ZargonDesign

ZIM (NYSE:ZIM) delivers buckets of money to investors by returning around 30% of profits to them. Like ZIM’s ships, those buckets show no signs of leaking. That low P/E both undervalues ZIM and distorts the dividend in percentage terms but the huge cash payout shows a more accurate story.

ZIM is categorised as a Transport Industrial and Tesla (TSLA) as a Consumer Discretionary. Both are cyclical and so exposed to economic downturns.

I have written several articles on Tesla. The most recent was Tesla Is Past Its Sell By Date.

My sole article on ZIM, so far, is ZIM’s 80% Dividend Is Not Too Good To Be True and the title of today’s is the conclusion of that one.

All my Tesla articles and that sole ZIM article have generated many comments. There was a huge difference in the tone of the comments. Many of the Tesla comments – some rude – were by people who can be only described as Elon Musk worshippers.

Those on ZIM were polite, mostly reflective, and showed more than a little confusion. Confusion is perhaps the only outcome possible given what the market has delivered.

Taking the end of June’s second half results shows us that dramatically:

Tesla – Net margin 13.3%. ZIM – Net margin 39%

Tesla – ROE 31% ZIM – ROE 178%

Tesla – P/E 109 ZIM – P/E 0.63.

Tesla insiders have been selling only since June 2020 and that has continued this month, September 2022! No ZIM insider has sold.

The world’s largest airfreight carrier, FedEx (FDX) has just released lousy news about its business, blaming a world recession for that. That day, Tesla’s stock price went down 0.13%. ZIM’s sank 4.4% – over 30 times as much! And that sent the dividend soaring up to nearly 88%!

I use Tesla simply to highlight the extremes existing in today’s market with it and ZIM being at opposite ends. Tesla is priced higher than perfection while ZIM is dumped on the brink of bankruptcy end – a near-blind denial of reality and facts for both.

This article is not an anti-Tesla article, it is a pro-ZIM article, and given ZIM’s facts, I shall start first with more about it and its financial health…

ZIM Integrated Shipping Services Ltd.

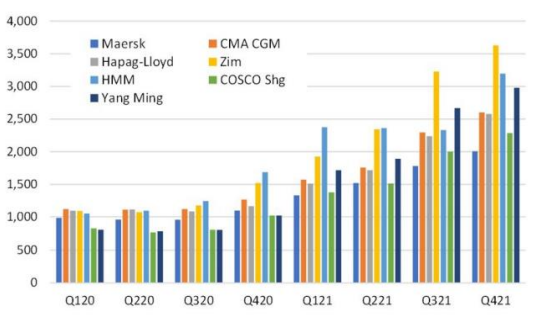

ZIM is an Israeli-based shipping company established in 1945 and transformed in recent years under new management into a container-only shipping company. It had its IPO on the NYSE last year (Jan 2021) and was one of the best-performing IPOs that year on the back of super financial results following the transformation. Their average revenue per TEU (a 20-foot container to us laymen) by quarter from 2020-2022 left competitor’s ships in its wake…

ZIM

According to marine digital data, ZIM now has the world’s 10th largest liner fleet, with less than an eighth the capacity of the largest one, Maersk (OTCPK:AMKAF).

It has an asset-light model that is a non-balance sheet “asset” in bad business conditions because its fleet is almost entirely chartered in. 94% of ZIM’s vessels are chartered. The company has also expanded its car-carrying activities to diversify its operations.

More can be found about ZIM on their website. I would like to detail a bit more here about the financials behind that huge “dream come true” dividend.

The dividend key is cash

ZIM’s ships earn and carry buckets of money safely to investors’ wealth accounts.

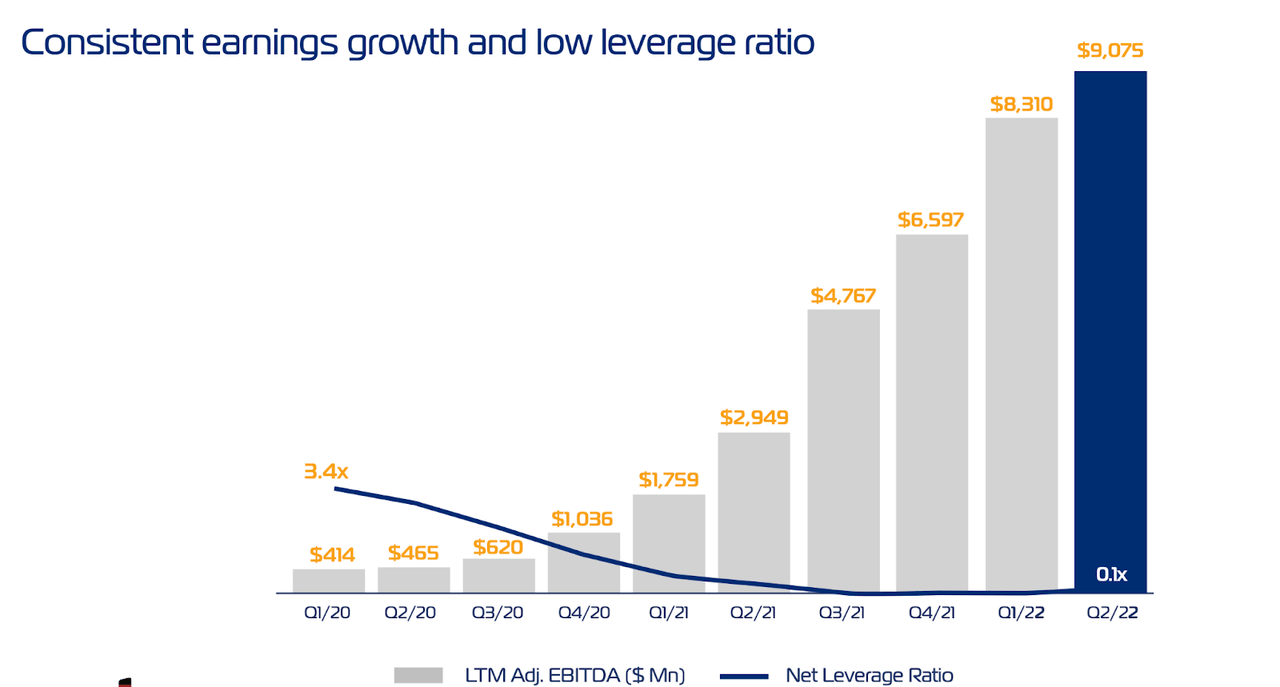

ZIM ended the last quarter with $946.8 million of cash, $3 billion of bank deposits versus $4.3 billion in lease liabilities. If lease liabilities are ignored and the bank deposits included, then that $3.9 billion net cash position represents more than 90% of the current market cap. ZIM’s leverage ratio is virtually nonexistent.

ZIM’s 2022 Q2 Presentation

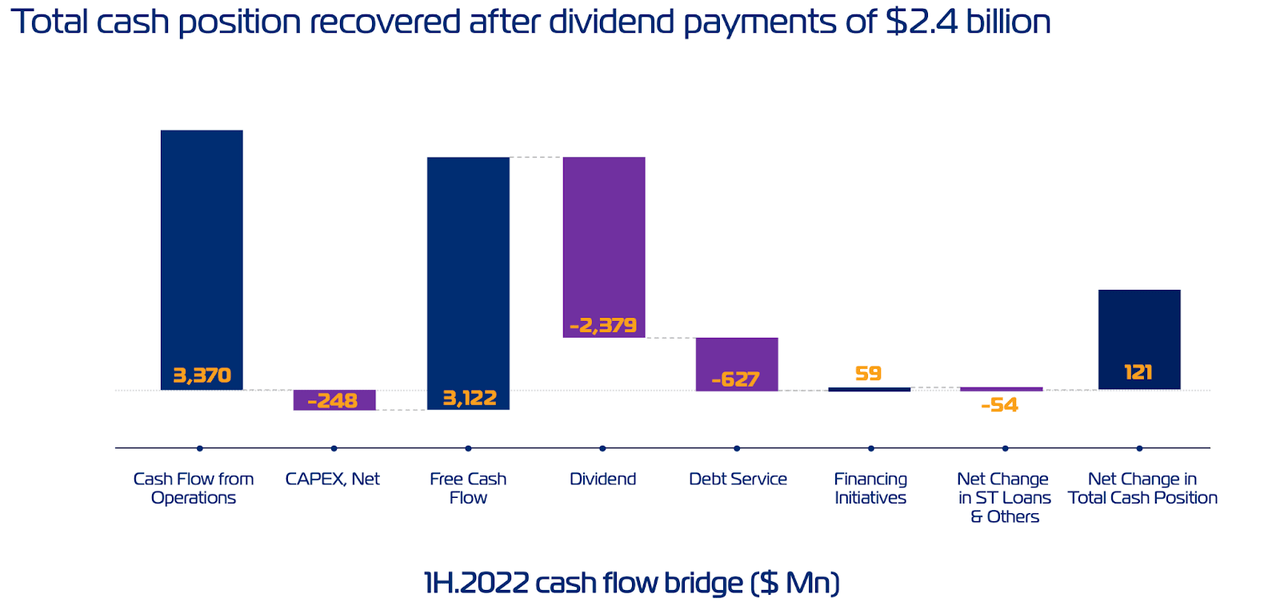

ZIM generated so much cash in the quarter that even after paying out $2.4 billion in dividends and investing in the future, it still retained $743 million of cash that it used to pay down debt.

ZIM’s 2022 Q2 Presentation

ZIM again confirmed full-year guidance which called for up to $6.7 billion in EBIT. That implies that ZIM will earn more net income than its current market cap!

At the Q2 earnings call, the CEO Eli Glickman said –

Based on our solid performance in the first half, we are reaffirming our full year guidance for 2022 and are on track to deliver another year of record earnings and profitability.

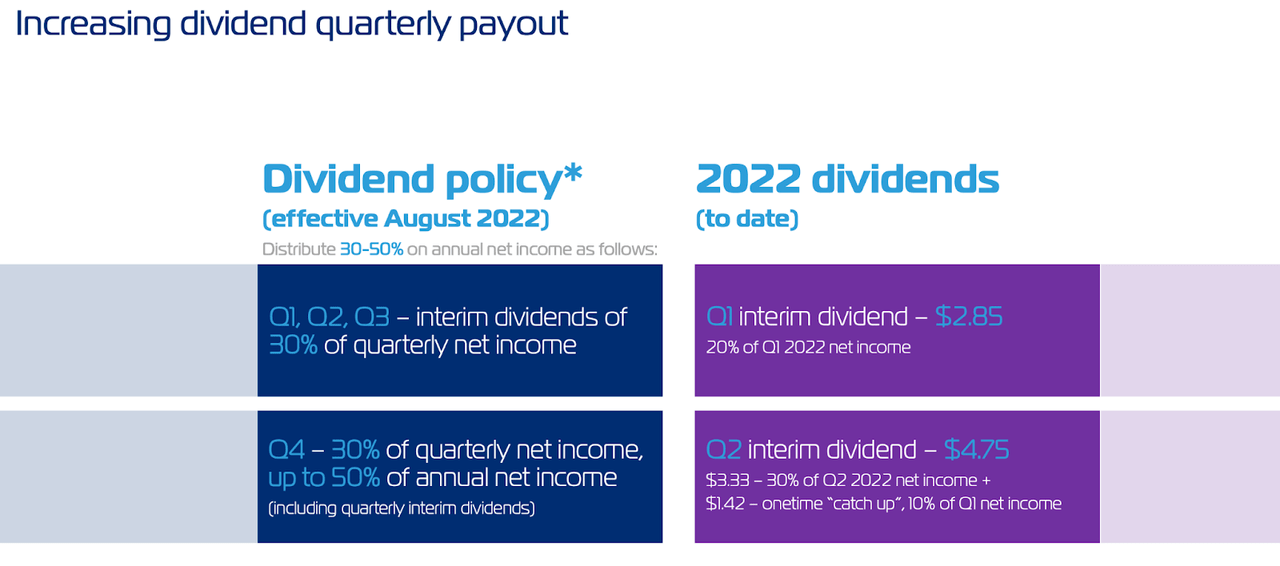

We are also announcing today the increase in our quarterly dividend payout from 20% to 30% of quarterly net income.

ZIM’s 2022 Q2 Presentation

The dividend is safe!

Those wanting more can find it on that earnings call transcript and presentation.

One thing I would point out. Many comments on my first ZIM article referred to Israel’s 25% withholding tax on dividends. I cannot give advice on taxation, I use a tax advisor for my tax returns. But simplistically, it seems to me that even if that 25% is not recoverable, then one still gets a 60% payout.

What encourages me is…

ZIM’s Differentiator

I went into the competition and what differentiates ZIM from the competition in my previous article.

That differentiator puts ZIM in a niche because some main shipping company competitors are sailing in other directions by heading ashore. Others are remaining nothing but traditional container shipowners.

All would like to know what the future brings and so I will use most of my words on my view of the…

Market Outlook

I put some in the previous article.

More has come to light since then.

FedEx’s CEO reckons the world is in recession. That could actually mean FedEx is in recession because some analysts are questioning the CEO’s credibility. This SA report tells more including this quote “We’ve seen a clear trend lower in freight trends, but FedEx performance likely stands out to the downside versus UPS, which reiterated guidance in early September”.

The markets give ZIM a P/E of 0.6 on super results. FedEx is in the same business except in the air, and even after that panic profit warning, its P/E remains sky high – by comparison – at 11!

One should remain cautious but the world is not in recession. The US is the world’s largest economy and is not in recession. The IMF downgraded China’s growth to 3.3 percent in 2022. That is still big given China’s position as the second-largest economy. India – now the 5th largest – is forecasted by Moody to grow 7.7% this year.

China

I will spend most words on China as it is arguably the most important economy in terms of global freight movements.

China’s growth slowed due to constant Covid Zero lockdowns that continue but industrial production rose by 4.2 percent in August from a year earlier, while retail sales rose by 5.4 percent last month. Fixed-asset investment rose by 5.8 percent in the January-August period.

Some of the following China information and quotes I learned from reading an excellent book called The NEW MAP by Pulitzer prize winner, Daniel Yergin. I can recommend that to all interested in today’s world outlook.

In many ways, China invented international trade. Zhang Qian – the Han dynasty’s special envoy to Central Asia – reported to the emperor about the potential value of trade with the heretofore unknown west. That started the development of trade routes that ran to the west, first to Central Asia and Persia, and then intermittently to as far as the Roman Empire. It became called the Silk Road. Much of that trade was carried on the back of camels.

When unveiling China’s Belt and Road Initiative – BRI or B&R for short – current Chinese President Xi waxed lyrical saying of those times “As I stand here and look back at that episode of history, I could almost hear the camel bells echoing in the mountains and see the wisp of smoke rising from the desert”.

The Han Chinese are now at least 40% of China’s population and growing.

Belt and Road is focused on energy, infrastructure, and transportation. To put its scope into perspective, the potential overall investment is estimated at about $1.4 trillion – a scale never seen before and at least seven times larger, measured in today’s dollars than the Marshall Plan, the US initiative that rebuilt Europe after World War II.

Camels are not used anymore, but both overland and at sea, much of trade today is travelling in containers.

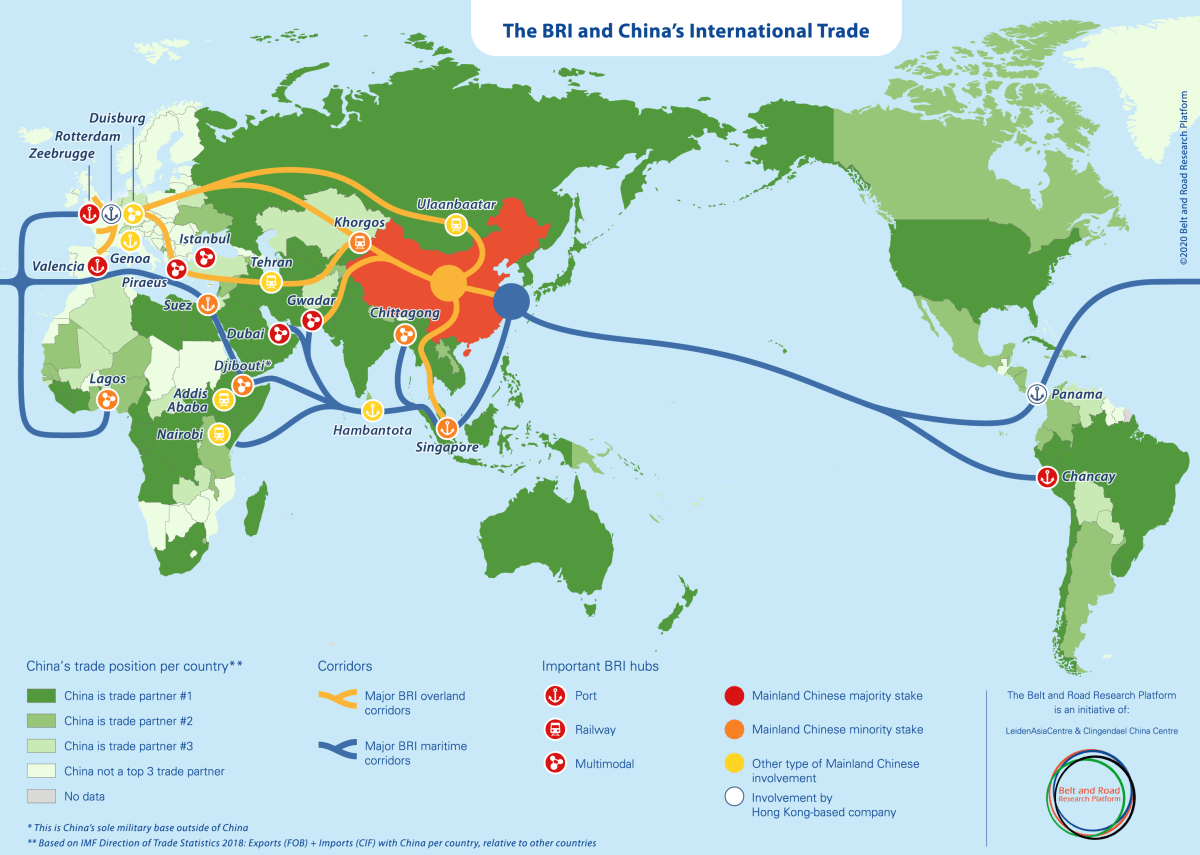

Belt & Road Research Platform

The orange lines show the new Eurasia Land Bridge. The blue ones are the Maritime Silk Road.

China today is thus crucial to sea container shippers! Now, more than two thousand years later, China is the world’s largest exporter by value; mainland China exported US$3.026 trillion worth of goods around the globe in 2021. That dollar amount reflects a 33.2% gain since 2017 and a 16.8% acceleration from 2020 to 2021. The value of China’s total exports represents 14.1% of overall global exports (based on the world’s total of $21.513 trillion for 2021).

It is the world’s second-largest importer. The US is the largest importer and is China’s biggest customer despite trade wars!

China and Israel aim to sign a free-trade agreement by the end of 2022 in a breakthrough that would give Beijing its first deal in the Middle East. ZIM is an Israeli company so could benefit from increased trade.

Also, world trade routes have changed!

Latin America has long been seen as a US domain, but the largest economy there, Brazil, now does more trade with China…

| Main Customers (% of Exports) | 2020 |

| China | 32.4% |

| United States | 10.3% |

| Argentina | 4.1% |

| Netherlands | 3.2% |

| Canada | 2.0% |

| See More Countries | 48.0% |

| Main Suppliers (% of Imports) | 2020 |

| China | 22.1% |

| United States | 17.9% |

| Germany | 5.8% |

| Argentina | 4.9% |

| South Korea | 2.8% |

| See More Countries | 46.5% |

Source: Comtrade, Latest Available Data

Brazil’s Economy Minister, Paulo Guedes, recently pointed out China’s importance to it now compared with where France once was. He said that in 2000, Brazil did $1.84 billion in trade with France, on par with China. Now it is $7 billion with France and $120 billion with China. Given the fact there was little inflation at that time, even the growth with France was considerable.

Much of that trade goes by sea with most imports via containers. Putin’s attack on Ukraine means Brazil and other LM countries will become more prosperous via more agricultural exports, thus allowing them to import more manufactured products, most of which travel by sea.

Many of China’s textile makers have shifted to lower-cost countries in Africa and to Vietnam. New Chinese-built railways in Africa link countries to Chinese-built seaports, allowing them to export goods for the first time and import more with the wealth created. That has opened new sea trade routes.

In short, deglobalisation is not happening. Globalisation is changing and China is de-shoring some production. It has been dubbed Globalisation 2.0.

Some European countries have aligned themselves with B&R. A Chinese company owns the largest port facility on the Panama Canal that provides a major link for east/west trade, including to and from Europe and US west coast ports. Those west coast ports are choked due to years of underinvestment!

The US response to B&R so far is to Bitch and Rant about it rather than co-operating or, if that is not possible, emulating a Chinese norm by copying and competing with it.

Robert Zoellick, a former US deputy secretary of state and former president of the World Bank, has said that the US was pushing China “into championing its own parallel, separate system with very different routes”.

A Chinese official said, “The pullback of the United States is helping us”.

That can be a threat and I will touch on such later.

Optimistically looking at today’s world remaining relatively peaceful, there are many positives suggesting ZIM’s profits will remain high. Among these are…

Container Volume Growth Forecast

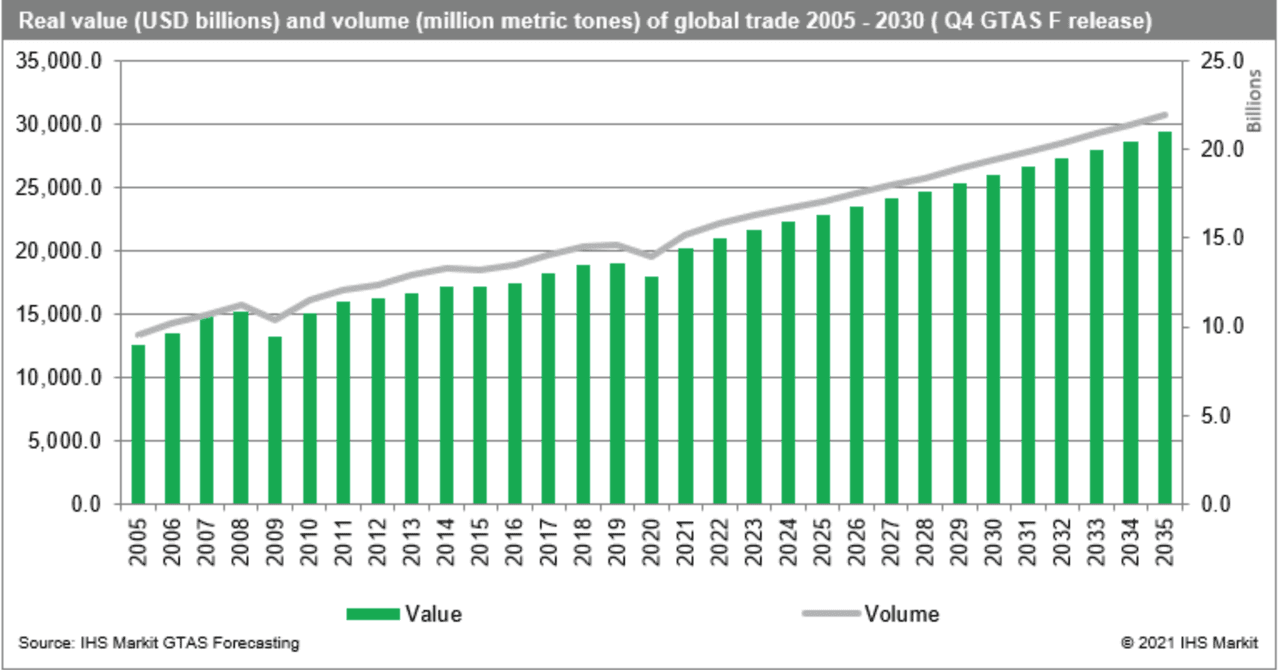

Although there are questions about future growth and trade, for now, there is a consensus that it will continue to grow, with IHS Markit estimating that the real value of global trade will rise to $30 trillion by 2035, compared to $20 trillion in 2021, translating to an increase in volume from 12.8 billion metric tons in 2021, to 20 billion metric tons in 2035.

IHM Markit

Container ship contracting activity was up 256% in the first quarter of 2022 compared to the previous three months, according to Danish Ship Finance.

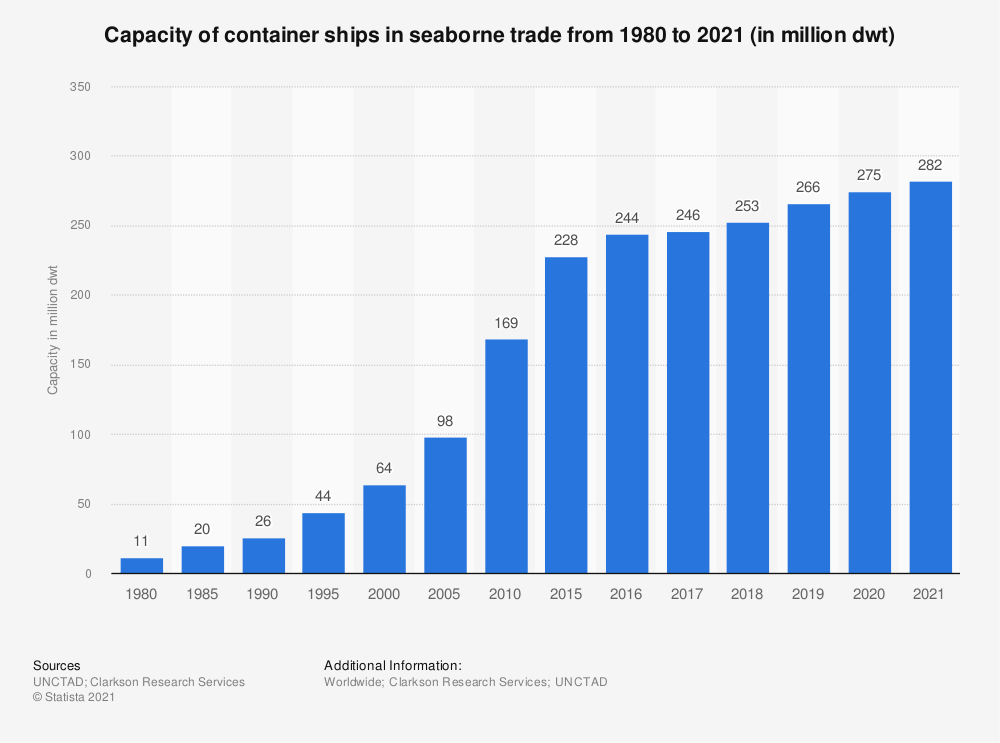

Container Ship Capacity Growth

Statista

Growth rates have slowed dramatically as capital discipline and profits have replaced the growth-only practice that caused boom and bust in the past.

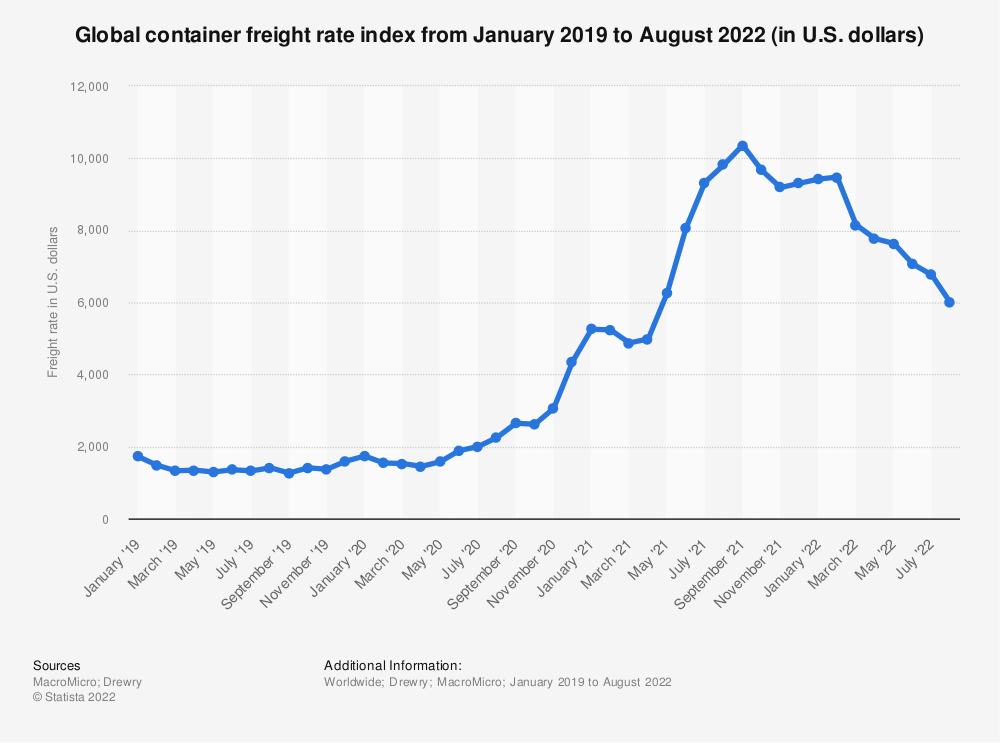

Freight Rates

Statista

According to Freightos, global freight rates fell 8% to $5,682/FEU in August as demand continued to slow. Since the September 2021 high, they have fallen by 44%. ZIM’s share price crash predated that. It reached its high of $76.67 on March 17, 2022, and ended last week at $29.46 – a crash of 62%!

These are container freight rates worldwide for September 1, 2022, according to the Freightos Baltic Index:

| FBX Lane | Global | Asia – US West Coast | Asia – US East Coast | Asia – North Europe | North Europe – US East Coast |

| This Week | $5,608 | $5,405 | $9,073 | $9,579 | $8,302 |

| Last Week | -1% | 0% | 0% | -4% | 0% |

| Last Year* | -46% | -71% | -55% | -31% | 40% |

| * Compared to the corresponding week in 2021 | |||||

Even at today’s rates, ZIM – and most sea container shippers – remains very profitable.

Threats

Over capacity. In 2023 and 2024, 319 and 263 new vessels will be delivered, propelling fleet growth, Danish Ship Finance data shows. Some of that will be offset by scrapping old vessels and more of the filthy fuelled ones will go soon after as more and more ports ban them.

According to this GreenBiz report last month, Long Beach, California, signed onto a historic effort to clean up the shipping industry when city council members unanimously passed a resolution to reach 100 percent zero-emissions shipping by 2030.

The move comes just months after a similar declaration from Los Angeles, whose port abuts Long Beach’s to make up the San Pedro Bay Port Complex – the U.S.’s largest port, handling more than 275 million metric tons of furniture, car parts, clothes, food, and other cargo every year. Together, the two cities’ resolutions represent one of the world’s most aggressive shipping decarbonization targets and reflect a growing desire among policymakers and environmental advocates to drive down the industry’s emissions.

ZIM has chartered new LNG-powered ships to be delivered next year.

Politics

I mentioned earlier Robert Zoellick has said that the US was pushing China “into championing its own parallel, separate system with very different routes”. He followed that up by saying that could be very costly economically and politically. Instead of cooperating or competing in trade terms, the US is confronting in war-like ways.

Among the latest flashpoints, Speaker Nancy Pelosi’s visit to Taiwan, a de-facto independent nation that China considers its territory, only stands to inflame tensions on the topic already stoked by President Biden’s consistent undermining of US strategic ambiguity. Military drills conducted around the island following the visit have only raised alarms among Taiwanese military officials. In recent days, President Biden discarded ambiguity completely by saying the US will indeed defend Taiwan.

China is no innocent and such tensions could accidentally trigger a new world war.

Hopefully, both sides will pull back from the brink, in which case the biggest threat is…

The Fed

Together with other central banks worldwide, the Fed uses outdated economic orthodoxy that dates from the 1980s. Since then, China, and not them, kept world inflation low.

The Bank of England governor recently stated that 80% of the UK’s inflation is imported yet is pushing up interest rates to control something totally outside his control. All he has succeeded in doing is push up inflation via mortgage rate increases and import costs due to the collapse of the British Pound because currency investors have no confidence whatsoever about monetary and fiscal management in that country.

The Fed is determined to bury its inadequacies with big interest rate increases that suppress investment in the new supply needed to bring down prices.

The normally non-political World Bank – that Zoellick once headed – recently said there needed to be some monetary tightening but this should be modest and accompanied by every effort to ease bottlenecks both internationally and domestically to allow production to increase. That needs political actions outside the realm of central banks. I fear they will not hear!

Those threats leave investors and…

ZIM navigating through the fog.

There is a pot of gold at one end of a rainbow but today’s rainbow is a fogbow.

Getty Images

|

|||

It looks as though ZIM and other container shippers have sunk 6 months too early and investors today will soon find that pot of gold…

ZIM’s 80% Dividend Is A Dream Come True

ZIM’s CEO gets a big part of his pay from stock awards, so has a vested interest paying out that dividend.

Investors, therefore, can be fairly sure to get that bucket of money/pot of gold this quarter and in Q4 because ZIM’s CEO knew where their ships are going for at least the rest of this year when he said at the Q2 earnings call.

“Based on our solid performance in the first half, we are reaffirming our full year guidance for 2022 and are on track to deliver another year of record earnings and profitability.

We are also announcing today the increase in our quarterly dividend payout from 20% to 30% of quarterly net income.”

Be the first to comment