. The increase was mainly the result of operating leverage, other revenue growth and higher merchandise margin, partially offset by higher inventory shrink. Meanwhile operating margin increased 130 basis points to 15.5% of sales compared to 14.2% last year. Diluted GAAP earnings per share increased 35.5% to $5.34 per share compared to $3.94 per share last year. Ulta ended the quarter with $250.6 million in cash and cash equivalents and basically no long-term debt.

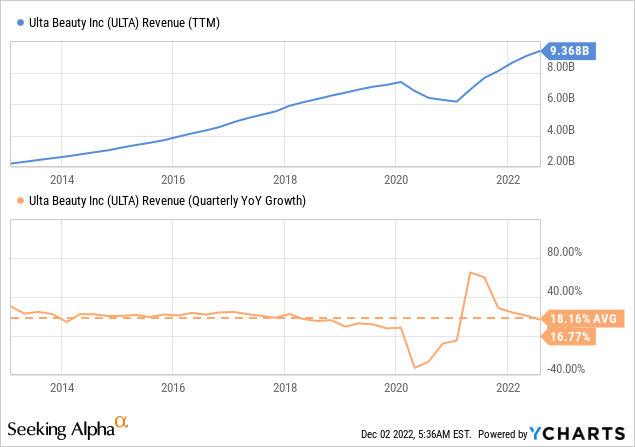

Growth

Ulta’s sales and earnings growth are significantly outperforming its financial targets. It is also clear that the company is back on its previous growth trend after the significant disruption brought by Covid. The sales increase of 17.2% is close to the 18.1% average of the last ten years.

Guidance

The company told investors to expect net sales for the year to be between $9.95 billion and $10 billion, with comparable sales growth of between 12.6% and 13.2%. This guidance reflects an expectation that fourth quarter comparable growth will decelerate compared to the third quarter to between 6% and 8%. Diluted earnings per share for the year are expected to be between $22.60 and $22.90.

Valuation

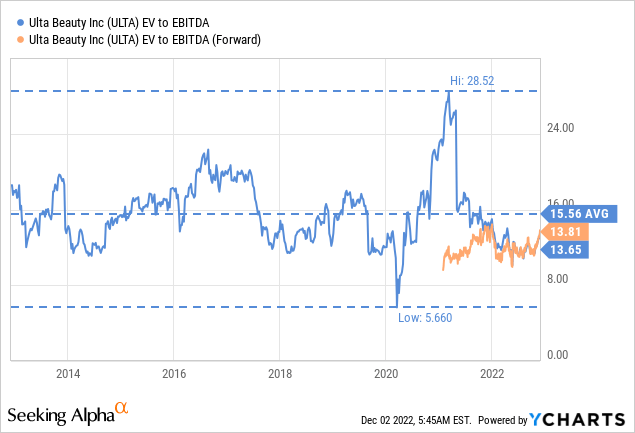

Trading with a p/e ratio of ~22x, shares are not exactly a bargain, but given the quality of the company, its growth, and solid balance sheet, we think the multiple is well deserved. The EV/EBITDA multiple remains somewhat below the ten year average of ~15.5x.

Based on guidance for fiscal year 2022, and assuming 9% earnings growth for the next ten years, 3% terminal growth, and discounting everything at a 10% rate, we estimate the fair value of the future earnings stream to be ~$459 per share. We therefore believe shares are currently trading close to fair value, and don’t have much in the form of margin of safety. Still, if the company continues to deliver strong growth with healthy margins, long-term investors can do relatively well.

| EPS | Discounted @ 10% | |

| FY 22E | 22.60 | 20.55 |

| FY 23E | 24.63 | 20.36 |

| FY 24E | 26.85 | 20.17 |

| FY 25E | 29.27 | 19.99 |

| FY 26E | 31.90 | 19.81 |

| FY 27E | 34.77 | 19.63 |

| FY 28E | 37.90 | 19.45 |

| FY 29E | 41.31 | 19.27 |

| FY 30E | 45.03 | 19.10 |

| FY 31E | 49.08 | 18.92 |

| FY 32E | 53.50 | 18.75 |

| Terminal Value @ 3% terminal growth | 764.32 | 243.54 |

| NPV | $459.54 |

Risks

The company has a solid balance sheet, strong profitability, and healthy growth that mitigate potential risks. These include a potential recession next year, and a consumer that is facing high inflation and a weakening economy. Still, the biggest risk we see for Ulta investors is that the current valuation already reflects an expectation of growth continuing for several more years. While we currently view shares as fairly valued, we don’t believe there is much in terms of margin of safety, especially if the current high growth meaningfully decelerates.

Conclusion

Although Ulta Beauty delivered an impressive third quarter, investors should temper expectations for Q4 and 2023. We continue to believe that Ulta is one of the most resilient retailers, and this quarter proved again that Ulta is a great operator with competitive advantages. In particular, it was great to see very healthy growth in its loyalty program. Looking forward, we think gains will be a little more difficult for shares, given that they already appear fully valued and without much in terms of margin of safety. Still, if the company continues to deliver, we see potential for long-term investors to earn a decent rate of return.

Be the first to comment