gorodenkoff

Investment Thesis

DigitalOcean (NYSE:DOCN) has a high quality offering in the small business cloud computing market. The company has strong growth and a high quality self service business model. But the company’s growth is slowing. I’m also concerned about high stock-based compensation and an unusual amount of buybacks. I’m not buying for these reasons, even though I’m bullish on the company’s core business.

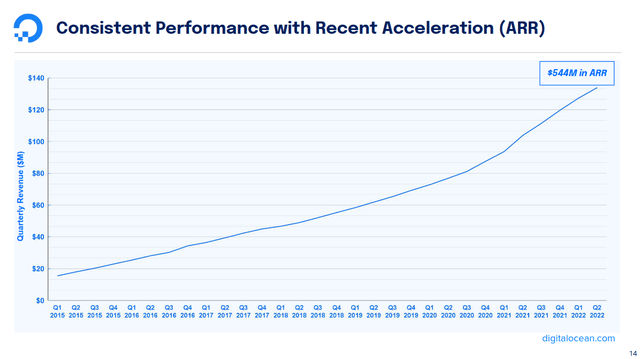

Top Line Growth Remains Strong

DigitalOcean has continued to grow its top line at a solid rate. The company grew its revenue by almost 30% year over year. The company is continuing to grow even in an unfavorable environment. The business seems well on its way to achieving its target of $1 billion in revenue by 2024.

DigitalOcean Q2 2022 Earnings Presentation

The company has also hit a turning point in its profitability. The company expanded its margins significantly. During the last quarter, gross margins increased from 58% to 65% year over year. The company’s non-GAAP operating margin almost doubled. Most importantly, the business has started to become meaningfully free cash flow positive.

The business’s rate of growth has slowed year over year. Management attributes this to a slowdown in Europe and Asia. Additionally, the company has a significant number of blockchain customers. These customers have higher churn levels due to unfavorable crypto market conditions.

Focus on Small Businesses

What sets DigitalOcean apart from its competitors is its focus on small users. Many other cloud companies focus heavily on recruiting enterprise clients. DigitalOcean specifically targets individual developers, startups, and small businesses.

The company has lower revenues per user. This means it can’t spend a lot acquiring individual customers. Because of this, the business has focused on a self serve acquisition model. The company uses its ecosystem and content marketing to bring in new customers. Its community education website generates approximately 3.5 million monthly visitors. During the last quarter, the company acquired JournalDev, another developer education website. This should add another 9 to 10 million monthly visitors.

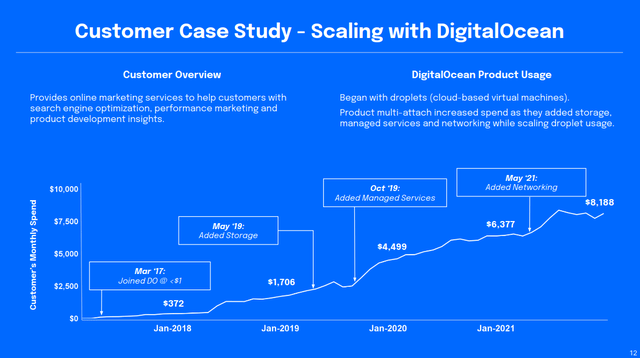

This customer acquisition engine is important to the company’s strategy. The business brings in individual developers and startups at their earliest stages. DigitalOcean benefits as customers build and scale out their products. As clients’ ventures succeed, they spend more on infrastructure and boost DigitalOcean’s ARPU.

DigitalOcean Q4 2021 Earnings Presentation

These let the company run a very efficient sales and marketing operation. During the last quarter, the company spent less than 14% of revenue on marketing. Management described this efficiency on their last earnings call.

Let’s look at the payback period for customer acquisition. Using Q1 2022 non-GAAP sales and marketing expense of $15.7 million and net new ARR in Q2 of $20.5 million combined with improving gross margins to 65% of revenue, we are paying back our customer acquisition costs in less than six months. And that’s happening while we are ramping spend to build our sales capabilities. This efficiency is paramount in our ability to sustain our revenue growth targets and drive margins higher over the course of not just this year, but for years to come.

This customer acquisition model is impressive. But this type of strategy can also be unpredictable. Unlike traditional sales, it can be difficult to scale up these growth channels. I think this is why the company has recently put together an outside sales force. They can directly target later stage customers. This is a more scalable channel, and should help the company further boost its ARPU. Growth from direct sales channels almost doubled sequentially during the last quarter.

Expanding ARPU and Valuable Customers

DigitalOcean’s customer growth hasn’t been especially impressive. The business only reported middle single digit increases in 2020 and 2021. During the last quarter, management stopped reporting total users entirely.

But the company has shown that it can consistently expand its average revenue per user. At the end of 2019, the company generated $40.16 per user. Since then, the company’s ARPU has jumped almost 80% to $71.76. The business has a healthy net dollar retention rate of above 110%.

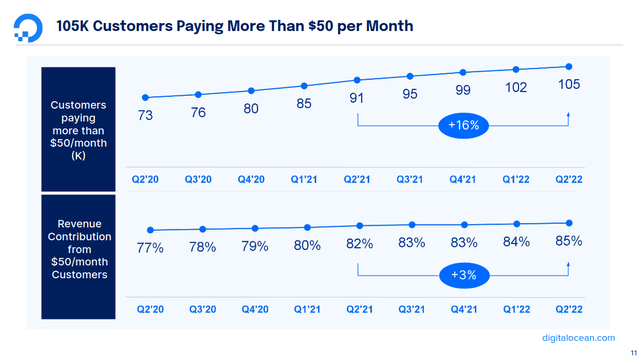

DigitalOcean Q2 2022 Earnings Presentation

Users spending more than $50 per month have increased significantly. Customers in this cohort expanded by 16% year over year. Growth from this segment has outpaced total user growth for some time.

The company is taking steps to further boost this revenue. It increased prices across infrastructure offerings at the beginning of the third quarter. This should further boost the company’s ARPU and its margins.

Not An Enticing Valuation

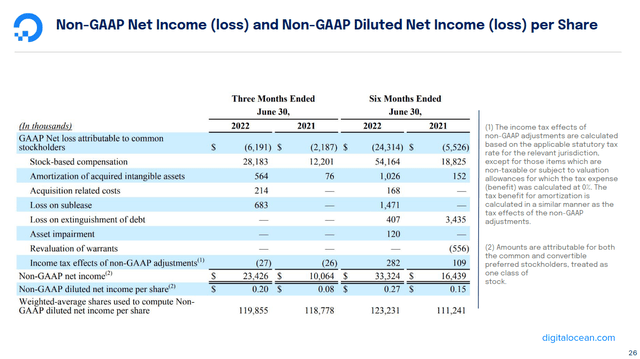

DigitalOcean’s fundamentals are solid. But its shares are trading at an expensive valuation. The company has guided for non-GAAP earnings per share of up to $0.75 this year. That gives the company a forward P/E of 54 times and a forward P/S of 8.5 times. That’s expensive, and I’d need the business to be very strong for me to consider buying a company with this profile.

DigitalOcean Q2 2022 Earnings Presentation

Unfortunately, there are some more valuation issues here. I think the company’s non-GAAP metrics make some questionable adjustments. Management’s adjusted earnings metrics exclude stock-based compensation. During the last quarter, the company paid out $28.2 million in shares. That’s up by over 130% year over year. At the current run rate, the company is set to pay out $113 million in stock-based compensation, or 20% of management’s revenue guidance. This alone would more than offset any profit the company would otherwise make.

The business is slightly free cash flow positive. But this is also overshadowed by the company’s unusual capital allocation policy. Since its IPO, the business has spent almost $925 million buying back its own shares. I think this is strange for an unprofitable growth company trading at an expensive sales multiple.

The business still has a healthy amount of resources. Its debt is now higher than cash on hand. But the debt is made up of 0% interest convertible notes that are not due until 2026. It’s not an immediate concern.

I understand that the growth channels the company relies on are more difficult to scale. But I think it’s concerning that a growth company like this one can’t find a better way to invest its cash.

Final Verdict

DigitalOcean has a solid business model and a strong customer acquisition model. But it seems likely that growth will slow. High stock-based compensation continues to be an issue for the company. I don’t really like how the company is choosing buybacks over growth. I think these are serious headwinds for the company.

For these reasons, I’m waiting to buy until there’s more clarity on the company’s future. I specifically want to see the company’s direct sales results. I also want to see the company’s preliminary 2023 guidance. Management intends to include it in their next quarterly report. Until then, I’m staying out even though I’m generally bullish on the company’s fundamentals.

Be the first to comment