hh5800

This week I decided to cover each of Berkshire Hathaway’s (BRK.A) (BRK.B) newest equity holdings and I plan to write up Berkshire tomorrow. On Sunday I covered Jefferies Financial (JEF), and yesterday I wrote up Louisiana-Pacific (LPX). Today’s article will be on Taiwan Semiconductor (NYSE:TSM), the largest position of the three at $4.1B.

Investment Thesis

Taiwan Semiconductor is a semiconductor manufacturing giant based out of Taiwan. This creates uncertainty around the company, which is a crucial piece of the global supply chain, due to China’s desire to take Taiwan. The company is the leader when it comes to technology and is years ahead of most of the competition. The valuation at 14x earnings isn’t as cheap as it was two weeks ago, but it is still attractive relative to the average multiple.

The company has a solid balance sheet with plenty of cash and has an impressive margin profile. The dividend yield will likely be a smidge over 2% (depending on currency conversion). Berkshire’s large long position is another reason to be bullish, but investors should come to their own conclusions regarding the uncertainty for the company due to the Chinese elephant in the room.

An Industry Leader

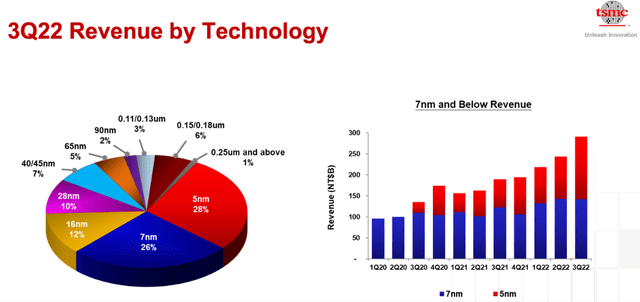

Taiwan Semiconductor is widely considered the best in the world when it comes to manufacturing semiconductors. Apple (AAPL) is a major customer, but they also manufacture for chip giants NVIDIA (NVDA), AMD (AMD), and even Intel (INTC). While they are primarily located in Taiwan (obviously), they are in the process of building a new facility in Arizona, which is expected to come online early in 2024. For Q3, 7nm and 5nm process made up approximately half of the revenue, while the less advanced technologies accounted for the rest.

The company has an impressive set of financial statements as well. The company has impressive margins and a rock-solid balance sheet with almost twice as much cash as debt. One of the reasons shares had performed so poorly in 2022 until recently is likely due to uncertainty with China. For a company like Taiwan Semiconductor that is widely considered the best in a critical industry, the complicated relationship with China creates additional complexity for investors.

An Impending Chinese Invasion of Taiwan?

While I’m no geopolitical expert, I pay closer attention to what is going on in the world than the average joe. This year has been interesting for a lot of reasons, including Russia’s push into Ukraine. Many people expect China to make a similar move on Taiwan, but I don’t think it will escalate into a hot conflict. I think China will continue to exert political influence over Taiwan until they have control, and I think it’s only a matter of time.

My guess is that it will happen in the next 3-5 years, but that’s just a rough estimate. The Chinese tend to play the long game when it comes to geopolitics and think in terms of decades and generations instead of years and short-term news cycles. I think there is too much to lose from an invasion when they can benefit from a soft power approach. While I don’t think China will take over in the next couple years, the heavy reliance of the US chip industry on Taiwan Semi is why you have seen the frantic buildup in capex (and government subsidies) for the American chip industry in the last year.

Valuation

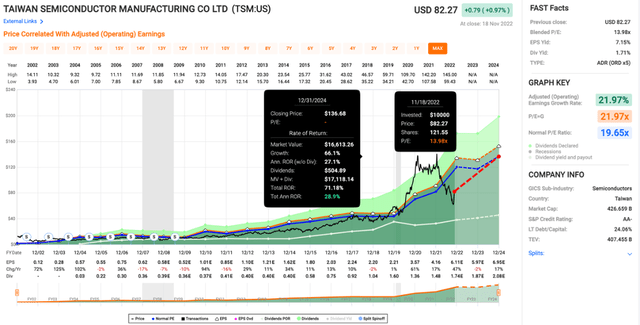

Like the other new Berkshire holdings, Taiwan Semi has had a nice run in November. Shares are up approximately one third from the low-$60 range. Despite that impressive run, the valuation is still attractive in my opinion. Shares are now trading at 14x earnings, which is well below the average multiple of 19.7x. They got expensive at $140 this January, but they were more than cut in half by the end of October.

Price/Earnings (fastgraphs.com)

I’m curious to see how accurate estimates turn out to be as there is a lot of uncertainty with the global economy over the next year or two. I do think shares have the potential to provide investors with attractive returns and it should only be a matter of time before shares head over $100, barring any disasters with China. Investors can count on the company’s dividend, which currently yields 2.3%.

The Dividend

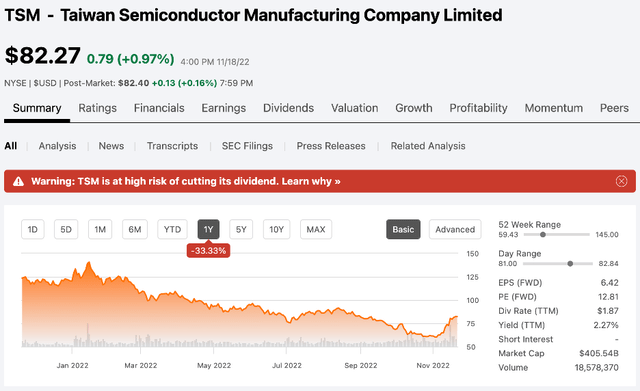

Taiwan Semi started paying a dividend in 2004, and they haven’t cut it since. The dividend is not constant due to currency fluctuations, but the yield should be somewhere around 2%, give or take. I’m expecting that the dividend will continue to grow over time, but despite that, this is what the Taiwan Semi homepage looks like on Seeking Alpha.

You can poke around for yourself, but I took a look at the dividend safety page for myself to see what it had to say. The warning page highlighted a couple things from the TTM payout ratio of 55% (not too high in my opinion), institutional ownership, downward revisions, and fixed asset turnover. While those are all interesting, the thing that stood out to me on the dividend safety page was the 42.5% net margin and $47.2B cash from operations for the last twelve months. Combine that with the company’s large cash balance compared to debt, and I doubt that we will see a dividend cut at any point in the next couple years.

Conclusion

Taiwan Semiconductor is one of the best in the foundry business and has been for a while. I owned the stock until late last year, but I sold as the valuation was pricy at the time. I would consider owning it again if not for a lack of dry powder at the moment. The relatively cheap valuation at 14x earnings is attractive, even after the recent bump when you factor in the company’s balance sheet and margin profile. Investors should come to their own conclusions on the risk China poses, as there are a lot of moving pieces and uncertainty there. I’m assuming China will continue to lean on Taiwan, but that it won’t escalate into a hot war.

My full disclaimer on this opinion is that it could change rapidly if I start to see signs that China is going to get its military involved. I also like the dividend, which is set to be over 2% at the current share price but will fluctuate due to currency changes. I will agree to disagree that TSM is at a high risk of cutting the dividend, but that will take a couple years to evaluate. Taiwan Semiconductor could be an interesting investment, as it is a wide moat company with impressive margins that could provide solid returns moving forward. Investors should familiarize themselves with the China situation before starting a position as it could spell trouble for investors, despite all the reasons to be bullish on the company.

Be the first to comment