AsiaVision

Bausch Health’s (NYSE:BHC) poorly timed spin-off of B+L (BCLO) and unfavorable Xifaxan patent order undermined the stock’s upside potential. In June 2022, the stock briefly soared by more than 20%. It gave back all of those gains and lost ground. After posting second quarter results that missed consensus estimates and cut its full-year 2022 guidance, will BHC stock fall to new lows?

Second Quarter 2022 Results

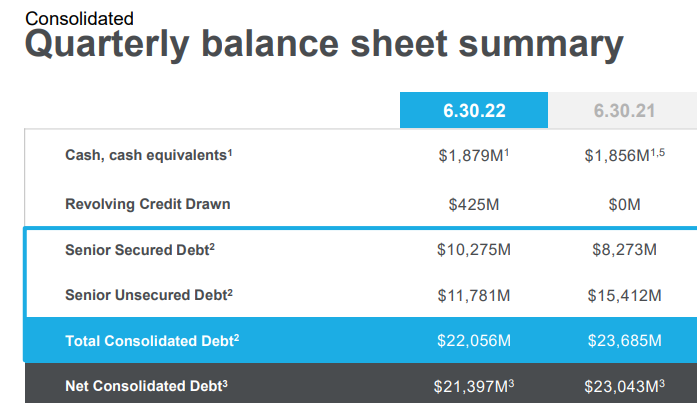

In the second quarter, BHC lost 40 cents a share. Revenue fell by 6.2% Y/Y to $1.97 billion. Although it extinguished $481 million of long-term debt through open market repurchases, BHC’s $22.056 billion debt remains high.

BHC Q2/2022 Presentation

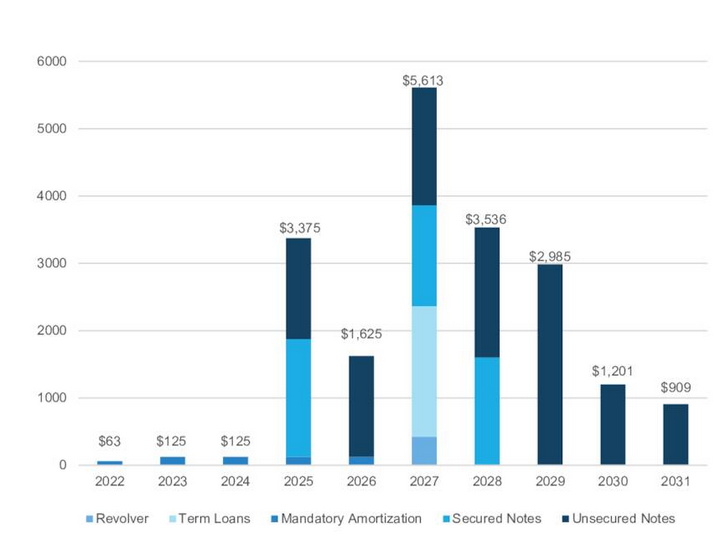

Liquidity fears will not worry investors or management until 2027. In that year, it will have $2.381 billion in a term loan due. Below is a table of BHC and Solta’s debt maturity profile.

BHC Q2/2022 Presentation

Approximately 75% of BHC’s debt is fixed. In 2025, it has ~ $3.4 billion in debt due.

Shareholders are concerned about Bausch Health’s cash flow from operations in the next few years. They lost confidence in its FCF potential for several reasons. First, the courts are challenging its intellectual property in the Xifaxan patent litigation. Second, the company’s strategic alternatives to mitigate patent litigation risks may not improve its balance sheet.

Patent litigation is a worry. The U.S. District Court of Delaware found the U.S. patents protecting the composition and use of Xifaxan for treating IBS-D invalid. CEO Thomas Appio said that the appeal process will take 12 to 18 months. The company will argue that Norwich does not have a tentative full FDA approval for generic rifaximin. He said the court’s decision does not give Norwich an Abbreviated New Drug Application approval. Without full FDA approval, Norwich cannot launch the generic drug.

CEO Appio said that the company did not receive the Norwich ruling or reasons for the decision. It expects to get the details in mid-August. In the medium term, Norwich may choose to exclude the hepatic encephalopathy (“HE”) indication. BHC may open a dialogue to negotiate with Norwich.

Catalysts Absent

Bausch Health’s units posted weak or negative revenue growth in the quarter. Bausch Pharma + Solta revenue of $1 billion fell by 12% Y/Y. Salix revenue fell year-on-year due to unfavorable changes in the primary retail channel inventory. This amounted to $21 million. In addition, retail prescriptions did not change. Demand for HE in the long-term care channel is still weak. This is partly due to post-COVID staffing constraints.

Revenue from Bausch + Lomb grew by just 1%. Although the vision care and surgical unit grew, particularly Biotrue (up 39%), Lumify (up 21%), and Ocuvite + PreserVision (up 7%), ophthalmic pharmaceuticals fell by 13%.

2022 Guidance

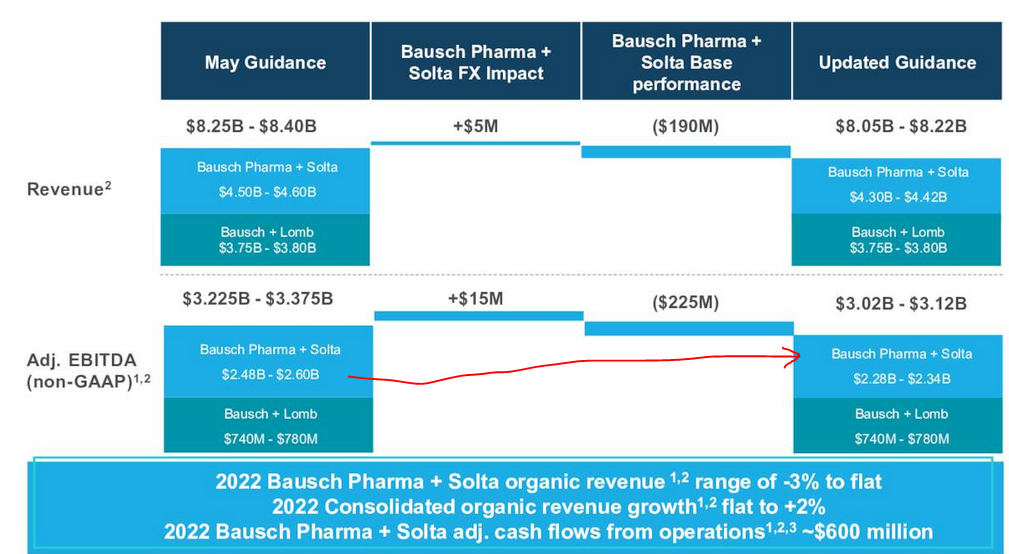

Bausch Health cut its guidance issued in May 2022. Revenue is now between $8.05 billion and $8.22 billion, compared to $8.25 billion to $8.4 billion in May. Adjusted EBITDA falls to $2.28 billion, down from $2.34 billion. The company lowered its expectations for Bausch Pharma + Solta. It did not change B+L’s outlook.

BHC Q2/2022 Presentation

BHC investors might think Bausch + Lomb (BLCO) is a better investment. However, BHC owns the majority of the shares. This limits the attractiveness of BLCO stock. Alcon (ALC) is a better alternative despite its unfavorable valuation.

Opportunity & Related Risks

Investors might speculate that Bausch Health has a good case to contest the court’s findings on the Xifaxan patent. The company has to take many steps to defend itself. In the interim, it has research and development activities for Xifaxan to treat RED-C. That is, a “Study to Assess Rifaximin Soluble Solid Dispersion (SSD) for the Delay of Encephalopathy Decompensation in Cirrhosis.”

The company’s debt levels constrain its R&D efforts. First, it must lower its leverage ratio. Unfortunately, the ruling delays its objective of lowering the leverage to the 6.5 times to 6.7 times level. Poor market conditions forced the company to suspend its initial public offering of Solta.

Bausch Health has a priority of returning the company to grow. It’s relying on expanding in Europe to achieve that. Still, this region has macroeconomic headwinds. Globally, inflationary pressures could cause a recession. Europe is particularly sensitive to rising inflation stemming from the Russian/Ukraine war.

Stock Score

According to Seeking Alpha Premium, BHC stock scores an A on all three key metrics. Valuation, growth, and profitability earn high scores:

SA Premium

The growth score may fall after the system accounts for the lowered guidance.

Chances are low that stock market conditions improve. Still, the Direxion Daily S&P Biotech Bull 3x Shares (LABU) returned nearly 88% for investors in the last quarter. Sentiment improved steadily since July. The solid month of positive market conditions lifted the biotechnology sector. Investors will eventually seek bargains from beat- up drug companies. They will consider BHC and BLCO stock.

Your Takeaway

Bausch Health’s second leg down in 2022 is a disappointment for shareholders. The company did not expect courts to challenge its Xifaxan patent. This uncertainty will weigh on BHC stock. It could give bears a reason to sell the stock, sending the stock to test the recent 52-week low.

Be the first to comment