noel bennett

KBC Group (OTCPK:KBCSF) has seen a strong quarter driven by strength in the traditional retail/commercial banking businesses, and resilience in fee and income, which should be more connected to the state of markets and the economy, but was saved by pricing measures. Insurance performs well too. The dividend is above 8%, and the reality is that it is likely sustainable. KBC covers the attractive extent of the financial space, levered to the continuing rate hikes. Looks like a good income play up there with ING Groep (ING) and other retail/commercial banking focused institutions.

Q2 Results

The story with banking that we foresaw some months ago was the following. Rates are of course going up, and therefore banking businesses that had not folded to the pressures on retail/commercial banking in a lower rate environment by focusing on extraneous businesses are well positioned now. We looked at some companies that had a dominant retail/commercial profile like ING and Nordea (OTCPK:NRDBY). KBC, while also featuring an insurance business, has a similarly well-positioned profile to rate hikes. Naturally, both the insurance business on the investment side and the banking business on the customer facing side benefit from higher rate environments as it offers greater yields and higher net interest margins. On the other hand, fee income, especially as it relates to asset management businesses potentially offered by the banks, were more at risk.

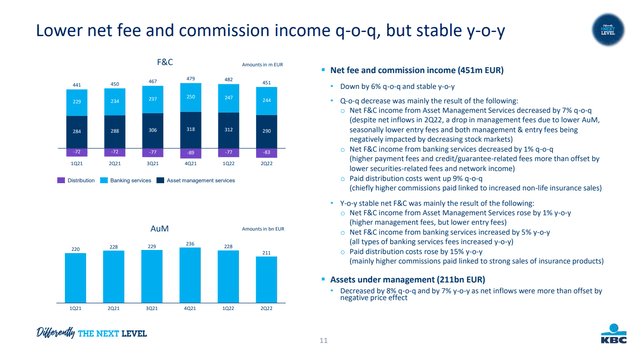

While Nordea saw declines, for example, in its fee and commission income, KBC actually saw increases YoY, which is a positive surprise. While AUMs fell, volumes were alright elsewhere and pricing measures compensated for AUM and asset management related declines.

F&C Income (Q2 2022 Pres)

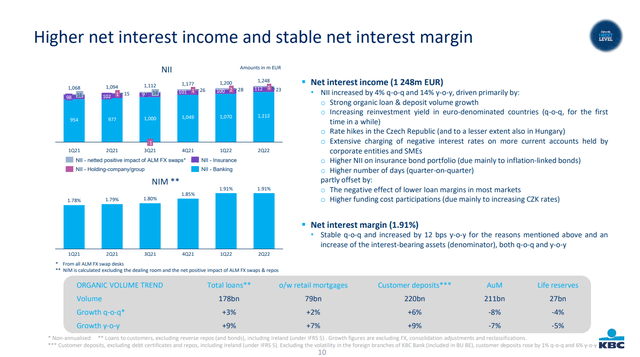

Critically, the lending and deposit dynamics were positive as one would expect. Loans actually grew, and of course the rates on those loans are higher now. Lending rates are outpacing savings rates generally in the banking business. The insurance side, which contributes through the investment activities to net interest income, was well positioned in particular with inflation linked bonds, but also benefited from rollover into higher rates, which are growing across KBC’s European markets like the Czech Republic and Hungary, and naturally in Belgium.

Interest Income (Q2 2022 Pres)

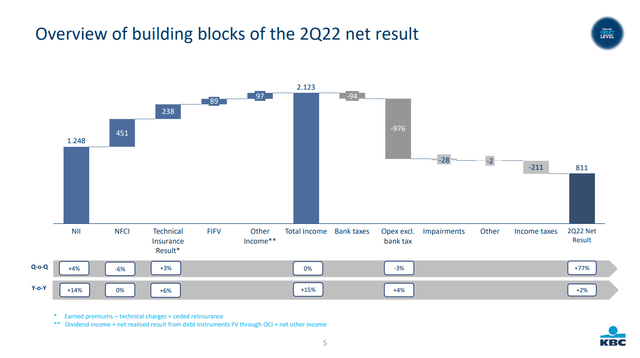

Net interest income grew, fee and commission income stayed strong YoY, and that was all that was needed by a decent 2% net income growth.

Income Evolution (Q2 2022 Pres)

As the higher rate environment passes through KBC’s business, we expect improvements to accelerate a little from these modest levels.

Overall, about 20% of KBC’s net income comes from fee and commission related activities, while the other 80% is positively exposed to the current environment, where premium income as well as investment income on the insurance side is growing, on top of the growth in the loan-deposit businesses.

Dividend Remarks

While the 9x PE LTM suggests value, we’re more interested in the dividend which is around 8%. The company has a great capital return policy of paying out at least 50% of income. Dividend investors should be happy. But American investors considering the stock must understand that there’s less of a culture for consistent dividends in Europe. The KBC dividend is more discretionary and variable. Still, a 11% earnings yield covers amply the 8% dividend yield. With the businesses all well positioned in the current environment, and resilience shown in theoretically weakest link of F&C income, there should be no problem paying this dividend going forward. Yield is good in uncertain markets as it offers some modicum of return while capital return becomes unreliable and dependent on sentiment. We think KBC is a good income proposition.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment