sankai

Dear readers/subscribers,

Since my last article on BE Semiconductor (OTC:BESIY), the market has traded mostly flat at roughly 0.85%. BESI on the other hand, has advanced or rebounded nearly 40% since that particular piece on September 3rd, making it an excellent sort of buy after long weeks and months of the company trading in negative territory.

The time has come for an update – and we’ll see what the company, at this time, is able to offer us.

I say that BESI offers a great deal – but that the company is now too expensive.

Revisiting BESI – An upside worth looking at with a 40% recovery

BESI has been interesting and undervalued for going on 7-8 months at this point. Even the latest recovery doesn’t take away from what BESI offers its investors, at least not in the long term.

The past 3 years have seen me shifting my investment approach quite a bit. From being reasonably open to speculative plays in large portions of my portfolio, my mind is mostly closed to them at this time, in favor of companies that may not offer the sort of yield many people are looking for – but offer the safety that everyone is looking for.

In layman’s terms, I’m accepting lower dividend yield rates in favor of higher fundamental safeties. Compared to my 2017 portfolio, my portfolio-wide yield is down nearly 0.8%, despite dividend growth rates that are fairly impressive.

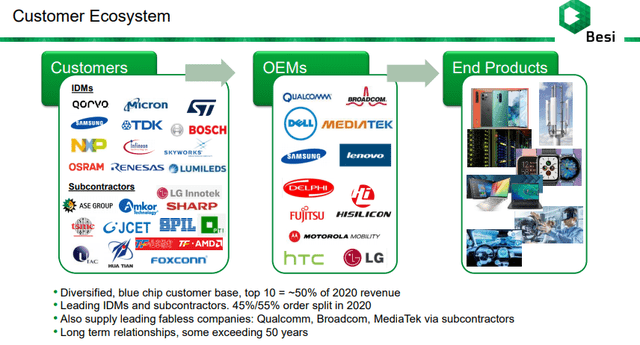

BESI is part of this trend. The company has everything that I look for in a play such as this. BESI is an assembly equipment supplier, a role that’s absolutely crucial to the entire semi industry. Despite being relatively unknown, it has a #1 and #2 in some key markets, and boasts, according to company info, a market share of no less than 32% in terms of addressable market share (not the market share the company actually has).

To put it simply, without going into specifics, the modern semiconductor world could not operate without the processes or the equipment that BESI and some of its nearer peers offer. And the company’s customer lists confirm this.

In its portfolio, you’re looking at die attaching, packaging, and plating, with strategic positioning in the substrate and wafer-level packaging. 75% of the company’s systems are used for advanced packaging applications.

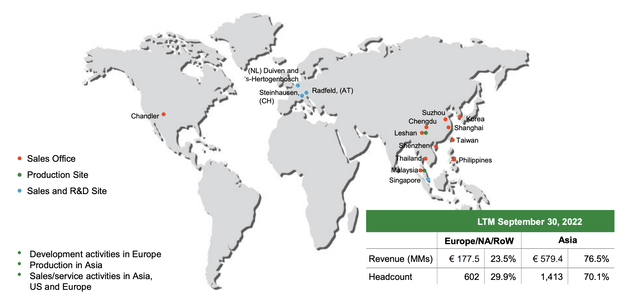

The company’s operations can be found across the world, with factories or offices in 6 countries. As of 2020, the company has 1901 employees, and it’s headquartered, as the N.V. suggests, in the Netherlands.

A few notes for BESI

- The dividend payout ratio can’t be considered like other companies. The company considers its high P/O, near 97% average on a 5-year EPS basis, an advantage and a positive. The downside of course is that in times of volatility, the dividend will be right-sized to the company’s EPS, as opposed to a steady tradition.

- The company’s products/machines essentially allow other semi companies to move their products to the next level of interconnection. As you might expect, this is an absolutely crucial portion of the market.

- The company lacks any S&P Global credit rating, or similar.

- Smaller companies can be hard to gauge in difficult times, due to these trends.

At first glance, it might not fulfill the “safeties” I speak of – again, I say it does because of its fundamentals. I have poured hours and hours of looking through financials and models, and there are very few overall risks, beyond what macro and the sector specifics tell us.

Its financial metrics can be compared to many larger peers that it competes against. The absolute majority of its revenues are derived from Die attach operations, with 18% of revenues coming from plating and packaging.

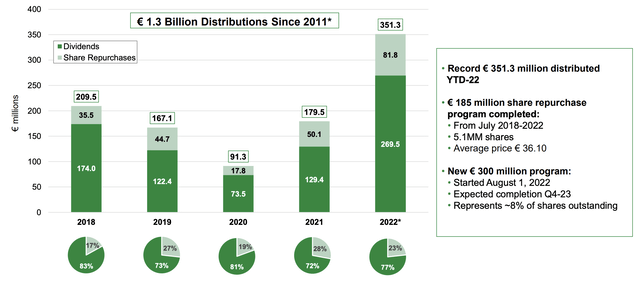

The company has a solid history of capital allocation and value creation. It’s outperformed broader indices both on a 5-year and 3-year basis, even with the current share price trend, and has spent over €1.3B on dividends and repurchases since 2011, representing a 25% revenue allocation. A company such as this needs to push most of its earnings towards R&D – and this is what BESI does.

In the risk portion of the camp, we have the company’s high exposure to APAC.

However, nothing can take away from the company’s through-cyclic earnings stability, with solid overall gross margins. The company has improved these from 34% to nearly 60% in less than 17 years, and even 2022E doesn’t see any expected GM impact that would send it down.

Rather, recent results confirm current margin guidance, and for it to come in close to 60% despite across-the-board cost increases. Price increases have seen the company’s net margin to stay intact, and dividend forecasts call for the next year to see a significant yield increase to the company.

In terms of chip macro, we’ve seen a volatile couple of years, and its uncertain at this point how far “down” we’ll go. COVID-19 and escalating US-China trade conflicts brought the company upward, and the past few years has seen CapEx hikes from Fabs and things like the memory inventory correction in July really wreak havoc with the market. This has resulted in downward revisions for the assembly market for both 2022 and 2023E, before growing double digits in 2024.

The company forecasts a revenue decline of 4% in the coming year, and unclear trends for 2023E at this time, as the correction takes hold. BESI’s own downcycle began in 2Q22 and is based on decelerating GDP, increased inflation, capacity issues, lower demand in high-end mobile, lockdowns and growth issues in China, supply chain disruptions, and the continued conflict-filled macro.

On the plus side, and making sure that sales are staying relatively solid, we have a working automotive market, a good iOS smartphone cycle, and 47 fabs coming online in the next three years, all needing the products that BESI brings to market.

Let’s see how this influences the valuation for the market leader in die attach and advanced die placement.

BESI’s Valuation

This is not the sort of company you want to buy at expensive multiples when it’s everyone’s darling.

This is the sort of business you want to buy when everyone is telling you what garbage the company is – and you know your stuff.

That’s why I was loading up on BESI’s native shares back during the past few months, and why I haven’t bought in a little over a month at this point. BESI not that long ago traded at multiples of 13.5x P/E. That’s a trough sort of valuation for this company.

I did not expect the company to bounce the way that it did – and it goes to show you that the market can be incredibly volatile and uncertain as to when and how it goes up, and then down again.

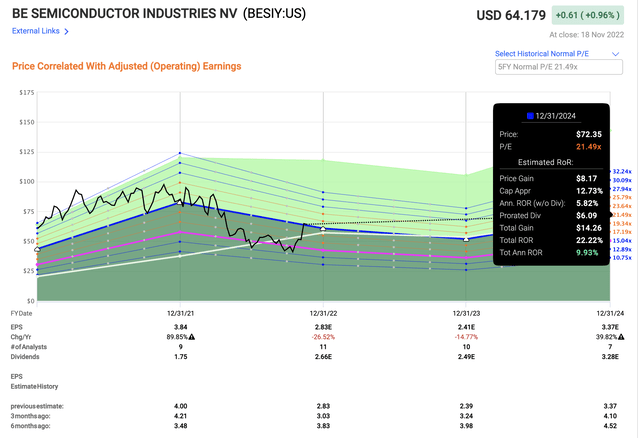

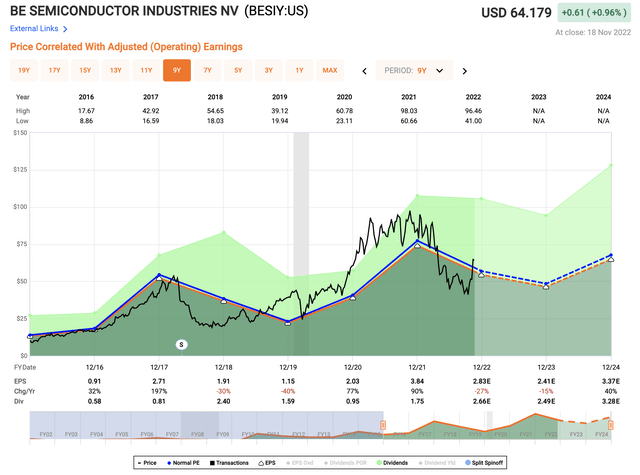

The market overreaction this time puts BESI above its premium in a time when earnings are expected to go not up, but down. This graph illustrates that fairly well.

Note the cycles. Note the way the company moves from ups to downs and back again.

Current company EPS forecasts call for BESI’s revenues to take a bit of a tumble in the coming years before going back up. This means that as a whole, the company is expected to generate 22% RoR on a 21.5x normalized P/E premium at 2024E, but it also means that we’re going through a negative cycle before this perhaps materializes.

Of course, the recovery may come sooner – but I prefer to err on the side of safety. At current valuations and trends, BESI is trading at a “full” valuation for this year’s results, and at an above premium for the next year at least.

Such pressure, if it materializes, can influence the share price to take another tumble – and another opportunity for a close-to-15x P/E or below 15x P/E investment level.

F.A.S.T graphs BESI Upside (F.A.S.T graphs BESI Upside)

You might look at this and wonder if it could not be time to rotate or reinvest part of the position here. I would say that is a very good consideration to start looking at this point. We’re still in a fluctuating market, and despite BESI being a very fundamentally attractive business with sound forecasts, a 30-40% RoR as I have on parts of my position isn’t something that should be ignored, if that money can generate equally safe returns at better valuations elsewhere.

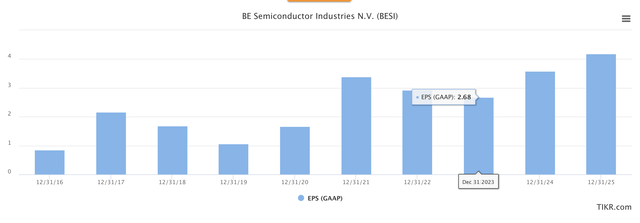

The current forecasts in terms of earnings look like this – downcycle followed by significant upcycle, though I personally expect things to be more choppy than this.

BESI Forecasts (BESI Forecasts)

Deciding whether to stay in investment and “weather” the downcycle is a question that’s easily answered if you’re in the red. I don’t sell quality at a loss – ever.

But if the situation is reversed and if you’re in the green – in my case 37% position-wide with FX included – it becomes tricky. Because I know that I could reinvest this capital, or parts of it, at positions at far cheaper multiples than 20x P/E in a downcycle, with a better near-term upward potential, as well as a higher yield. At the same time, BESI isn’t all that “overvalued”. I would call it fairly valued here.

Valuation targets somewhat confirm this. We’ve gone from a triple-digit €100/share PT back in March, to a €50-70 range for BESI from 10 current S&P Global analysts, coming to a current average of €67. The remaining couple of euros, to me, are a rounding error. The company is less “undervalued” here than it has been for over a year – and I would agree with that general assessment.

Just as the market is prone to overreaction in the negative, so can the market bounce up way “too fast”.

I believe that is what we’ve seen at this particular time.

My last stance for this business was a “BUY”.

I’m switching to a “HOLD”.

My last PT for the ADR was $65/share, and the company has touched this a few times in the last few days. This is still at a premium, allowing for the company to grow to slightly beyond that 15X P/E, but it’s well below any sort of valuation that’s currently the average for analysts.

But above this, investors need to ask themselves if they’re willing to hold BESI through a downcycle. If you’re willing to take the risk of a market reversal downward when more negative numbers come in the next few years, it shouldn’t be a problem.

Me, I’m considering at least reinvesting part of my position here – perhaps in Infineon (OTCQX:IFNNY).

For now, BESI is a “HOLD” for me.

Thesis

My thesis for BESI is as follows:

- BESI is a class-leading and market-leading company in the semi-sector, with several advantages over peers and similar companies. It has excellent RoR and a good yield.

- At the right valuation, BESI represents a solid “BUY”, and I’ve been loading up on BESI since past March.

- However, the current valuation calls for a “HOLD” for the company, my PT is $65/share.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment