alvarez/E+ via Getty Images

Investment Thesis

M/I Homes, Inc. (MHO) is a leading single-house builder in the United States headquartered in Columbus, Ohio. In this thesis, I will primarily be discussing the Q2 2022 results of MHO and its future growth prospects. I will also discuss the risks faced by the company at its valuation at current price levels.

Q2 2022 Results

MHO posted stellar second-quarter results, with outperformance on most parameters. Q2 2022 was one of the most profitable quarters in the company’s history. The company beat the market’s EPS estimates by a significant 26.5%, and the revenue was in-line with the market expectations. I believe the company has great momentum on its side, and it is on a solid growth trajectory, improving profitability even during the market slowdown. However, the company witnessed a 20% fall in new contracts for coming quarters, compared to Q2 2021, due to an overall slowdown in the real estate market. I believe this slowdown is temporary with respect to the real estate markets, and we can soon witness the industry pacing up after the recent slowdown.

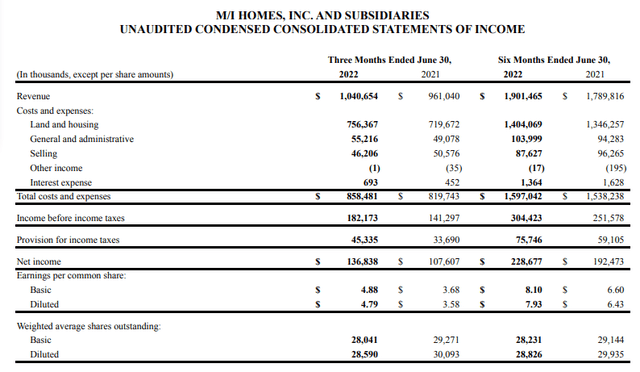

MHO reported revenue of $1.04 billion, an 8.4% increase compared to Q2 2022 revenue of $0.96 billion. I believe the primary factor behind the revenue increase was the increased average product price during the quarter. The company reported costs and expenses of $858 million, compared to $820 million in the same quarter last year, a rise of 3.6%. As per my analysis, the recent cost-cutting measures undertaken by the company are the major factor behind a low increase in the total cost and expense. MHO reported a record high Income before taxes of $182 million compared to $141 million in the corresponding quarter last year, a significant jump of 29%. The primary reason behind this increase was an increase in the revenue and a comparatively low increase in the total costs. The company reported a net income of $136.8 million, a 27% increase compared to $107.6 million in the same quarter the previous year. The net profit margins stood at 13.15%. The diluted EPS was reported at $4.79, a $1.21 increase over the Q2 2022 EPS of $3.58.

Robert H. Schottenstein, Chief Executive Officer and President, stated,

At a time of rapidly changing market conditions, we had a very strong quarter highlighted by record quarterly net income of $137 million, 27% better than a year ago, and a 34% increase in earnings per diluted share. These record earnings resulted in our return on equity improving to 27%. Our revenues increased 8% to a second quarter record $1 billion, with gross margins improving by 220 basis points to 27.3%, and SG&A improving by 70 basis points to 9.7%, all leading to a pretax income margin of 17.5%. Our backlog sales value at June 30 increased 9% to a second quarter record $2.7 billion.

Overall, MHO reported a strong quarter. Despite the decrease in the number of homes sold, the company still managed to improve its revenue and profit. The product price rise helped the company to maintain solid profitability even in the worsening real estate market. I believe by the end of FY22 the company will see a rise even in the organic revenue, that is, the number of houses sold. The housing and real estate market is consolidating currently, but I believe it will soon bounce back. I estimate FY22 EPS to be in the range of $16.70-$16.80. MHO is trading at a very attractive valuation at current levels, and with this strong performance in Q2 2022, I believe the company will show a massive upside in the share price in the coming quarters.

Key Risk Factor

Labor and Material Shortage: Construction delays, labor strikes, a lack of skilled subcontractors and construction workers, and the absence of suitable utility infrastructure and services are all issues that occasionally affect the housing construction business. Because of delays in availability or price changes for construction supplies, the firm may not be appropriately funded or insured if it must rely on regional subcontractors. Due to the current strong home customers’ demands, these risks and labor shortages may be more significant. These conditions could cause delays in the development and construction of communities and raise the price of building homes and communities. The increased cost of the raw material and labor can have an adverse effect on the margin of the company, which can lead to weak results. However, the company has taken steps to mitigate this risk by employing effective cost-cutting strategies in the company-wide operations.

Valuation and Quant Rating

The quant rating and factor grades of the seeking alpha support my investment thesis. It shows that the company is trading below its intrinsic value according to the factor grade the company has A+ in valuation. Factor grades also tell us that the company has strong growth prospects in the future as it has an A in growth. According to the quant rating of the seeking alpha, the company has a strong buy rating. The company is ranked 3rd in the housebuilding industry and 8th in the sector.

The company currently trades at $45.99 with a market capitalization of $1.26 billion. The company is trading at a forward PE multiple of 2.80x. The company is trading at a cheaper forward PE multiple of 2.80x against the sectorial median of 12.68x. The company has recently reported a strong quarterly result, and I believe it is well positioned in the market as it has low debt levels. The company has strong growth prospects, and it already has significant backlog orders. After considering all these factors, I believe the full-year EPS of the company to be $16.80, which gives the leading PE multiple of 2.7x. I think the company can soon gain momentum and trade at a higher PE multiple of 3.9x, which gives the target price of $65.52, representing a 43.81% upside from the current price levels.

Conclusion

The company has recently reported a solid Q2 FY2022 results. The results are even more impressive if we take into consideration the slowdown in the housing market. MHO is significantly undervalued at current price levels. The company has effectively managed the risk that it faces. I believe MHO has a great risk-reward profile. I assign a buy rating for MHO after taking into consideration all the risk and growth factors.

Be the first to comment