StockByM/iStock via Getty Images

Shares of Clipper Realty (NYSE:CLPR) have performed slightly better than with the broader REIT market as tracked by the Vanguard Real Estate index/ETF (VNQ) thus far in 2022. Though Clipper has benefitted from sharply rising New York apartment rental rates in its market rate apartments, overall NOI growth has been sluggish due to Clipper’s exposure to office and rent controlled apartments. Meanwhile, I expect that Clipper’s efforts to sell its second largest property (Flatbush Gardens) will fall flat.

I estimate that Clipper trading near its NAV per share and believe that investors are better off purchasing higher quality, lower-leverage multifamily REITs and what I believe to be more attractive valuations.

Current results are mediocre compared to peers

Clipper’s 2022 results have significantly lagged the apartment REIT sector in 2022. While coastal multifamily REITs have seen 13-16% year-over-year NOI growth thus far in 2022, Clipper has reported year-over-year NOI growth of just over 7%.

It is important to understand that while Clipper derives the majority of its earnings from multifamily properties, less than half of Clipper’s total NOI comes from market rate multifamily properties. Class B office and a few retail locations which represent 25-30% of NOI. These properties have long-term leases (mainly to municipal government) and has seen flat revenue growth. Further, as discussed below, nearly 40% of its multifamily NOI comes from rent controlled properties (primarily Flatbush Gardens) which actually has seen a decline in 2022. As such, less than half of Clipper’s total NOI comes from market rate multifamily properties.

Contemplating a Sale of Flatbush Gardens

In September, it was reported that Clipper is looking to sell its Flatbush Gardens property for $425 million. Flatbush Gardens is Clipper’s second most valuable asset behind Tribecca House. While I believe a sale of Flatbush for $425 million would be a great outcome for shareholders, I doubt the property is able to fetch anything close to that amount given:

1. Following the significant increase in interest rates thus far in 2022, we are in the midst of a period of dislocation/price discovery in the multifamily space. Debt is less available than it was a year or even 3 months ago and rates are higher. This was echoed by every multifamily executive on 3Q22 conference calls. Now is not a great time to sell a multifamily asset.

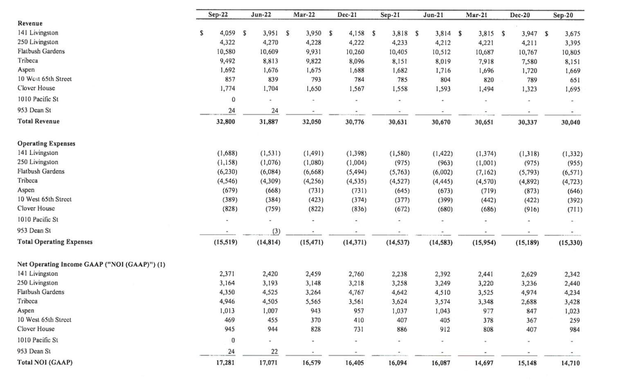

2. Flatbush Gardens is a rent controlled property. 2022 has been a tough year for rent controlled buildings in NYC. Management limited in its ability to raise rent (3.25%) which is a fraction of the ~15% increase in NYC market-rate residential rentals over the past year. To make matters worse, high inflation is causing the expenses of the property to increase faster than rental rates. As shown below, in 3Q22, operating expenses at Flatbush Gardens increased 8% while revenue grew just 2% causing net operating income (NOI) to fall over 6% (whereas market rate properties in NYC saw 16-19% NOI growth in 3Q22).

Results by Property (Clipper 3Q22 Supplemental report)

The $425 million reported price would represent a cap rate of 4.2%. While this may have been possible late last year or at the beginning of 2022, it is highly unlikely that any buyer would pay such a price for a rent controlled building in this environment (high inflation, high interest rates). Assuming 5.5% cap rate (still generous given that rent control subjects the company to inflation risk and impairs long-term growth), would suggest a $327 million value which is basically equal to the $329 million outstanding mortgage balance on the property.

Valuation

All valuation metrics suggest that Clipper is overvalued relative to multifamily peers. On the whole, Clipper trades at an implied cap rate of 5.7% which at first glance appears to be roughly in-line with coastal multifamily REITs which are trading between 5.5-5.9% cap rates. However, this universe of coastal multifamily properties has minimal exposure to onerous rent control (like Flatbush).

In addition, as noted above, 25-30% of Clipper’s NOI comes from Class B office space. Office valuations are much lower (higher cap rate) than residential. Consider that Class A NY Office REIT Vornado (VNO) trading at roughly a 9% cap rate. Then consider that Clipper’s assets are Class B (older, less amenitized, inferior locations) and worth less than Class A.

All-in, if I assign a 4.5% cap rate to Clipper’s market rate multifamily assets, a 5.5% cap rate to its Flatbush property, and a 7.5% cap rate to its office assets (very generous just for the sake of argument), I get an NAV per share of $7.90 which suggests just 3% upside from the current $7.67 share price.

Conclusion

I see Clipper as providing a poor risk/return here compared to the coastal multifamily REITs Essex (ESS), AvalonBay (AVB), and UDR (UDR) which I’ve recently written about and are better positioned for long-term growth while offering 30-45% upside from current levels.

Be the first to comment