Mara Fribus/iStock via Getty Images

Despite global economic issues amid a war in Ukraine and a major covid shutdown in China, copper prices remain near all-time highs and are probably headed higher. Freeport-McMoRan (NYSE:FCX) remains one of the best ways to play the strength in copper prices due to high demand in electric vehicles and green energy. My investment thesis remains Bullish on the copper miner headed into the Q1’22 earnings report.

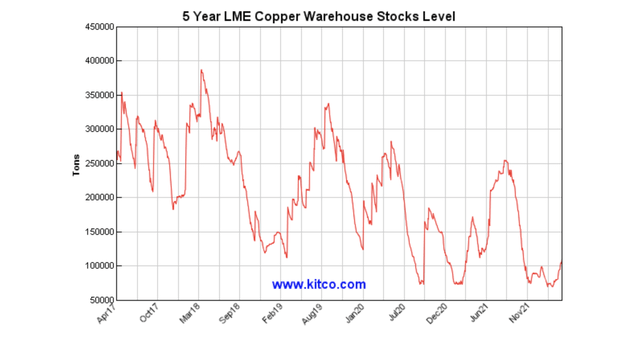

Low Copper Inventories

Goldman Sachs is promoting an event where copper markets are completed stocked out of inventories due to large demand in EVs and green energy while new mining projects aren’t in the works. The research suggests the 2022 refined copper deficit will reach 374K tons leading to a scenario where current inventory is actually depleted by year end creating a stock out.

LME copper inventories are at multi-year lows already despite the geopolitical issues and covid possibly constraining demand.

Goldmans Sachs predicted a stockout by year end due to decline in inventories in part thru the seasonal restocking period in March. The research firm predicted prices of $13,000 a tonne in the next year due to a major deficit of the red ore with demand now far outstripping supply in the next few years.

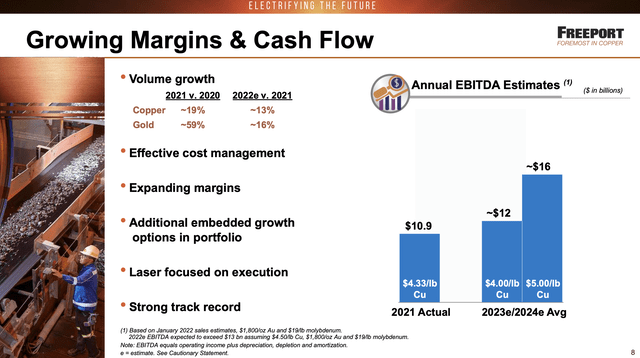

Copper prices are at $4.60/lb now and the Goldman Sachs target would suggest a nearly 30% upside to copper sending the price towards $6/lb. Freeport-McMoRan doesn’t even factor in prices reaching $6/lb into financial projections with the most recent presentation only factoring in a $5/lb price as the high.

Source: Freeport-McMoRan Q4’21 presentation

Big Year Ahead

Freeport-McMoRan is scheduled to report the Q1’22 earnings in the next week. The copper miner guided to the following financial metrics when reporting the Q4’21 earnings report back on January 26:

- 970 million pounds of copper

- 380 thousand ounces of gold

- 20 million pounds of molybdenum

- operating cash flows are expected to approximate $8.0 billion

- capital expenditures for the year 2022 are expected to approximate $3.3 billion when excluding the Indonesia smelter projects, including $2.0 billion for major mining projects.

Copper sales rule the financials at Freeport-McMoRan. The Q1’22 copper sales will be down slightly from Q4 levels, but the company is forecasted to produce 4.3 million pounds for the year versus 3.8 million pounds last year. The company is on the path for 13% copper production growth just at the perfect time when Goldman Sachs predicts a surge in copper prices due to the stockout potential.

Investors shouldn’t get stuck too much on analysts consensus estimates for Q1’22 revenue after the company reported Q4’21 revenues of $6.2 billion and an EPS of $0.96. The copper miner technically missed revenue targets by a wide $320 million, but just about a month later the stock is near recent highs above $50.

In Q4’21, Freeport-McMoRan generated $2.3 billion in operating cash flows with capex of $0.8 billion and $0.1 billion for the smelter project. Free cash flows were an impressive $1.6 billion when excluding the smelter project. The market expectation should be something in the similar area for the current quarter.

Freeport-McMoRan made cash flow projections for 2022 based on copper prices of $4.50/lb and with cash costs of $1.35/lb. Cash flows will absolutely jump on higher copper prices where another $1/lb in sales will immediately fall to the bottom line with ~1 billion pounds of copper sold each quarter.

As the stock valuation tops $70 billion, Freeport-McMoRan isn’t the same no brainer investment due to massive cash flows in comparison to the stock valuation. Regardless, the stock still only trades at ~5x the $16 billion EBITDA targets with Freeport-McMoRan trading above $60, much less the current price of $50. And not to mention, copper could easily top $5/lb and not look back while the company is repurchasing shares to further cut the actual market valuation.

The biggest risk remains that copper prices collapse as EV demand slumps due to a lack of materials to build EVs and green energy. Even a major recession and an extended shutdown in China could naturally reduce demand and offset the concerns about low copper supplies coming onto the market.

Takeaway

The key investor takeaway is that Freeport-McMoRan remains far too cheap with strong copper demand and limited inventories. Under a scenario where a stockout event actually occurs, the stock is headed to new highs.

Be the first to comment