cihatatceken/E+ via Getty Images

Thesis

BlackRock Resources & Commodities Strategy Trust (NYSE:BCX) is a closed end fund that has high current income as its primary objective. As per the fund’s literature, “The Trust will seek to achieve its investment objectives, under normal market conditions, by investing at least 80% of its total assets in equity securities issued by commodity or natural resources companies, derivatives with exposure to commodity or natural resources companies or investments in securities and derivatives linked to the underlying price movement of commodities or natural resources“. Therefore, a retail investor is gaining equity exposure to companies that derive their profits from the commodity space. When looking at the holdings breakdown we can notice that the components are predominantly large capitalization global companies that can be categorized as belonging to the large Oil & Gas sector or the Mining sector.

It is important to note and understand the difference between owning Oil & Gas / Mining sector equities versus owning the commodities outright (either via an ETF or futures). An operational company will have other risk factors driving its equity price, while a commodity is an outright price play based on supply and demand. To this end the article details below why for example TotalEnergies’ (TTE) stock price has been flat year-to-date while oil prices have gone up substantially.

BCX is a cyclical fund by the nature of the underlying stocks composing the portfolio, and exhibits a low Sharpe ratio of 0.55 and a high standard deviation of 19.3 (both on a 5-year range). The fund tends to have very deep drawdowns, which have averaged -50% both during the 2016 commodities downturn as well as during the Covid sell-off. On a long-term basis (10-year frame) the fund has a trailing total return of 5.9%, which is consistent with what a true buy-and-hold investor should expect from this vehicle. Unlike other CEFs, BCX only employs the minimum regulatory leverage (sub 2% leverage) and can thus be compared with energy and mining ETFs.

BCX is a CEF with minimum leverage that is a blend of global Oil & Gas majors and mining conglomerates. On a long term basis, we do not see BCX having generated substantial alpha versus plain vanilla ETFs. While there might be a bit more left in the current commodities bull cycle, BCX is not yet trading at its historic discount to NAV. For a retail investors already in the name we rate it a Hold, while in terms of new money we do not think this is an ideal entry point and there are better alternatives in the market.

Holdings

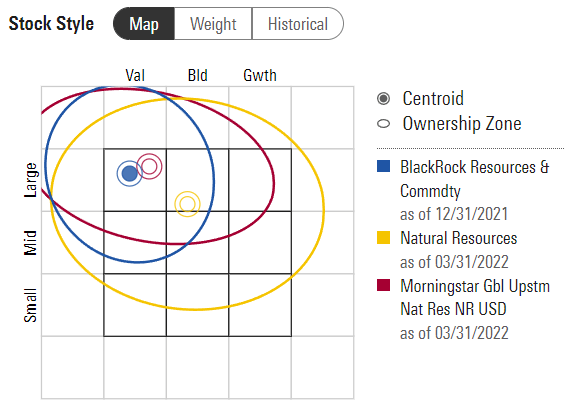

The CEF holds large capitalization companies:

Portfolio Style (Morningstar)

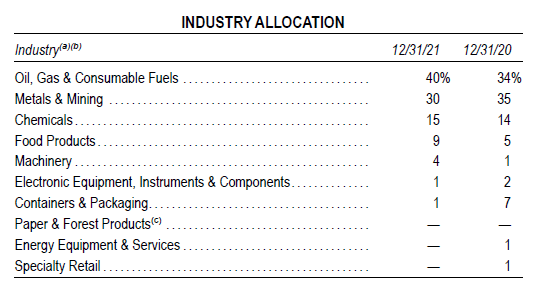

And specifically, the most exposure is run through global major Oil & Gas companies as well as large mining conglomerates:

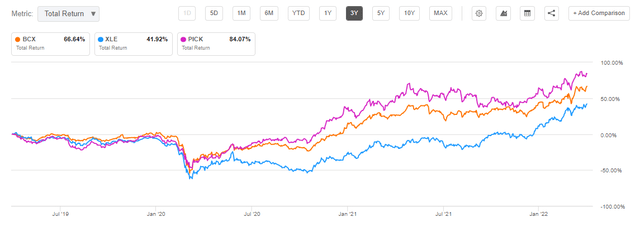

Industry Allocation (Annual Report) Ten Largest Holdings (Annual Report)

Three of the largest global Oil & Gas majors represent the top 3 holdings, followed by large multinational mining conglomerates.

The fund has only 47 holdings, and the top-10 names represent over 45% of the portfolio.

Owning a company which derives its profit from commodities is not equivalent to owning the commodity factor outright. The best example to illustrate this is the recent divergence between oil prices (the underlying commodity) and TotalEnergies’s stock price. While Brent and WTI oil went parabolic after the Ukraine conflict start date, the TTE stock actually declined:

Total Stock Price vs Oil (Seeking Alpha)

The reason for this occurrence is the fact that Total will have to write down its stake in oil & gas projects in Russia on the back of a general avoidance of the jurisdiction. There is a clear segregation in performance between the underlying commodities which are a pure price play, and large global operational companies that involve other risk factors outside of the commodities prices. A retail investor needs to clearly understand the bifurcation.

Performance

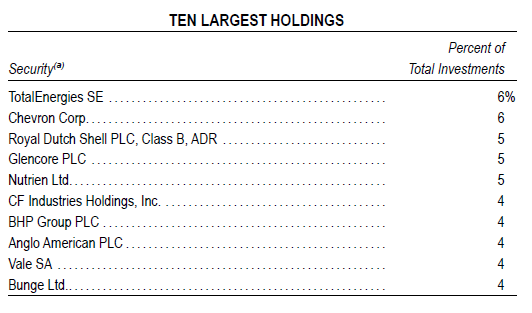

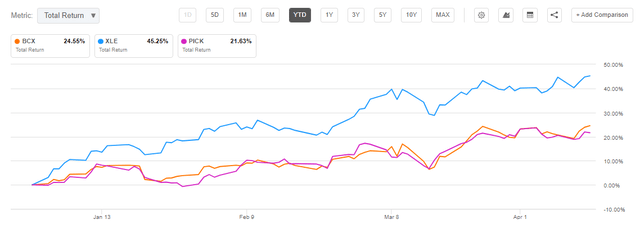

Given its composition we will compare BCX to the Energy Select Sector ETF (XLE) and the iShares MSCI Global Metals & Mining Producers ETF (PICK). On a year-to-date basis both BCX and PICK lag XLE:

The reason for this performance differential, especially for BCX resides in the large Oil & Gas companies in the portfolio – we see an overweight position for European companies, which have severely lagged their U.S. counterparts in 2022.

On a 3-year basis BCX and PICK outperform on the back of a strong miners’ performance:

3-Year Total Return (Seeking Alpha)

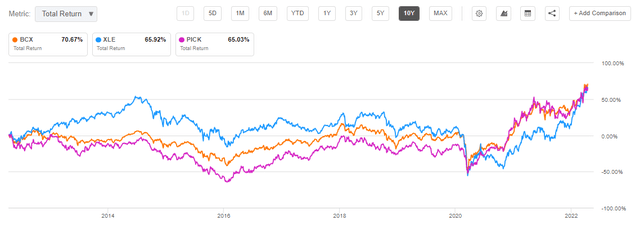

On a very long term time-frame all three vehicles expose similar performances:

10-Year Return (Seeking Alpha)

We can see how BCX underperforms the XLE ETF up to 2020, only to be helped after the Covid pandemic by its miners’ exposure.

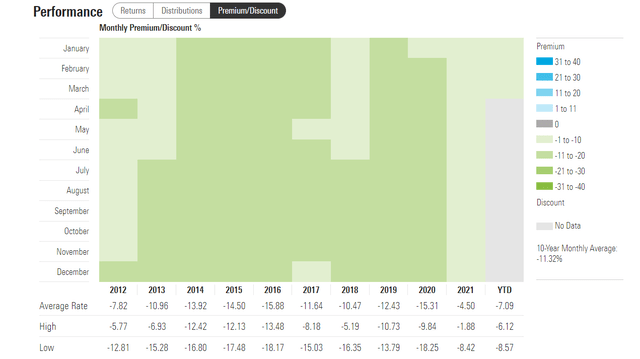

Premium/Discount

The fund has historically traded at a substantial discount to NAV:

Premium / Discount to NAV (Morningstar)

We can see how historically BCX trades at a discount to NAV in the -10% to -15% range. On the back of a historic rally in oil & gas majors and mining conglomerates the fund has narrowed its discount to the current level.

Conclusion

BCX is a CEF focused on equity securities issued by commodity or natural resources companies and displays a small yield of 4.71%. With minimal leverage (sub 2%) the CEF is very much akin to an actively traded ETF. On a long-term basis (10-year frame) the fund has a trailing total return of 5.9%, which is consistent with what a true buy-and-hold investor should expect from this fund. BCX has not generated enough alpha in the long term to justify the high management fees for a CEF structure. From an entry point perspective, BCX is not yet trading at its historic discount to NAV. For a retail investor already in the name we rate it a Hold, while in terms of new money, we do not think this is an ideal entry point and there are better alternatives in the market.

Be the first to comment