FinkAvenue/iStock Editorial via Getty Images

2Q22 summary

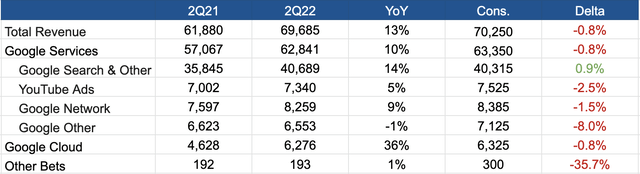

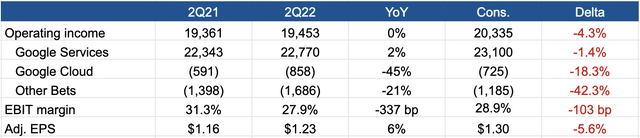

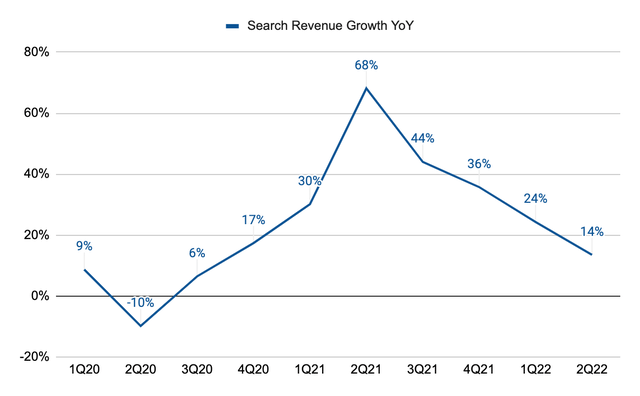

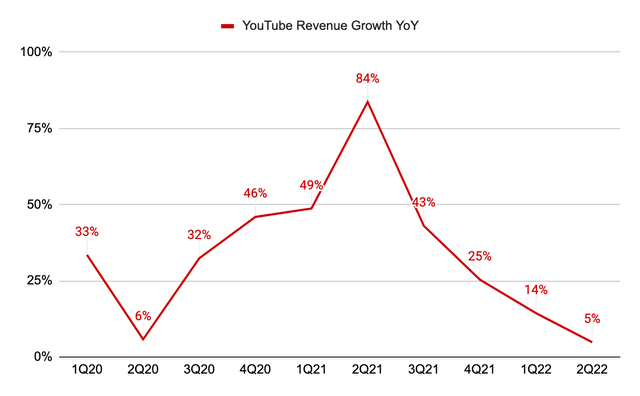

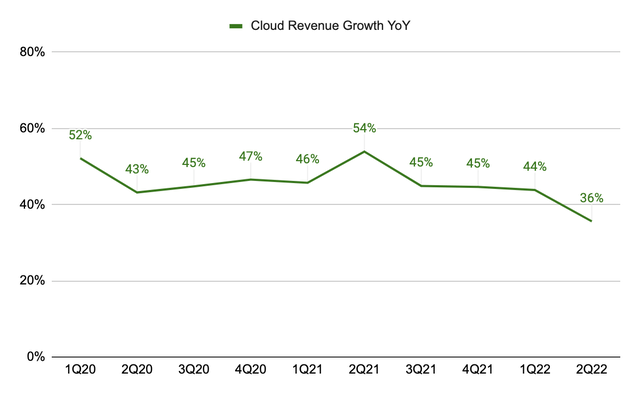

Google parent Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) reported 2Q22 results that mostly missed Street estimates with total revenue of $69.7 billion (+13% YoY) against a tough 2Q22 comp where top-line saw 63% growth. In advertising, only Google Search met expectations with revenue of $40.7 billion (+14% YoY vs. +68% in 2Q21), driven by recovery in both the travel and retail sector. On the other hand, YouTube and Network missed estimates by delivering a mere 5% and 9% YoY growth rate, as management noted a pullback by advertisers in light of the current macro backdrop. Google Cloud was largely inline with consensus with revenue of $6.3 billion which grew 36% YoY. However, the business unit continued to remain in the red with $3.3 billion in TTM operating loss while the team remained committed to investing aggressively in the cloud opportunities.

Moving down in the P&L, operating income was flat YoY while EBIT margin of ~28% compared negatively to 31% in 2Q21, driven by higher expense growth in R&D and sales & marketing. Operating margin for Google Services was ~36% vs. $39% last year. While Google Cloud profitability was materially better than 2020 levels, Q2 EBIT margin of -14% didn’t see much improvement over -13% a year ago. Going forward, management expects to slow down the pace of hiring and will focus primarily on critical roles such as engineering. As a result, headcount growth will likely moderate in 2023.

Search growth appears robust despite macro challenges

Despite signs of macro weaknesses, Google’s search business grew 14% YoY to reach $40.7 billion in 2Q22, lapping an extraordinarily strong 2Q21 where revenue grew 68% YoY. The strength in Q2 was supported by travel (10-15% of search exposure per JPM estimates) and retail, where search demand for summer holiday destinations and shops open “now near me” saw upward momentum. Google Lens (a multi-search app allowing users to conduct searches with their smartphone cameras) now has over 8 billion monthly searches and will add a local search feature later in 2022. Further, online merchants will soon be able to upload 3D images of their products to Google Search.

In the current macro backdrop, Google Search’s Q2 growth compares quite favorably to Meta (META)/Snap (SNAP)/Twitter (TWTR)/Pinterest (PINS) at -1%/+13%/+9%/-1% YoY, indicating that in times of uncertainty, advertisers are more inclined to cut top-funnel budgets while keeping ad dollars that are geared more towards conversions. This is also evident in Amazon’s (AMZN) Q2 advertising revenue that saw 18% YoY growth. Note that both Google and Amazon have not been experiencing much impact from Apple’s IDFA vs. their social media counterparts, given most of the user activities take place within their own properties.

For Q3, Meta is guiding -6% revenue growth while Snap pulled its guidance and said (in July) that top-line growth was flat thus far in the current quarter. Though Alphabet management used the word “uncertainty” to describe its business outlook, my sense is that search advertising will hold up relatively better than other digital ad formats. During the 2008/09 recession, Google’s revenue growth (mostly search advertising back then) declined to just 3% in 2Q09, while Yahoo’s Display business declined by 13% in the same period (analysis here).

YouTube is slowing, but remains a strong AVOD asset supported by growing CTV demand

While the Street typically sees YouTube as an important growth engine and would find 2Q22 top-line growth disappointing (+5% in 2Q22 / +84% in 2Q21), the slowdown was well understood prior to Q2 earnings due to an insurmountable 2Q21 comp and underwhelming guidance from peers like Meta and Snap in response to weakening macro headlines (inflation, war, rate hikes). YouTube sales have missed Street estimates for several quarters in a row now as management have not been providing any concrete outlook, leaving analysts to the majority of the guesswork. While 2H22 comps will again be difficult as revenue grew 43% in 3Q21 and 25% in 4Q21, Street estimates are already on the conservative end.

On the bright side, YouTube Shorts are now watched by more than 1.5 billion monthly users and have more than 30 billion daily views. This alleviates some investor concerns over Tik Tok competition as the Chinese short-form video app is estimated to have reached 1.5 billion MAUs in 2Q22 and will likely reach 1.8 billion by the end of 2022. While still early, management saw YouTube Shorts monetization as encouraging. Additionally, YouTube TV has surpassed 5 million subscribers in Q2. In July, YouTube also announced a new partnership with Shopify to allow e-commerce integrations on the video platform. As linear TV continues to give way to connected TV, YouTube remains a favorable beneficiary with 2.5 billion monthly active users by estimate. The read-through from Netflix’s (NFLX) intention to move into advertising is also testament to the notion that CTV will have to be ad-supported (at least to a certain extent) as subscription-only models ultimately run out of new customers.

Cloud growth decelerated, while profits are yet to be seen

Google Cloud delivered 2Q22 revenue of $6.3 billion, up 36% YoY from +44% in 1Q22. Management noted that macro factors may be in play as customers are being more conservative on spend and taking longer to think about contract durations. Cloud operating loss of $858 million in Q2 was 18% below the Street’s $591 million. In 1H22, Cloud delivered total revenue of $12 billion (+39% YoY) but a wider operating loss of $1.79 billion vs. $1.57 billion in 1H21. Evidently, there’s much work to be done on the profitability side of the story considering bigger players like AWS and Azure are performing much better.

At the end of Q2, Cloud had $51.2 billion of revenue backlog and about 50% is expected to be recognized over the next 24 months. This is up slightly from $50.5 billion at the end of Q1 and up 45% YoY from $35.3 billion in 2Q21. Compared to Amazon’s backlog of over $100 billion at Q2, which grew 65% YoY and 13% QoQ, Google Cloud seems to have some catchup to do. While cloud migration remains a long-term trend, my sense is that Alphabet is still very much a digital advertising company unless it can demonstrate above-peer growth rates and sustainable profitability to argue for a higher valuation.

Final thoughts

In short, it was not surprising to see Alphabet miss estimates across the board and provide a not-so-optimistic outlook for 2H22 in light of strong 2H21 comps and worrisome macro headwinds facing an economically sensitive sector like advertising. Considering the stock, along with peers, essentially took a somewhat positive turn after Q2 earnings, I think investors have adequately adjusted their expectations to a more cautious 2H22 and will begin to separate stronger names from the weaker ones going forward. In my view, Google remains a resilient household name with a strong position in search advertising, which is less vulnerable to budget cuts than higher-funnel ad formats. As markets begin to look towards the other end of the current down cycle, Alphabet should be a robust investment in digital advertising.

Be the first to comment